Beijing's Bold Economic Gambit: Masters of the Bubble Economy Strike Again

After mastering the art of inflating property bubbles, China's economic strategists are rolling out their next masterpiece. A stimulus package potentially exceeding 10 trillion yuan is in the works, proving once again that when it comes to artificial market inflation, Beijing plays in the Champions League of bubble creation.

The National People's Congress Standing Committee is orchestrating this latest economic performance, with special-purpose bonds serving as their conductor's baton. It's a familiar tune: pump liquidity, inflate assets, repeat – but this time with a global twist, as timing aligns strategically with the US presidential election.

Key movements in this economic symphony:

- Annual central government debt conducting at 2 trillion yuan

- Special-purpose bonds orchestrating up to 4 trillion yuan over 5 years

- Consumer stimulus arrangements worth 1+ trillion yuan

- Package size flexing based on US election outcomes

While the 2008 stimulus (13% of GDP) created a property market frenzy that would make tulip mania blush, this time they're promising a more "measured" approach. But as history shows, when China decides to inflate an economic balloon, it doesn't just blow – it soars.

The irony isn't lost: after dealing with the aftermath of their property bubble, they're reaching for the pump again. Different bubble, same playbook.

#China #Economy #GlobalMarkets #AssetInflation #EconomicPolicy #USElection2024 #AsianMarkets #GlobalTrade #BubbleEconomy #btc

Germany is the economy with the deepest recession in the European Union. It is facing the worst demographic dislocation after Greece and has opened up its social security to half the world, leading to the invasion of Europe. And now there are actually so-called economists who believe that Germany can reduce its debt relative to its gross domestic product, which is already reeling. What madness!

#germany #eu #debt #recession https://files.sovbit.host/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/8aee918653cf98e1c7d86c34c372df0e1bbf4759cf53c55cbfe5efbe5f67817c.webp

The State's Banking Monopoly: Marx's Blueprint for Economic Destruction

The Marxists have never hidden their intentions. Right there in their revolutionary manifesto, Marx and Engels explicitly called for "Centralisation of credit in the hands of the state, by means of a national bank with State capital and an exclusive monopoly." This was no mere footnote, but a central pillar in their plan to destroy the free market and impose economic totalitarianism.

By centralizing banking, the state gains the power to manipulate the very lifeblood of the market economy - money itself. Every expansion of the money supply amounts to a hidden tax, stealing purchasing power from productive citizens and transferring it to the state and its cronies who receive the new money first. This is no accident - it is precisely what the architects of state banking intended.

Consider the pernicious effects: When the central bank expands credit, it sets in motion an artificial boom. Entrepreneurs are misled by false interest rate signals to invest in projects that cannot be sustained by real savings. When reality eventually reasserts itself, we get the inevitable bust - but rather than allowing the necessary liquidation of malinvestments, the central bank doubles down with more credit expansion, perpetuating the destructive cycle.

This is exactly what Marx and his followers wanted - to destabilize the market economy through monetary manipulation. By monopolizing banking, the state gains the power to generate the boom-bust cycles that Marxists then disingenuously blame on capitalism itself. The central bank serves as their primary weapon for undermining sound money and economic calculation.

The Federal Reserve and its global counterparts represent the realization of Marx's vision. Through their monopoly on money creation, they enable the endless growth of state power, fund the welfare-warfare state, and steadily destroy the purchasing power of the common man's savings. Every new round of quantitative easing and interest rate manipulation takes us one step closer to the Marxist goal of abolishing private property and free markets.

The solution is clear - we must end the state's banking monopoly and restore sound money based on voluntary market choices. The free market, not bureaucratic central planners, should determine interest rates and the money supply. Until we eliminate this engine of statism, we remain trapped in a monetary system designed by our enemies to bring about our economic destruction.

#communism #socialism #wef #eu #fed #ecb #inflation #freemarket #mises #bitcoin

BRICS Ascending: A New Global Power Structure Emerges

In a shift that's reshaping the global order, BRICS nations are orchestrating what may be the most significant challenge to Western economic dominance since World War II and the manifestation of western order through the system of Bretton Woods 1944. The recent Kazan summit reveals an alliance that's no longer just an acronym, but a sophisticated network poised to reshape global power dynamics.

The New Economic Competitor

The expanded BRICS bloc—now including Egypt, Ethiopia, Iran, and the UAE alongside founding members Brazil, Russia, India, China, and South Africa—commands an unprecedented 33% of global GDP, surpassing the G7's 29%. This isn't merely about numbers; it's about fundamental structural change in the global economic architecture.

Breaking Western Financial Hegemony

The alliance's most ambitious move is the introduction of BRICS Clear, a settlement system that directly challenges SWIFT's monopoly. This isn't just another payment system—it's the foundation of a new financial order that could fundamentally alter how global trade operates. The system's innovative use of a stablecoin for clearing, managed by the New Development Bank, signals a sophisticated approach to reducing dependency on Western financial infrastructure.

Strategic Partnership Network

Perhaps most telling is the creation of a formal "partner countries" category, drawing in economic powerhouses like Indonesia, Malaysia, Thailand, and Vietnam. This strategic expansion creates a economic zone that could redefine Asian trade patterns and potentially reshape global supply chains.

Insurance: The Hidden Game-Changer

The establishment of the BRICS (Re)Insurance Company marks another critical step toward financial autonomy. By breaking free from Western insurance markets, BRICS is removing one of the last remaining dependencies on Western financial systems for international trade.

Looking Ahead

This transformation isn't just about economics—it's about fundamental changes in global power distribution. As BRICS develops its financial architecture, we're witnessing the emergence of a multipolar world where economic power is more evenly distributed across global regions.

The West faces a critical challenge: adapt to this new reality or risk accelerating its own relative decline. The success of BRICS Clear and associated initiatives could mark the beginning of a new era in international relations, where economic power is no longer concentrated in traditional Western centers.

For businesses and policymakers worldwide, the message is clear: the global economic landscape is transforming, and adaptation to this new reality isn't optional—it's imperative.

#Kazan #BRICS #InternationalRelations #Geopolitics #GlobalTrade #G7 #Economy https://files.sovbit.host/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/647511b6dfbdc79498247f19a81b9469c9e3af847cce0b3ae274bdd205b934a2.webp

Reality Check InbGermany: Volkswagen Plans Massive Job Cuts Amid Germany's Economic Turmoil

Volkswagen, Germany's automotive giant, is reportedly planning to close at least three factories in the country and significantly downsize its remaining operations, leading to the potential loss of tens of thousands of jobs. This move comes as a response to the country's economic challenges, including the impact of sanctions on Russia, soaring energy costs, and ongoing issues with migration policies.

According to the Volkswagen works council, the company's management has informed employees about these drastic measures. The Osnabrück plant is said to be particularly vulnerable, having recently lost a crucial follow-up order from Porsche. Additionally, the company is reportedly planning to implement mass layoffs and relocate entire departments overseas.

The Volkswagen works council has vowed to resist these plans, as the proposed actions could have a devastating impact on the livelihoods of thousands of workers. The German government has also weighed in, with a spokesperson stating that the chancellor's stance is clear - "that possible wrong management decisions from the past should not be borne by the employees."

The green socialist federal government shows the usual action-reaction pattern: any blame is dismissed, blamed on others to deflect suspicion that it could be their own infantile ideology that is causing such collateral damage, which is irreparable for the foreseeable future.

#Volkswagen #Jobs #Germany #Ampel #VW #Socialism #GreenDeal

PBoC Launches New Monthly Liquidity Tool 🇨🇳

China's central bank is rolling out a powerful new monetary instrument that's set to reshape banking liquidity management. Starting next week, PBoC will conduct monthly direct reverse repo operations with primary dealers, focusing on sub-year terms. The bank is also expanding its arsenal by implementing a comprehensive bond buyback program, targeting everything from sovereign to corporate paper. Stay tuned, there's much more to come...

#ChinaFinance #MonetaryPolicy #Banking #GlobalMarkets #PBoC

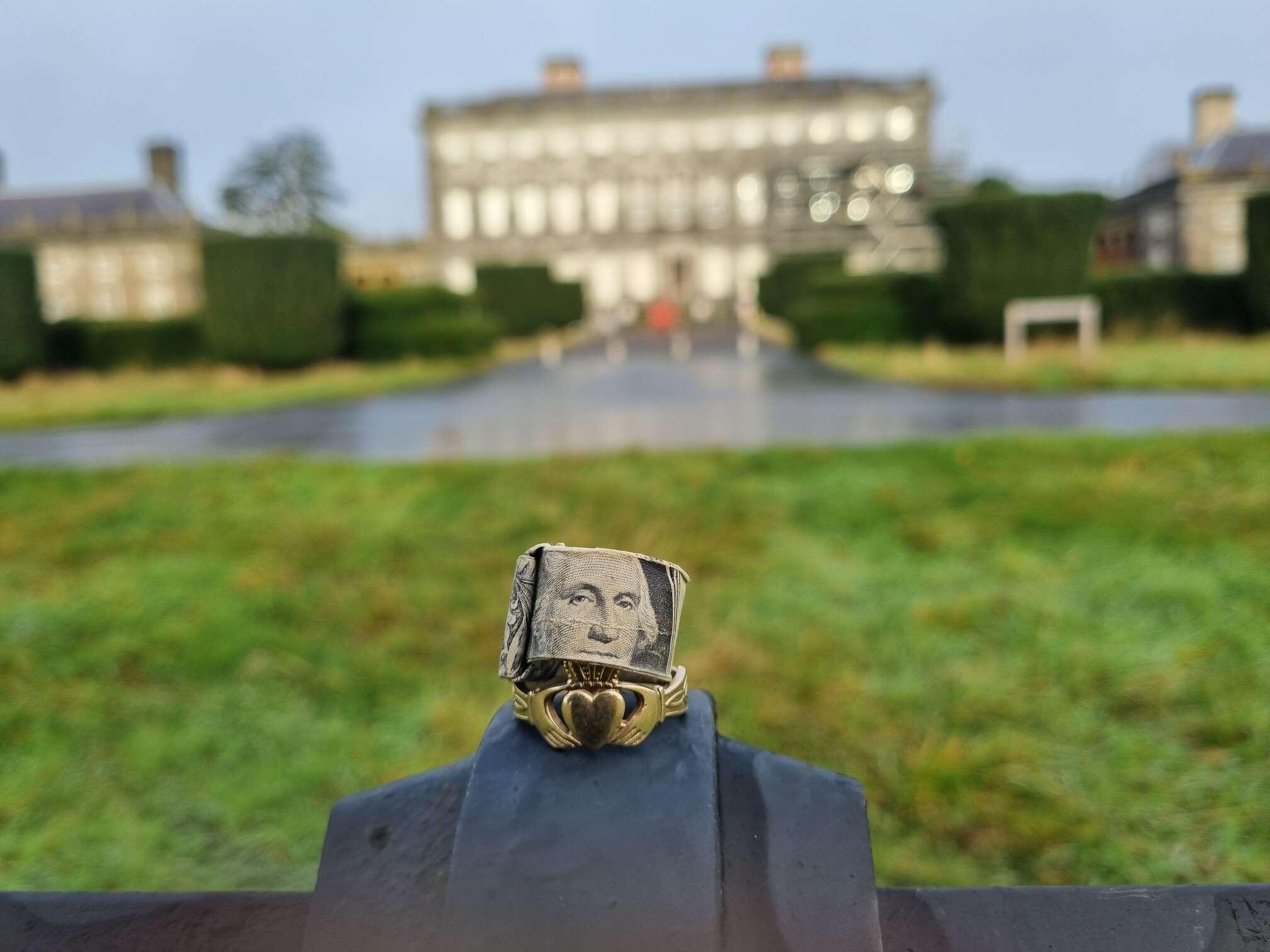

#uselections2024 in 7 days, 9h...

#usa #trump #harris https://files.sovbit.host/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/d622fbd3a8746063eb4ac577fb0416a830487cb352fdfd4b8194edc1f00dda97.webp

India-China Conflict: Impressive Void In The Mainstream

The BRICS conference in Kazan can certainly be interpreted in different ways. But to summarize the results of the BRICS group: the mills grind slowly, but they grind.

Some things are on the way, the important construction sites, such as the new monetary system, will take years. Some things are on the way, the important construction sites, such as the new monetary system, will take years, if not a whole decade, to be cast in an institutional form that can compete with the existing system dominated by the G7.

But one very big detail has been overlooked, or chosen to be overlooked, in the western mainstream media: India and China apparently settled their decades-long border dispute on the sidelines of the conference. This is more than just a mere statement, but it obviously goes far beyond the horizon of experience of Europeans in particular, who are busy saving the world's climate on a daily basis.

To cut a long story short: the rapprochement between the two economic and geopolitical giants is a big deal. Stability is all the new economic bloc needs. Stability and credibility of its pillar states is the foundation to get off the starting blocks. This was a big step towards the starting block though!

#BRICS #China #India #Kazan #geopolitics

Uk: Labor Intervening In US Elections

It is disturbing to see how the British Labor Party under Keir Starmer is intervening in the US election campaign. These are the same people who have always brought Russia contacts into play in the Trump campaign. But you can see how desperate the Europeans are to involve the American military complex on their battlefield in Ukraine. They can't do it alone and under Kamala Harris it would be much easier to do.

England is so financially involved in Ukraine that it is now dependent on the reparations that would follow a possible Russian defeat.

https://fountain.fm/episode/bpiJ60zrnAXNLAGW7arz

#uk #labor #usa #trump #harris #russia #ukraine #starmer

Is the #oil market anticipating a Donald #Trump victory, which could lead to a normalization of energy policy in the #USA? https://files.sovbit.host/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/c0f9834dcf5c280128cf1e20e23635d9016c88dff50a6f10c8faace7d567118a.webp

The stupid clown face you pull when you realize Russia won't have to pay reparations to fund your exploding state apparatus.

#Ukraine #Russia #UK #debtspiral https://files.sovbit.host/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/9c29df9839b95658788858ba179519f4377a9c9ea01d608e3abaf326fd5b1ff4.webp

Back to the boom times of a free society! Even approximative tendencies are more than welcome! Destroy the military industrial complex, it gives you room to do so.

#USA #freedom #bitcoin #mises https://files.sovbit.host/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/bf1c15489d6f71b1db6e6d37e54de90d368f4c26a256c6e242c9ee147a2e5830.webp

Inflation destroys the basic structure of the economy, it increases the time preference of individuals, it prevents us from having a reasonable relationship with the future. It is a cancer of our civilization and we are funding institutions, central banks, to officially bring this about. Madness!

#inflation #recession #centralbank #fed #ecb #bitcoin #mises

UK Shows Dangerous Signs Of Socialism Infection

Are we Europeans infected with socialism?A quick glance at the UK is enough to say, sure! The cradle of liberalism is severely infected as the island provides a vivid example of how this dangerous cancer has crept into Europe and eaten its way into society, politics and the economy, as well as infiltrating cultural life. Its vectors of attack are classic: it systematically undermines the institution of private property and autonomy of the individual. It discredits the nuclear family and kills meritocratic values in education and also in cultural life meanwhile religion gets under fire too.

Success Of The Unsuitable

It is significant that in internal party selection processes, the unsuitable who have failed in real life, in the free economy, are disproportionately successful. This is adverse selection - the counterpoint of a healthy meritocratic process of a natural elite that is subject to the rules of a performance-stimulating cursus honorum.

The British Flippening

The figures from England now show that the state's share has outgrown the private sector. The unproductive part of the economy, if it is an economy at all, is thus sucking a rapidly growing share of its energy from the private economy, leading to considerable misallocations and driving the impoverishment of society. The symptoms are unmistakable: rising crime, impoverishment, in short: the volatility of abstract sphere of financial markets (credit pump) is spilling out onto the streets, where it is coagulating into an all-destabilizing social explosive.

Total Control Is The End-Game

In the end, there is hardly a place of retreat for the once sovereign citizen that is not ransacked by representatives of the paranoid bureaucratic state. Narrative sovereignty is everything, maintaining the illusion of a healthy progression of a society in the process of socialization is done through an ever more expensive propaganda machine (remember how US president Biden has been a vital, intelligent and visionary leader over 3.5 years (sic!) until he was replaced by another moron that now holds the flame of eternal wisdom?) that seeks to nip any form of real or virtual secession in the bud.

Dying Spirit Of Initiative

The growing proportion of the state is an expression of the all initiative suffocating bureaucratization of the broader parts of society. They are the vampiric sector of society, the front organizations of the political class that must keep towering figures from the competing private sector like Elon Musk in check in the media to avoid losing credibility even faster. As we are now entering an accelerated phase of state failure, the good news at the end: 20th century history teaches us that this form of social organization usually collapses faster than its innovators can build it. So let's remain hopeful and put our faith 100% in freedom and reason!

#eu #uk #england #socialism #economy #coercivestate #mises #freedom

Germany: Europe's Sick Man (again)

Germany has become the sick man of Europe. It's amazing, but the increasing attacks by politicians on the middle class and the productive population are now having an effect on the health of the population. #germany #wef #socialism

Germany's Public Sector Boom Raises Economic Red Flags

Germany is deep in recession. To conceal this, politicians are resorting to familiar tools: they are manipulating the labor market with massive government spending and artificially created government jobs and taking refuge in side issues such as the climate apocalypse.

A striking analysis reveals an unprecedented expansion of Germany's public sector, with government employment soaring amid private sector struggles. Recent data shows public service positions increased by 990,000 since 2010, with a remarkable surge of 108,000 jobs in 2022 alone.

Government Growth Out Of Control

The cost implications are staggering - federal personnel expenses jumped 62% to €38.7B (2010-2023), while ministerial staff costs more than doubled in the past decade. Meanwhile, new regulations are costing German businesses €67B annually in bureaucratic overhead.

No Real Job Growth

Most telling: While total employment reached 46.1M in Q2 2024, the growth is heavily concentrated in public services, education, and healthcare sectors, which now employ 12.2M people - up from 11.3M in 2019. With every euro the state and its useless bureaucracy gets its hands on, the private sector shrinks its potential to allocate resources efficiently. This is the road to socialism and economic bankruptcy!

#German #Economy #PublicSector #GovernmentGrowth #EconomicTrend #mises #socialism

You really should give them a try.