The plan: Make debt and let the germans pay. That's the plan. Sadly they shot their economy towards green Walhalla before they could even start milking the cow

Incredible, isn't it? And people trust these guys like little kids

EU Shifts Towards Total Integration

It was only a few weeks ago that the former president of the European Communist Bank, the ECB, Mario Draghi, caused a stir with an immense working paper: it was about opening up new sources of finance in order to revive the recessionary European economy.

Now the debate is reviving, in addition to Mario Draghi, French President Emmanuel Macron jumped into the ring, both are calling for more integration, more central government, more Brussels, in other words: much more of what has made the European continent sick.

Draghi, mister 'whatever it takes' is now demanding nothing less than the joint financing of European national debt, which was previously excluded by law. It is about the complete integration of European banks, joint liability and, above all, about one thing: the movement of private capital into channels that the central planners prefer. This is an attack on the principle of private property, the likes of which we have never seen before in Europe.

Whoever still has the opportunity in Europe should now start acquiring KYC free Bitcoin and secure the future of their finances. It will be very, very difficult in the future, as the European Union is heading for a financial debacle!

A side note: exactly one month ago, the incoming Chancellor of Germany, Friedrich Merz of the CDU, proposed to raise at least 10% of the private cash capital to capitalize on a statefond, which is then to invest this capital levered in infrastructure projects of the state. It's unbelievable!

https://jacobin.com/2024/11/mario-draghi-eu-industrial-policy

#eu #europeanunion #draghi #ecb #euro #bitcoin #freemarket #mises

You're right. I really need to differenciate this complex better. Thanks

I think they have no idea what You're talking about

Dragon's Deflationary Spiral: China's Economic Warning Signs

Consumer prices in China dropped 0.3% month-over-month in October, while annual inflation crawled at just 0.3% - below the expected 0.4%. The world's second-largest economy is showing concerning signs of deflation, with only food prices bucking the downward trend.

The perfect storm: aging population meets Keynesian monetary policy requiring constant inflation to roll forward massive debt. The Communist Party's heavy-handed market interventions, especially visible in the real estate sector, have burst asset bubbles and wounded balance sheets across the banking sector.

Experts suggest Beijing needs massive stimulus measures to restart their economic engine - far beyond current interventions.

#China #Economy #Deflation #GlobalMarkets #MacroEconomics #RealEstate

Japan Doubles Down on Money Printing: New Stimulus Package Reveals More of the Same

Japan's latest economic intervention showcases a familiar pattern - combat inflation with more spending. The new stimulus package, exceeding ¥13T ($85B), targets low-income households with direct payments and expands funding for disaster preparedness. PM Ishiba, facing political headwinds after October's election setback, aims to tackle record inflation through traditional Keynesian approaches.

Key points:

- Cash handouts scaled by household size

- Disaster infrastructure upgrades

- New semiconductor funding mechanism using NTT shares

- Debt-to-GDP ratio hits 255% in 2024

The package arrives as Japan grapples with its highest inflation in decades, while debt servicing costs already consume 25% of the annual budget.

#JapanEconomy #Inflation #MonetaryPolicy #GlobalMarkets #Economics

Wall Street Positions for Bitcoin Era

Major financial institutions are strategically preparing for Bitcoin's expanding role in the financial system. Leading bank executives indicate 2025 could be pivotal for Bitcoin adoption within traditional banking infrastructure. Industry analysts, in this case superbank JP Morgan (which sets the agenda for the industry) note increasing institutional interest in Bitcoin services, suggesting established banks could become key players in bridging traditional finance with the Bitcoin economy. As regulatory clouds that long shadowed Bitcoin's institutional adoption begin to part, a clear horizon emerges, Bitcoin leads the way. Frontrunning these guys will be a game changer for Your family's future!

#bitcoin #banking #wallstreet #btc #finance #jpmorgan

Japan's Central Bank Faces Critical Decision as Debt-Currency Loop Intensifies

Japan's economic tightrope walk is getting more precarious. The nation's massive public debt makes interest rate hikes nearly impossible, while the Bank of Japan's tight grip on bond yields continues to weaken the yen beyond sustainable levels.

JP Morgan analysts now predict the BoJ might be forced to raise rates earlier than expected, possibly by early 2025. Strong wage growth and persistent currency weakness are pushing inflation projections higher than previously anticipated.

I guess Fed swaplines are already in place....

#JapaneseEconomy #YenCrisis #btc #MonetaryPolicy #BoJ #GlobalMarkets

Germany's Economic Freefall: From Industrial Powerhouse to 'Green Desert'?

In a stunning revelation that has economists reaching for their anxiety medication, Germany's premier economic research body, the ifo Institute, has released data suggesting the country's industrial heart isn't just skipping beats - it might be coding. A whopping 41.5% of German businesses are now reporting critical order shortages, marking the worst performance since the 2009 financial crisis.

"Remember when 'Made in Germany' meant quality manufacturing, not quality virtue signaling?" quipped one Frankfurt-based analyst, speaking on condition of anonymity. "We're witnessing what happens when you try to run factories on good intentions and sunshine."

The data paints a picture of an economy increasingly strangled by a perfect storm of self-imposed challenges. While politicians champion their "green transformation," businesses are seeing more red than green on their balance sheets. The automotive sector, once Germany's crown jewel, is being forced through an unprecedented transition that has many questioning if the cure might be worse than the disease.

Germany basically is conducting the world's largest economic experiment of how to transform a first-world industrial powerhouse into a third-world economy while maintaining a straight face about it.

The numbers tell a sobering story:

- 41.5% of businesses reporting order shortages (up from 39.4% in July)

- Manufacturing sector confidence at historic lows

- Investment flight accelerating

- Energy costs crippling production

Meanwhile, demographic challenges and high fiscal burdens continue to weigh heavily on businesses, creating what one industry leader described as "the perfect storm of economic masochism."

While other nations watch Germany's great green experiment with a mixture of concern and schadenfreude, the real question remains: Will Europe's economic engine rediscover its industrial roots, or will it complete its transformation into what critics are now calling "Europe's most ambitious renewable poverty project"?

The ifo Institute's warning comes as a stark reminder that good intentions don't pay bills, and solar panels don't manufacture steel. As winter approaches, Germany's industrial leaders are left wondering if their economic future is as reliable as their renewable energy grid - which, coincidentally, isn't very reassuring at all.

#GermanEconomy #EconomicCrisis #GreenTransformation #IndustrialDecline #EuropeanEconomy #EnergyPolicy #ManufacturingCrisis

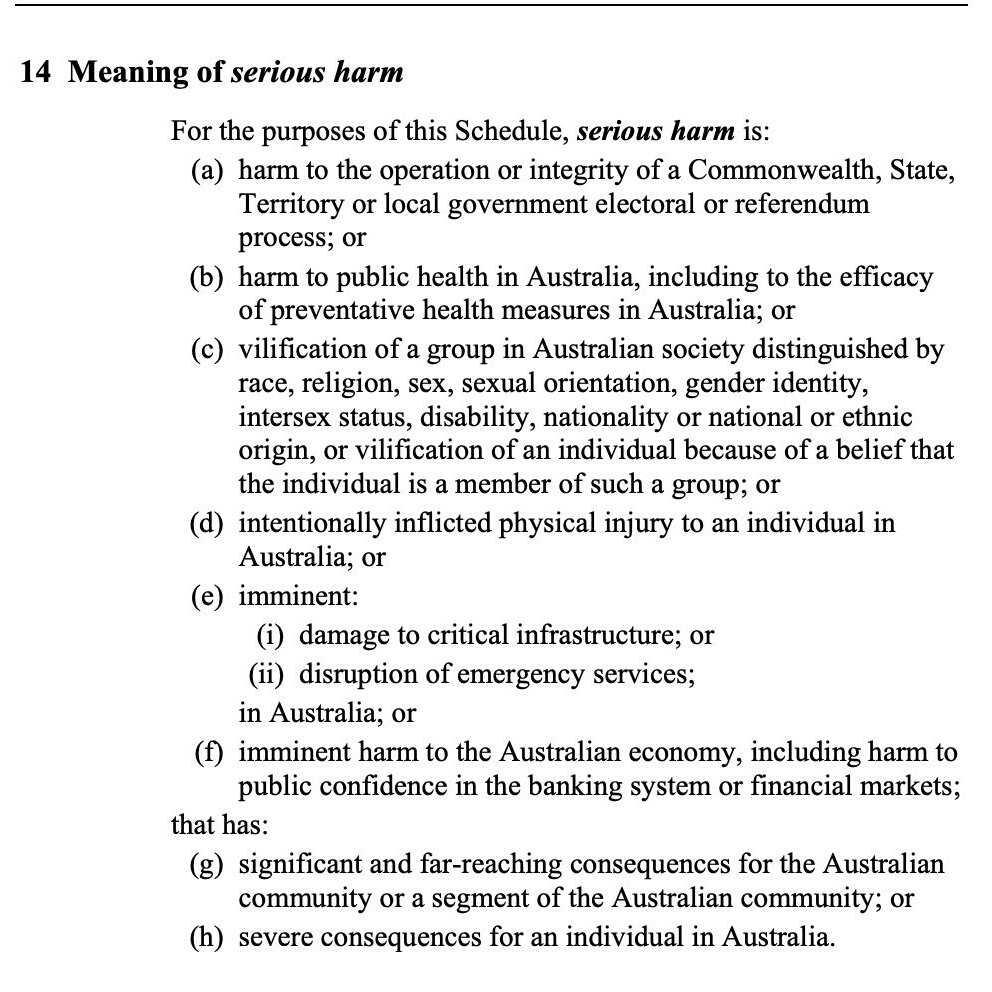

AUSSIE GOVT PUSHES ORWELLIAN SPEECH CONTROL DISGUISED AS "SAFETY"

New Australian legislation marketed as protecting citizens from "harmful misinformation" raises major red flags for individual liberty. The Human Rights Commission itself is sounding the alarm, warning that this trojan horse could be weaponized to silence dissenting voices under the guise of fighting "misinformation."

While bureaucrats added window dressing about "serious harm," the bill's vague language leaves the door wide open for government overreach. Even more concerning: reduced platform transparency requirements mean less public oversight of enforcement.

The state wants three years before review - a lifetime in the digital age. Time to push back before another domino falls in the global war on wrongthink.

#FreedomOfSpeech #Censorship #australia #freedom #bitcoin #DigitalRights #AusPol #BigGovt #1984

There was a line of interested people. Don't look at London now...

Don't trust the EU Europeans! Von der Leyen proposes to replace the remaining Russian gas with LNG from the USA, which is 4x as expensive, in order to kiss Trump's ass. The new government should deal harshly with these people, they cannot be trusted, nothing is meant honestly, every gift is poisoned. Ask the Europeans

#vonderleyen #eu #russia #gas #usa #LNG

https://video.nostr.build/d79bc3ede909510ab222f03c60aca226b362e4f6bd6d8d19d2d2770039483f18.mp4

Yep. Let's see if people get it this time

France needs colonial style imports of Uranium to run its economy. But but Niger......

Und immer weiter Richtung Regenbogen

Former Chair Of The European Communist Bank (ECB) Warns Of Productivity Gap

While Brussels bureaucrats continue their paper-pushing parade, Europe's tech sector is getting absolutely demolished by freer markets across the Atlantic. Former ECB head honcho Mario Draghi (yes, the money printer himself) finally admitted what Bitcoin bros and tech entrepreneurs have been screaming for years: the EU's regulatory stranglehold and infantile destruction of free markets is killing innovation (don't worry, of course the commie didn't say that!)

Speaking to a room full of EU central planners, Draghi basically confirmed that their beloved regulatory framework is about as useful as a chocolate teapot when it comes to fostering actual technological progress. The productivity gap between the US and EU isn't just a gap anymore - it's turning into a canyon, and it's getting wider by the day.

Here's the real kicker: while US companies can pivot and innovate at the speed of market demand, European firms are still waiting for regulatory permission to tie their own shoelaces. The EU's response? More committees, more regulations, and more "unified approaches" - because that's worked so well so far, right?

The irony of having a former central banker warn about competitiveness issues would be hilarious if it wasn't so tragic. Here's a wild idea: maybe, just maybe, less central planning and more economic freedom could do what decades of EU directives couldn't?

But hey, at least they're unified in their commitment to staying behind. 🤷♂️

#EU #EuropeanUnion #Socialism #Draghi #FreeMarkets #Bitcoin #CentralPlanning #TechFreedom #RegulatoryBurden #Economy #DeregulationNow #ECB https://files.sovbit.host/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/f556860cf0f2259db74b298460b743aec6369bd0e2b055dfabeaec49b2d627e2.webp

So far I haven't found a better example of how to caricaturize the infantile politics of the Germans.

#Germany #Germany #eu #energycrisis #GreenNewDeal #ampel https://files.sovbit.host/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/5317e66db01107d3f715461110fad0ac2c9360d3116394d5a71fdd442bd723bf.webp