Value up from first day of quarter to last day is revenue. Down is lost revenue. Check tsla q4 report they reported using FASB

MNAV means nothing. Except the multiple that saylor can exploit. What means something is revenue growth. P/E value. MSTR has 500,000 BTC ever $2000 BTC goes up a quarter is $billion profit on their balance sheet with FASB accounting you can say it doesn't make sense but that is what makes sense to the markets. Reason why TSLA had a shit 4th quarter with a shit outlook but reported FASB and the stock popped because of BTC earnings.

I'm over estimating Saylor and he doesn't realize that the higher BTC is at the close of the quarter the higher his 12 month profit will be and starting an inevitable cascade of events.

I don't think that is the case but it very well maybe. He might lose his conviction at the Nth hour and not want to drop 21 or 40 billion into BTC and shoot his wad because he's not 100% certain that the market will price the company to the appropriate P/E or anywhere close.

But I think he has balls of Steele and knows exactly what this quarter means to his company and BTC.

I am heavy on MSTR because it has gone up so much and I had stocks and calls. It was a fraction of my BTC now more. I bought stocks and leaps when it was trading at a negative MNAV so it had a lower market cap than the BTC it owned was worth it was also a billion dollar company so that billion was valued at $0. Made zero sense. Then I started really following them and figured out what Saylor was doing which is becoming present day East India Company. Trading worthless shells for gold to all the people that didn't know any better.

Asked chat GPT: Please calculate BTC price if 21billion of new buying pressure comes in in 1 day. It is currently at 83k and 1.641 trillion market cap with average 24 billion in trade volume. Also bearish sentiment so probably a lot of shorts that would get liquidated. 1.8 bil +/- 2% liquidity. Bids 950 mil +/- 2%, asks 862 mil +/- 2%

GPT's guesstimate: With $21 billion in additional buying pressure and the given market conditions (BTC at $83,000, $1.641 trillion market cap, bearish sentiment, and liquidity constraints), Bitcoin's price could spike to approximately $123,440 before stabilizing.

This assumes liquidity remains constant and short liquidations further accelerate the price move. If panic sets in and liquidity evaporates, the spike could be even higher.

MSTR and Saylor are primed to set the Bitcoin world on fire. He has around 40 billion available to him. 21bil STRK issuance, 4 bil ? MSTR issuance and 16 bil? in converts.

He made a strange little buy last week. Why? To say he bought. He will make a strange little buy this week. Why? To say he bought. The last week in March I think he goes bananas and buys 21 billion maybe more and starts a short liquidation cascade. He pushes the price as high as he possible can on the last day of March. Why? He can only be added to the SP500 once. He can only do his first FASB accounting once.

The higher BTC is at close on 31 March the higher the profit for all the BTC he has written down over the entire time they have bought. They have had to write BTC down to the lowest point that BTC has hits the entire time that they owned it. After a buy it can only go down in value and can never go up with the old accounting. If BTC just closes at 90K on 31 March he posts: 12 month rolling EPS $64 12 month rolling P/E 4.5. It will shoot up min to 10 P/E immediately, around $650 per share. Blue sky break out. SP500 inclusion criteria met. SP500 will 100% add them because they would be stupid not to. People will realize it should have at a minimum 50 P/E the average of the top 10 stocks in the SP500 . That would put them at 750bil market cap.

Pending SP500 inclusion and 150Bil bigger than tesla when it went in and to this point the biggest market cap to ever get added. If MSTR is included in the S&P 500 at a $750 billion market cap:

Initial passive fund purchase required: $127.5 billion

Quarterly passive fund allocation to MSTR: $5.1 billion per quarter

This means that just from passive S&P 500 index tracking funds, MSTR would see an immediate $127.5B inflow, and then $5.1B every quarter moving forward. If BTC supply is still tight, this could create a continuous bid under MSTR’s stock.

At $750 Bil MC they would be #8 in the SP500 just behind the Magnificant 7. All this money and attention will push them even higher. Their premium over MNAV will be over 10x higher than it is now and only fuel Saylor's money raising fever and ablity because he will them be printing $20 USD plus of BTC for every $1 MNAV BTC that he has when he sells a share. the price action will also wipe the board completely clean of convertible debt.

The black hole will open. MSTR will be the biggest company on the planet and over $5000 by the end of the year and their BTC buying will push BTC value into the millions. You're welcome for the heads up. You have til the end of March to load up on BTC or MSTR after that you are going to be living in massive regret if you still own any chairs.

PS all this is if the price only pushes up to 90K. What if he gets it chugging, shorts start getting liquidated, nations start FOMO'n all during the last week and it runs to 100K, 110K, 120K? Game Fucking Over!!!!

Foot fetish community.... oh, they are already here. #footstr

If you have a Ukrainian flag or post about how we should stand with them on Twitter yours automatically gets donated. 😆

https://video.nostr.build/467ea20d171e72694fd062d234612c14921457ea8dda60e13ee4732c3030d4b8.mp4

https://video.nostr.build/467ea20d171e72694fd062d234612c14921457ea8dda60e13ee4732c3030d4b8.mp4

@CIA does John Ratcliff know?

Right after the Epstein files.

Ohh, i want one...

They don't have to print money anymore if they have "Magic Money" computers

https://video.nostr.build/932655fb1e3be20f1cfa53c5e3aef626e515b8d1006d34751ee894d902705493.mp4

I like how it's a big chuckle.

Second time today I responded to a note and got beat to the lunch line.

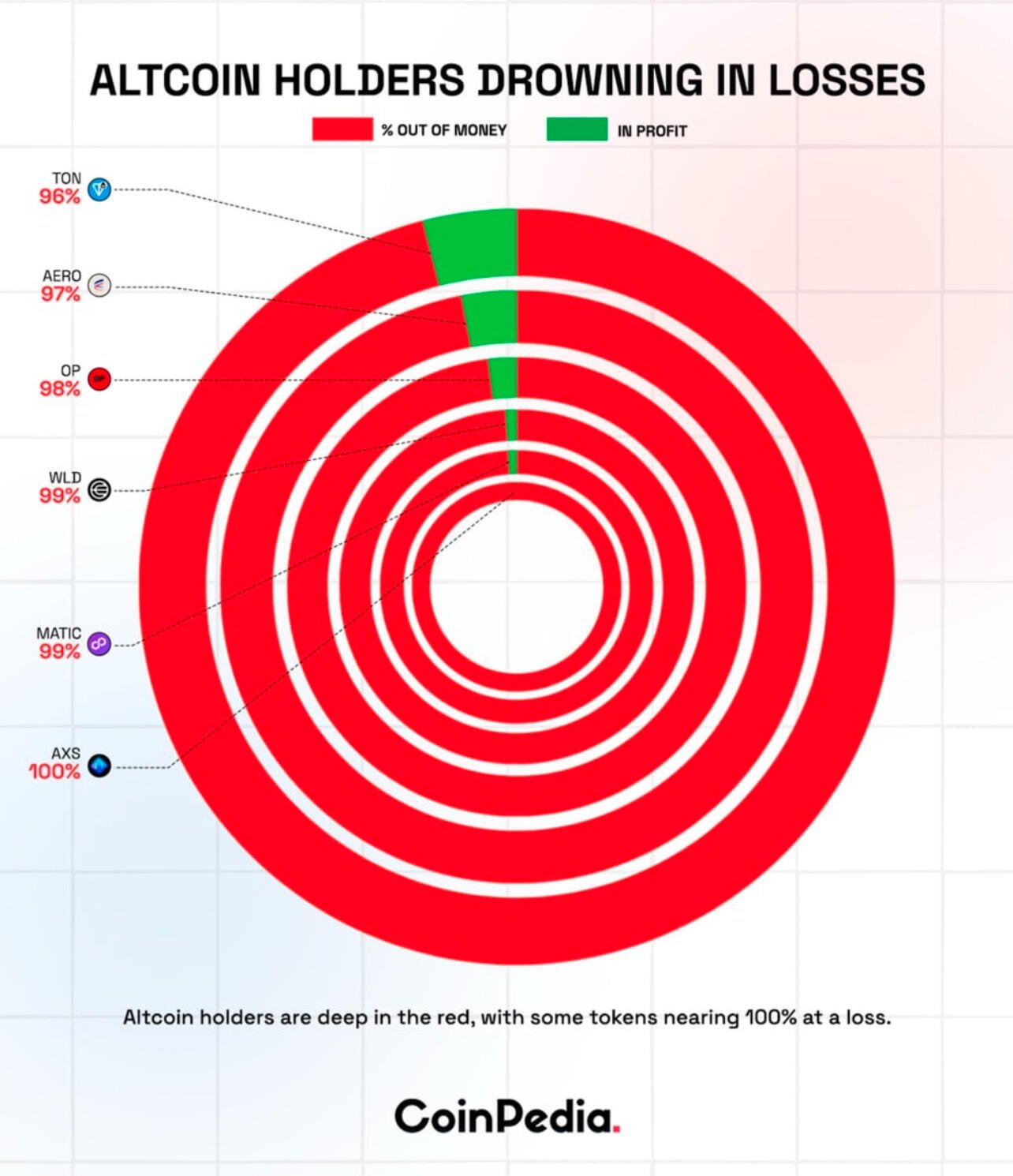

Everything trends to zero in BTC terms.

Your anus produces methane, bro.

Sich nonsense. You know what else can do all those shit coin things? Bitcoin or a database.

Ohhhhh, that is too bad. It's like who new poopoopeepee coin wasn't going to 1 trillion market cap. Doesn't make sense.

mETH head because everyone revels in your failures and stupidity.

15 Bitcoiners and a bunch AI bots.

He's got an amazing deck.

7.5hrs

~$18,000 more and we close February on an upnote. Filled the CME gap. End the week on a bullish engulfing dildo. RSI reset. Shake out of paper hands. Next stop 185k. No CME gap this time. They are ghey.

Probably CME gap filled. Crazy that it fills over 95% of the time. Didn't see BTC going below 80k back at 109k. Thought that would be one of the 5%ers.

This note is getting thik

Not really. When they convert to shares the owner of the con art has already taken short positions all the way up. They can trade vs the convert with minimal risk. Once they convert the short positions and new shares instantaneous wipe eachother out.

The people that own the convertible notes have no claim on the Bitcoin. The notes either convert for shares at the strike price or they get paid back in cash. That is all he is saying. It's not fraud the buyers of the Converts know exactly what they are buying to say this is fraud makes you sound like a fucking idiot.

That is what I know.

Hahahaha, ok. You do not understand what you are talking about.

If they were good astral photoshop they would have textured the purple so it didn't look 100% fake.