😂😂😂

😂

If someone doesn’t want to talk to you, just walk away.

Don’t be happy or sad because of that.

#nostr eliminates middleman.

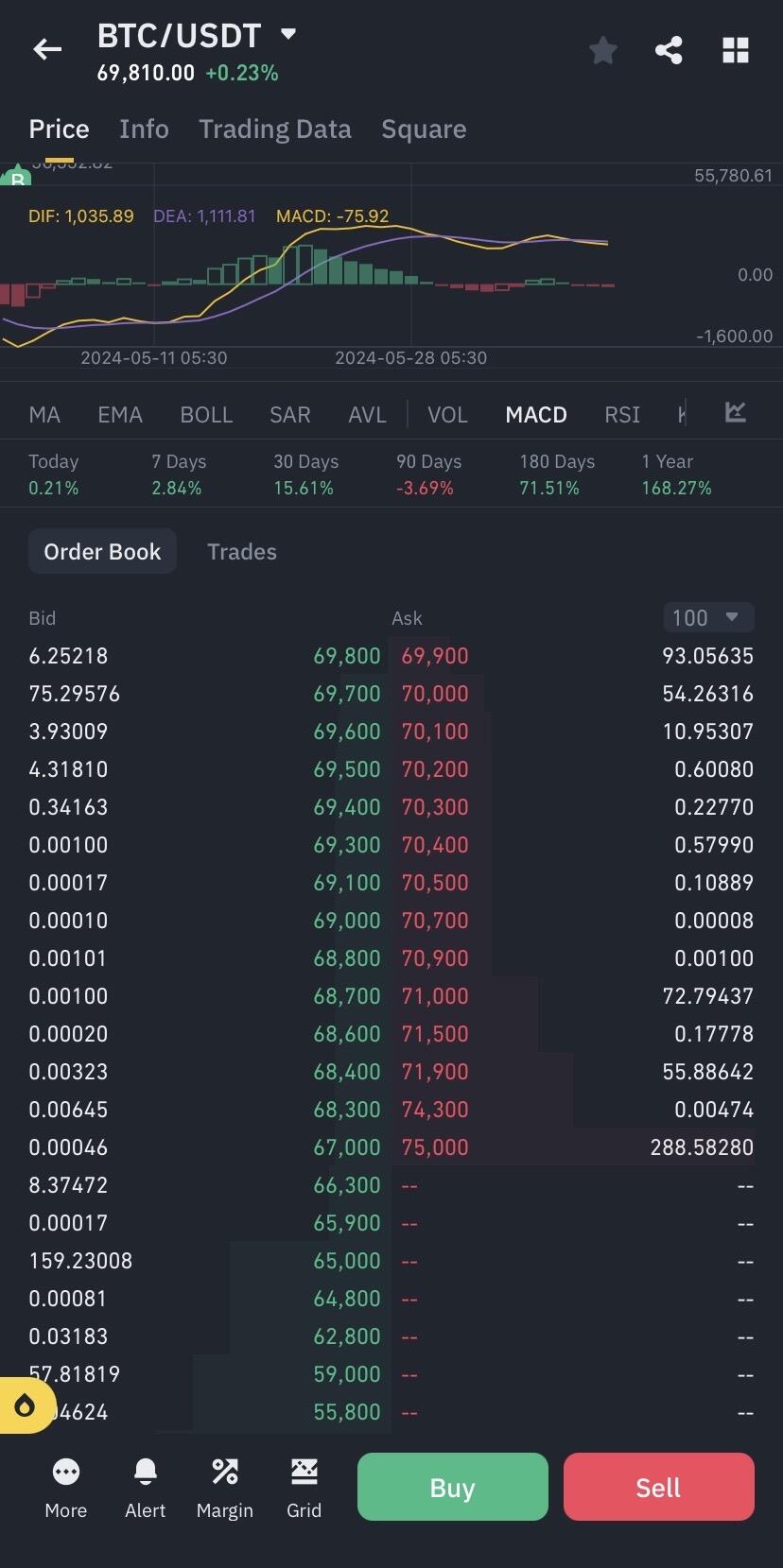

No one is selling their corn in spot market meanwhile there are huge short positions in futures markets.

So when these leveraged positions starts to get wiped out, we moon😂🚀

🚨Why are the hedge funds are up to their eyeballs in billions of dollars worth of Bitcoin short positions!

Are they suppressing the price to accumulate cheap Bitcoin?

Or are we watching a repeat of the cash and carry trade repeat from the 2021 cycle that made Grayscale BILLIONS?

📺I explain all of this and more in the FULL video below:👇 https://video.nostr.build/d9de24d4b337c351393c9fb582ef9e8b1c82820087fc5b8100869a45062fe717.mp4

It’s a simple strategy by Wall Street, you short the #bitcoin in futures, the market makers have to hedge their positions so they short the equivalent amount of it. Meanwhile large institutions keep on engulfing it in the spot market. Also in this process speculators and paper hands donate their #bitcoins to large institutions.

Look at futures vs spot sell order😂

Every exchange nearly has the same type of order book.

You are the product.

I don’t want to agree with you, but you are right.

#Bitcoin - A $69k stable coin.