Just remember that giant springs must be respected because they can absolutely take off an finger, arm, or even kill ya. Much potential energy

Les Paul shredding on his Gibson Les Paul guitar in the early 1950s

#justrock https://video.nostr.build/e27eb54e6cb2d6a114daaf97dfcb1888eacd59961b0796dc8d0643a5a2469860.mp4

Wouldn't call it rock though

Got a couple new people! I'll have to make it out there sometime.

Next one is Feb 13th

And entertainment, you can lick it if you get bored and it provides not unpleasant stimulus!

Guess they just had to lose the world juniors real bad

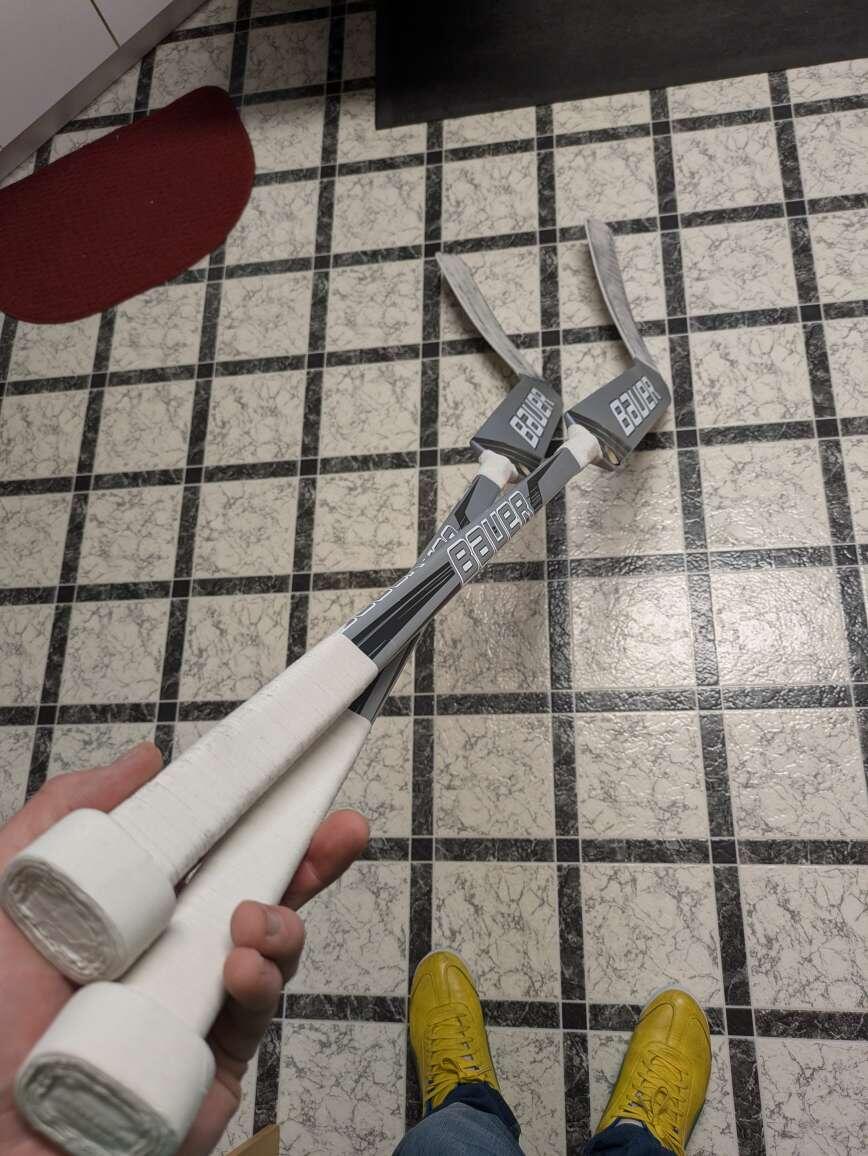

Two fresh new sticks, notched, taped, and waxed.

I typed out a really long reply but then took a step back and it was more of an argument on the usage of the words and it was boring and not really furthering thought so I'll save you the time, lol.

Fun conversation though!

That's a good looking pie, it is

I would say a space to occupy has intrinsic value. You can't exist without a space to exist in. The number associated to that value isn't static but it's never zero.

The wont of man is truly unquenchable and it cannot be swayed by logic. A fool and his money will soon be parted and even the hardest money in the world doesn't change that.

Living in a space is also a utility. We would absolutely see a sharp decline in the amount of debt, and the use of property as investment would decline.

To say we will be rid of debt entirely ignores the human desire to live beyond their means and to desire that which they do not have.

The responsible ones will live debt free, those without restraint and self control will continue to be indebted.

Should I bother with blue sky?

So I would say this is a very true statement for the majority of consumer credit that we see today.

However I believe you're neglecting two aspects that we don't generally see today because of artificial interest rates:

1. The interest rate of the loan would be directly proportional to the risk associated to it.

Because our brains are biologically the same as they were 100k years ago, people will always want more than they truly have. There will always be an opportunity to make and lose money through credit due to this.

The rate of interest would be determined knowing that the value of bitcoin will continue to increase. Let's say by then Bitcoin increases in value relative to everything else ~5% on average YOY. The rate of the loan would need to cover all the expenses+profit to service the loan, plus that 5%. The profit is directly correlated to the risk of the investment.

2. Land has inherent value and always will. Things need places to be. Owning land is the second best asset after Bitcoin. Food needs a place to grow, livestock needs a place to graze. Even waste products need to go somewhere.

The house itself will decrease in value over time, but land is still scarce and has value. Once land's true utility value stabilizes in a deflationary Bitcoin economy, I would expect land value (on average) to keep steady, or slightly lag behind Bitcoin.

That's a long winded way to say that land can still be repossessed and sold as an insurance to secure the loan same as now.

A loan is nothing more than a gamble of the future. And I don't ever expect people to stop gambling. It's the one addiction where the next hit might actually change everything for the better.

Fargo, ND Bitcoiners meeting at Brewhalla. 7PM Thursday, December 5th

I think an argument could be made that young adults (and teens) have always run around being entitled and taking little to no responsibility for their actions, it's just the consequences for doing so now are substantially lessened.

Shot gun weddings were a thing for a very very long time and are the epitome of not considering future consequences.

I don't think forefathers are good examples to draw from if not only because many of their more negative qualities were filtered through lenses of historical idolatry but they were also a bunch of rich kids compared to the rest of society.

I'm not really arguing one way or another but it's an interesting topic of discussion.