GM, much love and aloha. Daily Dose for nostr:npub16secklpnqey3el04fy2drfftsz5k26zlwdsnz84wtul2luwj8fdsugjdxk

If you study Lumeria, they were regularly living 200 to 300 years with accounts of some living up to 900 years. WoW

Just think about what our star parents / ancestors did some 200,000 years ago with their high science when they fused chromosomes 2 and 3 together to make 23 visibly, active pairs of chromosomes while the 24th pair remains invisible, quantum and multi dimensional.

Several countries have residency programs that allow healthy, financially independent individuals to settle without requiring investments, often under "non-lucrative" or "financially independent" visa categories. These typically require proof of sufficient income or savings to support oneself without working locally.

These programs generally target healthy individuals who can support themselves without burdening the host country’s economy. Requirements vary but typically include proof of income/savings, health insurance and clean criminal records. It could even be as much as showing you have 1 BITCOIN in some places (WHOLECOINER)

COUNTRIES THAT ARE DOING THIS

Austria: Offers a "Settlement Permit – Gainful Employment Excluded" for financially independent individuals. Applicants must show stable income (e.g., pensions, investments, or savings), health insurance, and accommodation. No investment in businesses or property is required, as noted in the image.

Spain: Provides a Non-Lucrative Visa for individuals who can prove sufficient financial means (around €28,800/year for a single person, as of my last data) and private health insurance. It’s designed for retirees or those with passive income who won’t work in Spain.

Portugal: The D7 Visa targets financially independent individuals with passive income (e.g., pensions, rentals, or investments). The minimum income requirement is around €820/month for an individual, plus health insurance and proof of accommodation.

France: Offers a "Visitor Visa" (Visa de Long Séjour Visiteur) for those who can demonstrate financial self-sufficiency (around €1,500/month) and won’t engage in local employment. Health insurance and proof of residence are required.

Italy: The Elective Residency Visa is for financially independent individuals with stable passive income (minimum €31,000/year for a single person). Applicants must show they won’t work in Italy and have suitable accommodation.

Greece: Has a Financially Independent Person Visa, requiring proof of €2,000/month in passive income, health insurance, and a place to live. No local employment is allowed.

Malaysia: The Malaysia My Second Home (MM2H) program allows residency for those over 50 (or younger with certain conditions) who can show liquid assets (e.g., MYR 1.5 million, ~$350,000) and monthly income (e.g., MYR 40,000, ~$9,000). No investment is strictly required, though some deposit conditions apply.

Thailand: The Non-Immigrant O-A/O-X Visa for retirees (over 50) or financially independent individuals requires proof of monthly income (e.g., 65,000 THB, ~$1,900) or savings (e.g., 800,000 THB, ~$23,000). Health insurance is mandatory for some categories.

Panama: The Pensionado Visa is open to those with a guaranteed pension of at least $1,000/month, while the Friendly Nations Visa allows residency for financially independent individuals from certain countries who establish a bank account with $5,000 (not strictly an investment).

COUNTRIES THAT TAKE CRYPTO BALANCES AS PROOF OF WEALTH

Antigua and Barbuda

St. Kitts and Nevis

El Salvador

Vanuatu

Grenada

Hong Kong (residency only, not citizenship)

Source: IA

Happy Friday. Daily Dose for nostr:npub16secklpnqey3el04fy2drfftsz5k26zlwdsnz84wtul2luwj8fdsugjdxk to ease into the flow of the incoming weekend 😎

https://open.spotify.com/track/6uYgngEehjgS1nTedZLkw5?si=4Mw2ilOCS4-DleLfZGgldQ

Oil is ‘the master economic resource’ while Bitcoin is ‘the master store of value.’ Oil provides the energy that does the work to make the world go round. Bitcoin is the safest way to store built-up value when everything else is falling apart. As we all know, Bitcoin is tied to energy and is extremely scarce.

In California, the top 1% pay half of all taxes. But it goes deeper than that. In the first half of 2024, nearly 10% of California’s income tax came from stock gains tied to just four tech giants—Nvidia, Alphabet, Meta, and Apple. This shows how much wealth these few companies are creating, especially through stock-based pay to employees. California’s tax system heavily depends on income from wealthy individuals, many of whom work in tech and earn big when stock prices rise. While this brings in a lot of money when the market is booming, it also makes the state’s finances vulnerable if tech stocks drop.

Source: IA

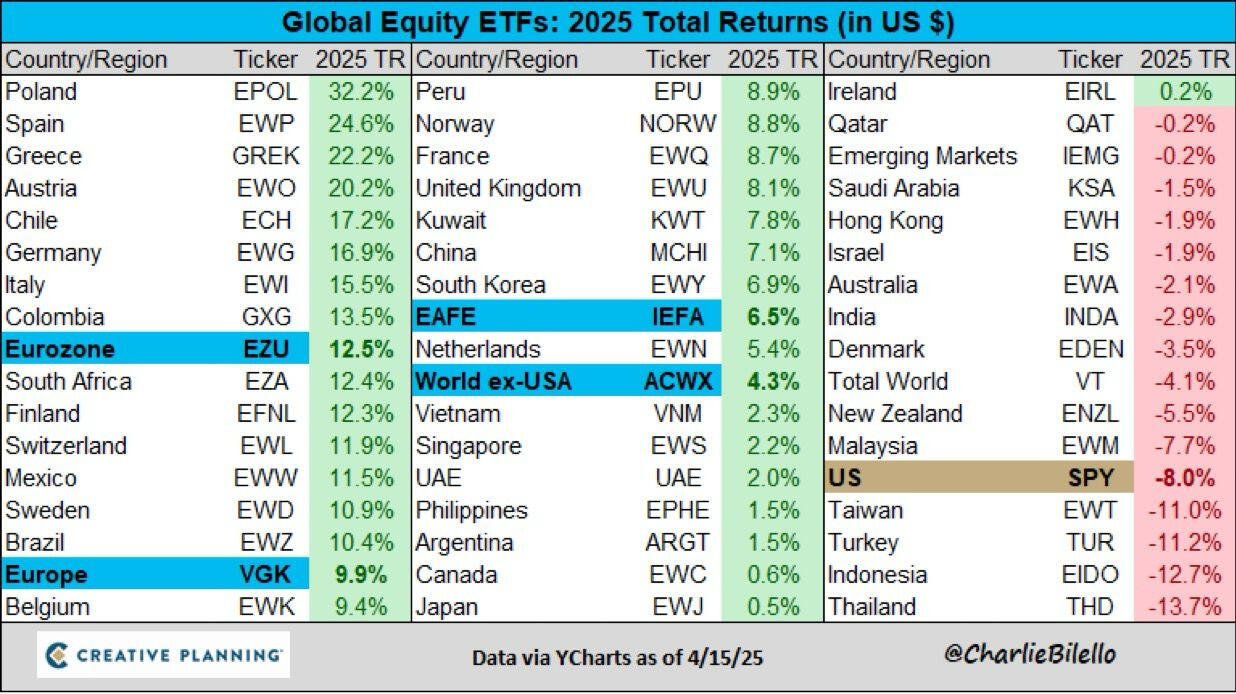

Emerging markets and international stocks have lagged US S&P500 for over 16 years — but 2025 is shaping up as a massive reversion to the mean.

After 16+ years of relentless U.S. outperformance — the longest streak in history — the tides are shifting.

So far this year:

Eurozone stocks +13%

International stocks +4%

S&P 500 –8%

Trade realignments and the aftermath of tariff wars may be setting the stage for a global comeback.

Source: IA

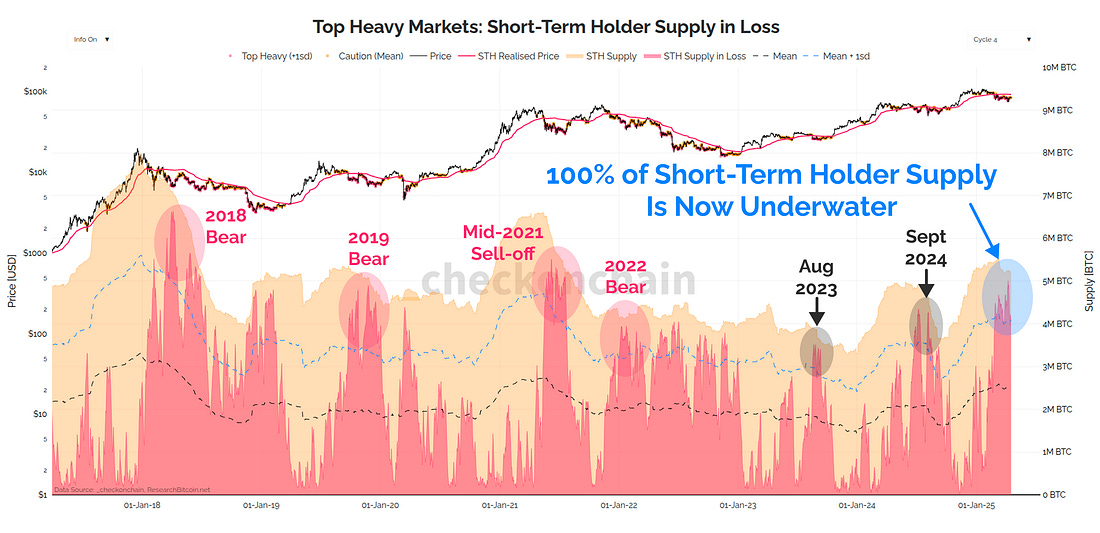

Source: Checkonchain

It’s going to ₿e a ₿eautiful day so there’s really nothing left to do but smile, smile, smile 😊 Daily Dose for nostr:npub16secklpnqey3el04fy2drfftsz5k26zlwdsnz84wtul2luwj8fdsugjdxk

https://open.spotify.com/track/5MOHiX0uAj555wbYJyBnDy?si=-jzyz5jJQF-AghprcS2Zeg

Funny how things turn out. U.S. President Donald Trump looks on as his nominee for the chairman of the Federal Reserve Jerome Powell takes to the podium during a press event in the Rose Garden at the White House in 2017.

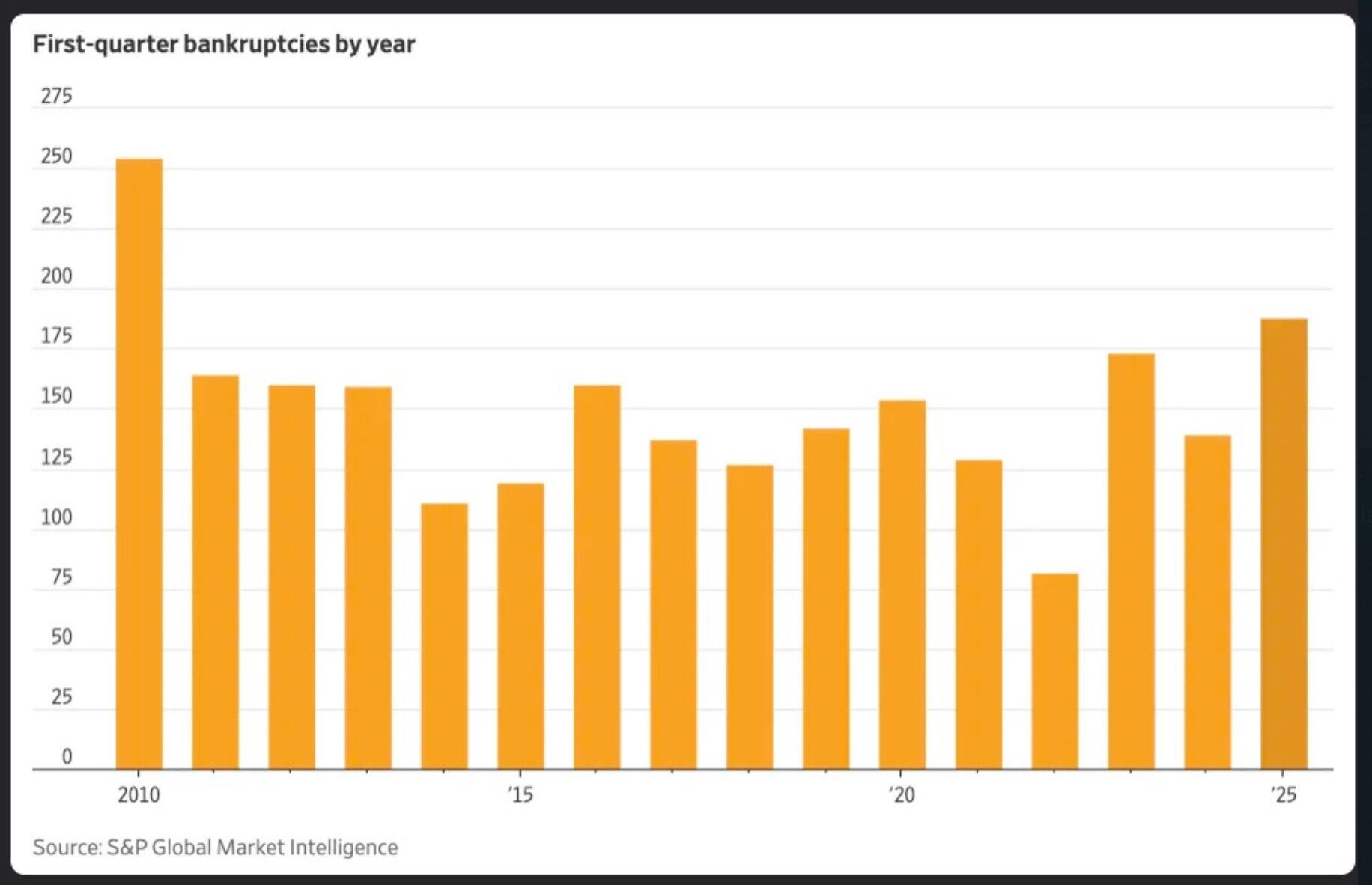

U.S. companies are going bankrupt faster than at any time in the past 15 years— last time was after the global financial crisis.

These bankruptcies aren’t caused by tariffs—they started well before that.

Daily Dose for nostr:npub16secklpnqey3el04fy2drfftsz5k26zlwdsnz84wtul2luwj8fdsugjdxk Things are really burning up around here.

https://open.spotify.com/track/6tASfEUyB7lE2r6DLzURji?si=WGV-8Z-eTsupQWvCfcojzQ

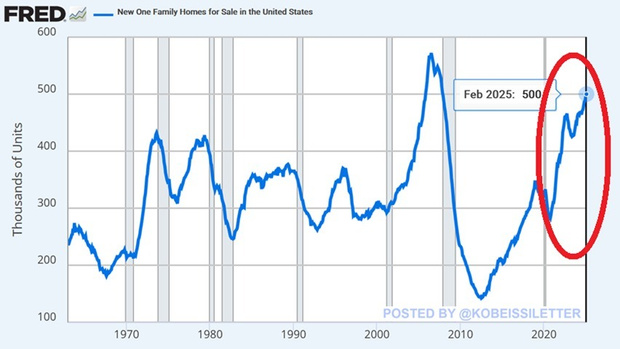

In February, new single-family homes for sale hit 500,000, the highest since November 2007. Over the past 13 years, inventory has more than tripled from a low of 142,000, marking the largest supply ever outside the 2006 housing bubble. In the South, new homes for sale dropped 8,000 to 296,000, still near a record high and above the 291,000 seen in 2006 before the market crashed.

Be careful what you ask for.