This was an amazing rip. Needs to be heard by all.

The story of how I “woke up”.

nostr:note1sxvpm6fytrdn2xhnlk3hlcf0sl63994pkqjljufytn5tvdtw0r6q92t3gg

I finally started wake up to the fact that our government does not have our best interests at heart, but indeed views us as little more than livestock to be exploited and sacrificed at will, between 2001 and 2003.

It was a combination of things that led me to this conclusion. In 2001 at age 30, I finally learned about what “money”, as I had known it since I was a kid, is. A man whose brothers I was working on a startup venture for suggested that I read “The Creature from Jekyll Island” by G. Edward Griffin. Having studied economics a bit in college, it didn’t take much to convince me to read it. My mind was blown. I instantly realized that on top of the criminal, overt forms of taxation we are being subjected to, there was this insidious hidden tax called inflation that was not only stealing from all of us, but had only one possible eventual outcome in terms of the long term economic effects on the country itself. It was the first time that I finally understood that the word inflation doesn’t mean “the increase in the cost of goods and services over time”, but that it simply means inflation/dilution of the money supply. What really blew me away was that none of this immensely important material was covered in any of my Econ classes.

The whole thing stunk, but what was there to do with this information? I was working an exciting job, trying to “get somewhere” and didn’t really have any assets to speak of.

After my friend (and CEO of this venture) and I took this group of companies from incorporation to profitability in an 18 month period, the owners unceremoniously cut us loose and basically said “we’ll take it from here” and moved the whole operation to Texas. I had just gotten married and started a family, so I had to try to parlay what experience I had in business into another position that would pay me similarly to what I had been making.

Of course that fall was when 9/11 happened. While I was initially gripped by the same nationalistic desire for justice as the rest of the country to see this act of terror avenged, there was something about the events of that day, the collapse of the towers themselves, and the official narrative that didn’t mesh with what I knew about physics.

I worked for a couple of years doing whatever I could do to pay the bills and keep a roof over our heads, and eventually got a job as national service manager for a company that builds and distributes critical power equipment for healthcare, industry, the military and transportation.

Despite the owner of that company being a real tyrant and it being the longest three years of my life before the 2008 financial crisis and the owner’s lack of fiscal responsibility led to mass layoffs, the position afforded me a lot of free time to read. In the first year I automated a lot of the QA and service functions in the company, so things that used to take the former service manager all day to do, I usually had done by mid morning most days.

All this time, the things were bothering me about our monetary system and 9/11 had persisted. That was when I read Niels Harrit’s peer reviewed report in The Open Chemical Physicals Journal 2009, entitled “Active Thermitic Material Discovered in Dust from the 9/11 World Trade Center Catastrophe”. Between that and the hours of research I did through resources provided by Architects and Engineers for 9/11 Truth and other organizations, I became obsessed with unravelling a bunch of other things that weren’t meshing with my previously held belief that government and authority were there for our good.

I consumed everything I could on history, Austrian Economics, the teachings of Ron Paul, and material from notable anarchists for the next couple of years. I spent a good five years quite angry and disillusioned. And I was driving people around me crazy sharing what I had learned, particularly about 9/11 and the government.

I finally reached a point where I realized that I could either drive myself and my family crazy with things I was powerless to change, or I could focus on preparing for what lies ahead and enjoying my life.

It wasn’t until I found Bitcoin in 2020, and finally learned enough about the mechanics of acquiring, moving and custodying the asset in early 2022, that I was not only fully awake, but finally had a sense of real hope again.

God Bless Bitcoin ₿

I think that press conference was part of the reason the networks started inserting a delay in live broadcasts. It’s pretty disturbing.

Here’s what I sent to my 19 year old daughter after I was first introduced to the concept while reading The Bitcoin Standard. I knew about the concept of delayed gratification, but time preference is even broader.

The Most Important Concept You Can Learn to Optimize Your Chances of Success - Time Preference

Concept Demonstration: The Marshmallow Experiment

The Stanford Marshmallow Experiment was a study that looked at time preference and was conducted by researcher Walter Mischel between 1968 and 1974. The experiment involved approximately four-year-old children in whom reward deferral was studied.

In individual sessions, the children were shown a desirable object such as a marshmallow or a cookie. The experimenter told the children that he would leave the session room for some time and that they could call him back by pressing a bell and then receive a marshmallow.

However, if they waited until the experimenter returned on his own, they would receive two marshmallows. If the child did not ring the bell, the experimenter usually returned after 15 minutes.

Follow-up Observations

In follow-up observations of the Stanford Marshmallow Experiment, reward deferral was shown to be a reliable predictor of later academic success and a number of personality traits.

The researchers found that children who were able to wait longer for preferred rewards tended to have better life outcomes. These outcomes were measured by factors such as academic achievement, educational attainment, body mass index (BMI) and other factors.

In short, it’s about delayed gratification. Statistically, peoples’ level of success is linked to their ability to delay immediate rewards in favour of greater rewards in the future, through patience, and investing time and energy today that will pay greater rewards tomorrow.

Examples of low time preference behaviour:

- saving up for quality items versus buying lower quality items today

- exercising

- eating high quality food

- getting adequate sleep

Pretty much the most important concept one can teach their kids.

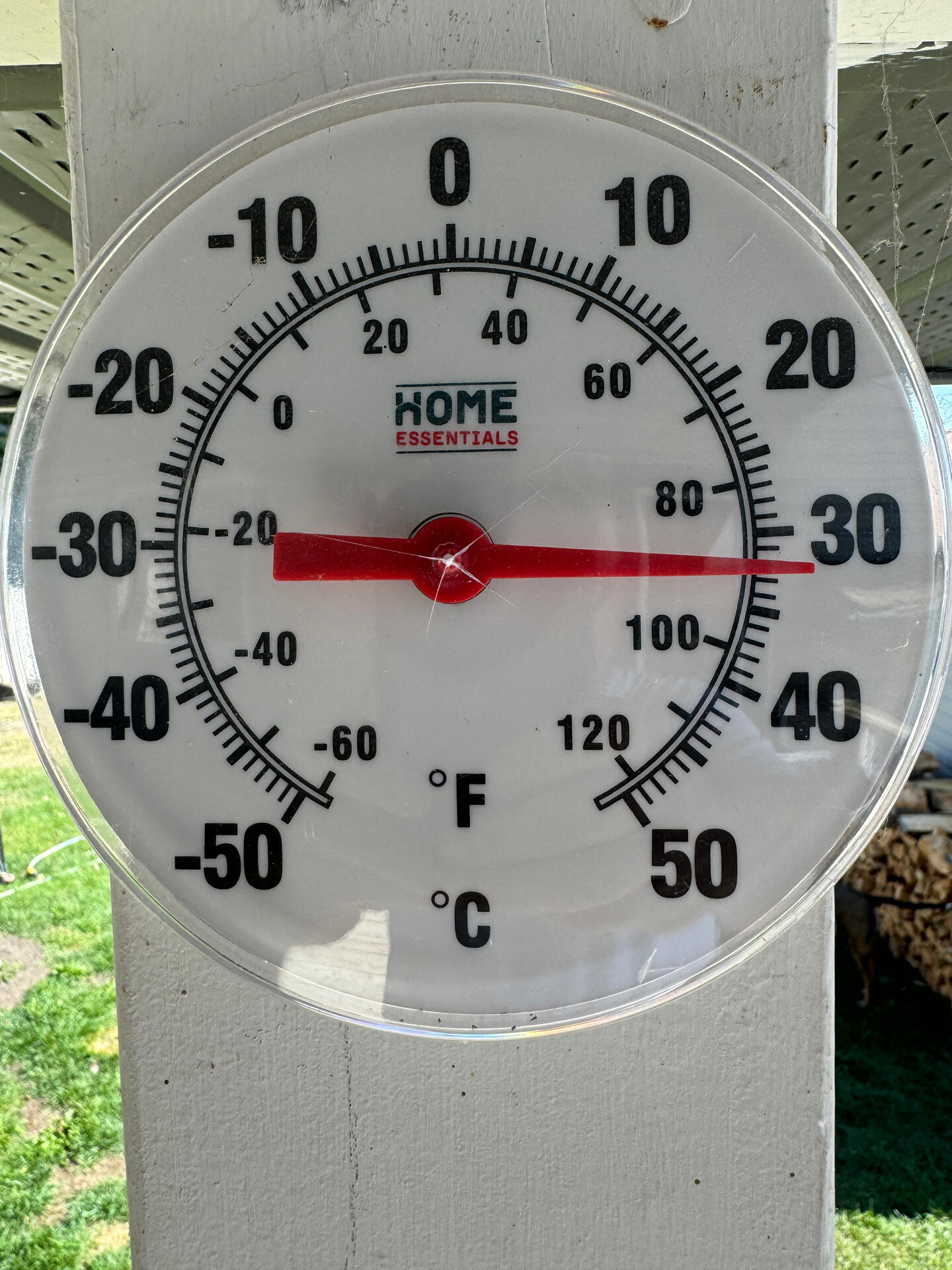

Not bad in the shade in Sept in northern AB. Hard to believe I’ll be freezing my ass off in a deer stand a month and a half from now.

This is one of my best food product discoveries of the year so far. It’s like soy sauce with the taste of wasabi already in it. Nice and hot.

Carrots finally done for the year. The dog never moved from that spot trying to get the odd piece. He loves carrots 🥕. 11 good sized servings survived what we pilfered for meals over the summer.

I need to get one for sure! This year was a pressure canner, vac sealer, and a dehydrator.

I love that single by Filter. Have you ever seen the televised press conference with R. Budd Dwyer that the song was based on? Quite the story.