Gah, BTC going back up too fast!

More like the CPI was manipulated to a lower number that most people will still believe.

Far greater?? No way. Existential threat? How exactly does the cartel fight an expeditionary war against the US military? People forget about the Cold War and the arsenal of nukes still pointed our way. The black swan event is a Russia/US nuclear exchange. This is political, I don’t trust him anymore.

The ECB’s Digital Euro is set to launch in October. Key concerns include:

– Real-time transaction tracking

– Potential for payment blocking

– Automatic tax deductions

– Restrictions on cash withdrawals

– Programmable money with expiration dates

https://video.nostr.build/a281ceb4d5f2522402f07cacb61acef320d1d707b06f02117d7d5b8b7de33e50.mp4

They couldn’t convince us voluntarily, so now they’re using fear and most likely a new crisis to force this system upon us.

This is nothing but a financial Great Reset, total control over what you buy, where you go, and even what you eat.

SAY NO WHILE YOU STILL CAN!

#bullishbounty #ff17

Q IS connected to your #bitcoin

The SBR is happening whether any of us like it or not. We can’t create a free system and then expect the government to come in and do the right thing. Relying on them to burn the bitcoin or create laws to not seize it only creates a temporary and local solution. We shouldn’t be asking the government to do this because that creates a perverse incentive to the devs to create technology that nests within that framework. What happens when the government doesn’t want to play by their own rules? We have to build technology that resists this no matter who is in charge.

The government will likely keep the seized BTC, and we should use it as an incentive to innovate and create a protocol with the fitness to withstand future seizures. Adopting a free monetary system meant giving up the consumer protection that the government currently provides, there were bound to be casualties. This is way bigger than bitfinex and the Silk Road, the long game is what matters.

Don’t get me wrong, if they return the coins to the rightful owners, that would be great, as long as we operate as if they didn’t. I don’t think returning the coins now would mean anything at all to future regimes that want to steal it. I get wanting to go along when the government aligns with our interests, but there’s always the next election. We can’t get complacent.

Right there with you brother

Michael Howell talks about a 6 week lag between M2 and BTCUSD. Could be a great setup. Also, what are your thoughts on truflation realtime inflation metrics? Shows a steep drop off in March. I’ve never used it before, but I read about it today. 1.35% seems super low, but if it is dropping, we may turn the corner on QT.

Yep!!! My panic selling days are way behind me. Swimming with the whales now.

Well, that’s not happening until you code a way for me to troll Peter Schiff

Ah ok, that seems to make sense. Thanks!

⚡️🤔 Would you recommend nostr:nprofile1qqsy67zzq5tc9cxnl6crf52s4hptdwhyaca5j7r8jwll535tdadedvcpr9mhxue69uhkummnw3ezu6r90p5x27pwdahxc6twv5qjxamnwvaz7tmswfhhs7fdv4u8qetjd9kk2mn59ehkuun9dejx2u3wvdhk60mg8pn to someone new to Nostr? Why or why not?

Yes!! I still haven’t quite figured out the news feeds on nostr yet, so nostr:nprofile1qqsy67zzq5tc9cxnl6crf52s4hptdwhyaca5j7r8jwll535tdadedvcpydmhxue69uhhqun00puj6etcwpjhy6tdv4h8gtn0deex2mnyv4ezucm0d5q3gamnwvaz7tmjv4kxz7fwv3sk6atn9e5k7nelmet keeps me from having to look at X

Informative as always. I’m a little confused by the last paragraph though. Can you elaborate a little more on how they’re pulling down inflation and treasury yields? I thought those were economy stimulating things.

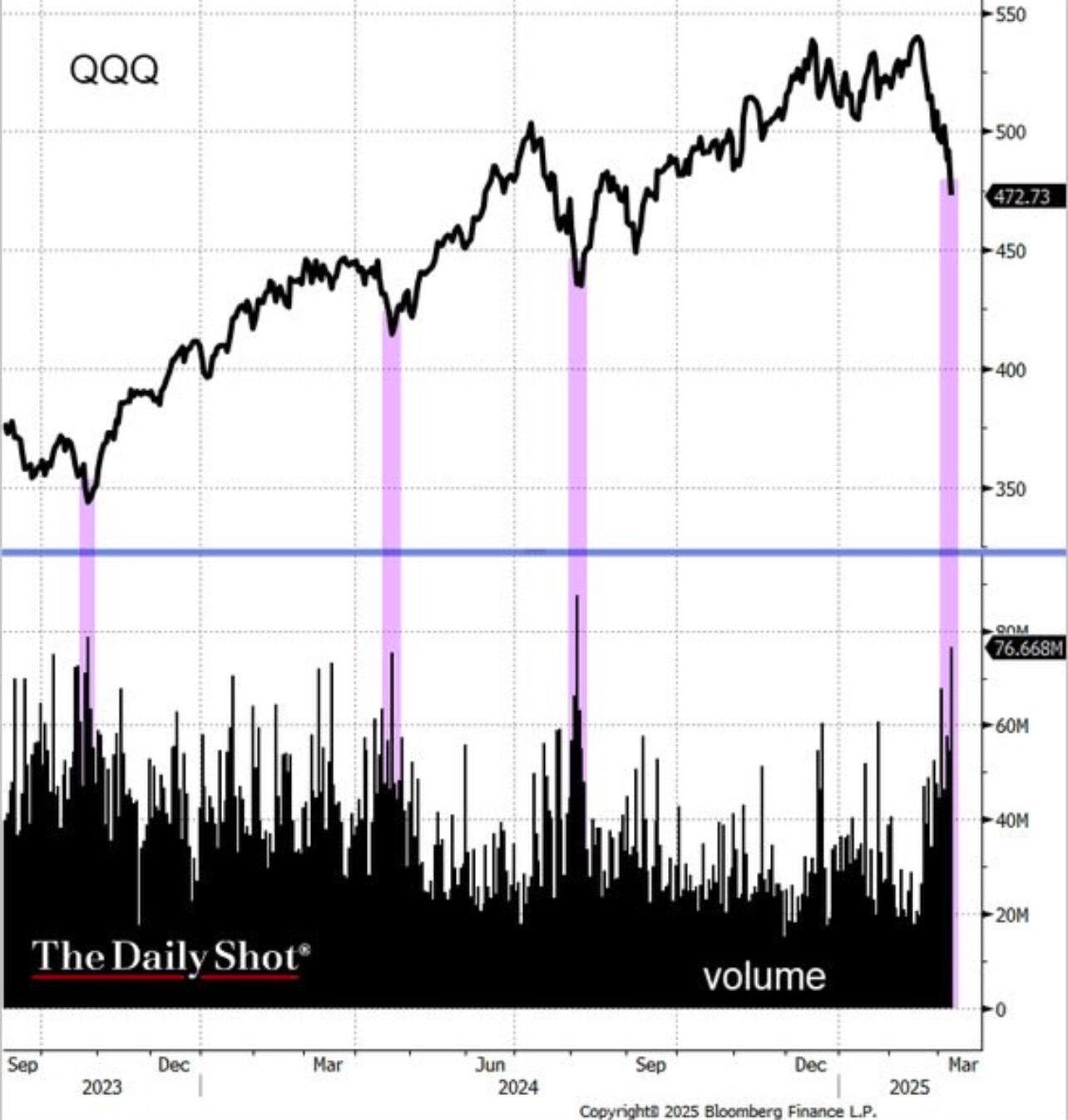

This chart is 🔥 The more I see stuff like this, I realize emotional control and conviction are far more important than investing knowledge. I’ve orange pilled several people just to watch them bail at the first sign of volatility. Adding this to my orange pill slide deck!

Alright US faithful, who has the sign? Our EU brethren are in need!

Ross is free, SBR in place, friendlier regulatory environment. I don’t care what the chart says, I’m bullish AF.

The problem is what can you really do about it? The game theory we use to play out nation state adoption of bitcoin was largely developed during the nuclear arms race. Can’t put the genie back in the bottle, the only thing left they can do is stack.

Start9 servers, good choice

Can you elaborate more on the seized assets. They’ve said they’re returning some to BitFinance. Are you saying the rest of the btc was unethically seized as well?

I feel like we still need a Congressional bill to make it permanent, but definitely directionally correct. Congrats to all the bitcoin community!

nostr:nprofile1qqst0xtvrqlqxm0j0qpfgkuqh0wgkzl4judkvgdgd0e4d8pnyytlqlgpzfmhxue69uhk7enxvd5xz6tw9ec82csprpmhxue69uhhyetvv9ujuumwdae8gtnnda3kjctv5zvf6p where do you stand on the power law price curve a la porkopolis economics?