The fact that Milei shills a shitcoin before having proper probitcoin laws is a clear statement about his libertarians views.

Not much hope for Argentina, but still much for El Salvador.

I suppose this is an automated account. Still pretty cool to be able to read his notes in a more native way on Nostr.

nostr:note15mmrl53kemhuu4se8f4yuj79rrfyavallwy3pnvjhlthtqsuwr4quwglan

Where I’m from, we call that 'balconing.' We keep track of how many people die doing it each year and even curate a league table by nationality. Be careful!

I feel like there might be some irrational exuberance here. I wish them the best, but I am ready for the worst.

Sparrow v2.1.0 released with:

• Lark for USB hardware wallets

• Ledger multisig wallet registration save

• Jade Plus USB support

• Restore tables sort & sizing on wallet load

• PSBTv2 support

And much more: https://github.com/sparrowwallet/sparrow/releases/tag/2.1.0

🫡

Is the bitcoin pal for the measurement of temperature 😌 .

You have to be a leader is some things and a follower in others. Believing you can have only one role will put you in a subpar situation. The key is picking right.

Nuts. If Dallas wins the Championship will shut mouths, but the trade is awful in so many ways.

It's not a dramatic change. I wish all countries had the amended version.

Bitcoin is like Steven, you think he is dead but he is just chil https://m.primal.net/OGdc.mp4 lin.

I left Twitter (and I miss FinTwit a little—just about five content creators), but I feel YouTube is going to be much harder. I would say stay on YouTube but bring your micro-blogging to Nostr. And encourage your viewers to contact you through Nostr.

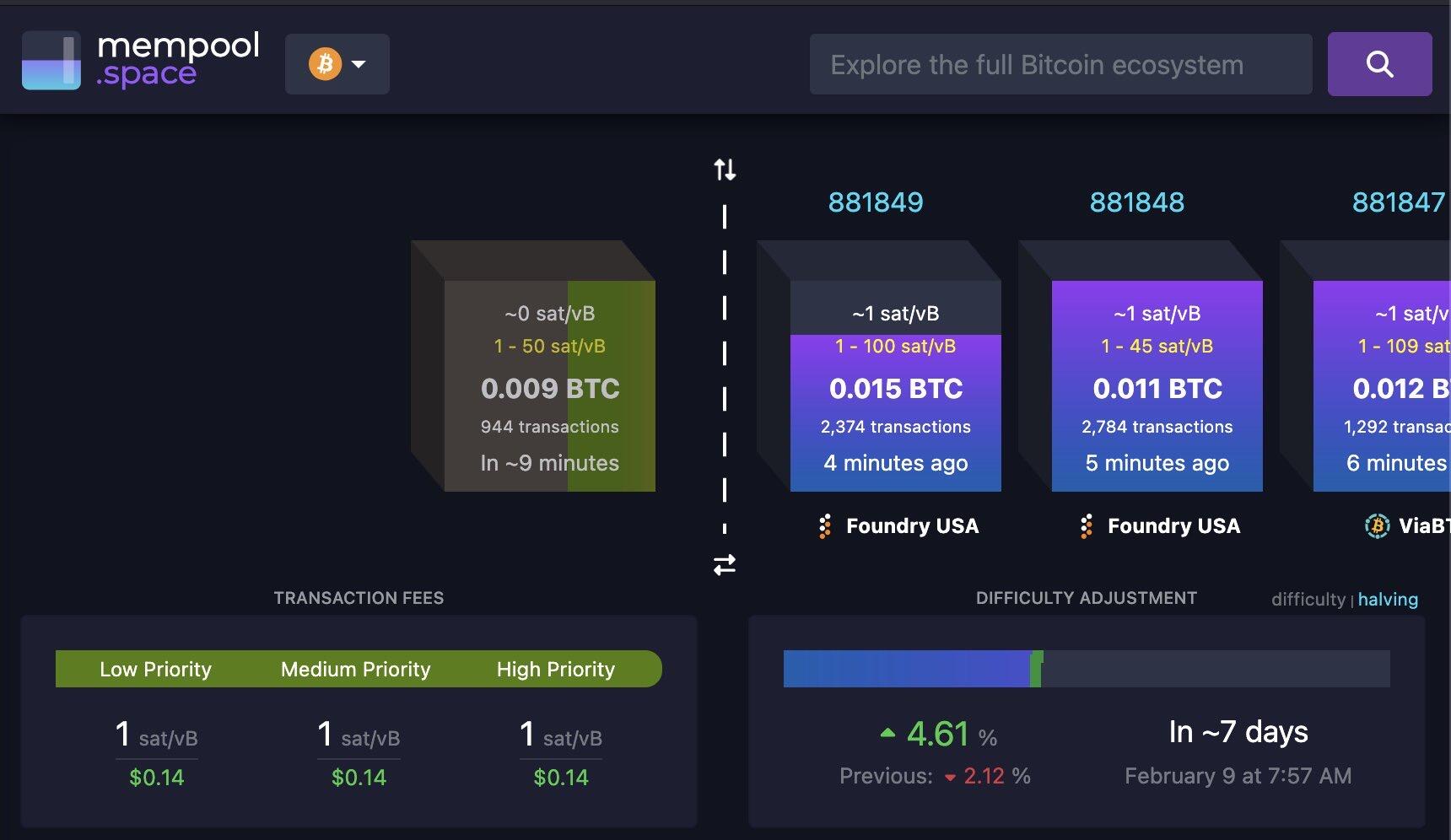

Hard to believe that at 100k per Bitcoin, we would have such accessible on-chain fees. I guess it's a combination of the centralization of coin storage and the success of the Lightning Network

12% body fat is crazy, I feel that would be too skinny.

From 1980–2024 annual average for weather disasters in the US is 9.0 events; the annual average for the most recent 5 years (2020–2024) is 23.0 events. The risk of owning Real Estate is increasing, as proven by the increase of insurance prices.

It's great, Im actually tired of seeing GMs on the top posts. It's a sign of lack of quality content. GM and meme crowd must be defeated 😛.

That's vandalism...

What keywords best describe Nostr current atmosphere? I think I go with Bitcoin and Carnivore.

Merry Christmas! / Bon Nadal!

You must use the desktop version. I paid a full year with a lightning invoice.

You can pay with bitcoin.

I see it as both an asset and a liability. Debt is a form of time-traveling money, you bring money from the future into the present. If you cannot service it, you risk worsening your future. However, if used properly, it can improve your future.

It's not a huge loss. Not great, but still a Bitcoin friendly country. According to that fragment most policies are on the line of detaching government involvement with Bitcoin, but not from individuals. That's the important part.

In fairness many times users don't know what they want. Is more about observing and delivering what your see they could need.

A little bit. I deleted my X account and I don't regret it. Obviously we need more people who bring content variety at a quality level. But it's getting better.

**Bit late this quarter, but here now for the latest release on the most irreducible form of money, the monetary base. Data comes from the top 50 currencies in the world, their countries of which represent 96% of global GDP and 84% of global population (not very fair, right there). Gold and silver is analogous to this money supply. As is the stock of bitcoins.**

**This is quarterly release #26, for 2024 Q3.**

If you have followed [my work](https://www.porkopolis.io/) before, then you know that the constant hymn I've sung while speaking publicly about Bitcoin is that the only, economically comparable money supply in the fiat world to 21 million bitcoins is what economists call the "monetary base," or "base money." This is a corporeal money supply that has existed across all of modern economic and central banking epochs. For an apples-to-apples, ontological comparison with Bitcoin, look no further then Base money.

## **So what is it?**

It is *central bank money*, comprised of two supplies:

1. **Physical currency**: Notes and coins, or “cash;”

2. **Bank reserves**: The “Master account” that each commercial bank holds with its central bank.

Now, why do I refer to this as, "Central bank money?" This is because, unlike all other money supplies in the fiduciary banking world (like M1/M2/M3), the Monetary base is the sole and ultimate money supply controlled by the central bank. It is, literally, the *printing press*.

What follows won't be a lesson in reserve ratios or monetary economics. The point is that you simply understand that ***there is*** a money supply that central banks solely control, and of course (of course!) this is what Bitcoin's 21 million are up against.

The monetary base is to the core of the entire fiat financial system, as 21 million bitcoins are to the core of the Bitcoin protocol.

One is open and permissionless, and one is not.

By the way, the monetary base is essentially (though not entirely) analogous to the *total liabilities* of a central bank, so we can (basically) say that the monetary base is the "balance sheet" of each central bank.

**On cash**. Quick notes on the above. Certainly you understand what "cash" is, and it is indeed an instrument that has been fully monopolized by each central bank in each nation around the world--only they can print it. Even though it is true that banks in more free banking societies in the past could freely print and strike notes and coins, the central bank (or state) monopoly has been around for a long time. Kublai Khan was the first to do it 750 years ago.

**On bank reserves**. Don't stress your brain on this too much, but this is the main "settlement money" that banks use between each other, when they want to settle their debts. It is digital now (Fedwire in US, CHAPS in UK), but it doesn't technically have to be, and of course before modern technology took over even a few decades ago, it was not.

These two stacks of retail and wholesale cash, stacks of *central bank money*, are what makes up the **Monetary base**. This is the *printing press*. Only this compares to 21 million bitcoins.

And gold, and silver by the way.

Final note, central bank digital currencies, or CBDCs, which are simply LARPing on Bitcoin's success, are indeed created by central banks, and they are indeed classified as Base money. They are going to be a "third rail." They are thankfully incredibly small, pilot projects today. We will see how far democracies will be tested, as autocracies no doubt will mainstream them; but for now, consider them, at least economically, to be inconsequential to the update below.

With that review out of the way, onward to Q2 update for 2024.

## **Bitcoin is the 6th largest money in the world.**

In February 2024, it surpassed the monetary base of the United Kingdom, that is its value was larger than the Bank of England's balance sheet, and it remains so to this day.

As of 30 September 2024, it is only the balance sheets of the big four central banks that are larger than Bitcoin. They are:

1. **Federal Reserve (dollar)**: $5.59 trillion

2. **People's Bank of China (yuan)**: $5.40 trillion equivalent

3. **European Central Bank (euro)**: $5.28 trillion equivalent

4. **Bank of Japan (yen)**: $4.69 trillion equivalent

If we remove gold from the equation (we shouldn't), then Bitcoin could be considered the 5th largest money in the world.

However, the all-important monetary metal throughout history that even a child knows about--gold--is still king at around **$16.5 trillion in value**, or 6.1 billion ounces worldwide. Note, this does not include gold lost/recycled through industry; in that case, it is estimated that about 6.9 billion ounces of gold have been mined throughout humanity.

">

*Update #26 Executive Summary*

Silver, for what it's worth, is still a big "monetary" metal; though it is true, much more silver is gobbled up in industry compared to gold. There are about 31 billion ounces of non-industrial silver floating around the world (most of it in jewelry and silverware form) that is valued in today's prices at nearly $1 trillion. Bitcoin bigger.

## **State of the Print: $27.0 trillion.**

If we add up the Big Four central banks already mentioned above (again, Bitcoin being larger than the Bank of England's monetary base), as well as the next 46 central banks, we get to a total, USD equivalent value of **$27.0 trillion in base money across the world**.

I**f we consider $27.0 trillion as the Big Boss of central bank money, then Bitcoin at $1.25 trillion network value (September, quarter-end figure!) indeed has some way to go.** But as we can see from the last month leading up to this publishing, that can change quickly. We have just surpassed $100 thousand per bitcoin, which **brings the network value to $2 trillion**. We can also imagine how the Pareto distribution occurs even in money, if Bitcoin after only 15 years is already larger than every central bank money in the world except for four of them. Wild to ponder.

## **Supply inflation: 12.7% per year.**

It is also true that for two years they have been trying to "normalize" their balance sheets after the 2020-22 Covid madness, stimulus, and money printing. Of course, they have been trying all along to normalize since the 2008 global finance crisis (GFC), but I digress.

When I first started my website, I vowed never to use such a non-corporeal thing as CPI to discuss how much things cost. A "general increase in the level of consumer prices," or CPI, as measured by planning boards around the world, is not a real thing. It may be calculated by people with the best of intentions, but it has been manipulated and volumes have been written about it. I don't use it.

I have always defined inflation as the classical economists did: Inflation is an increase in the "stock" of money. If we know the all-time stock of euros printed by the European Central Bank now, and we know the all-time stock of euros printed by the ECB 12 months ago, then it is very easy to calculate the annual inflation of the euro. Not only is it easy, but *it is real*. It is corporeal. **Watch what they do**, not what they say.

I have been tracking this since 2018, and though this figure has evolved slightly (mostly increasing from massive COVID stimulus of 2020-2021, the high-signal, important to remember figure of all-time compound annual growth (CAGR) of the global base money supply since 1969 is 12.7%. That is **12.7% compounded, per year**. It is a doubling time of **5.8 years**.

">

***Growth rate of the monetary base***

It is highly valuable to understand that, *ceteris paribus*, if the demand for cash balances does not keep up with this monetary supply increase, then prices will rise. This erodes purchasing power. I do not attempt to measure the demand for cash balances in this research. Regardless, 12.7% is a useful figure to understand.

## **Let's compare.**

For the rest of this report, I want to do something different and simply spend some time looking at the compound annual growth rates of various corporeal things around the world, in order that we can compare those to the growth of the fiat monetary base, and Bitcoin.

Remember, most things in the financial and economic world grow exponentially. This simply means that they grow *constantly*. The financial term here is compound growth, or compound interest. This rate of growth can indeed change year to year (interest rates can go up, or down), but over the years we can observe a strong trend, and that is what I want to summarize here for you.

## **Population.**

The world has grown exponentially at **1.7% per year** over the last 75 years. However, despite all the overpopulation myths you've probably heard, this rate of growth is actually falling, well below trend, and we only grow at **0.9% per year** at the moment.

">

## **GDP.**

The United States has grown its economy at 5.2% compounded per year since the founding of the republic. We are at the higher end of this trend right now, $28.8 trillion output per year, growing at **5.3% per year**. As this is exponential growth, if I put it on log scale, it will become a straight line.

">

## **Stocks.**

Stocks grow exponentially as well, don't let anyone tell you otherwise. The growth rate is **7.3% per year** for the S&P 500, the main US index that tracks more than 80% of total market caps. Showing this one on linear scale on the left-hand axis, just so you can see how it typically scales.

">

## **Stocks. With Dividends.**

*If you reinvest those dividends* into the same stock market, you'll earn more. The all-time compound annual growth increases by 2% higher to **9.3% per year** for the S&P. Also displaying this one on linear scale.

">

## **Bonds.**

Bonds are supposedly safer than stocks (bondholders get paid back first), and more cash flowing. If you look at the longest running bond index in the US, it grows at **7.1% per year**, compounded. Notice how, in a rising interest rate environment (which we are at the moment), bonds will suffer, if viewing the price (or index, as in this case, using the Bloomberg Aggregate Bond Index). This has kept the bond market returns at the lower end of the range, since the global financial crisis in 2008.

">

## **Base Money.**

As we've discussed, base money grows across the world at a weighted average of **12.7% compounded per year**. However, this trendline analysis looks at it differently than my headline figure. It simply looks at the USD value of the global monetary base (again, **$27.0 trillion**), and draws an exponential trendline on that USD equivalent growth for 50+ years. In other words, this is going to be *after all currency fluctuations* have played themselves out.

Do you think the growth rate here will be higher or lower? Actually, it is lower, at **10.3% per year**. But there is a big asterisk here, in that the series is not consistent across time. I typically just display it for visual effect. As more and more central bank balance sheets were added to this analysis across the 1970s and 1980s, it is not technically rigorous to run an exponential trendline analysis across these totals. **Better to use my headline figure of 12.7% CAGR.** Again, the 12.7% figure is rigorously calculated, measuring the native growth rate of each monetary base across every month recorded, then weighting that across every other monetary base in that monthly basket, then averaging all months for an all-time figure, and then raising that all-time monthly weighted average to the power of 12.

What is interesting, however, is that the 10.3% derived CAGR using the exponential regression below is *lower* than my native headline figure of 12.7% . Remember, the 10.3% exponential regression **does not** account for all the new money supplies coming in during the 1970s and 1980s (which should push the regression slope higher as new supplies are added), *and* it is after all currency fluctuations have been factored in, to arrive at a USD equivalent. The lower 10.3% CAGR can only mean that central bank balance sheets actually lose value against the US-dollar *faster* than they can print!

">

Note, I am showing this one in linear scale. The trendline projects out to **$83 trillion** by December 2033. The current global supply of base money ($27 trillion) is about $6.5 trillion less than the current trendline ($33.5 trillion).

## **Silver.**

This is total ounces ever mined. They trend upward at **1.4% per year**.

">

## **Gold.**

This is total ounces ever mined. Gold trends upward at **1.7% per year**. Faster than silver. Surprised? Notice the R-squared (goodness of fit) for both silver and gold production increase.

">

## **Bitcoin.**

Bitcoins grow according to a basic logarithmic curve. Trying to draw percentiles is pointless here, and even measuring a trendline is relatively pointless, as everyone knows the bitcoins prescribed into the future, per the protocol. Better to just quote the trailing 12-month growth figure, and it is **1.5% per year** and falling, as of quarter end Sep-2024. Less than gold.

">

## **Silver price.**

Since 1971 it's trended at 3.4% per year. Silver bug?

">

## **Gold price.**

Since 1971 it's trended at 5.1% per year. Gold bug?

">

## **Bitcoin price.**

Now, we have finally arrived at something that grows differently than exponential. [As I've observed since 2018](https://x.com/1basemoney/status/1079740420438011905), Bitcoin grows according to a power trend. Did you notice that the prior exponential trends displayed themselves as straight lines on log scale? Well, with Bitcoin, the power trendline gradually falls across time, but the growth is still well larger than anything we've covered thus far.

Why? It's being adopted, of course.

Bitcoin's power trendline has grown **167% per year** since Bitcoin Pizza Day in 2010. Note that this is something akin to a "Lifetime Achievement" figure, and it will continue to fall every day. Over the prior 12 months ending 30 September 2024, Bitcoin grew **134.6% over the year**. Well higher now at $100k. The compound growth of the power trend today is **44% per year**. By 2030 it will fall to "only" **36% per year**.

">

Oh yes, and it is free (as in speech), open, and permissionless money.

## **To summarize.**

That was a lot of data across a lot of charts. I've compiled it all in a helpful table here for you to review at any time. This is the monetary and major asset world at third quarter end, 2024:

">

## **Base money concluded**

The following table gives you a complete summary of the fiat currencies, gold, silver, and Bitcoin figures used in this analysis, for this quarter. Please print it out if you like, it is meant to be a helpful, in-depth companion when fiat friends come asking.

">

Thank you for reading! If you enjoyed, please consider zapping, and you can also donate to my [BTCPay](https://donations.cryptovoices.com/) on [my website](https://www.porkopolis.io/) if you'd like to help keep this research going.

Happy to see you posting long-form content on Nostr. This is quite a long article, not sure if you will be able to sustain it four times a year. With one or two updates a year I would be happy 😁.

A quiet important task! 🦾

[Ecash systems](https://en.wikipedia.org/wiki/Ecash) built on top of bitcoin have seen increasing adoption over the last couple of years. They have become a polarising topic in the bitcoin community, due to their centralized and custodial nature. Like any system, ecash comes with a lot of pros and cons when compared to other systems, that are fercely debated in cyber- and meat-space.

I have been working on developing tools and software for the ecash implementation [Cashu](https://cashu.space/) for about 2 years now. I have had countless discussions with various people from different backgrounds about the topic. OG bitcoiners, fiat bankers, friends and family, privacy enthusiast... . As you can imagine the flow and outcome of these discussions varied widely.

Usually, conversations with bitcoiners were the most interesting for me. Their opinions about ecash polarised the most, by far. (excluding the fiat bankers, but that's a story for another day). In this short peice, I want to share some insights from the discussions I had, and maybe clear up some misconceptions about ecash on bitcoin.

### What is Ecash?

If you still don't know what ecash is, sorry, I won't go into much detail explaining it. I recommend reading the [wikipedia article on Ecash](https://en.wikipedia.org/wiki/Ecash) , and then [this article](https://cryptome.org/jya/digicrash.htm) on the rise and fall of digicash, the first and maybe only ecash company that existed. This will bring you up to speed on ecash history up until bitcoin entered the scene. Ecash was pretty much dead from the day after digicash went bankrupt untill it recently saw it's revival in two different spheres:

One of these spheres is obviously the **bitcoin sphere**. Here, ecash got reintroduced with the two open source projects [Fedimint](https://fedimint.org) and [Cashu](https://cashu.space/). In my opinion, the main reason for this revival is the following fact: Unlike an implementation of ecash in the fiat world, that would rely on the permissioned system to "allow" something like ecash to exist, bitcoin does not come with that limitation. The permissionless nature of bitcoin allows for these protocols to exist and interoperate with the existing bitcoin stack.

The second, and maybe lesser known sphere is the revival of **ecash as a CBDC.** Bitcoiners might get scared at the mentioning of that word. Trust me, I don't like it either. Nonetheless, privacy enthusiasts see the opportunity to steer the CBDC-ship in another direction, by using an underlying technology for them that would limit targeted discrimination by the centralized authorithy. Something that works like cash... but in cyberspace... Ecash. One such implementation is [GNU Taler](https://taler.net/en/), another one is [Project Tourbillon](https://www.bis.org/about/bisih/topics/cbdc/tourbillon.htm). Usually, these kind of implementations use a cuck-version of the OG ecash, where only payers are anonymous, but not payees.

Anyway, in this article we will focus on the implementation of **ecash on bitcoin**.

## About self custody

Bitcoin as a whole is about sovereignty and liberation. **If someone else controls your money, they control you**. For the first time since we've stopped using gold, bitcoin allows us to fully take control back of our money. A money that doesn't corrode, a money which supply connot get inflated, and a money that cannot be easily seized. All of this is true for bitcoin. There is only one precondition: **You have to hold and use it self custodially**.

### Using bitcoin self custodially

The problem comes in when using bitcoin in a self custodial fashion. For bitcoin to maintain the monetary properties mentioned above, it has to remain decentralized. This means it is hard to scale, which in turn means the use of bitcoin tends to become more costly as usage increases.

So even if we wish that everyone would use bitcoin self custodially all the time for everything, I fear it is mostly just a dream, at least for the forseable future. Even with trustless second layer protocols like the [Lightning Network](https://en.wikipedia.org/wiki/Lightning_Network), we are running into scaling issues, since at the end of the day, they are bound to the same onchain fee realities as bare-bones bitcoin transactions.

For most of humanity, it is financially not viable to pay even 1$ transaction fees for **every** transaction. Second layer protocol may bring the cost down a bit, but have other requirements. For example in lightning, you have an online assumption, to make sure your channel peers aren't trying to cheat. You need to have inbound liquidity to receive payments. There are cost associated with opening or closing payment channels, or rebalancing liquidity.

Other upcoming second layer protocols like [Ark](https://arklabs.to/) may improve on some of these issues. It is definitely something to look forward to! But they will have their own trade-offs, most likely also cost related. The fact remains that all trustless protocols that use the bitcoin timechain for conflict resolution, will have to deal with this matter. This is the cost of trustlessness.

### Soo... Don't self custody...?

**NO! If you can, you should always use self custody. As much as possible!**

Personally, I use all the tools mentioned above. And I recommend that if you can, you should too.

But the fact is, not everyone can. Many would love to take control over their financial freedom, but the threshold for them to use bitcoin in a sovereign fashion is simply to high. So they will either remain in fiat slavery land, or they will end up using "bitcoin" through a custodian like coinbase, binance, or whatever banking service they have access to.

I will also mention that for some usecases, enjoying the convenience of a custodian is just very attractive. Of course, this is only the case as long as the custodian plays by the book, and doesn't suddenly freeze-, or worse, run away with your deposits.

### The right tool for the right job

I don't beleive that one way of using bitcoin is better than the other. It entirely depends on which problem you are trying to solve.

If the problem is storing or transfering wealth, then of course you would want to do that on chain.

If on the other hand, you want to send and receive frequent small to midsized payments, you might want to get setup with a lightning channel to an LSP. Depending on how deep you want to get involved, you may even set up some infrastructure and become part of the Lightning network.

If you want to receive digital tips that you can later claim into self custody after they reach a certain threshold, you might opt for a custodial solution.

If you require certain properties, like offline peer-to-peer transferability, or cash-like privacy, you might choose an ecash system.

It doesn't mean that if you use one, you cannot use the other. You should use whatever is useful for the current problem you are trying to solve, maybe even using multiple tools in conjuction, if that makes sense.

## Ecash vs Onchain vs L2?

First of all, we have to understand that ecash is neither a replacement for self custody, nor is it a replacement for trustless second layer protocols. They are irreplaceable with something that is custodial in nature, due to the simple fact that **if you lose control over your money, you have lost the control over your life**.

So. No one beleives you should prioritize custodial solutions to secure your wealth. Self custody will always remain king in that regard. Custodial wallets should be thought off as a physical spending wallet you can walk around with, even through the dark alleyways where it might get robbed from you. Keep your cash in there for convenient spending, not worrying about fees, liquidity, data footprints, channel backups, etc. etc. etc... These benefits obviously come at the cost of trust, that the provider doesn't rug-pull your deposit.

I really like the user experience of custodial services. I would never put a lot of money into any one of them though, because I don't trust them. Just like I wouldn't walk around with $10000 in my physical wallet. The risk that it gets stolen is simply to great. At the same time, this risk doesn't mean I will get rid of my physical wallet. I think having a wallet with some cash in it is super useful. I will mittigate the risk by reducing the amount I carry inside that wallet. This is the same way I think about digital money I hold in custodial wallets, be it an ecash service or others.

All things considered, it is hard to argue that self custody comes even close to the UX a custodian can give you, due to the fact that they can take care of all the complexities (mentioned above) for you.

## So then, why ecash?

We now know, that we are **NOT** comparing ecash with the sovereign bitcoin stack. We are comparing it instead to traditional custodial systems. This is the area ecash is trying to improve uppon. **So if you've chosen that the best tool to solve a problem might be a custodial solution, only then should you start to consider using ecash.**

It offers a more privacy preserving, less burdonsome and less censorable way of offering a custody solution.

It offers some neat properties like offline peer-to-peer transactions, programability, de-linkage from personally identifiable information, and more.

**Here is an example, on how ecash could create a fairer environment for online consumers:**

Online services love to offer subscriptions. But for the consumer, this is mostly a trap. As a consumer, I would rather pay for a service right now and be done with it. I don't want to sign up for a 10 year plan, give them my email address, my date of birth , create an account, etc...

One way of doing that, would be for the service provider to accept payments in ecash, instead of having an account and subscription model.

It would work like this:

1. The user creates ecash by paying into the service's mint. Hereby it is not required to use lightning or even bitcoin. It could be done with any other value transfer meduim the service provider accepts (cash, shitcoins, lottery tickets...).

2. You use the issued ecash, to retreive services. This could be anything from video streaming, to AI prompts.

3. Once you are done, you swap your remaining ecash back.

In a system like this, you wouldn't be tracked as a user, and the service provider wouldn't be burdoned with safeguarding your personal information. Just like a cash-for-goods transaction in a convenience store.

I beleive the search engine Kagi is building a system like that, according to [this podcast](https://optoutpod.com/episodes/how-kagi-is-fixing-search-vlad-prelovac/). It has also be demoed by <https://athenut.com/> how it would be implemented, using Cashu.

**Here is another example, on how an event organizer can provide privacy preserving electronic payment rails for a conference or a festival, using ecash:**

If you have been part of organizing a conference or an event, you might have experienced this problem. Onchain payments are too slow and costly. Lightning payments are too flaky.

Do merchants have to setup a lightning channel? Do they have to request inbound liquidity from an LSP? Do they have to splice into the channel once they run out of liquidity? In practice, these are the realities that merchants and event organizers are faced with when they try to set up payment rails for a conference.

Using ecash, it would look like this:

1. Event organizer will run a dedicated ecash mint for the event.

2. Visitors can swap into ecash when ariving at the entrance, using bitcoin, cash, or whatever medium the organizer accepts.

3. The visitor can spend the ecash freely at the merchants. He enjoys good privacy, like with cash. The online requirements are minimal, so it works well in a setting where connectivity is not great.

4. At the end of the event, visitors and merchants swap their ecash back into the preferred medium (cash, bitcoin...).

This would dreastically reduce the complexity and requirements for merchants, while improving the privacy of the visitors.

**A bold experiment: Free banking in the digital age**

Most bitcoiners will run out of the room screaming, if they hear the word **bank**. And fair enough, I don't like them either. I believe in the mantra "unbank the banked", after all. But the reason I do so, is because todays fiat/investment banks just suck. It's the same problem as with the internet platforms today. You, the "customer", is not realy the customer anymore, but the product. You get sold and squeezed, until you have nothing more to give.

I beleive with a sound money basis, these new kind of free banks could once again compete for customers by provididng the best money services they can, and not by who can scam his way to the money printer the best. Maybe this is just a pipe dream. But we all dream a little. Some dream about unlimited onchain transactions (I've had this dream before), and some dream about free banks in cyberspace. In my dream, these banks would use ecash to respect their users privacy.

## Clearing up misconceptions and flawed assumptions about ecash on bitcoin

Not only, but especially when talking with bitcoiners there are a lot of assumptions regarding ecash on bitcoin. I want to take this opportunity to address some of those.

### Ecash is an attack on self custody

As we've mentioned above, ecash is not meant to compete with self custody. It is meant to go where self custodial bitcoin cannot go. Be it due to on-chain limitations, or network/infrastructure requirements. Ecash is completely detached from bitcoin, and can never compete with the trustless properties that only bitcoin can offer.

### Ecash mints will get rugged

100% correct. Every custodial solution, be it multisig or not, will suffer from this risk. It is part of the deal. Act accordingly. Plan for this risk when choosing to use a custodial system.

### Working on ecash is a distraction from what really matters, since it is not self custodial

While it is true that improving self custodial bitcoin is one of the most important things our generation will have to solve, it doesn't mean that everything else becomes irrelevant. We see that today, in a lot of circumstances a fully sovereign setup is just not realistic. At which point most users will revert back to custodial solutions. Having technology in place for users that face these circumstances, to offer them at least some protection are worth the effort, in my opinion.

### Ecash mints will retroactively introduce KYC

Yes it is true that ecash mints can do that. However, what would they learn? They would learn about the amount you were holding in the mint at that time, should you choose to withdraw. They would not be able to learn anything about your past transactions. And needless to say, at which point you should be one and done with this mint as a service provider, and move to someone that respects their users.

### Ecash will be used to "steal" bitcoins self custodial user base

I would argue the oposite. Someone that has realized the power of self custody, would never give it up willingly. On the other hand, someone that got rugged by an ecash mint will forever become a self custody maximalist.

## Closing thoughts...

I hope you enjoyed reading my take on **ecash built on bitcoin**. I beleive it has massive potential, and creators, service providers and consumers can benefit massively from ecash's proposition. Using ecash doesn't mean you reject self custody. It means you have realized that there is more tools than just a hammer, and you intend to use the tool that can best solve the problem at hand. This also means, that to some the tool "ecash" may be useless. After all, not everyone is a carpenter. This is also fine. Use whatever you think is useful, and don't let people tell you otherwise.

Also, please don't take my word for it. Think for yourself.

Best,

Gandlaf

Good read. I struggle understanding cashu (and other ecash implementations), this has helped a little.

A relative issue I see is that the best Nostr clients mimic the twitter structure, which focuses on names rather than subjects, and we are missing names compared to twitter, at least in any subject other than bitcoin.

Something like stacker news is interesting, I miss clients that put more focus on subjects rather than names.