😂 Better than the 2024 homes where the whole build is "fuck it, good enough"

Our 1930s home has been a bitch to update, but we couldn't rebuild the same quality for even 2x the price

Agreed. Good news is this a good anti-fragility test. Spammers are inevitable if/when nostr grows with more users and content.

Same. A few reply guy posts show up for me, but my default relays seem to be filtering most of them (my nostr feeds are certainly not nearing "unusable")

Excellent. Got the vid queued for the flight 🙏

Interested to listen to your take.

I watched a bit of her Tom Bilyeu interview where my "ick" became apparent. Tom asked her a few times "what would you do to fix it"? She never really gave an potential solutions other than "fix it".

She's extremely knowledgeable shedding some light on the corrupt shot callers. In all fairness, I think she's doing good work work, but she's only a small piece of the "fix the world" movement.

Also a side note... Given her content has become more regularly available on the big platforms, I'm suspicious that her research is (accidentally?) doing the opposite of her intentions. Either that, or whatever she is uncovering isn't effective in creating any real movement.

I don't like that Doc and I agree on the 38-42 flush out 😂

My read is 49k wick was the chopsolidation bottom OR we have a spicy Q4 to test the 48s and test the resolve of the 38-42 buyers (ETF run-up buyers)

That makes sense to me. In a low momentum environment we might see "get out while I can" and a high momentum environment would encourage more hodling to the inflation adjusted MVRV multiple.

Stoked to see the next 18 months haha

Do it 🥜🚀

cashuAeyJ0b2tlbiI6W3sibWludCI6Imh0dHBzOi8vbWludC5taW5pYml0cy🥜5jYXNoL0JpdGNvaW4iLCJwcm9vZnMiOlt7ImlkIjoiMDA1MDA1NTBmMDQ5NDE0NiIsImFtb3VudCI6MSwic2VjcmV0IjoiZDB2OHVNQWJyT2NQZDUvbjJ6ZFBUMmgrRmlNSDJKeitkNmFVMVpQemtvbz0iLCJDIjoiMDIwYWQ5ZTU2ODNjMjhjNThmNmZjYmJiNWNkMjhiZDg0OWRjNWZmNzFmY2ViNjFhYjYyODhmMzk4ZDlhNjY2MTRhIn0seyJpZCI6IjAwNTAwNTUwZjA0OTQxNDYiLCJhbW91bnQiOjQsInNlY3JldCI6Im84Vit2MGxSZ3ZQajIxSStZNnNpd3V4OE5NVnlZTVlMNUNaOG1TeDd1Ukk9IiwiQyI6IjAyYzRmMjFjZDQ3ZTc1YzUyNzY5Y2I0NzdhZWZmMTcwNmU2NmVkMWRlMzU5NWQzMWRkNjQzNjU2YmNjMGUzOWVhZSJ9LHsiaWQiOiIwMDUwMDU1MGYwNDk0MTQ2IiwiYW1vdW50Ijo2NCwic2VjcmV0IjoiODE0WjNvN0NtTWJnVk81Z1AvVDl3REVHcFBZWWVuTGRHcWxQenRkbE9sST0iLCJDIjoiMDJjNDcyOWMxYzdhNjViMzdhYzc4MTdiMzYzODAwOTdkYjQ3YzZkNzE5ODhkMGI4NTE4MTY4ZjM5MThkMzJlYmE0In1dfV0sIm1lbW8iOiJTZW50IHZpYSBlTnV0cy4ifQ

Using my zaps to ask Unleashed.chat the mysteries of life.

Inflationary Illusions.

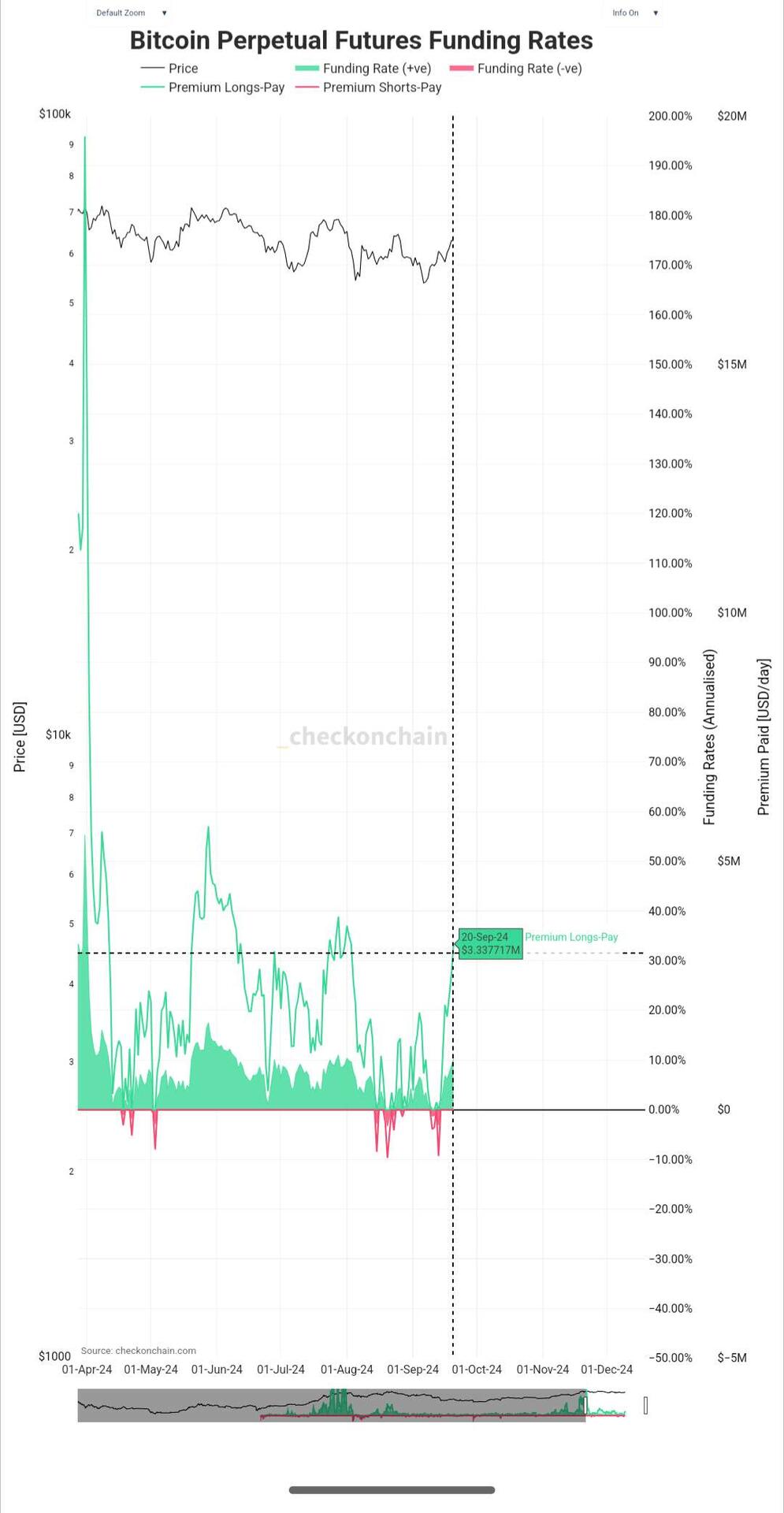

My latest #Bitcoin research piece is out for _checkonchain subscribers, examining why this cycle, ATH, and market feels different to prior ones.

What if we never made a real ATH at all?

https://newsletter.checkonchain.com/p/inflationary-illusions

I think it would be interesting to compare inflation adjusted MV to different RC cohorts. Meaning, when there is a large RC impulse, these new buyers' sentiment is being weighed in their "inflation feeling" at the time of purchase. E.g. Oct 20 - Oct 21 sentiment is pricing 35% CPI impulse. Aug 23 - Aug 24 sentiment is pricing a 25% impulse.

Essentially saying the same thing as you've noted in the video/charts, but with added context that each cohort has an inflation-adjusted price that "feels good", regardless of the current inflation rate.

If this concept has legs, I think we should expect Long term holders to hold off heavy selling until they get closer to an inflation adjusted MVRV multiple. I.e. rather than 2-4x, we should see LTH selling at 3-6x (assuming 50% CPI contribution impulse for this cohort).

I don't love quoting Peterson... However,

"I act as if God exists"

This is productive to me for two reasons. The relationship, if God exists, requires me to take responsibility for my side of the relationship. Dogmatic/ignorant belief allows Christians to self-deceive, utilizing cliches to mask their fears/uncertainty and ultimately act in ways that are antithetical to Christ.

Imo, feeling strongly about Jesus comes from the continual practice of questioning the uncertainty and often "taking the narrow path". Funny thing about the narrow path... It's always uncomfortable and (I think?) always (often?) strengthens a relationship with Christ.

On that note... Has there ever been an Adam Back style email service? I.e. you need to send me 10k sats for your email to land in my inbox? Google wasn't particularly helpful 😅

Anyone have recommendations for a non-connected heart rate wearable? Used a Whoop previously with good success, but I've been cleaving the data-harvesters from my life 😅

Using it for interval training and target heart rates.

#asknostr #fitness

The latest _checkonchain subscriber Q&A session is live.

I cover three topics in a 1hr video:

1) Why I hold gold alongside #Bitcoin

2) How I think about $BTC Miners

3) A routine of metrics I use to assess blood is in the streets before I stack sats.

https://open.substack.com/pub/checkonchain/p/how-to-identify-blood-in-the-streets

Blood in the streets indicators keeping me disciplined (and same) during this chopsolidation.

Npub.cash and eNuts app works well if you're not looking for self-custodial lightning

Yesterday added some serious fuel to the markets. BTC relatively stable, USD bid, yen bid, QQQ/Mag7 heavily shorted, paired along with volatility funds heavily short vol.

If/when the liquidity is realized, there is going to be a face ripper of a move as the short vol positions unwind. If BTC can show stability in this 54-60 range, I'll be high conviction long BTC.