Sure it sounds toxic, but it's balanced out by the fact that it's only 2 days a week. I believe that people would get more done in 2 days than they would in 5 if they knew they got the rest of the week off after. Win-win for company and employee.

Obviously this is dependent on the type of job/company.

If I send an on-chain tx to nostr:npub1mutnyacc9uc4t5mmxvpprwsauj5p2qxq95v4a9j0jxl8wnkfvuyque23vg, will it auto go into the mint I'm a part of now?

... and if I send an on-chain tx out of the mint I'm part of now, how does a signed-transaction get created and broadcasted if all of the mint's keys are on cold-storage devices (which must be signed manually)??!!!

I smiled on the outside, and laughed a little on the inside.

That didn't answer my question. You just told me a story of some kind.

What is "god"?

I guess it's a person? (Guessing based on your word salad). Would love a better definition.

I think about this question far too often....

I didn't even think to ask.... they just said "$12 por favor". Dammit! Why didn't I ask!?!?

Btw, is this a short term promotion or you planning on always offering it?

So, I've ordered through Oshi a few times, and it's been great. Except the shipping kills me.

Now you're telling me if I buy 6 or more bottles at a time, you'll wave the shipping?! I'm so fuckin stoked right now. You just made my night.

Was quitting alcohol and coffee worth it? I mean, do you notice any major differences?

I have a little of both daily. It helps me get through the monotony of the desk job.

Yup! Gotta get ready for when we start 200 a day til 200k.

"100 a day til 100k" is just the warmup.

In every single rate hiking period since the creation of the scam that is the Federal Reserve, rates went up slowly but dropped rapidly. They take the stairs up, but the elevator down. Every. Single. Time.

The end of the BFTP at the same time we’re starting to see stress in the banking sector is telling. It’s clear that the Fed either needs to renew the program OR start some QE. They simply cannot do both without major, systemic disaster in the economy. They announced the end of the BFTP, so I think it’s clear which of those two options they have chosen. But they do not want the public to realize what the Fed’s plan is. They want us to continue to believe the “higher for longer” narrative, for as long as possible.

Beyond the brewing banking crisis, there are a lot of signs of serious downturn and distress. Many of these indicators only just started flashing red, in January. So they are very recent. We know the Fed is mostly backward looking and their data is always lagging. They haven’t factored in all the new stuff that is starting to happen. Case in point: yesterday, the bank NYCB announced that it is in trouble, the stock dropped 50%. The Fed was not prepared for this happening on the same day as their FOMC meeting. They already had their speech prepared, and their paper ready to release. When they released the paper, they crossed out the words: “The U.S. banking system is sound and resilient.” They didn’t have time to revise their statement, so they crossed this part out completely. They also seem to have told reporters to not ask anything about NYCB’s impending failure. The Fed learned about it only hours before their meeting, and did not have time to reevaluate. So they pretended that everything’s fine, and they pretended that there is no stress in the banking sector currently. Even though, there clearly is.

This brings back to my opening statement. Interest rates take the stairs up, but the elevator down. I think something is going to break before or around the March timeframe. Something big enough to cause an instant rate cut from the Fed, probably something around 100 basis points immediately. The elevator down.

The markets are not pricing this possibility in, whatsoever. They’re still buying the “higher forever” narrative. I think a rate cut is coming in or around March, even though they’re trying their best to make us think otherwise.

You ever get that Zapit paywall setup that nostr:npub1zcjv4t06jm6tk84nypk8g7q6z8jsra8u8q4kprv08krcpvmskzwqvwam8a told you about.

That Zapit shit is under-appreciated. The ability for creators to create their own paywalls without involving a 3rd party is absolute fire. Direct Zaps for content.

I don't see any "proof" here.

How do we know those rocks aren't just cheap tungsten inside?

Well that just blows my mind.

Normally, when a channel is closed, it's settled as two on-chain utxos, one for each side of the channel, into their respective wallet.

Now, you're telling me we never have to settle on-chain? Without new utxos, how is it settled at all? What does it mean to settle up "out of band"?

A tip for public node runners:

- Do you run a public routing node with good liquidity?

- Do you want to help some of your fellow new bitcoin users (friends and family)?

Onboarding them on self custodial Lightning Network is quite easy and free !

Activate 0-conf channels on your public node and let them open channels with your node with 0 sats opening fee.

They can make and receive payments with these channels as with any other ordinary LN channel, until are closed. They will pay the onchain fees ONLY when the channel is closed.

Remember: these 0-conf channels require some level of trust between the parties ! Do not open them with random nodes from internet.

Wallets supporting this feature: nostr:npub1xnf02f60r9v0e5kty33a404dm79zr7z2eepyrk5gsq3m7pwvsz2sazlpr5 and Blixt. These 2 wallets and mobile nodes are also offering LSP on-the-fly channels, opened directly from depositing from a LN invoice paid from another wallet (if you do not have funds onchain).

Read more here:

- https://docs.lightning.engineering/lightning-network-tools/pool/zero-confirmation-channels

- https://docs.zeusln.app/for-users/embedded-node/trusted-funding/

"They will pay the onchain fees ONLY when the channel is closed"

So, the way this works is that the channel opening is not broadcast to on-chain nodes whatsoever, and the first time L1 even knows about the channel is at the time of closing? Is this correct? I'm just trying to get a better understanding of the technical aspect of 0-conf.

Relevant Reddit thread:

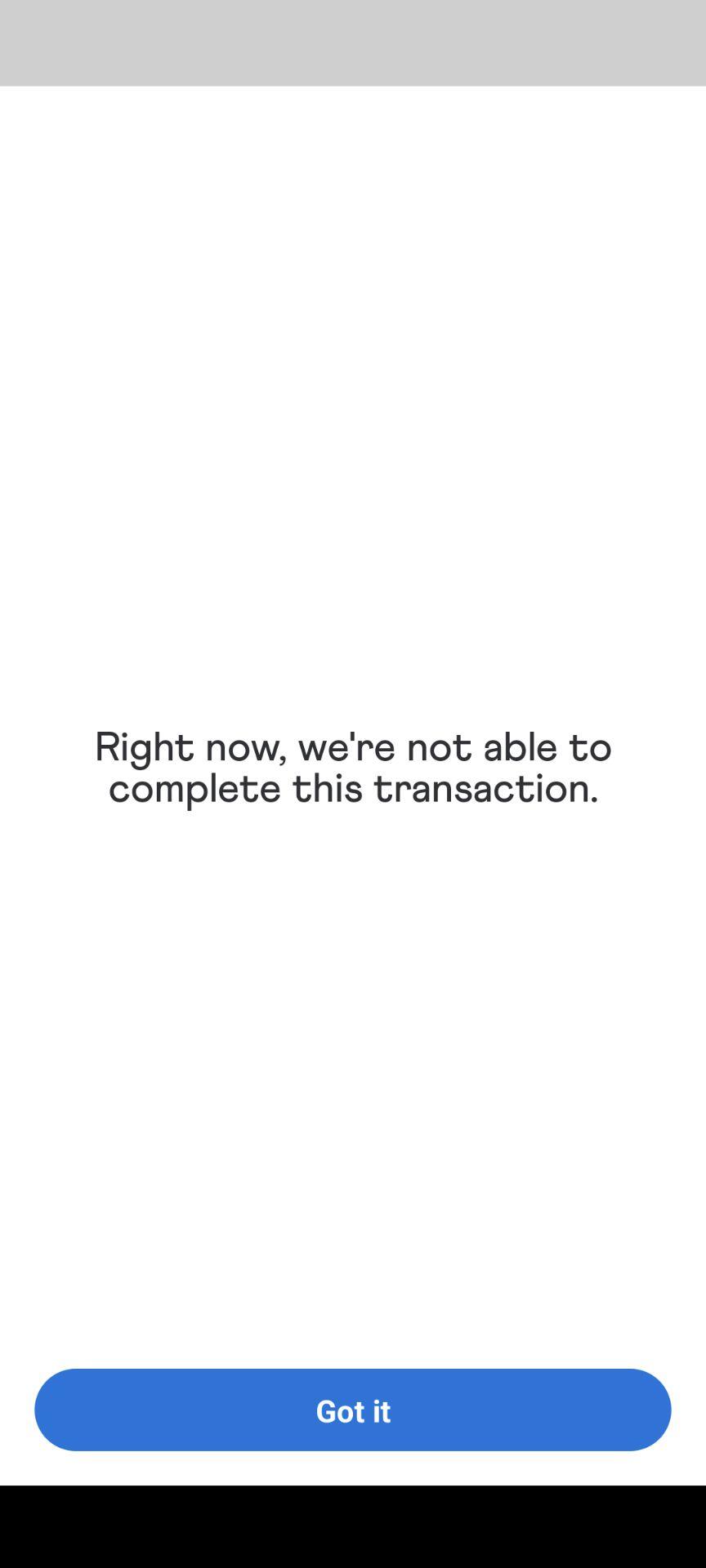

https://www.reddit.com/r/venmo/comments/14krskp/bought_btc_but_cant_send_it/

Never used Venmo myself, but it doesn't appear to have very good reviews for using with Bitcoin. I hope they resolve this cuz it's unacceptable BS. Keep us updated!

#m=image%2Fjpeg&dim=864x1920&blurhash=%5BORpB%7Bj%5Bt6j%5B%7EofQWCfQ00fQj%3FfQ_2fQWCfQ00ayoffQ%25MfQj%5BfQDifQWBfQkYfQoefQI9fQa%23fQ&x=53de7c4f2e5bd3314b0ac67bc3cbbe5c23ae8afb1ddfab2c1d12a371e1d3a96d

#m=image%2Fjpeg&dim=864x1920&blurhash=%5BORpB%7Bj%5Bt6j%5B%7EofQWCfQ00fQj%3FfQ_2fQWCfQ00ayoffQ%25MfQj%5BfQDifQWBfQkYfQoefQI9fQa%23fQ&x=53de7c4f2e5bd3314b0ac67bc3cbbe5c23ae8afb1ddfab2c1d12a371e1d3a96d