Profile: 772f9545...

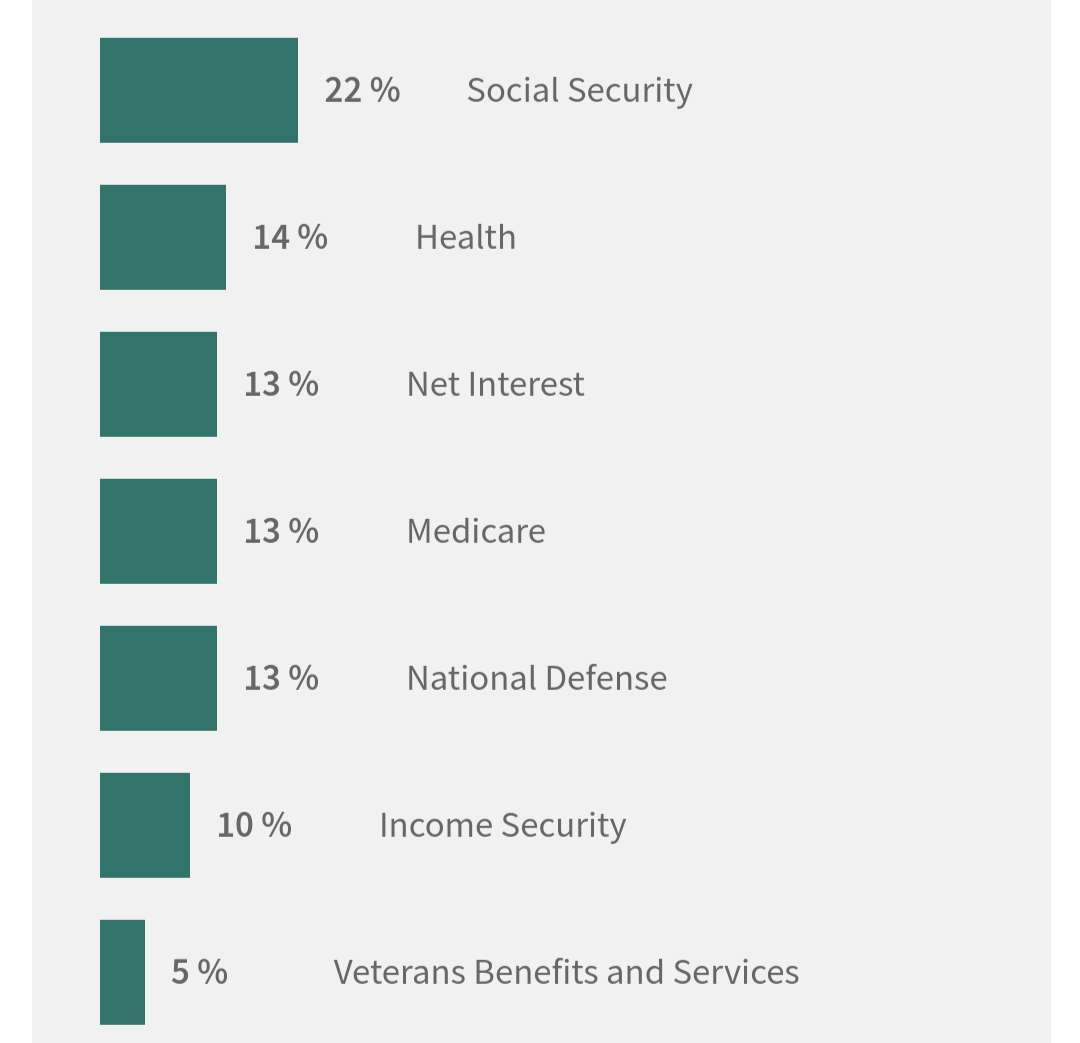

Eliminate the income tax and capital gains taxes entirely, along with the amount of government spending that is funded by these, and that would go a long way.

Other than your first sentence, I think we agree.

When I posted, I was thinking about two different views of democracy. For example, whatever the US Democrats think demoracy is could be undone by US Republicans who were elected by popular vote, so the second view of democracy could be such popular voting.

But regardless of the particular definitions of democracy, I think the statement works.

Suppose you define democracy as extending meaningful voting privileges to all people. In that case, people can vote to restrict voting privileges.

Suppose you define democracy as a strong, unaccountable bureaucracy; something like rule by experts. In that case, the bureaucracy can undo itself by hyperinflation.

Suppose you define democracy as letting the minority have their say and the letting the majority have their way. In that case, the majority can remove the rule about the minority having their say.

All the permutations seem to work too. Suppose you let the first "democracy" be "a strong, unaccountable bureacracy" definition and the second "democracy" be "let the minority have their say and the majority have their way." In that case, the unaccountable bureacracy can overrule the majority.

Mullvad does Bitcoin right.

1. No KYC.

2. Discount for Bitcoin payments.

3. Pro-rated. Service length adjusted to actual amount paid.

There's a budget?

250g of benjamins is bulkier than 250g of gold, sure. For most of us, we're not spending 250g worth of either day-to-day. Physical presence is a much higher bar than remote access of a computer. Authenticity is indeed a problem. Gold issuance is not centralized and does require work. Divisibility is indeed a problem.

nostr:npub1acg6thl5psv62405rljzkj8spesceyfz2c32udakc2ak0dmvfeyse9p35c What do you think of a feed view that only displays the most recent post from every person followed? I find that many people post many messages while others are silent for weeks, but in order to find a last post for everybody, I need to go to the list of people and then load each person in turn.

I should qualify the "in Bitcoin for a buck" with "AND are OK with it becoming exclusively the property of gatekeepers" because it really is nice to make a buck and there's nothing wrong with that.

If Bitcoin's value does not come from its utility as a medium of exchange, it is essentially a Ponzi scheme. At least with gold you can use the gold as a decoration. No such property is present for Bitcoin. As long as some people somewhere can use Bitcoin as peer-to-peer cash, it will be valuable to them, and on this basis custodians, institutions, and governments can hold it without a contradiction. On the other hand, if Bitcoin is exclusively the property of custodians, institutions, and governments, who do not seek to use it as a medium exchange, and who bar everyday people from using it as a medium of exchange, Bitcoin's value should be roughly zero in the long run. It lost its utility. I want Bitcoin or something like it to become money along with gold and silver. Fiat currencies are the problem and Bitcoin is a potential solution. I think if you are in Bitcoin for a buck you're just scamming the folks who buy it from you in the future.

If peer-to-peer cash (Bitcoin) solves the problem of institutional gatekeepers of money, then when Bitcoin is exclusively a medium of exchange for institutional settlements it has failed.

If it is only a medium of exchange for institutional settlements, that would mean it's custodial and a failure as peer-to-peer cash.

Maybe. We could distinguish adoption as a stock to be exchanged later for money versus adoption as a money to be exchanged later for goods or services. Whether my second exchange for goods or services takes place 20 years from now or 20 minutes from now I can use Bitcoin as a medium of exchange. My intent to exchange it for another money versus intent to exchange it for goods and services shapes my perspective. Emphasis on "SoV" is the former and emphasis on "MoE" is the latter. Emphasis on "MoE" necessarily includes "store of value" but the reverse is not always true.

I am trying to clear up some confusion but I'm afraid I created more. I have another post in this same thread I wrote on the same day as the one you responded to. I hope that one helps.

If not, I'll try again.

I think if you start with Bitcoin and ask yourself if it's a medium of exchange versus store of value, you're already on the wrong track. I would rather you ask what the replacement money for the dollar is going to be. Ask if Bitcoin can replace the dollar (and Euro, and Yuan, etc.) and if not figure out why not. When I say "money" I mean what Mises meant, namely the most commonly used medium of exchange. I already tried to explain the fallacy of "medium of exchange" versus "store of value." Again, if something is a medium of exchange it must necessarily be a store of value, otherwise the second exchange will be a disappointment.

When I try to use Bitcoin as a medium of exchange (not as a stock) in hopes that someday it can become money, sometimes it is a breeze and sometimes it is full of friction. Bitcoin is far from money at this time. One time when I tried to pay my server bill, I saw that transaction fees were much more than 3% of the amount I wanted to spend, and that on top of the vendor's processor fees. The fees were so high because some numbskulls wanted to save cartoons into the Bitcoin blockchain. Thankfully it was not a coffee, it was a utility bill, so I waited a few days, fees came down, and I paid my bill then. Other times I tried to buy things sellers added a fee much higher than 3% of the thing I was buying. I keep referencing 3% based on approximate credit card fees. Another time I tried to buy something they wanted personal information akin to a job application. Then I have to pay taxes on top of all that, too, as though it were some kind of real estate transaction. Getting back to the point, every now and then I see some comment about transaction fees being higher as good for Bitcoin. High fees being good for bitcoin is an argument against Bitcoin becoming money and I think those mental gymnastics are mistaken. Folks might also add the "store of value" to that argument. These arguments are treating Bitcoin like a stock or real estate holding rather than like a money. I think you should be free to participate in Ponzi schemes if you want, but I would rather Bitcoin become money someday, along with gold or silver, which are also assets that people are treating like stocks that instead should become money.

Does that make sense? I'm frustrated by people moving the goalposts away from Bitcoin as money. I think you should be able to buy a coffee with Bitcoin. If you cannot, for any reason, then something has gone wrong, someone is getting in the way, or technical problems need to be acknowledged and resolved.

Thank you for the kind words. I haven't read much of the debate but heard hints of it in Man, Economy, and State.

Thank you for the kind words.

There is no contradiction between support for the four software freedoms and opposition to so-called intellectual property.

Property (whether we think of it as natural or conventional) protects people's exclusive control over scarce resources. Sequences of words are not scarce. If I tell you "bananas are yellow" and you repeat "bananas are yellow" we now both have the idea "bananas are yellow" without any deprivation or violation of anything. If, however, you have a banana and I take your banana, now I have a banana but you do not have a banana. In this latter banana-taking case, you have been deprived of a banana, a theft happened, your right to that banana was violated.

There are many things in the internet infrastructure that are indeed scarce. Machines, bandwidth, CPU cycles, RAM, storage, data centers, network switches, spectrum, and more are all scarce. Those are scarce property. The exact bits and bytes that traverse those scarce resources are not themselves property.

One might be able to argue that copyleft is anti-property in that it uses false property "rights" in its scheme. I mean it gains its power from unjust copyright privileges that are grants from the state. But copyleft is a clever reversal of that same unjust privilege so I don't have a problem with it. Regardless of the mechanism, the only just use of violence is in defense against aggression. An unjust violation of my actual property, such as my computer, by way of the unjust mechanism of state-granted copyright privilege gets corrected using that same mechanism. If we eliminate copyright privileges, that would also work fine, but given the state copyright privilege mechanism, copyleft is pretty clever.

One might object that developers need to make money for their services. Fair. Another scarce resource is software engineers and their time. Figuring out who should pay and how within a freedom paradigm is an ongoing area of research. But objecting to a glass-blowing machine that can do a thousand times the bulbs of a human artisan glass-blower on the grounds that glass-blowers need to make money is the old fallacy about the curse of machines. See Hazlitt's Economics in One Lesson on this. In other words, we don't start with the way the world works today and then assume that that is all right and fair to argue against a potentiall disruption, we first figure out the truth and then try to conform the world to the truth.

We need to make gold, Bitcoin, and Monero money. People need to be free to choose. No one should be prohibited from using any of these as media of exchange or money.

If any of them is best as a medium of exchange, that means it will be best as a store of value too. In order for the thing to be a medium of exchange, it must be valued at the time of the first exchange, and also be valued at the time of the later exchange, thus a "store of value." So to be a better medium of exchange necessarily means to be a better store of value or a better money.

Value isn't really stored anywhere, valuation takes place in the minds of the valuers, so it's kind of an idiom to talk about "store of value" in the first place. You have no guarantee that the thing you are keeping will be valuable in the future, even if it's money, because its future value depends upon the minds of the individuals later in time.

Is an appreciable asset a store of value that is not a medium of exchange? Sure. But if Bitcoin is not easily exchanged, it has lost its way and value should go to near zero. What other function does it have besides its ease of transfer? It might be kind of like "owning" the name of some distant star: just kind of a fun curiosity or game. But that's not money. That's not a medium of exchange.

The reason we talk about "store of value" is probably due to some flawed econ textbooks of the past saying that money needs this special attribute.

Let's make gold, Bitcoin, and Monero money. If it doesn't work as money, we have work to do.

I build freedom tech. I also need help.

Oh, but did you mean help doing the building of the freedom tech? Whoops, my mistake.