What did I miss? What’s an NPC?

Nice one. Apparemtly they don’t like bitcoin toxi maximalists 👀

Stop eating chemical sugar and processed foods. Eat some #bitcoin instead and GFY.

HFSU if you think your body needs that poison

GM

Some people are unbelievable. They just need a dose of #bitcoin

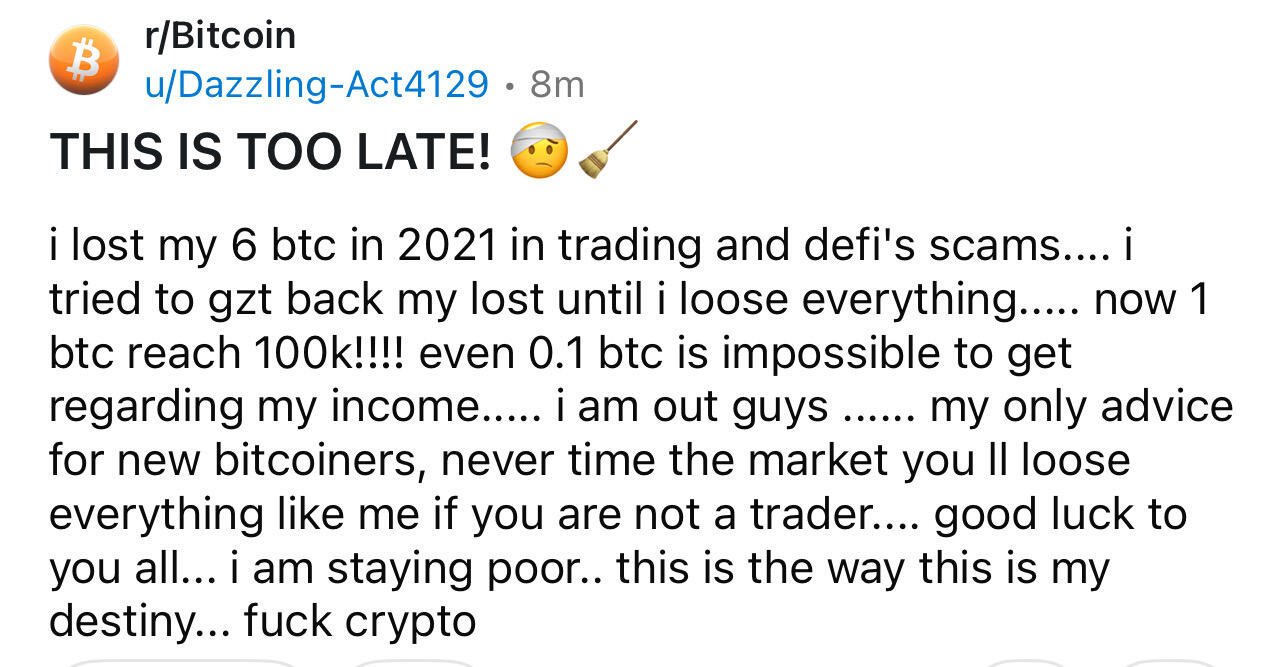

Well, never is too late though. He can still improve his life. He just needs to change his time horizon, maybe work harder

Happy family. 🧡🧡

Merry Christmas you #bitcoin psycopaths. 🎄

Unpopular opinion.

Multisig is a tool for collaborative custody.

Single sig is safe enough for any amount, otherwise Satoshis keys with 1M coin bounty would have already been found.

Don’t be paranoid. 2^256 or 2^128 are large enough possibilities to choose from.

Don’t sell me the ETFs because #bitcoin is difficult to safeguard thereby everyone needing complicated multisig.

The ETFs are just a mere vehicle to access a securitized version of bitcoin by the boomers while BlackRock takes advantage of having them custodied.

Much FUD lately on #bitcoin world from #quantum computing crying babies. Simple query to perplexity (hopefully is not too far from accurate) gives a firm answer and hints that we’re decades away from it being even considered a threat at all:

“

A 100-qubit quantum computer would not be able to find Satoshi's private keys in a practical timeframe. While 100 qubits is a significant milestone in quantum computing, it's not nearly enough to break Bitcoin's cryptography.

To break Bitcoin's elliptic curve cryptography, which protects private keys, would require a quantum computer with thousands or even millions of high-quality, error-corrected qubits. Current estimates suggest that factoring a 2048-bit RSA key (comparable to breaking Bitcoin's security) would require about 20 million "reasonably good" physical qubits and take about 8 hours[4].

It's important to note that the 100-qubit systems being developed, like the one planned by QuTech in Europe by 2026[8], are primarily intended for research, quantum simulations, and developing quantum algorithms. They are not yet capable of running complex cryptographic attacks.

Furthermore, the qubits in current quantum computers are noisy and error-prone. To perform reliable computations, many physical qubits are needed to create a single logical qubit through quantum error correction. For example, it might take hundreds or thousands of physical qubits to create one reliable logical qubit[6].

In summary, while a 100-qubit quantum computer is an impressive achievement, it's still far from being able to break Bitcoin's cryptography or find Satoshi's private keys. Such a task would require a much larger and more advanced quantum computer that is not expected to be available for many years, possibly decades.

Citations:

[1] https://thenextweb.com/news/heres-why-100-qubit-quantum-computers-could-change-everything

[3] https://www.ibm.com/quantum/blog/100-qubit-utility

[4] https://quantumcomputingforbusiness.com/essentials/timelines/

[5] https://blog.google/technology/research/google-willow-quantum-chip/

[8] https://physicsworld.com/a/europe-plans-to-build-100-qubit-quantum-computer-by-2026/

“

That’s why we have bitcoin, to protect ourselves from the ones in power. Only the most pure form of bitcoin will allow us freedom. GFY 🔥

This bull market is going to melt some faces down. Bitcoiners to increase their purchasing power and start entrepeneutial endeavours integrating #bitcoin in all aspects of the business. Onwards! 💪

Saylor is playing a different game. The bitcoin-fiat game. And in the bitcoin-fiat game he is king.

He is not a cypherpunk, or in need of property rights, and he doesn’t need self-custody himself for his game.

But he needs the network (paranoid crypto anarchists) to self-custody, otherwise his game is over.

If not NgU, no game is possible.

And guess what, without the possibility to self-custody, custodians (not even the ETFs, but mainly Coinbase here) would be incentivized to play the same games as with gold (i.e. fractionally reserve).

Saylor sees a future where bitcoin is deeply entrenched in the fiat system, and everyone is happy lending and hypothecating their coins.

Well, let us see. Bitcoiners don’t trust, by definition. An executive order is plausible, and we need to be prepared for anyone trying to seize our wealth (by tax or confiscation), because that is ultimately keeping the old guard alive.

#bitcoin

Can’t believe you’re the only one that had reviewed the code until now.

Do you refer to Sparrow just the desktop client or any specific functionality within it?