Bitchat is so sick. I have mixed feelings in that I’m grateful I don’t need it but simultaneously it would be cool if I actually got to use it.

You stopped listening literally moments before she explained where she got it from and why it’s relevant lol

The anti-government bitcoin bet is this simple:

- 195 nation-state governments globally

- statistically some of these must suck

- “sucky” government is subjective and relative to each individual

- at any one time, people are moving capital away from sucky nation-states and into safe havens outside of government control

- a % of this is allocated to bitcoin

This is about the craziest election prediction market graph I’ve seen yet.

The upcoming Australian election, much like the Canadian election, highlights just how much impact the US political landscape has had internationally.

The Liberal (conservative) party aligned themselves with Trump, you can see almost to the day that when tariff talks turned serious, Australians turned away.

All the Labor Party have had to do is to seem sensible and pragmatic, and to stay the Australian-first party line.

There is no single-issue policy deciding the election. For the Bitcoiners, neither party have offered anything meaningful.

For added context, the Labor party is centrist-left, not progressive left.

Someone needs to tell Kanye about Nostr, my mans can’t help but get banned on everything else. He would probably bring in 100k new users overnight too.

A $1200 second hand 500cc motorbike is about the highest fun / $ thing money can buy.

Anyone used Ledn B2X in small, repeating cycles to stack sats?

Long term assuming the credit card launches fine, who knows in this crazy short term.

I just figured $2.69 was just wayyyy undervalued, market cap was equal to the value of the bitcoin in the treasury. Thats gotta be a reasonable floor right?

Financial goal: hit escape velocity.

Expenses lower than passive income.

Thats it, keeping it simple. Grow the income side, reduce expense side. Don’t fret the details.

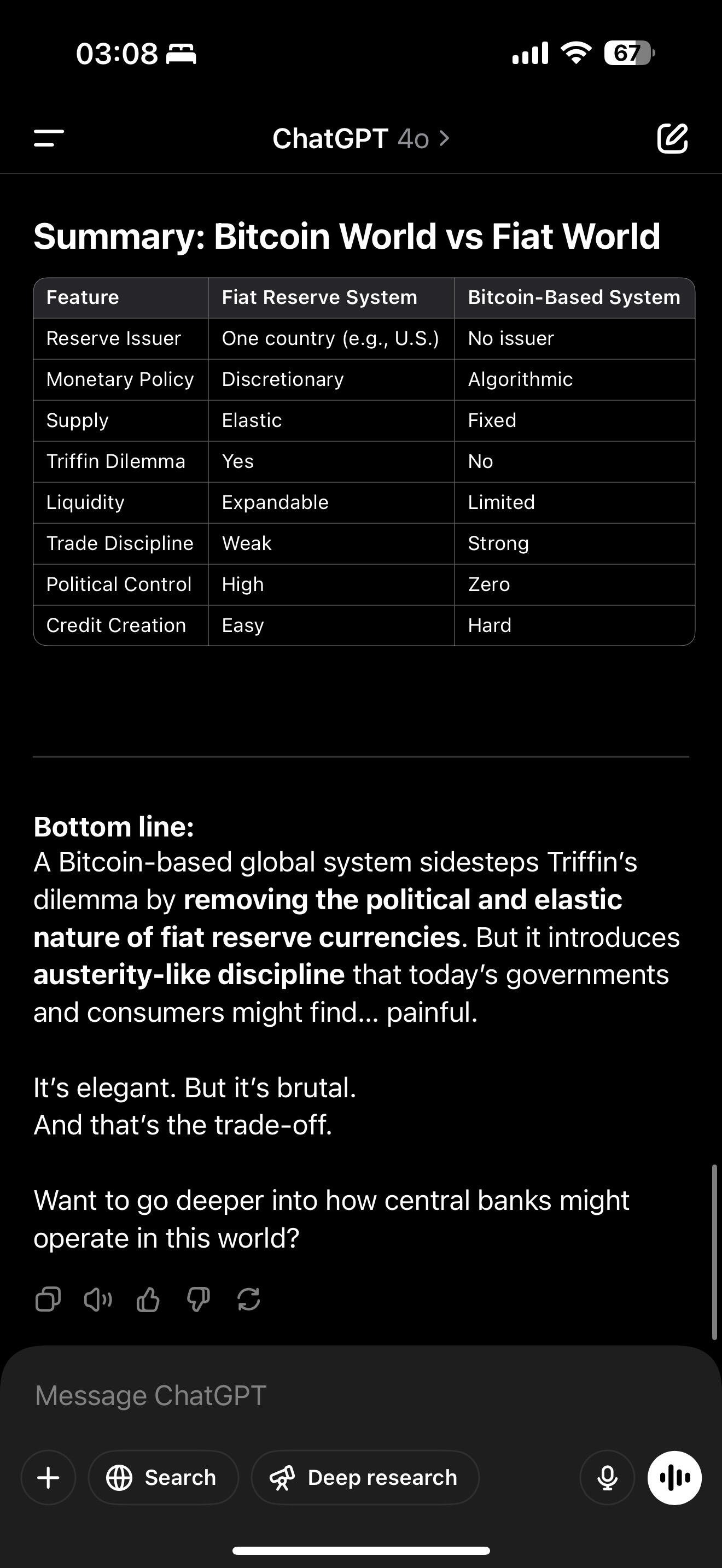

I’ve got 2 points of Bitcoin maxi rhetoric I’m struggling with at the moment, maybe you can help me out.

In a BTC-only world, my biggest concern is the rebirth of financially-driven wars in geopolitics. Bitcoiners say without infinite money, wars are unsustainable, however I think nations will start analysing the potential profit from seizing other nations’ BTC. Especially given there can be no sanctions on the permissionless transactions.

The nation-state equivalent of a $5 wrench attack is a 50000 BTC invasion to seize150000 BTC.

My other concern is that I don’t understand how credit can work in a BTC-only world with deflationary prices, I feel like we would end up with no social mobility. The rich stay rich, the poor can’t grow their wealth as they won’t have access to capital to expand their businesses. I guess you could raise capital via selling equity in the business.

Raise 1 BTC to buy a machine that has positive sats flow, pay dividends to your equity holders. The compression of prices without credit brings prices closer to the cost of production. The machine would need to return more BTC than the deflation rate, or no one would take the deal. It feels really economically restrictive?

I’ve settled on the idea of the 2-tier system being the most likely. All international trade in BTC, substantial savings of citizens in BTC but the majority of internal domestic activity in the fiat of your country.

Well run nations will have small debt, small new currency issuance and attempt to maintain a peg ratio to BTC. Allows for the creation of credit (we’ll never escape the need for a young person needing a mortgage) but likely requires high interest rates. Citizens of these countries will be able to hold a cash balance in fiat and savings in BTC.

Poorly run nations will inflate their currency against BTC endlessly and their citizens will maintain both cash and savings in BTC, only using the fiat of their county when required.

Oooooft RIP LNP

Possibly some free alpha for my NOSTR freaks in our goon cave.

Fold App (FLD - Fold Holdings) with 1485 Bitcoin ($125mil) in its treasury trading at $2.69, market cap $126 mil…

Trying to work out this valuation, assets minus liabilities minus a % on cash burn rate?

I can’t use Fold as a non-US based person, is it a good user experience?

59000 people in the credit card waiting list. Assume average APR of credit card of 21.47%, average of 47% of credit card holders have a carry over balance, average carry over balance is $6580. Potentially approx $39 mil a year ($3.3 mil a month) in interest payments to collect from Fold’s current waiting list.

Fold spends ~$360K a month cash burn.

Fold cost of capital is reported as “around industry average”, 8.74%, rounding up to 9%. Fold would be paying ($6580 x 0.09) x (59000 x 0.47), $16.4 mil a year, $1.3 mil a month for this credit.

Looking at ~$2 mil a month in free cash flow before additional costs and losses around providing credit (no idea what to deduct here).

Cash burn rate goes from -$360K a month, to $1.64 mil.

Long term, assume some Bitcoin purchasing into treasury once profitable of like 10% of profits, accruing $160K BTC a month.

Bitcoin Yield (%) = ((BTC per share at end of period / BTC per share at start of period) - 1) × 100

Modelling out 2 years from credit card launch, assume BTC average price of $100K (insert your optimistic BTC price here)

$160K / $100K x 24months = 38.4 BTC

50mil shares (approx fully diluted)) , assume no capital raises via equity.

((((1485 BTC + 38.4 BTC)/50 mil)

(1485 BTC /50mil)))-1)*100 = ~2.6% BTC yield.

2.6% BTC yield just on re-invested profits, plus assumed BTC in treasury price appreciation.

Assume some credit rating increase, ability to issue convertible bonds to buy BTC etc.

Essentially, $20mil a year in profit, 50 mil shares gives a DCF enterprise value of $480mil, add in 1485 BTC to enterprise value, $580 mil total. Gives a share price of $11.71.

Assume my analysis is full of holes (bitcoiners don’t carry a card balance maybe?), but I see the path forward. Pretty bullish at current price, unless credit card product gets denied.

1 WEEK UNTIL THE CAPS LOCK WILL RISE AGAIN nostr:nprofile1qqsqfjg4mth7uwp307nng3z2em3ep2pxnljczzezg8j7dhf58ha7ejgprpmhxue69uhhqun9d45h2mfwwpexjmtpdshxuet5qyt8wumn8ghj7un9d3shjtnswf5k6ctv9ehx2aqnz0fd0

That’s fair. I wonder if framing it as, given roads and public transport infrastructure are a monopoly of the state, and no private infrastructure can really be built for mass public use (with very limited exceptions, toll bridges, tunnels etc), is the state’s obligation here to reap the highest reward for the tax payer by incentivising the most productive use of the infrastructure with the least cost?

Or does that just lead back to letting individuals make their own appropriate economic choice is best?

Wildcard play: Social security is going to get bailed into treasuries