I mean, I ask elites questions they never answer or blatantly call out their actions, so why not?

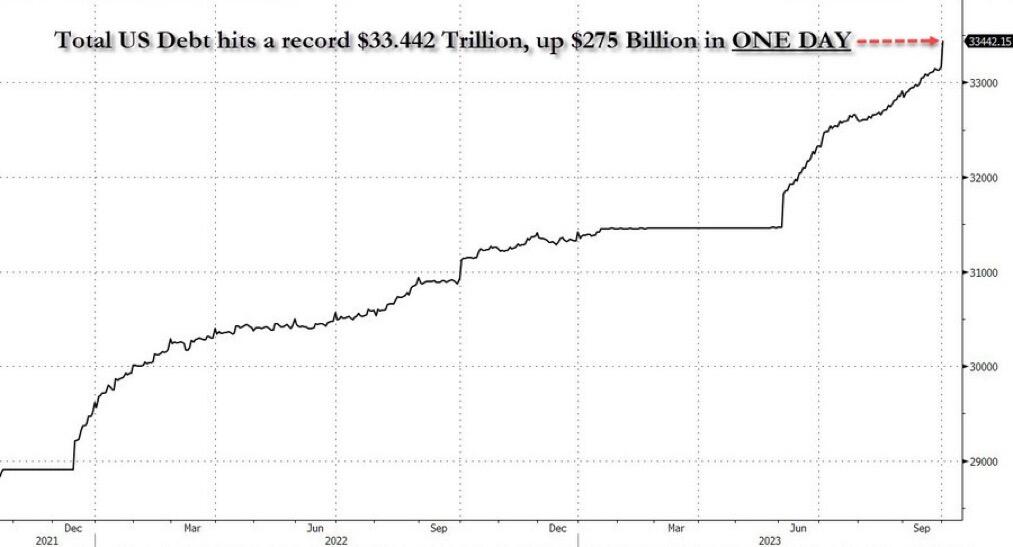

But we have been trying so hard to keep inflation down, all the world wants to get 5% “risk-free”

Chancellor on brink was an educated guess. Covid shutdown was the first nail in the coffin, and they learned nothing.

Rules > Rulers. Bitcoin wins.

I don’t even know what the derogatory term for edge is. Can’t use internet exploder anymore.

🚨 Announcement time! 🚨

We're proud to unveil our refreshed Wallet of Satoshi logo! ⚡

Staying true to being 'The World's Simplest Bitcoin Lightning Wallet,' we transition from our classic design to a simpler, friendlier and more modern aesthetic.

https://void.cat/d/TsFTEiBtvNyY89AhhDCde2.webp

We hope it grows on you as it has us, becoming the first sight for the next billion Lightning users exploring #Bitcoin!

Watch out as the new look gradually rolls out!

You might spot it in a double stacked format too.

We want to hear - what are your thoughts on our new look?🤔

Thank you, just keep the nodes alive!

I think what happened with the Bitcoin price is that some very smart people and some people with a lot of money, realized what it is and bought it. They refuse to sell it and waiting for the rest of the world to figure it out. There’s also stimmy checks, etc.

It’s not that it’s over or under priced. It’s just a timing issue.

So for a while it flows with the fiat currents, until it doesn’t.

I tried to explain this to my wife who is a RN, not financially savy.

I said what if in 1998 youworked and earned money to buy a dollar worth of gas. But instead of buying the gas, you invested in the S&P500 at inception. 25 years later it would still only get you the 1 gallon of gas, except for taxes.

You have to take on that level of risk, and when you cash out, in nominal terms it went from $1 to $3. So you gotta pay 30 cent tax and you still can’t afford your gallon of gas.

Why should a person have to take this kind of risk to keep the value of what they earn, and pay tax on nominal “gains”?

The depth of theft here has yet to be understood.

I wouldn’t want to be a msm editor right now. Propaganda shoved down their throats. I wonder who in that game is still ethical?

We live in a world where you're born into a country & that's the money you use

It's like a casino, where you get given chips that you can only use at that casino; & the casino next door has its own chips. This cannot be the best system 🎰

- nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z

It’s more like we’re inventory for the state’s consumption if you look at a birth certificate now.

Did an interview with nostr:npub1xtscya34g58tk0z605fvr788k263gsu6cy9x0mhnm87echrgufzsevkk5s today regarding Nostr and Damus.

It was freaking great!

That would be no surprise.

The medium of exchange here is Bitcoin.

Salability is near 0.

Tax collectors seeking info on it would be ddos’d with all the “transactions.”

Congrats! Super happy for you!

The irony of many people in the west is that we have capital but no clue what to do with it.

The thing is, you have to know, and not many people do their due diligence to understand the realities of the world we live in.

So the government schools don’t teach financial literacy. That’s not by accident.

It’s a damn shame when the people who get down and do the dirty work consistently, get passed over for promotions and recognition.

While the ones who sit back timid and unknowing rise up the ranks. I see it everywhere I go, and it’s disgusting.

We’re gonna find out who’s been swimming naked.

As a Canadian, I'm proud to be a part of #nostr community.

Freedom of speech matters.

https://nostrcheck.me/media/public/nostrcheck.me_8180894103530985271696294600.webp

Isn’t he Fidel Castro’s kid?

Same team, team orange.

Red vs blue is a waste of time and energy, probably causes climate change.