Profile: 772f9545...

They can have a stipend. But the budget they manage should be $0/year.

In school I was taught to use three-inch by five-inch index cards when writing a paper. There was a specific format. Perhaps the title in one corner, the page number(s) in another, and the quote in the middle. One card per citation. Then collect them using a binder clip, rubber band, or an index card box.

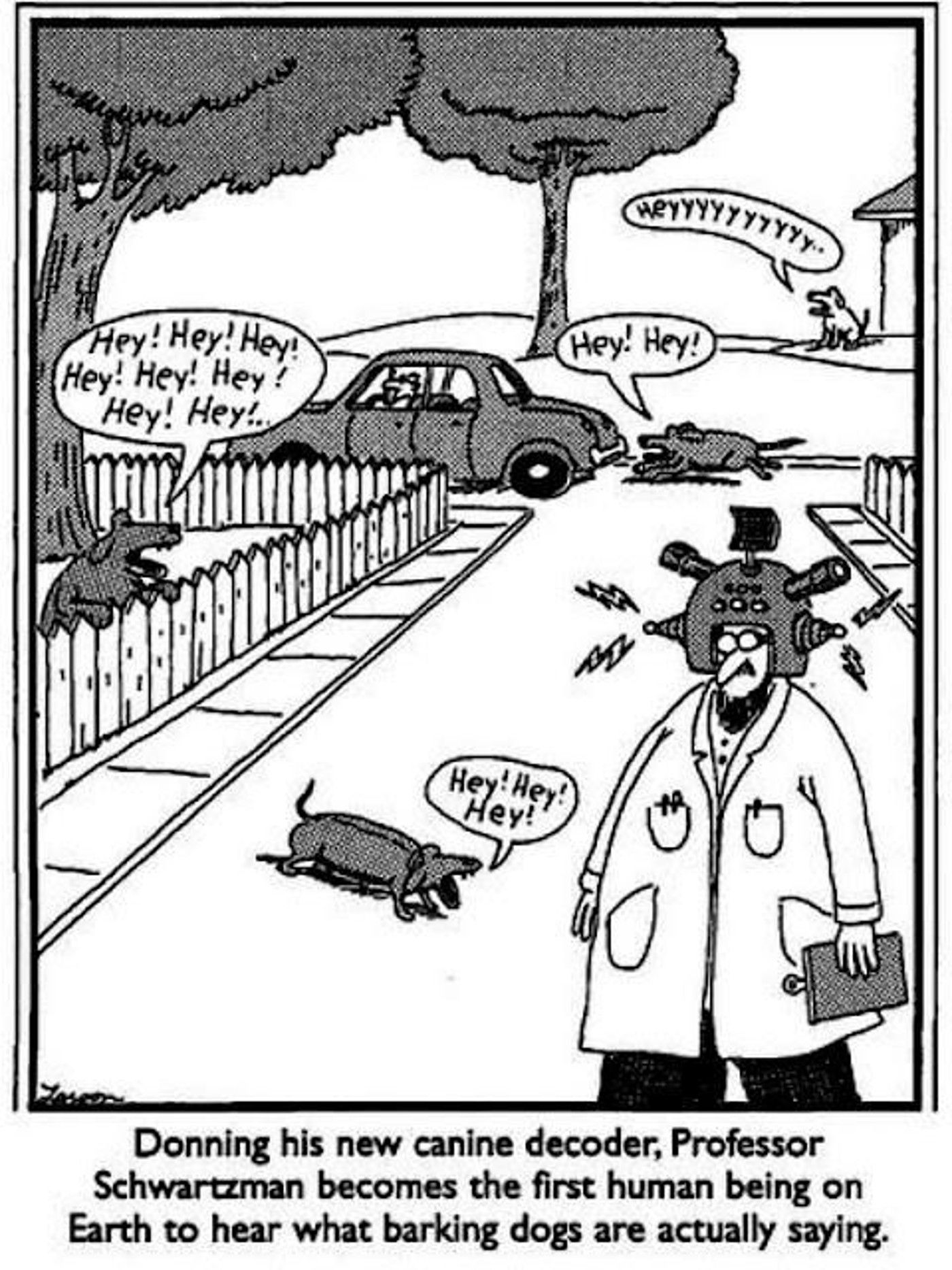

Donning his new canine decoder, Professor Schwartzman becomes the first human being on Earth to hear what barking dogs are actually saying.

Hey! Hey! Hey!

Heyyyyyyyyyy.

Hey! Hey! Hey! Hey! Hey! Hey!

Hey! Hey!

What would stop government agents from deporting me or you to an El Salvador prison? Are you ready to prove your citizenship at a moment's notice? Should we be required to carry our papers around at all times?

When the very question is whether someone has committed a crime, there has to be someone other than a government agent accusing you before the government can do something against you. Even if you believed that witches or terrorists or illegal aliens were subhuman and had no rights while non-witches or non-terrorists or non-aliens had rights there still must be a bootstrapping process (due process) to establish whether someone is in fact a witch or terrorist or illegal alien to avoid violating the rights of the non-witches or non-terrorists or non-aliens.

The only real rights are human rights: natural and negative rights. They do not apply to different classes of people. No one, not even citizens, have a "right" to health care, for example, they only have rights to not be prevented from voluntarily exchanging for health care, especially by a government.

So whatever that due process is, if the government has done it for that individual, they should deport. If they have not, they should not.

Yes, there is risk in everything, especially in a speculative asset such as money. We don't need someone telling us about total supply to know that the total supply is limited by God and not by social convention. Subjective valuation leading to exchange on the margins brings prices. You don't have to accept an "official" price, either. The actual physical exchange prices of gold frequently deviate from the Chicago and London prices. The subjectivist marginal revolution in economics did not come until 1871, yet gold was money for thousands of years prior to that understanding. Or if you prefer Smith's 1776 work, still, gold was money for thousands of years prior to that. It didn't require the understanding of the participants in order to work.

With two parties, whatever exchange rate they prefer. They don't need to worry about the total supply but if they're curious, sure. Supply and demand work as usual: subjective value on the margins. If there are large deposits somewhere, they pale in comparison to total mined supply. Yes, you do need to guard it, kind of like your keys. The safely exchange question applies to any honest money, but if you already know a that second party who will exchange, you're OK. Authenticity is a legitimate concern.

Never fully, but they are more and less free/libre. Support those vendors who are moving in the right direction.

I don't know enough about it. If I understand correctly, the RISC-V instruction set architecture is free/libre but that is separate from particular implementations, meaning actual chips and their designs. I don't know enough about how that distinction plays out or which manufacturers produce free/libre stuff and which don't. I would look at https://libreboot.org/news/policy.html to try to learn more. Somehow I recall hearing about very large and proprietary binary blobs used to boot RISC-V but I cannot quickly find it. So maybe it's fine, maybe not.

I hope you meant to say "running it for years" haha!

Oh, and in order to have the 21M limit, you need protocol ossification, otherwise that limit can also be relaxed. Given that the limit is a social convention resting on social agreement, you really do need people to buy into the fact that a 21M limit is good. Give it three or four generations and all bets are off.

You hit on some real issues that I think derive from "it's software" and "it depends on people's right thinking and acting in order to work." Both I guess derive from "the social." Gold still needs some other person to accept it as payment, but that's about it. Neither party even needs to know why it works or how it works or to depend on other people's actions. I think of myself as pro-bitcoin but gold is still better in the long run. Of course, the dollar is garbage compared to either.

Not purely so, but the list at https://doc.coreboot.org/distributions.html#hardware-shipping-with-coreboot is a good start.