Technically true but the reserves that were keeping our peg were at least controlled by the Bulgarian national bank. However, now the crazy euro witch aka Lagarde has a say.

Exactly my thinking

If it's this hard, then you're doing something wrong.

Buy yourself an UmbrelHome device, run your nodes there. Use #BitBanana or #Zeus to connect to and manage the CLN node. Those two wallets will help you open and close channels, send and receive payments and sign stuff if need be.

Have a cold wallet — Coldcard, Bitbox, Jade — to store the amount you're holding instead of spending. On and off ramps only through true p2p environment: for EU, there's Peach and Robo sats with decent liquidity EUR payment methods.I advise gags isn't using SEPA transfers if you're selling #BTC as the rules around chargebacks are against you, use payment methods like Wise if you're on the fiat receiving end. Everything is done through the phone app, no need to host anything on top.

The effort is minimal, the sovereignty of the setup is excellent.

The epitome of "Don't trust, verify".

nostr:nevent1qqs2ylg2uv7u69s2uvvf3ldtcesdg632e72gg7cq7vp5yk7kcej6qpqy7kz0q

Generally, I agree that geeks overcomplicate things. Start9 and Umbrel actually can make your life easier, but only if you let them 😂😂!

This is sad, I didn't know.

I thought that China is no longer a low lage country?

Literally all the fraud would be gone in an instant 😂😂😂

I don't tell people to buy Bitcoin, I just donate Bitcoin to causes and in this way I have been quite succesful at converting people.

Getting your first introduction to Bitcoin as a donation is extremely powerful ♥️!

Any distortion to the free market has caused problems!

It is time for politicians to learn that their actions actually have severe consequences 🙃. nostr:note1vupkjkehe8vynwz52yxg9mfukdzdmqw89s090dzw8au0wrq3uprqlrkclj

Very indepth story that shows what happened with the music art industry! nostr:note1cyftzyx8j2egyc7k0y2zdmdcx380dkh5wlhutc4gg00y64em3hvsxg4wxd

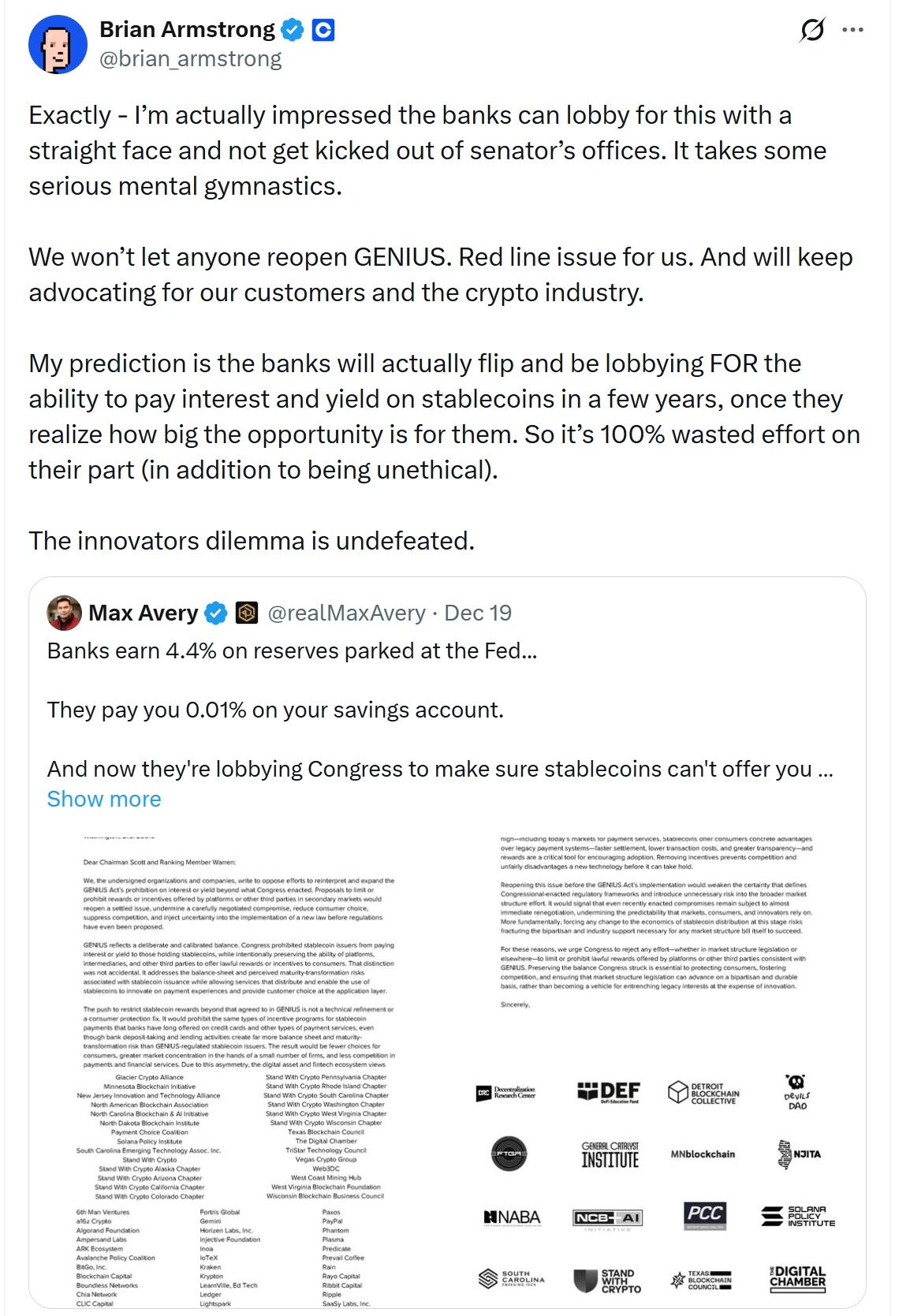

Coinbase CEO Says Reopening GENIUS Act Is 'Red Line', Slams Bank Lobbying

Coinbase CEO Says Reopening GENIUS Act Is 'Red Line', Slams Bank Lobbying

https://cointelegraph.com/news/coinbase-ceo-genius-act-red-line-bank-lobbying-stablecoins

Coinbase CEO Brian Armstrong said any attempt to reopen the GENIUS Act would cross a “red line,” accusing banks of using political pressure to block competition from stablecoins and fintech platforms.

?itok=AJAT-QSp

?itok=AJAT-QSp

In a Sunday https://x.com/brian_armstrong/status/2004693396074758287

on X, Armstrong said he was “impressed” banks could lobby Congress so openly without backlash, adding that Coinbase would continue pushing back on efforts to revise the law.

“We won’t let anyone reopen GENIUS,” he wrote.

“My prediction is the banks will actually flip and be lobbying FOR the ability to pay interest and yield on stablecoins in a few years, once they realize how big the opportunity is for them. So it’s 100% wasted effort on their part (in addition to being unethical),” Armstrong added.

The https://cointelegraph.com/learn/articles/genius-act-how-it-could-reshape-us-stablecoin-regulation

, passed after months of negotiations, bars stablecoin issuers from paying interest directly but allows platforms and third parties to offer rewards.

?itok=kAEbM_Be

?itok=kAEbM_Be

Coinbase CEO warning against reopening the GENIUS Act. Source: https://x.com/brian_armstrong/status/2004693396074758287

Bank lobbying targets stablecoin “rewards”

Armstrong’s comments came in response to a post by Max Avery, a board member and business development executive at Digital Ascension Group, who outlined why parts of the banking sector are pushing lawmakers to revisit the legislation.

Avery argued that proposed amendments would go beyond banning direct interest payments by stablecoin issuers and instead restrict “rewards” more broadly, cutting off indirect yield-sharing mechanisms offered by platforms and third parties.

Avery pointed out that while banks currently earn around 4% on reserves parked at the Federal Reserve, consumers often receive close to zero on traditional savings accounts. Stablecoin platforms, he said, threaten that model by offering to share some of that yield with users.

“They're calling it a ‘safety concern.’ They're worried about ‘community bank deposits,’” he wrote, adding that independent research “shows zero evidence of disproportionate deposit outflows from community banks.”

US lawmakers propose tax relief for stablecoin payments

Last week, US lawmakers unveiled a discussion draft https://cointelegraph.com/news/us-lawmakers-stablecoin-tax-break-staking-rewards

on everyday crypto users by exempting small stablecoin transactions from capital gains taxes. The proposal, introduced by Representatives Max Miller and Steven Horsford, would allow payments of up to $200 in regulated, dollar-pegged stablecoins to avoid gain or loss recognition.

Beyond payments, the bill targets taxation issues around staking and mining by allowing taxpayers to defer income recognition on rewards for up to five years.

https://cms.zerohedge.com/users/tyler-durden

Sat, 12/27/2025 - 17:30

https://www.zerohedge.com/crypto/coinbase-ceo-says-reopening-genius-act-red-line-slams-bank-lobbying

Banks having a strong lobby and the ability to buy up politicians hm..... I wonder what made them that perhaps the fact that none of them ever suffered the true consequences of their irresponsible actions.

⚡️💬 NEW - Tom Lee is predicting:

1) $7k-$9k Ethereum in early 2026

2) $200k Bitcoin in 2026

3) $20k ETH over time

"I don't want to overuse the word supercycle"

https://blossom.primal.net/5a2a97b9d087383341ef0e205837cf869ab133163bd4bbb224306fe780eeb14d.mov

When has this guy been spot on? I have a feeling that everything he ushers is basically wild speculation!

The art of software engineering will disappear if the companies that require it no longer engineer but just prompt engineer.

Another propagandist telling how good is to not care about anything and anybody and just work for the "rewarding corporate ladder 🪜"!

Great recipe. I am thinking that with orzo, it would also be shockingly 😊.

JPMorgan Freezes Accounts Of Two Stablecoin Startups Over Sanctions Concerns: Report

JPMorgan Freezes Accounts Of Two Stablecoin Startups Over Sanctions Concerns: Report

https://cointelegraph.com/news/jpmorgan-freezes-stablecoin-startup-accounts-sanctions

JPMorgan Chase has reportedly frozen bank accounts linked to two venture-backed stablecoin startups after identifying exposure to sanctioned and high-risk jurisdictions.

?itok=grr5ZkkN

?itok=grr5ZkkN

The accounts belonged to BlindPay and Kontigo, two stablecoin startups backed by Y Combinator that primarily operate across Latin America, https://www.theinformation.com/briefings/jpmorgan-freezes-accounts-risky-stablecoin-payments

to a report by The Information. Both companies accessed JPMorgan’s banking services through Checkbook, a digital payments firm that partners with large financial institutions.

Per the report, the freezes occurred after JPMorgan flagged business activity tied to Venezuela and other locations subject to US sanctions.

A spokesperson for JPMorgan reportedly said the decision was not driven by opposition to stablecoins themselves.

“This has nothing to do with stablecoin companies,” the spokesperson told The Information.

“We bank both stablecoin issuers and stablecoin-related businesses, and we recently took a stablecoin issuer public,” the spokesperson added.

Chargeback surge triggers JPMorgan account closures

Checkbook CEO PJ Gupta reportedly told The Information that BlindPay and Kontigo were among several firms linked to a surge in chargebacks that prompted the bank to close accounts.

According to Gupta, the spike was driven by rapid customer onboarding.

“They opened the floodgates and a bunch of people came in over the internet,” he said.

The account freezes come as JPMorgan and Checkbook deepen their partnership. In November 2024, the two companies https://www.businesswire.com/news/home/20241104412738/en/Checkbook-Joins-J.P.-Morgan-Payments-Partner-Network

that Checkbook would join the J.P. Morgan Payments Partner Network, enabling corporate clients to send digital checks. Checkbook also expanded its B2B payment offerings earlier in 2024, targeting sectors such as legal services, government and banking.

As Cointelegraph reported, cryptocurrencies are https://cointelegraph.com/news/venezuela-crypto-adoption-bolivar-inflation-2025

as citizens turn to digital assets to shield themselves from a collapsing currency and tighter government controls.

Cointelegraph reached out to JPMorgan for comment, but had not received a response by publication.

Winklevoss accuses JPMorgan of retaliating against Gemini over criticism

In July, Gemini co-founder Tyler Winklevoss claimed JPMorgan Chase https://cointelegraph.com/news/tyler-winklevoss-says-jpmorgan-blocked-gemini-after-criticism

process in response to his public criticism of the bank’s new data access policy.

Winklevoss accused the bank of engaging in anti-competitive behavior that could damage fintech and crypto firms.

Meanwhile, JPMorgan is https://cointelegraph.com/news/jpmorgan-crypto-trading-institutional-clients

, including spot and derivatives products, to its institutional clients as interest grows amid a more favorable US regulatory environment.

https://cms.zerohedge.com/users/tyler-durden

Sat, 12/27/2025 - 15:10

This is just one of the stories of debanking, there are many more. The fiat banking oligarphy at its finest.

Back in my country - Bulgaria 🇧🇬 and I feel happy and warm. Others see many faults with Bulgaria and it's ruiling elite and although I agree with them I really feel happy every time I am back in my country!

This feeling might be feel strange to others but somehow I got attached to even the unpleasant bits of Bulgaria 😂😀!

PS: Wish you all to enjoy the negatives of everything as much as the positives since the imperfections are what shapes the "human experience".

This is some wild story, thanks for sharing.

Seattle is losing the Crocodile and only 40% of independent venues in WA are profitable.

https://www.thestranger.com/music/2025/12/18/80376142/seattle-music-scene-gut-check

This is some shocking stat. I would be very interested to see if this is a recent phenomena - profit plummeting or always big part of the arts field was just unprofitable.

What is your feel?

Given the amount of pardons beging thrown at all sorts of people, I see no one deserving more one than the samourai devs. Hopefully they get one!

Op return has exited in core since like 2015. What you are saying is dumb or you claim Bitcoin has been censored since then and only now will be uncensored 😂?

I think we have to convince Dave Smith to come to Nostr. He is a perfect guy that can other libertarians to come as well. Bonus points he is already a Bitcoiner.

I have never sold Bitcoin, I don't see why I would. However, this doesn't mean that I don't use Bitcoin. I use it as often as I can. For example this weekend I am going to Arnhem to support the local Bitcoin economy.

The impossible happened, I was able to send from my self custodial lightning node 1 Satoshi to my custodial wallet of Satoshi wallet. Not only that but I did that using the Zeus wallet connected to my own personal lightning wallet all over Tor.

Attaching proof: