If you have any debt and also #Bitcoin, you are leveraged long Bitcoin.

The only question is how much.

Rule #1 of Fed operations is to keep the game going.

Shut up and take your pre-flight coffee enemas. https://youtu.be/g0m4rhisQog

In a corrupt system, being responsible is irrational.

What money supply metric are they using? According to M2, we’re still roughly 5% below the high of April 2022.

I witnessed this in my own life. My parents always advocated for living within your means. Making extra mortgage payments to pay it off faster etc. They disparaged my friends’ parents who over-extended, burdened by huge mortgages, but living in big nice houses.

Nothing bad ever happened to those people my dad talked about, as far as I could tell. The lesson I took from this was that the system does not reward prudent behavior. In a corrupt system, being responsible is irrational.

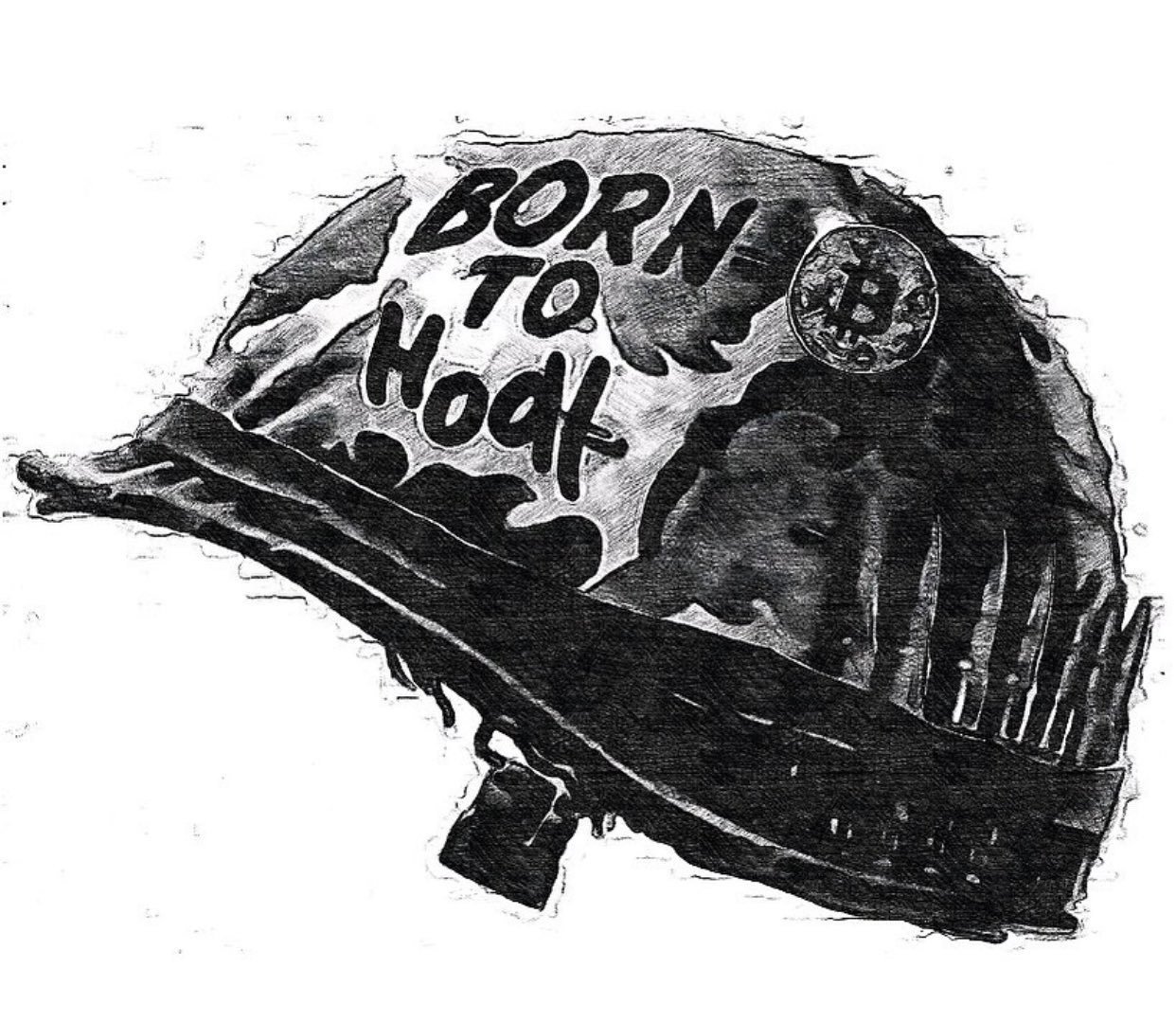

Under a Bitcoin standard, debt will be fatal. But under our current fiat standard, the winners will be those who can acquire the maximum debt in fiat units and stack Bitcoin with it.

Just don’t be a forced seller.

I was ready to try it, but iOS not available.

Correct. OP was complaining about people who get away with it in perpetuity, which, IMO, is just playing the game well.

If you go bust, then you played poorly.

Unpopular opinion: it’s not “living beyond your means” if you get away with it in perpetuity. That’s just winning.

You gotta play the game you’re in. The game we’re in rewards people for buying assets on credit, then using those assets to lever up. I don’t make the rules.

58k gang undefeated

It’ll be ok

What you got on there, a couple of 45s and a 25 on each side (275)?

Kevin Kelly

Not so. In #Bitcoin, ownership is knowledge. You either know the keys or you don’t.

If you die with that knowledge in your head, you take your coins with you.

Regtest then. Whatever Polar spins up.

nostr:note156ckac6w4lgu5xwzd97eusjntcjczz6ex0se6lpx0uug2f5vacyqdn9uzq

nostr:note156ckac6w4lgu5xwzd97eusjntcjczz6ex0se6lpx0uug2f5vacyqdn9uzq