For several years on Christmas Eve we would have dinner at a low end restaurant which had a waitstaff (Denny’s, Wafflehouse, etc.) and leave a large tip. I’ll never forget the year the server ran after me and hugged me as we were leaving because she was going to be able to rent a car to visit her kids in Ohio. It really is more blessed to give than receive.

I update the model first, in order to form my own opinion, then read management’s spin. I think this order is essential for critical thinking.

Clem’s disclosure at the bottom: “I own ether.”

I have a question: what time should I come over for dinner?

I’m reminded that while it’ll be fun for those of us in the U.S. to celebrate #Bitcoin crossing the $100,000 USD milestone, we can always find other major milestones to celebrate. $150,000 AUD for our brothers and sisters in Oz is very cool also.

Ep2: I speak with my good friend Greg Hahn, founder and Chief Investment Officer of Winthrop Capital Management.

Greg on #government mamagement of the #GFC: “We had to come to our own view of how the machine worked. Back then we assumed that the #bank #regulators were on top of it.”

https://podcasts.apple.com/us/podcast/the-generous-investor/id1765039441?i=1000672201156

I’m happy to share the launch of The Generous Investor podcast. I hope to share actionable wisdom from #investors #philanthropists and #nonprofits doing really great work. It won’t be the only topic, but I expect #Bitcoin will be a recurring topic.

For more: www.generousinvestor.com

It was a great interview, Daniel. Yours is a thoughtful, patient approach which will bear much fruit in time. Keep up the good work.

More than any other podcast, WBD made me the Bitcoin freak I am today. Thank you for helping the world, Peter and Danny. I’m forever grateful.

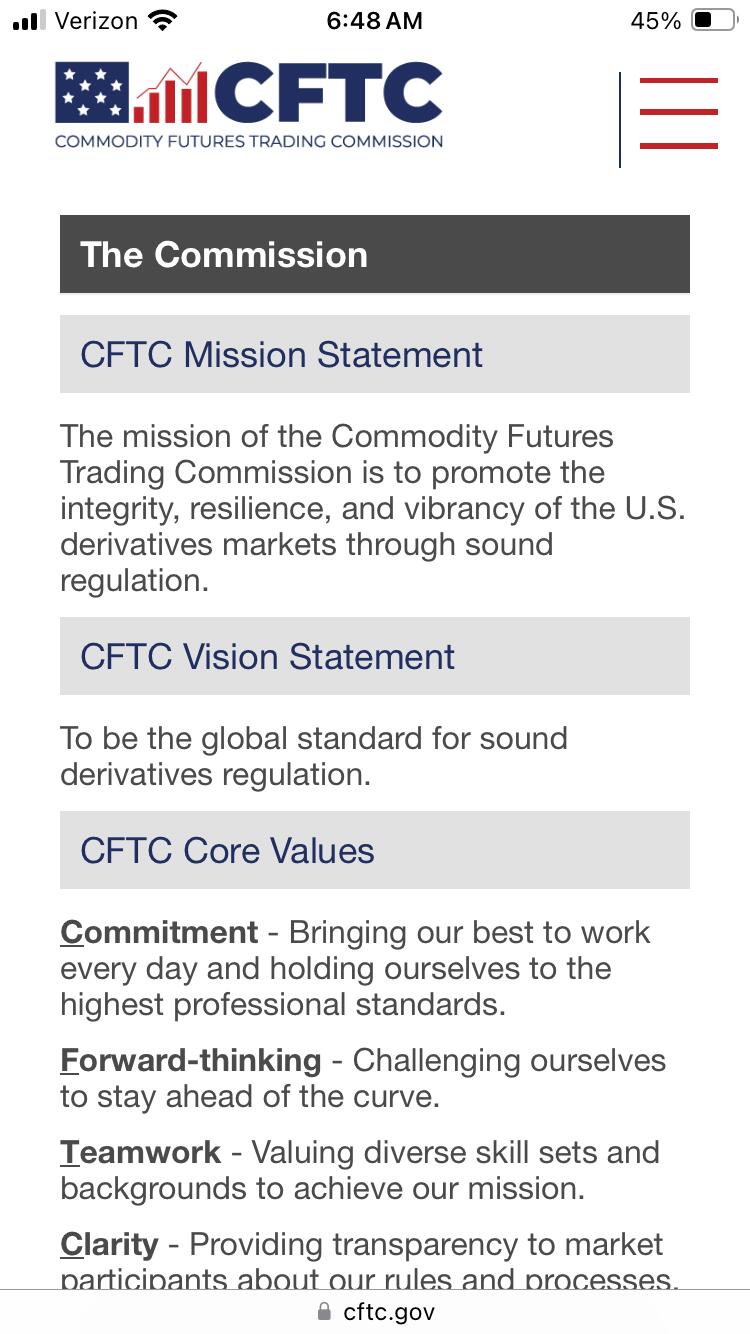

I’ve seen several reposts of nostr:npub1guh5grefa7vkay4ps6udxg8lrqxg2kgr3qh9n4gduxut64nfxq0q9y6hjy's note about Sen. Stabenow’s hearing. The mission and vision statements for the #CFTC show that regulating spot #BTC (or any spot commodity, for that matter) is simply beyond the agency’s purview: they regulate derivative contracts. Period.

Write, email, or call your elected representatives today. nostr:npub1h8nk2346qezka5cpm8jjh3yl5j88pf4ly2ptu7s6uu55wcfqy0wq36rpev nostr:npub1mhe7uv6m6faes325wsmwygp2mtw6gdylqxp8gak4zgy374qx6hxsxwwzcz nostr:npub1xsf5h8suhveztq4u5spq5wwvzftqxmglt6vwllxg8z6zrlpqn4yqrulu9v

The picture needs to have Macron in the middle gesturing to Biden to go to the right instead, where the other G7 dignitaries are waiting for a group photo.

Agreed. I would add that the point at which I began taking myself less seriously and my work more seriously was freeing and meaningful.

FWIW, my heart-felt prayers for wisdom almost always return solutions which I can’t imagine coming up with on my own.

Although it seems like fractionally reserving would also cap demand for Treasuries sooner or later. When that demand dries up, maintaining the reserve currency would necessitate some kind of dollar backing, à la your proposal at the BPI this spring.

In the end it all comes back to fiscal discipline, which is downstream from national character. We haven’t balanced a budget in over two decades and the public appetite for bread & circuses seems strong as ever today.

I hope I’m wrong.