Love south Africa. Such a beautiful country. Its odd though. When you see the amount of rubbish everywhere, it's like the population living here hate it!

All aligned for a great day!

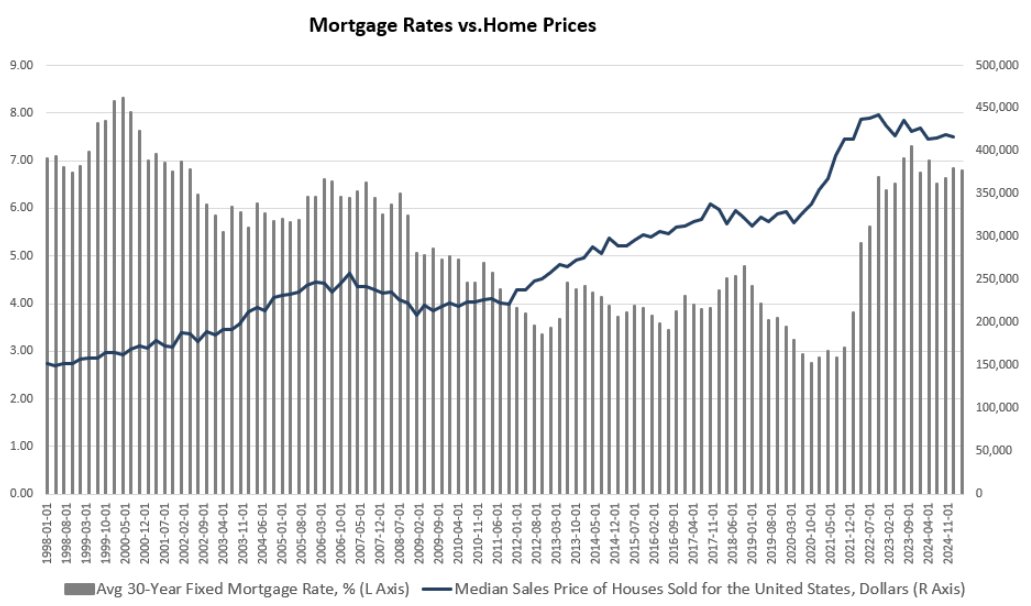

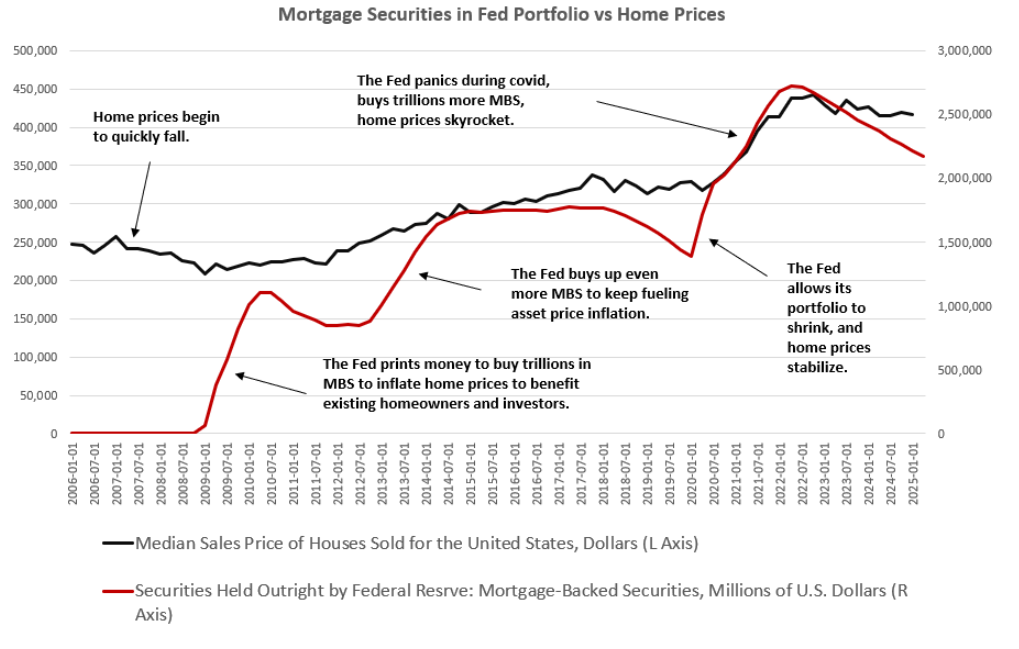

Why Are Houses So Expensive? It's Deliberate Government Policy

https://mises.org/mises-wire/why-are-houses-so-expensive-its-deliberate-government-policy

By Ryan McMaken

> High prices are not the “unintended consequence” of good intentions.

I wonder if homeowners will get rugged once Boomers have less political power than the Zoomers. I'm guessing not, because localities also count on high property values for tax revenue, so the pressure will always be upwards.

Just look in gold terms. Says it all

Love quiver trees. So unusual

GM!!!

All empires behave the same as most citizens would not agree to wanton slaughter if they didn't feel a moral high ground imperative. All people outside the bankers and top class lose. Regardless the empire

Another 305kg of gold removed from bullionvault? That's some serious stacking!

The link to iraq and libya is something that there's definitely a knowledge divide. I mention these things outside USA and people are much more likely to know. Am in south Africa and I didnt mention it myself but was brought up by a chap in conversation yesterday. It's an american blind spot because many people outside understand the link, hate it and want the cycle of violence to stop

That's the problem with stats on this. Some cultural groups its normalised to the degree that there's less reporting. Spain has been doing a huge education campaign on this for years but then judges have aquitted rape gangs so it causes further demoralisation and lack if reporting. Very hard stats to analyse due to confounding

⛔️

🔴🔴🔴🔴🔴🔴🔴🔴🔴🔴🔴🔴🔴🔴🔴🔴

"👂, 😏WE'VE JUST OPENED

PANDORA'S BOX.. 👀👀👀❕️❗️❕️🫢🫣🫢"

😳

🔴🔴🔴🔴🔴🔴🔴🔴🔴🔴🔴🔴🔴🔴🔴🔴

🔺️ 🔥 The Bitcoin Revolution 🔥😳❗️🔺️

🩵❤️🔥🩵

https://blossom.primal.net/f9bae3248fba60b13d117c0fe37ef65a6a2f2ed8633f47c1a5eb486090561183.mp4

Who is this chap?

Random chats to many people on my wanders around south Africa, I think we should redefine politics as "the co-ordinated act of extraction from the productive sectors of society"

Out of the door.

Type, read, post. Why I do I find that so hard?!

So many videos etc about health say "before you try this, discuss it with your healthcare provider" and yet most medical consultations now seem to be aimed at getting people out if the don't within 10 minutes. Where's the discussion potential? So hyper fiat

Ask if merchants accept bitcoin every time and more importantly, if they say yes, pay in bitcoin. Just takes everyone doing that. Also whilst paying, encourage merchants to offer discount, even if just the 3.5% they pay card companies

Goldman Sucks. F them. Mister Krugerrand ain’t give no shit about some Brioni-suit-cocksucker’s price ANALysis.

#gold #bitcoin or bust

https://www.mining.com/web/goldman-flags-record-gold-weak-oil-in-2026-commodity-picks/

I know an ex Goldman analyst who quit 6 or 7 years ago. He's 100% btc and gold. Anecdotal but words and actions vary!