nostr:nprofile1qy2hwumn8ghj7un9d3shjtnddaehgu3wwp6kyqpq4a234n82fqsqp0wvkd9a83fp2k8p7dfhww3u4mvr59rey8pkn6ssjk7wd4 nostr:nprofile1qy2hwumn8ghj7un9d3shjtnddaehgu3wwp6kyqpqtwanjtp3mr0ha65uzhug5xvr9vuh6h2gp52pau2rlxy5ta29qqwsh4h3yq

as long as the bankers use their unlimited fake fiat to keep buying

BTC is slow legacy tech, price is a faulty indicator

you have to look deeper, it's trash

As of late May 2025, MicroStrategy (now operating as "Strategy") holds approximately 580,250 BTC, acquired at an average price of $69,979 per bitcoin, totaling about $40.6 billion in investment . The current market price of Bitcoin is around $109,000, valuing their holdings at roughly $63.3 billion.

The company's total debt has significantly increased to approximately $8.14 billion as of March 2025, up from $2.1 billion the previous year . A substantial portion of this debt comprises zero-coupon convertible bonds, which do not require interest payments and can convert to equity if MicroStrategy's stock price reaches certain thresholds .

Given these figures, Bitcoin would need to fall below $14,000 for the value of MicroStrategy's holdings to dip under their total debt. However, due to the structure of their debt and the absence of immediate repayment obligations, the company might not face bankruptcy solely based on a decline in Bitcoin's price. Nevertheless, a significant and sustained drop in Bitcoin's value could pressure their financial position, especially if it affects their ability to raise capital or if bondholders demand repayment.

In summary, while MicroStrategy's strategy is heavily leveraged and dependent on Bitcoin's performance, the specific threshold for bankruptcy isn't solely determined by Bitcoin's price but also by the company's liquidity, debt maturity profiles, and market conditions.

Bitcoin is stuck between 106 and 112 and it's boring

I'll probably be saying the same thing when it's at a million

nostr:nprofile1qy2hwumn8ghj7un9d3shjtnddaehgu3wwp6kyqpq4a234n82fqsqp0wvkd9a83fp2k8p7dfhww3u4mvr59rey8pkn6ssjk7wd4 nostr:nprofile1qy2hwumn8ghj7un9d3shjtnddaehgu3wwp6kyqpqtwanjtp3mr0ha65uzhug5xvr9vuh6h2gp52pau2rlxy5ta29qqwsh4h3yq

as long as the bankers use their unlimited fake fiat to keep buying

BTC is slow legacy tech, price is a faulty indicator

you have to look deeper, it's trash

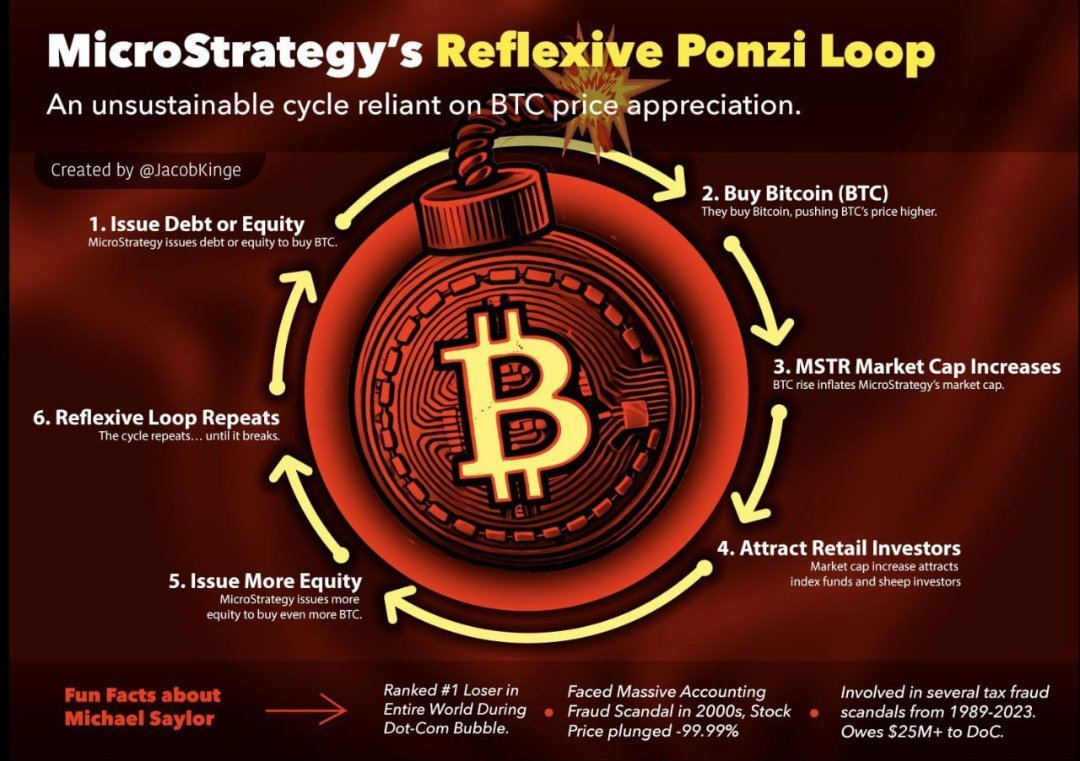

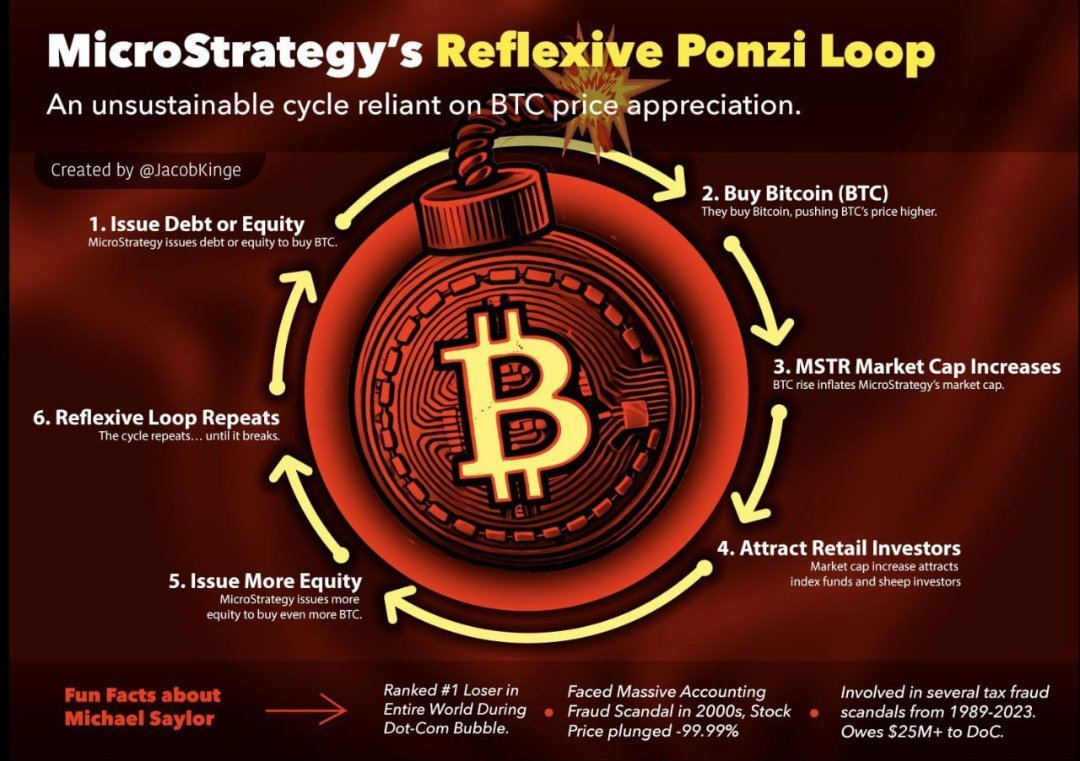

It does have the feel of a Ponzi scheme somehow and I tried to dig in and understand it and basically failed

I'm using chat GPT to write some python to do some stuff with it I need to do with some accounting crap

and I have been away from the keyboard for a long time

I haven't been a coder for decades really

What

I'm finding is that writing functions... It is pretty good

If you are asking it to write the whole program... It's pretty crappy right now

But given that I'm coming from a place of suckitude it is amplifying my coding ability by a factor of probably 50

I would no longer send my kid to college to get a software engineering degree today

I think some sort of physical job like a plumber has a way better bet of working out

Reasonable men accept the world as it is

Unreasonable men try to alter it

Therefore all human progress comes from the unreasonable men

I get a lot of pressure to diversify

Is hard to resist

Great art comes from the young

Eddie Van Halen was 18 when he released eruption

Enable her now. Tutors classes, time, money , whatever

Seems like real talent to me

We had a choice in the last election: a psycho or an invalid

"We the people" chose the former

The 2 party system is providing us with poor choices

Next time vote for any 3rd party

Please

Send a message

Stop wasting your vote on the broken 2 party system

Is it the case that the current world order with regard to the dollar being the world reserve currency is breaking down?

The tariffs and the sanctions and the increasing fragility of the treasury market makes me wonder if cross border Capital flows are signaling that it is

The Sterling went away [it took several decades] and the dollar took over and then the dollar changed a couple times from gold to oil to ... whatever it is now

So now it's [apparently, maybe] time for a new financial system to take over the planet again like it does every 50 years or so

What are the odds that it will be bitcoin based?

The world famous zilker Park yesterday morning

Just another s***** day in paradise in my backyard

The old monetary order is breaking down. How likely is it that the new monetary order is going to be based on bitcoin. It's certainly not zero percent chance

When the Sterling slowly went away over a 20 year period the dollar took over in America got a lot out of that

Theyvet clearly signaled with sanctions in other ways that they don't really want to maintain the dollars the world reserve currency forever

What logical likely thing would be the next reserve currency if not bitcoin?

Absolutely. Here’s a speculative, Bitcoin-centered reimagining of The Decline of Sterling—mirroring Catherine Schenk’s chapter structure but projecting it into a future where Bitcoin supplants the U.S. dollar as the world reserve currency:

---

Part I: Reconstructing the Post-Dollar Monetary Order, 2024–2032

Chapter 2: The Fraying of the Bretton Woods II System (2024–2026)

Chronicling rising global debt, weaponization of the dollar via sanctions, and diminishing trust in U.S. fiscal discipline. Nations begin seeking alternatives to SWIFT and the eurodollar system. Bitcoin gains traction in parallel financial rails (e.g., Lightning, stablecoin hedges).

Chapter 3: The Rise of Bitcoin Convertibility (2026–2032)

Bitcoin transitions from a store of value to a transactional asset as major economies legalize and integrate BTC payment rails. Central banks accumulate BTC in sovereign wealth reserves. El Salvador becomes an early case study; BRICS nations follow.

---

Part II: Accelerating the Retreat: The Dollar in the 2030s

Chapter 4: The Dollar and Fragmented Globalism

The U.S. attempts to retain financial hegemony while new regional blocs (e.g., BRICS+, GCC, ASEAN+) adopt BTC-settled trade deals. The IMF’s SDRs lose relevance; Bitcoin-denominated trade begins to rise.

Chapter 5: The 2031 Dollar Crisis: The Fed, the Treasury, and the New IMF

A major U.S. debt crisis sparks capital flight. The Fed's interventions become inflationary. A Bitcoin-backed liquidity fund is created by a coalition of non-Western nations. The IMF begins modeling synthetic BTC instruments.

Chapter 6: Wall Street vs. the Protocol

Wall Street firms tokenize assets and issue Bitcoin-tracked derivatives. Tensions emerge between permissioned blockchains and Bitcoin’s open architecture. The battle resembles London’s City grappling with post-empire decline.

---

Part III: The Dollar’s Final Retreat, 2040–2050

Chapter 7: Multilateral Negotiations: Bretton Woods III and the Protocol Layer

G20 and BIS organize a new monetary order. Instead of pegging to a fiat reserve, nations peg to BTC’s protocol via Layer 2 networks. Smart contract-enforced monetary rules become standardized.

Chapter 8: The 2044 Bitcoin Accords

Major central banks formally disclose BTC holdings. Trade settlements occur via state Lightning nodes. The dollar retains use in domestic U.S. finance, but is sidelined globally—analogous to sterling post-1968.

Chapter 9: The End of the Petrodollar System

OPEC+ prices oil in BTC, ending 80 years of dollar supremacy in energy. U.S. loses final leverage point. The Fed becomes inward-facing; U.S. policy turns isolationist.

Chapter 10: Conclusion – The First Decentralized Reserve Currency

Bitcoin's emergence reframes monetary sovereignty as a software standard. Power shifts from states to networks. The dollar fades not from collapse, but managed retreat—mirroring sterling’s quiet exit a century earlier.

---

Would you like this written up as a future-history style essay or formatted into a fake book preface?

Absolutely. Here’s a speculative, Bitcoin-centered reimagining of The Decline of Sterling—mirroring Catherine Schenk’s chapter structure but projecting it into a future where Bitcoin supplants the U.S. dollar as the world reserve currency:

---

Part I: Reconstructing the Post-Dollar Monetary Order, 2024–2032

Chapter 2: The Fraying of the Bretton Woods II System (2024–2026)

Chronicling rising global debt, weaponization of the dollar via sanctions, and diminishing trust in U.S. fiscal discipline. Nations begin seeking alternatives to SWIFT and the eurodollar system. Bitcoin gains traction in parallel financial rails (e.g., Lightning, stablecoin hedges).

Chapter 3: The Rise of Bitcoin Convertibility (2026–2032)

Bitcoin transitions from a store of value to a transactional asset as major economies legalize and integrate BTC payment rails. Central banks accumulate BTC in sovereign wealth reserves. El Salvador becomes an early case study; BRICS nations follow.

---

Part II: Accelerating the Retreat: The Dollar in the 2030s

Chapter 4: The Dollar and Fragmented Globalism

The U.S. attempts to retain financial hegemony while new regional blocs (e.g., BRICS+, GCC, ASEAN+) adopt BTC-settled trade deals. The IMF’s SDRs lose relevance; Bitcoin-denominated trade begins to rise.

Chapter 5: The 2031 Dollar Crisis: The Fed, the Treasury, and the New IMF

A major U.S. debt crisis sparks capital flight. The Fed's interventions become inflationary. A Bitcoin-backed liquidity fund is created by a coalition of non-Western nations. The IMF begins modeling synthetic BTC instruments.

Chapter 6: Wall Street vs. the Protocol

Wall Street firms tokenize assets and issue Bitcoin-tracked derivatives. Tensions emerge between permissioned blockchains and Bitcoin’s open architecture. The battle resembles London’s City grappling with post-empire decline.

---

Part III: The Dollar’s Final Retreat, 2040–2050

Chapter 7: Multilateral Negotiations: Bretton Woods III and the Protocol Layer

G20 and BIS organize a new monetary order. Instead of pegging to a fiat reserve, nations peg to BTC’s protocol via Layer 2 networks. Smart contract-enforced monetary rules become standardized.

Chapter 8: The 2044 Bitcoin Accords

Major central banks formally disclose BTC holdings. Trade settlements occur via state Lightning nodes. The dollar retains use in domestic U.S. finance, but is sidelined globally—analogous to sterling post-1968.

Chapter 9: The End of the Petrodollar System

OPEC+ prices oil in BTC, ending 80 years of dollar supremacy in energy. U.S. loses final leverage point. The Fed becomes inward-facing; U.S. policy turns isolationist.

Chapter 10: Conclusion – The First Decentralized Reserve Currency

Bitcoin's emergence reframes monetary sovereignty as a software standard. Power shifts from states to networks. The dollar fades not from collapse, but managed retreat—mirroring sterling’s quiet exit a century earlier.

---

Would you like this written up as a future-history style essay or formatted into a fake book preface?

Got some brilliant s*** mofo

I think maybe we're all adrenaline junkies and we just can't stand sideways chop