Just asked Bard why it was legal for banks to use customer deposits to generate yield, and here are some nice blurbs from the response:

"It is legal for banks to use consumer deposits for bank yield because it is a necessary part of the banking system. Banks need to generate income in order to cover their costs and generate profits. Bank yield is one of the primary ways that banks generate income."

"Without bank yield, banks would not be able to lend money to businesses and consumers. This would have a negative impact on the economy. Additionally, without bank yield, banks would not be able to generate profits for their shareholders. This would make it difficult for banks to attract capital, which could destabilize the banking system."

"Overall, there are good reasons why it is legal for banks to use consumer deposits for bank yield. Bank yield is essential for a healthy and stable banking system, and it is protected by government regulations and FDIC insurance."

The 'essential for a healthy and stable banking system' is classic

Imagine being so out of touch you think Martin Sheen is going to help you?

Just linked my NOSTR zaps to my own nostr:npub126ntw5mnermmj0znhjhgdk8lh2af72sm8qfzq48umdlnhaj9kuns3le9ll node using nostr:npub1xnf02f60r9v0e5kty33a404dm79zr7z2eepyrk5gsq3m7pwvsz2sazlpr5 - let's see if this works!

👀 watching this closely — would love to do this

I’m expecting something similar — expect the worst hope for the best 🤷♂️

Big time plus one on this

Sparrow v1.8.0 released with:

Transaction diagram captions

Larger and denser QR display

Search all open wallets

Airgapped message signing

Satochip and Krux support

And much more: https://github.com/sparrowwallet/sparrow/releases/tag/1.8.0

Thank you for your services good sir 🫡

nostr:note19wc8gzgyrkgz5mxtw89zwsgmrc2da3ru3ndzz23jwygsfcqvazdqyjdh7u

This is why we ⚡️⚡️

Customer spotlight:

Rosie’s Chips now accepts Lightning Payments through nostr:npub1ex7mdykw786qxvmtuls208uyxmn0hse95rfwsarvfde5yg6wy7jq6qvyt9 ⚡️⚡️

Get chips made the way they should be with beef tallow and Himalayan sea salt 💪

Anti seed oil chip lovers rejoice 🎉

Get yourself some @ https://rosieschips.com/

absolute 🔥 suit

A band that keeps surprising me to the upside is Papa Roach. I listened to them as a kid and teenager, and never liked their name but liked their music.

And today, 30 years after their founding, they are still making music and maturing as a band. I hear them on the radio and think, "damn, that's Papa Roach? They're still around? Holy shit."

https://www.youtube.com/watch?v=FmjrTdTydLE&ab_channel=PapaRoach

I didnt even know they were still around that's amazing. I liked them then and now will check out their newer stuff for sure

Quick thoughts on the state of 'beauty' and how my recent trip to Europe left me with some questions.

“A March 2022 poll by Monmouth University found that one in three Americans prefer to keep the continue the biannual clock-resetting process as it stands, but more Americans (six out of 10) would prefer to do away with the twice-a-year change.”

All I want to know is who are these psychos in the 33%?

https://time.com/6330561/what-to-know-daylight-saving-time-change/

This is the last daylight savings right? Didn’t we get rid of this now? At least in the US?

Anyone use Proton calendar and make it work?

I like their interface and mission but can’t seem to make the switch feasible as I have a couple active calendars for work and need an aggregator so they’re all in one place

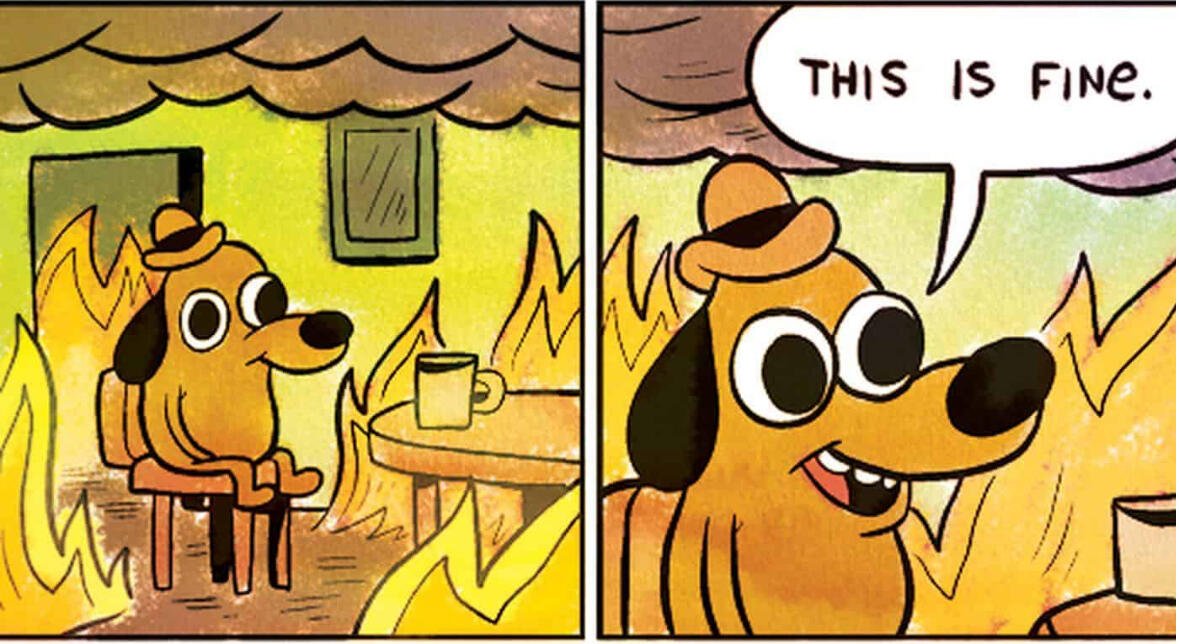

SBF was a scammer is and should be going to jail

His defense of “I thought it was legal to use customer deposits and loan them out for yield , isn’t that what banks do?”

Is kinda unfortunately very right though

What are the chances this was recorded?

I remember not too long ago my premium was 14.99 🫠

Krugman: “why don’t people realize inflation is fixed?”

My Netflix subscription 👇

I thought I remember Vida and nostr:npub1ylepraz59lvf6eeultg4kmvr3nza2ftpt2hgd90drh8tcwdjmtdss8xgy8 having those features but playing around with it now doesn’t seem like it and is more focused on spam

Is there an app out there that is like calendly where you can send others a link to book an appointment on your cal, but if someone pays a certain amount of sats they just get access to the calendar too?

So if the pump wasn’t from liquidity expansion, what’s your thesis?

God damn sorry about that — hope no more issues 🙏

I used it on my recent trip to Portugal and Italy and it was a dream — worked so well

Got it for myself and my wife