I’m not on Facebook anymore but there’s an avid Ninja Creami group on there. They talk all about this issue. I’d check that out

Had one of these Ninja Creamis and used it religiously. I would highly recommend looking into what people do in terms of flattening the tip of the mix once frozen, because it will eventually break your machine down. I haven’t replaced mine yet and it was heartbreaking to lose

Interesting perspective and I largely agree. Solar stinks in most use cases, and nuclear is criminally underutilized

Finally reading The Price of Tomorrow by nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe. Jeff, I’m curious if you still believe in solar as the path to declining energy costs, solar actually being a “clean energy”, and if you still believe in carbon dioxide is causing a warming of the earth, or that a warmer earth is even a problem after the last 4-5 years and any additional DYOR you may have done?

Enjoying the book. Thank you for writing it.

For new bitcoiners, I always recommend Bitcoin Standard, Price of Tomorrow, and then Broken Money. Jeff’s book is so simple but profound

Thought the 100 day MA was about $73k - isn’t it the red line in this chart?

Fresh grilled pheasant, chukar, and lamb steaks from nostr:npub1f5pre6wl6ad87vr4hr5wppqq30sh58m4p33mthnjreh03qadcajs7gwt3z. Eating like a king. #foodstr

So good. Ate pheasant and chuck earlier this week. Unfortunately bit down on some shell still in there!

These look great

This is the #1 way that I use to stack a lot of extra, EASY bitcoin.

I'm not even *buying* it.

~$8,000 worth in 1.5 years... not a joke.

People really dismiss this combo, but it makes a huge difference if you use them consistently. 👇

Shout to Fold, nostr:npub18tcc00lqpysdsurg567dllzg7jeyr5wcyk2v6w23rx3s3ygyze2qv32nxx and nostr:npub1ex7mdykw786qxvmtuls208uyxmn0hse95rfwsarvfde5yg6wy7jq6qvyt9 for the setup that makes this work. 🫡

Add Lolli to this!

Proof of steak. Tonight, a wagyu strip

Pump the TFTC quarterly liquidity update with nostr:npub1guh5grefa7vkay4ps6udxg8lrqxg2kgr3qh9n4gduxut64nfxq0q9y6hjy and nostr:npub1ath4je07y7py74nvu044fum3f8hz3exc3dtcv782qg94w5gaddusl74k6d directly into my veins. One of my favorite podcasts every quarter. Thanks for the quality content guys

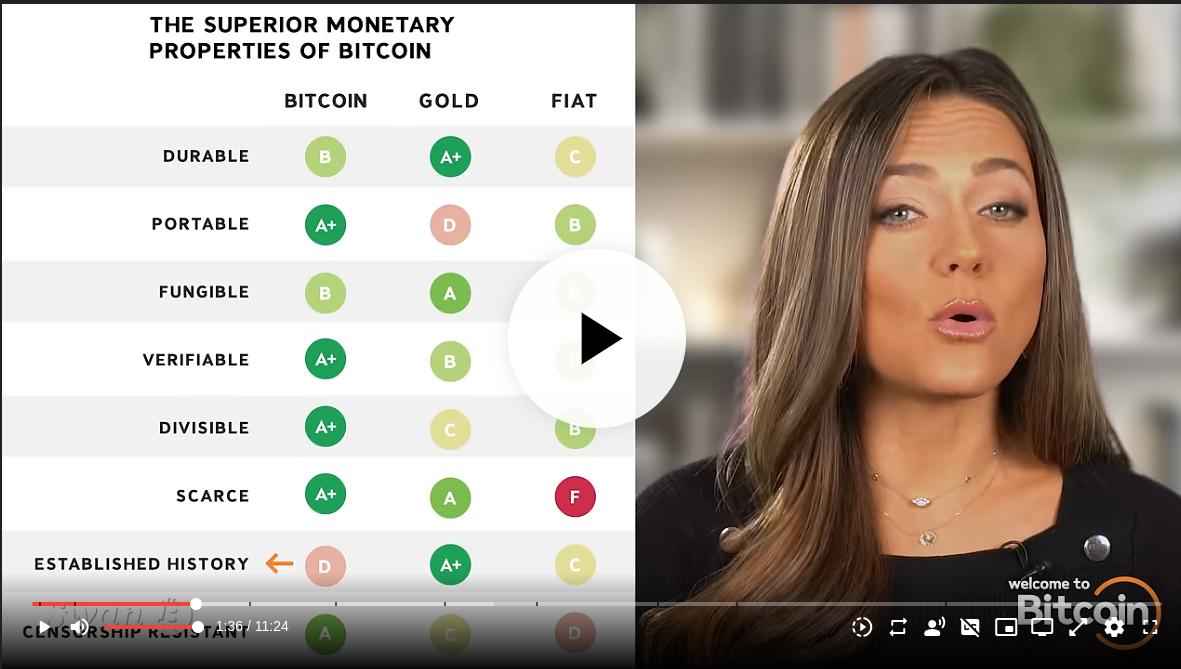

Not sure that’s the argument I’d make. A good counterpoint would be utility of UTXOs holding a small number of coins and the inability to transfer on layer 1 with fees that outweigh the amount. But I think that’s too nuanced a point (a counterpoint to that would be layer 2s) for this kind of course. In the abstract, it’s perfectly fungible and much moreso than gold

Makes no sense why Bitcoin would be at B on fungibility with Gold at an A

Totally agree

A very delicate balance to not use too much tallow; easy to overdo it and have the pan be too watery. Respect.

Had a BTC $100k celebratory steak dinner tonight with a friend and two other “crypto guys” he knew. Here was the breakdown:

- friend: career day trader, bought bitcoin at $300 and made $1M selling it, has been trading ever since. Rolled initial return into a “blockchain fund” and holds all current Bitcoin at Coinbase and the ETFs

- guy 1: similar story, has “no idea” why anyone values bitcoin at $100k+

- guy 3: holds a large MSTR position only, no Bitcoin

Reminded me how early we still are. 4 people celebrating $100k Bitcoin and only one actually holds any Bitcoin. The other 3 guys have net worths well over $10M each.

I get increasingly uncomfortable with these MSTR weekly buys. On one hand, coins are moving from weak hands to strong hands, which should strain future supply. On the other hand, it supports the feeling that a couple of buyers are propping up Bitcoin at these prices.

And I can’t help but focus on the increasing counterparty risk with Coinbase. Not only with MSTR, but also nearly all of the ETFs.

Hope I’m wrong. But I’m stacking sats carefully and resisting the “greed mindset.”

Lots of truth to this. No generation before us has been met with this level of temptation / ease of access. All while being constantly overloaded with sexuality in nearly all “normal” media from a young age.

“Wild World” - Cat Stevens & Chris Cornell https://video.nostr.build/109e97ce3f806f042b3a1c27af3724872f8675f03f58d9f268a001ce2b4a0d1b.mp4

No one sings like you, anymore