Tragedy and Hope. Lays out how we got here and how we’ve incrementally moved towards a socialist/communist society.

/2

The Bank for International Settlements IS and ALWAYS was the one in control, post 1914-1919.

“History never repeats itself, but it does often rhyme.” - Mark Twain

It looks a lot more like a repeat than a rhyme. Either way it’s very similar!

I was going for that thing that connects humans in a way and speed like never before.

#bitcoin is to monetary technology as the iPhone was to cellular and communications technology.

Moving from a credit society to a debit world is going be a huge challenge for most.

That’s the hurdle that #bitcoin most get over. Credit and the BIS are the final bosses that must be beat.

If I had one wish I would of course ask to go back in time to 2009 and stack a looooot of sats

#dream

All of the wealth you need is around you and available for the taking.

Most of this wealth cannot be bought with money.

It’s all still there waiting for you, just as it was in 2009.

Money takes many forms, but liquidity is the name of the game.

I like no ads better, personally. Thoughts?

This is without question the way.

Infrastructure ✅

On ramps ✅

Product use case ❌

The latter is what this wave will bring.

How much easier will it be to swap software on a terminal than the current way of ripping and replacing the software, hardware, and systems in place?

Enjoyed another #Bitcoin chat with nostr:npub1ez00a5lnc54z64jy47er50k083jnfvsn29czaw0t9vhywgydpnlqy420zy where we discussed Bitcoin Price To Trend, a #btc valuation metric.

🎙️ https://podcasts.apple.com/us/podcast/navigating-bitcoins-noise/id1583424361?i=1000634375545

It's always fun to 👀 at Bitcoin w/ math experts & see the different tools that can be created from historical data.

Enjoyed another #Bitcoin chat with nostr:npub1ez00a5lnc54z64jy47er50k083jnfvsn29czaw0t9vhywgydpnlqy420zy where we discussed Bitcoin Price To Trend, a #btc valuation metric.

🎙️ https://podcasts.apple.com/us/podcast/navigating-bitcoins-noise/id1583424361?i=1000634375545

It's always fun to 👀 at Bitcoin w/ math experts & see the different tools that can be created from historical data.

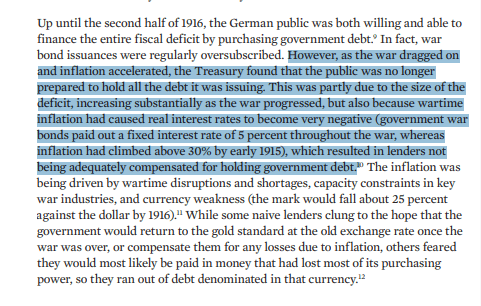

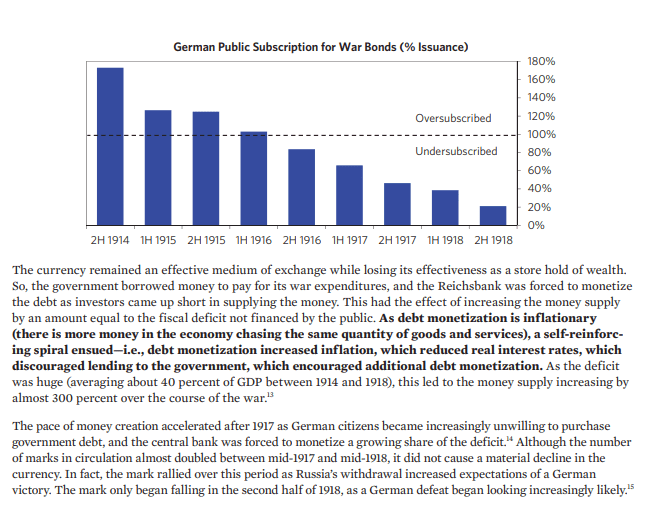

Dalio talked about this a lot in The Big Debt Crisis.

I don’t have my copy so I can’t find the notes but here is a rough example.

As nostr:npub1zrysysh8wq9zs3u5xzac9vf69we3wxrdj8rehns3japxdftqcqvsst8vpd would say, “it’s for the kids”.

What are the most important lessons we can teach our children from #Bitcoin ’s bear?

1. The power of fear

2. The power of consistency -> dollar cost averaging

3. The power of compounding -> good & bad choices compound daily

It’s a cycle of irrational emotions. Generally, I agree, though #Bitcoin is still cheap on a relative basis.

https://www.bitcoinpricetrend.com does a goos job of showcasing this.

The popular basis trade has almost identical characteristics to Terra/Luna.

J Pow => Do Kwon

Fed/Treasury => Terra/Luna tokens

Dealers => 3 arrows, Celsius, BlocFi

Foreign sellers => 🦈 trying to take out the 3rd leg.

It’s called a currency war.

https://podcasts.apple.com/us/podcast/eurodollar-university/id1506469669?i=1000633991625

When it’s #Bitcoin & crypto… FTX, Three Arrows, Celsius it’s a crime.

When it’s hedge funds & TradFi prime brokerage… look the other way.

There are structural ramifications like: $GBTC arb, $GME gamma squeeze, etc

When levered trades get crowded fault lines show up.