Best risk explanation I’ve seen. FA/FO - BTC doesn’t play nice always.

“As the premium widens between #Bitcoin and $MSTR, more shorts will be added because of the "risk-free" arbitrage trade. Most conventional funds will go long on Bitcoin and short on $MSTR. However, these shorts will likely get wrecked repeatedly because the momentum on Bitcoin is quite bullish. Once Bitcoin makes a significant upward move, $MSTR will jump even more. This results in short covering, which, in turn, drives the share price even higher.”

Don’t even know what that is so there’s that.

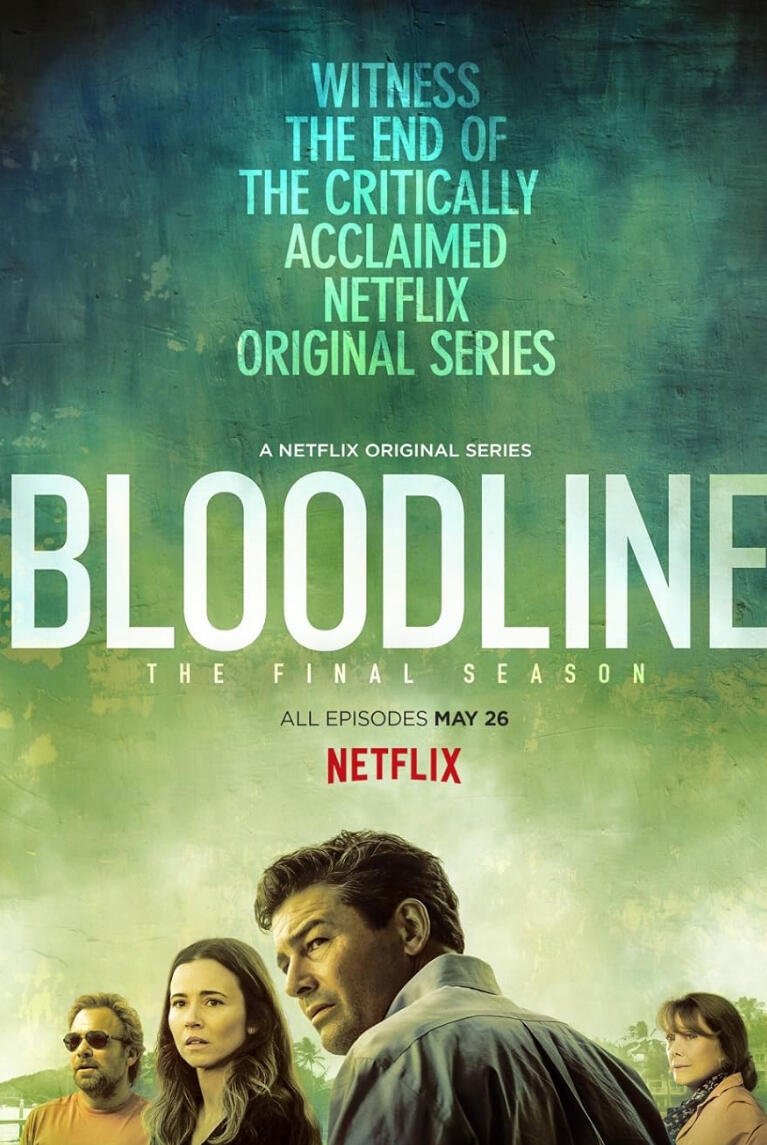

Weird little show on Netflix that my wife found & we loved.

Bloodline.

Just for anyone looking for a show.

Brilliant. Hilarious.

BTC on the top.

Monero on the bottom.

Perfect illustration.

Nobody cares.

Beat it.

Set up zaps or bye Felicia.

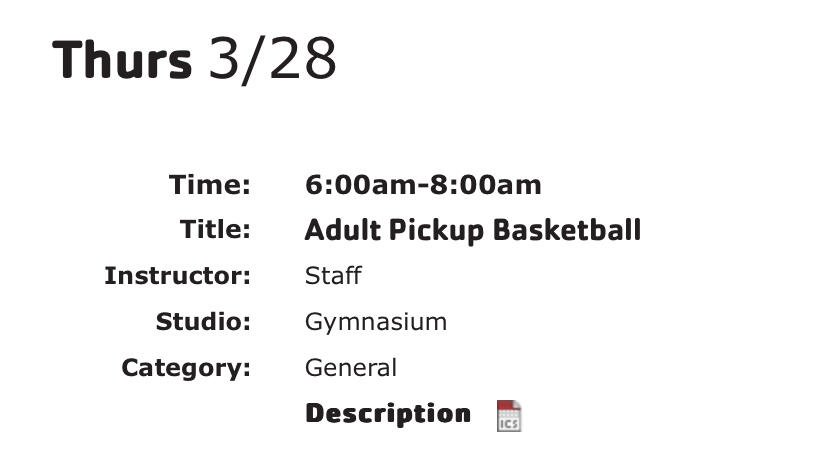

This is the next big war. I’ve been preparing for it.

I’m ready.

That’s why I asked. I don’t know. I’m not a trader.

Don’t run naked.

Especially with scissors. ✂️

Right. Makes sense until it doesn’t.

To be clear. When a hedge fund states they are long BTC & short MSTR; they are 100% talking about playing with leverage & a specific timeframe (locking up funds etc).

Their own client funds.

Leveraged long on one side & short on the other.

What client would agree to this fucking strategy? Am I missing something. I don’t trade so probably missing something.

nostr:note1ueg9qm9rp5fl5e7g6h8emw9hm6ucefs0lagvfxdevzvk6er50txq2futz8

nostr:note1ueg9qm9rp5fl5e7g6h8emw9hm6ucefs0lagvfxdevzvk6er50txq2futz8