Nostr is grand. Welcome ⚡️

A Daily Dose hitting nostr:npub16secklpnqey3el04fy2drfftsz5k26zlwdsnz84wtul2luwj8fdsugjdxk in this flowing Saturday afternoon 😎

https://open.spotify.com/track/1LzFh1VZ0FLeUesOFEuhyl?si=K3bx60_8S6W8Jw6L3rDjNw

FAMILY FIRST FOR LIFE, PERIOD.

FAMILY FIRST FOR LIFE

Bitcoin is a vector that has a million reasons why to hold it.

Bitcoin is money, everything else is credit.

For Bitcoin investors, the important point to realize is that inflation is a stealth form of default. It’s a deliberate policy. And it’s well under way. You (we) can expect higher inflation in 2025. No matter who wins next month, total US debt is going up.

Big brother holds gold. The little brother holds cash. I hold Bitcoin and this is why: From 1920 to 1932, it took 1 $20 bill to buy 1 ounce of gold. In 2016 it took $1,260 (63 $20 bills) to buy 1 ounce of gold. Today it takes $2,660 (133 $20 bills) to buy 1 ounce of gold. Gold has done good, but Bitcoin has and will continue to do better.

Fact: Total Federal debt was $9 trillion in the third quarter of 2007. It’s $35.7 trillion today. The gross federal debt to GDP ratio was 60% in 2007. It’s 120% today. I've identified 130% as the debt-to-GDP level from which there is no going back. It’s a trigger point that starts the next big blow up.

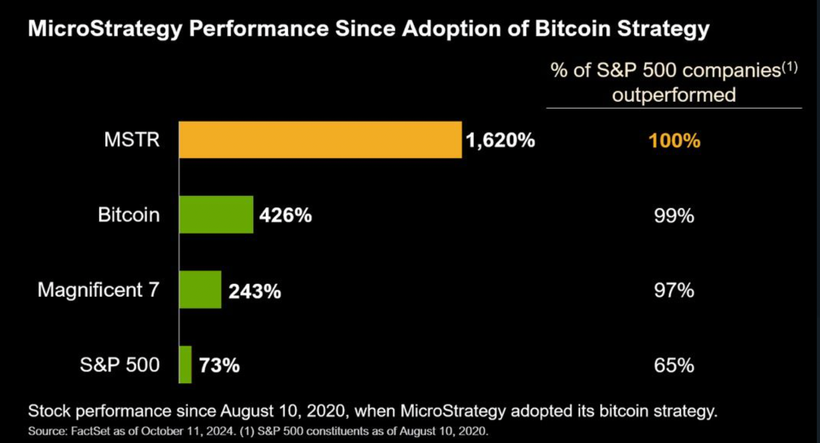

Yesterdays MSTR move was truly something to behold. This will be analyzed for decades to come.

Spooky, scary and lovely.

Stacked. Stay safe, stack sats. Stack and save. Stack for health.

Soon they will run back

The ₿itcoin dominance is currently 55.44% after seeing an increase of 0.41% in the last 24 hours. ₿itcoin's market capitalization is currently 1.24T. Up 3.27% in the last 24 hours.