100% baby 🤘  nostr:note1ucxqudhyqw2jw5635w77j93sg97wjzzyy0uj0tf9d5wk0rqwk6dqnlkv47

nostr:note1ucxqudhyqw2jw5635w77j93sg97wjzzyy0uj0tf9d5wk0rqwk6dqnlkv47

An article I wrote on why Bitcoin rehypothecation should be illegal for TBTF banks now that SAB 121 was rescinded. And yes, I know, Bitcoin doesn't need laws. But I also know that all your grandmas will probably have exposure to Bitcoin through an ETF. So this is for all your grandmas.

https://egodeath.capital/blog/too-big-to-fail-banks-amp-bitcoin-custody

Good reading, thanks Preston. I suspect banks will have a clause along the lines of ‘return the assets (bitcoin) OR the dollar equivalent’ in the case of distress. However this may also be the return to sound money banking as failures result in people demanding 100% deposits

Hello people of nostr! I am brand new here thanks to nostr:npub1xr7t5h0l25ej73pm04zgz9afeexyzsjx67s5v0xxf2sshjn4sx6sep2gqh for sharing the info about this app on TikTok. I am a rock singer songwriter, and look forward to to checking out this new platform. I love the idea of a decentralized space for us all to freely share. Look forward to getting to know you.

Danny

Welcome Danny. Have some zaps

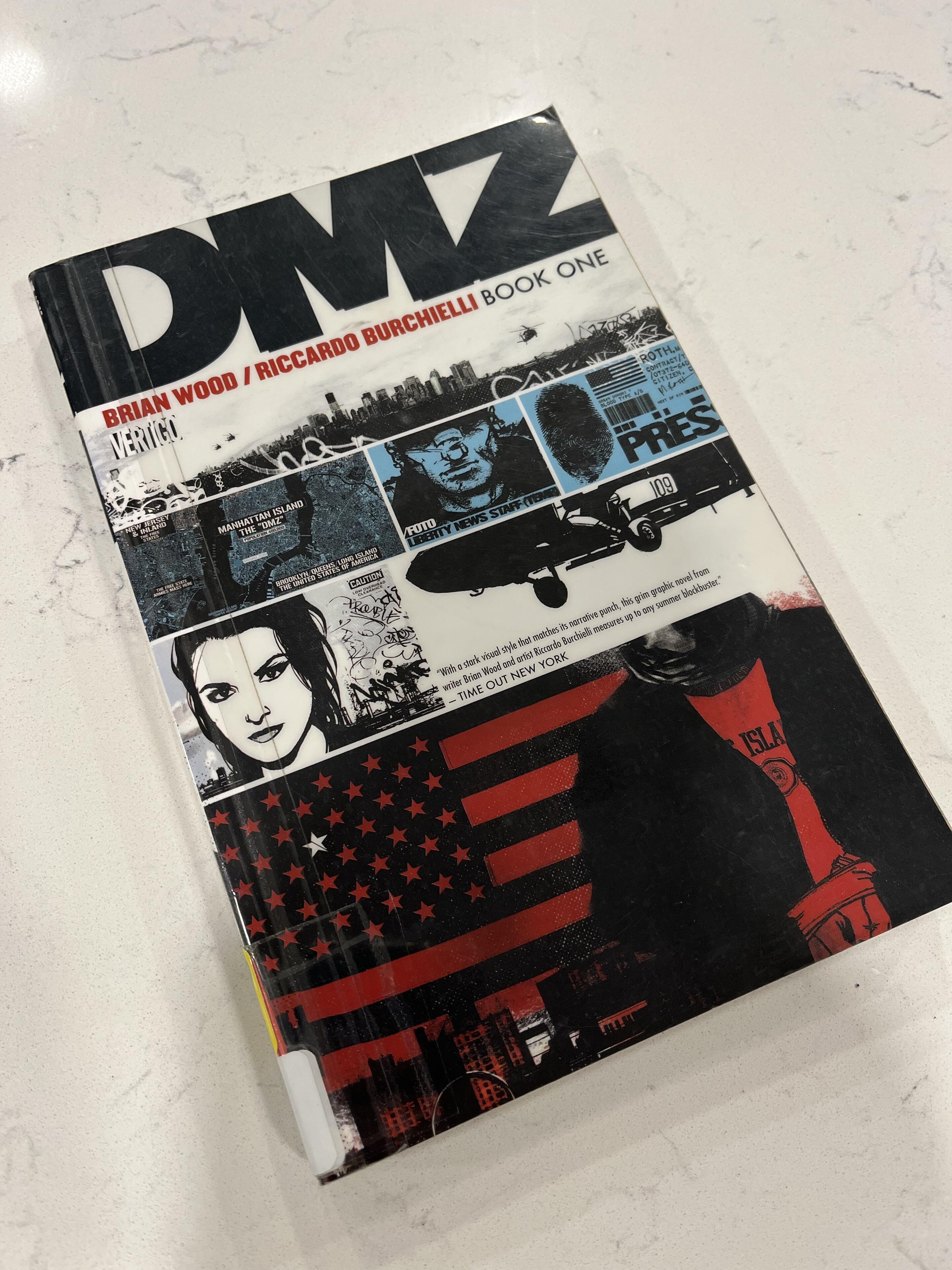

A great work of fiction can teach you more than leadership or business books can. Visual fiction paints a vision you may not have imagined. Comics are raw emotion and street art fused into story telling. And this is a fantastic specimen.

Interesting read, thanks Susie. As the saying goes ‘Bitcoin is for everyone’, so it’s for governments too. Bitcoin works on the premise that people follow their own incentives, and that will apply to governments too. It brings to mind the Softwar thesis. Cyber power is the next frontier. It makes perfect sense that governments would want to control the network and block space and the only way to do this is through hashpower - hence cyberwar. Furthermore while transaction costs may be higher for non-compliant transactions, this is the case for non-kyc peer to peer bitcoin sales too. These are more expensive than buying from an exchange. People will pay more for less surveillance.

Bitcoin groceries with Alby Go 🛒 https://video.nostr.build/e9d33d6354045633b3d13e333fcbe89b25d44943491821515e5d48e0c4f4d710.mp4

nostr:npub1m0sxqk5uwvtjhtt4yw3j0v3k6402fd35aq8832gp8kmer78atvkq9vgcru just tried to zap you and the invoice failed. Pretty weird since you work for Alby and I’m using Alby Go connected to Alby Hub to send zaps

https://www.cyclingeu.com/492783/does-anyone-know-how-to-remove-rounded-out-allen-key-6-bolt-on-the-shimano-deore-xt-crankset/ Does anyone know how to remove rounded out allen key 6 bolt on the shimano deore xt crankset? #Bicycling #Bike #BikeRepair #Biking #Cycling #Repair

Use a 6mm bolt with pratley steel to glue the bolt head into the cavity. Once it dries clamp the shaft and turn

An introduction to Bitcoin Strategic Reserves for Companies

As we embark on a new year in 2025, it is worth taking a moment to reflect on a development in 2024.

Corporations, both public and private, have been acquiring bitcoin since 2018. Interestingly, it was the public companies that initially led the charge (over 3400 public companies vs 12 private companies by the end of the year). This trend is surprising especially considering the timing. Remember back in 2018 Bitcoin was a far more speculative and less understood technology. There was no ETF’s, no SEC ruling on Bitcoin as a commodity, FASB laws had not changed, it was a much wilder and uncertain environment in the Bitcoin space. Public companies are often owned by a diverse group of stakeholders, including venture capitalists, other companies, stockholders, and pension funds which tends to result in a more conservative approach to strategy and risk appetite. So, one would have expected private companies to be more adventurous and willing to take risks due to their simpler ownership structure and nimbler decision making.

Feb 2021 had a huge explosion of private companies holding Bitcoin. The number went from 12 to more than 25,000 overnight. While public companies nearly doubled in number over the month of February. This coincides with the early 2021 bull run in the Bitcoin price when it went from $10,000 in Oct 2020 to $61,000 in April 2021.

However, in late 2022, there was a sudden and significant increase in the number of private companies reporting bitcoin ownership. This surge was so substantial that it exceeded the number of public companies holding bitcoin up until that point, almost overnight. The number of private companies went from 25,000 to 367,000 in a two day period. What is interesting about the Bitcoin price at that time was that this was almost the very lowest point in the Bitcoin bear market priced. I have no idea what caused this overnight explosion, but I do suspect it has something to do with reporting or regulatory requirements. It seems unlikely that about 340,000 companies decided to purchase Bitcoin on exactly the same day.

In mid-July 2024 to early August 2024, the number of private companies holding bitcoin dropped by approximately 100,000. At that time the Bitcoin price was trading sideways in the $60,000 range. Following this brief period of decline, both public and private companies experienced slow but steady growth until November 2024 when the bitcoin price broke out of the $60k range for good and went on to hit a new all-time high of $106,000. From then on, both types of companies began to increase their bitcoin holdings rapidly and in tandem with each other, with public companies more than doubling over the next two months.

To summarise we have the following:

Public companies have been more aggressive than private companies

Companies bought bitcoin in a bull run (early 2021)

Companies bought bitcoin in a sever bear market (late 2022)

Companies divested their bitcoin holdings when the price was stable

The only time the number of public companies holding bitcoin went down was between 28th Jun 2022 – 1st July 2022 when the number dropped by 18%, since then it has continued to increase.

The trend is clearly up, on both fronts. Price be damned. And with 2025 being the year it is expected that nation states will announce their own Bitcoin Strategic Reserves, this may well accelerate.

It would be a crying shame if nation states, just like public companies have out run their privately owned compatriots, end up being nimbler and leaving the private sector in their dust.

https://bitcoinforbusiness.io/an-introduction-to-bitcoin-strategic-reserves-for-companies/

nostr:note1093rle0q8yc6za0kjf3cctu30y3cz3yu3eeuy5yhgrufhypecqds4pc448

nostr:note1093rle0q8yc6za0kjf3cctu30y3cz3yu3eeuy5yhgrufhypecqds4pc448

Borrowing against your Bitcoin via a life insurance policy? Bitcoin loans are trending and in this episode with Danny Baer of Meanwhile we discuss these new products: https://fountain.fm/episode/RQGPfTRtmWlXnWi43bWr

Looks like your zap wallet is not working, just tried zapping but it keeps failing.

A bearer instrument is a financial instrument that can be transferred without formal process or central authority involvement. Its key characteristics include: ownership determined by possession, no registration required, transferable by delivery, and no need for endorsement or signature. Examples of bearer instruments include cash, where the person holding the cash is considered the owner. Shares, however, do not fall under this category.

Shares are NOT money nostr:note1mh2yys4ln0w5qnlvht87gmmsdqg25nxm9377k3hy5aq4qlkalqusmzq7ju

If an EMP goes off and there is no electricity, then regular bank accounts, payment options, credit cards, PayPal, etc all goes away. And there is a good chance it never comes back ie when power is restored your funds may have been ‘affected’. With Bitcoin your money will be right where you left it.

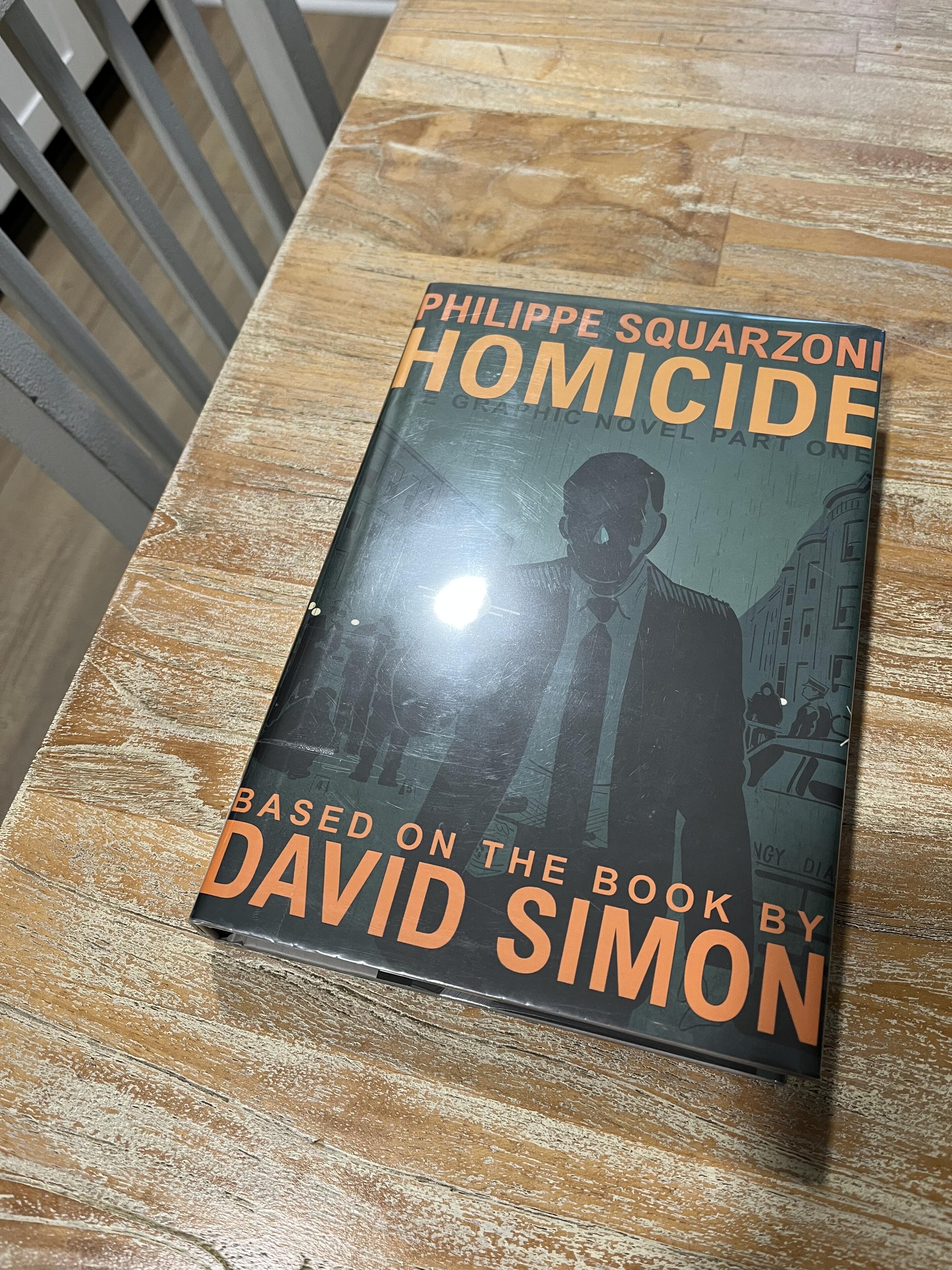

Amazing graphic novel, based on the book by David Simon. Artwork perfectly captures the mood. A few TV shows have been based on the book. Highly recommended

I AM BRAND NEW TO THIS! I BOUGHT MY FIRST BTC LAST WEEK AT 100K AFTER WATCHING A POST OF JACK ON X. I FEEL SO DAMNED STUPID. I WAS AN XRP XLM GUY THIS WHOLE TIME. WTFFF!!!! I AM SO EXCITED!! WHY DID NO ONE TELL ME WHAT BITCOIN WAS? WHY DIDN'T I LOOK UNDER THE HOOD?? UGHHH.. YOU LIVE AND LEARN. THANK U nostr:npub1cn4t4cd78nm900qc2hhqte5aa8c9njm6qkfzw95tszufwcwtcnsq7g3vle FOR MAKING ME TAKE THE ORANGE PILL. HERE TO STAY.

I LIKE nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx HE SEEMS SICK LOL

IF YOU'RE READING THIS... HAPPY HOLIDAYS!!

Welcome Brother

I’ve been using nostr:npub1getal6ykt05fsz5nqu4uld09nfj3y3qxmv8crys4aeut53unfvlqr80nfm Hub for about a month now. Being able to zap directly from my LN node, and do regular LN payments from my node is a total game changer.

Why is it that coffee shops attract a certain type of employee?