QE and QT

Rekt. Make a repayment plan. The capital gain can only be carried forward to future gains.

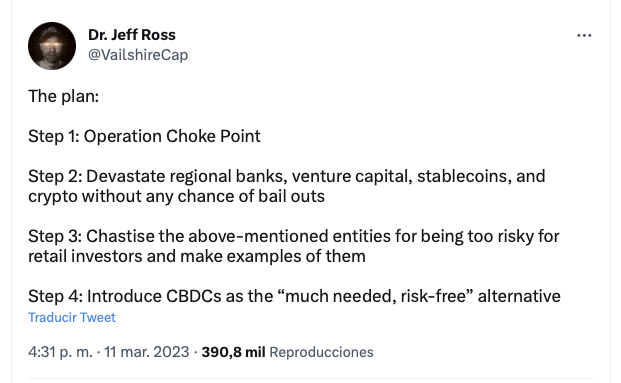

Correct me if I'm wrong. Credit money is supposedly market based debt obligations. But what are CBDCs? Promises?

I don't think they are equivalent

#[0]

I'm not a fan of the war language used by Jason Lowery, and I'm sceptical of invoking the second amendment, but I think the power projection argument to SECURE property is the right counter argument to CBDCs. Particularly from a national security perspective for international trade. What country is going to trust another's CBDC?

Softwar as summarised by Chat GPT

"Bitcoin's "proof-of-work" function has the potential to be a strategically important national security technology for the US in the digital age. However, the American public lacks the necessary understanding of the complexity of proof-of-work, modern power projection tactics, the function of militaries, and warfighting. This lack of understanding could jeopardize US national strategic security as the future of US national strategic security hinges upon cybersecurity. Bitcoin has demonstrated that "proof-of-work" functions as a new type of cyber security system. Nations are beginning to recognize the potentially substantial strategic benefits of Bitcoin, and the US could lose its strategically vital power projection technology lead to its competitors if it does not consider stockpiling strategic Bitcoin reserves. If the US policymakers continue to categorize Bitcoin as "cryptocurrency" and allow institutions with conflicts of interest to claim to be experts in proof-of-work technology, they could compromise US national strategic security. The primary function of militaries is to protect and defend access to international thoroughfares, including cyberspace. Until Bitcoin, nations have not had an effective way to physically secure their ability to freely exchange bits of information across cyberspace without resorting to lethal power. Bitcoin can provide nations with the technology to impose severe physical costs on belligerent actors trying to access or interfere with valuable bits of information. The adoption of Bitcoin could represent a new type of cold war, a cyber space race. The US needs to recognize the potential benefits of Bitcoin and encourage its adoption to maintain its global power dominance."

https://twitter.com/JasonPLowery/status/1634691751293210626?s=20

#[1]

Heads up for any #AUSTriches who aren't aware yet, but Australia has capital gains tax exemption for amounts under $10k

"If your crypto is a personal use asset, capital gains or losses from disposing of it may be exempt from CGT. Crypto is a personal use asset if it is kept or used mainly to purchase items for personal use or consumption.

A capital gain on a personal use asset is subject to CGT if it cost you more than $10,000 to acquire the asset."

https://www.ato.gov.au/individuals/capital-gains-tax/list-of-cgt-assets-and-exemptions/#Cryptoassets

Does anyone know if you have pumped more than 10k into Bitcoin, can you buy sats for spending, keeping them separate, without complicating your tax return?

I sat quietly on Bitcoin for years, not wanting to be responsible for my friends and family losing money if I was wrong or the time was wrong.

Turns out they don't listen to me anyway 🤣🤣🤣

If you want a net gain in quality content you need to accept a net loss in sats

#[0]

I read this from Australia's national broadcaster yesterday. Getting warmer.

"If you really want to point the finger, why not at the governments that rescued multinational finance corporations in 2008 and 2009 after they ran into big trouble as a result of taking on too much risk?

It enhanced what economists call moral hazard.

We now see more monopolies with the power to set consumer prices as they choose, and monopsony power, as Treasury research has recently showed, may explain why wage growth is stuck at low levels."

https://www.abc.net.au/news/2023-03-11/housing-crisis-cost-of-living-personal-debt/102077818

#[0]

Some people didn't realise that pegging means getting shafted

#[0]

I calculated that for my dog yesterday. Lol.

#[1]

Zapping 21 sats instead of liking feels good. For me it means pressing a few more buttons and waiting for my wallet to load, which makes it more sincere. Sorry it's never going to be a life changing amount, but it actually means I value your input, rather than just giving plateaueds.

What about blockstream Jade? They are a lot cheaper, but no recommendations?

Yeah, bit I don't want to spend bitcoin.

I'm looking for a card that I can spend fiat and get sats back. Any recommendations?

GM PV

GM PV