We need experts and we need institutions. And most importantly we need them to not be corrupted.

Yeah, I think Snyder’s view is nearly opposite. Although “opposite” implies two possible answer at different ends of a spectrum and it’s not really that. Anyway, he would argue that the FED can’t “print” money. Mostly what gets “printed” ends up on bank balance sheets but doesn’t make it out into the real economy.

Are you familiar with his thoughts on this? He had a discussion about this very thing at last year’s Bitcoin conference with nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a .

I don’t remember struggling with linear algebra too much (although I don’t think I aced it). I just remember really not enjoying it and thinking it was stupid and also thinking “here’s one more reason I don’t want to study computer science”.

I mostly agree with this and I’m not one to tear down and optimistic outlook. We need hope or why are we even getting up in the morning.

But, my biggest concern is that systemic fragility is increasing and we just keep spinning the roulette wheel. I don’t know how times we can do that. nostr:note1x0cyxs970zdnwrnq25gcsgjw7x3yu7h3sp94a0qz2ce0zejd85ssk38uee

I think that makes sense. But it seems like - and please correct me if if I’m wrong - you are equating “money printing” to inflation in consumer prices and I’m not sure that there’s a direct causation between those two things. (Money printing meaning, in part, the increase in the M2 money supply). At least that was my understanding from Jeff Snyder when he described inflation versus “money printing” and the Eurodollar. Are you familiar with his framework for inflation, the macroeconomy, and the Eurodollar?

I love proofs! But, I never took complex analysis. So that might’ve been the end of the fun for me. lol

I did find calc-based prob and stats quite difficult. I would say that’s toughest math I bumped into.

I’m not sure what that means exactly, but why do you think that?

A student asked a great question earlier today when we were talking about the connection between position, velocity, and acceleration in calculus. She asked, “if the integral of acceleration is velocity, and the integral of velocity is position, then what’s the integral of position?”

We had a great conversation about it after I did some thinking and research.

Here’s an in depth explanation for anyone interested. #teaching #math

Have you listened to Eric Weinstein talk about this? He echoes similar points - essentially cpi is a BS quantity (scalar) when inflation should be represented more like a vector field. It’s like saying the average temperature in the United States is 52 degrees. What does I even do with that information if I live in Montana? A weather map with information dependent on location is a much better description.

He discusses it in his most recent conversation with Chris Williamson. If that interests you then I will look for the time stamp.

Just to be clear, I love teaching math. I get to be around math most days and I love sharing math with my students. I love working with young people and watching them grow.

A few of you mentioned that if I love doing math then I should pursue it - and maybe I should! But if it went full throttle into all the stuff I’m passionate about I’d need about a half dozen lifetimes. 😂 I’d spend one getting amazing at guitar. I’d spend one doing math. One teaching math. One backpacking all over the world. And maybe one studying philosophy. Heck, maybe one just bass fishing. #grownostr nostr:note1q0zukkcdu69kp5gy5c0xh5naxecjym0v8l8d5zfrelj5ska6x5hsljr98q

Reading about elaboration theory this morning. #education #teaching

Man, I love doing math. I’m making solution guides to every calculus assignment this year and it’s reminding me of how much I love it. I sometimes wish I had pursued it beyond my bachelors, but I’m not sure if I had the mathematical chops to cut it. Probably could’ve made through a masters program. But I doubt much beyond that. I actually looked into it a few years after I started teaching but there was no way to make it work while also maintaining a full time job. #math #grownostr #teaching

Good to know. Thanks for sharing. nostr:note10zfw83zj9y8tgg3l754ja7w3f82ec5dk2zwac3vre0n345tquchshxa90l

Beautiful nostr:note1aaqrndcyau5heglef7fpl0sga5fjfh3uej2qnhvypu7843aa3pgq7xxp6x

Three hours of Eric Weinstein just dropped. 👀

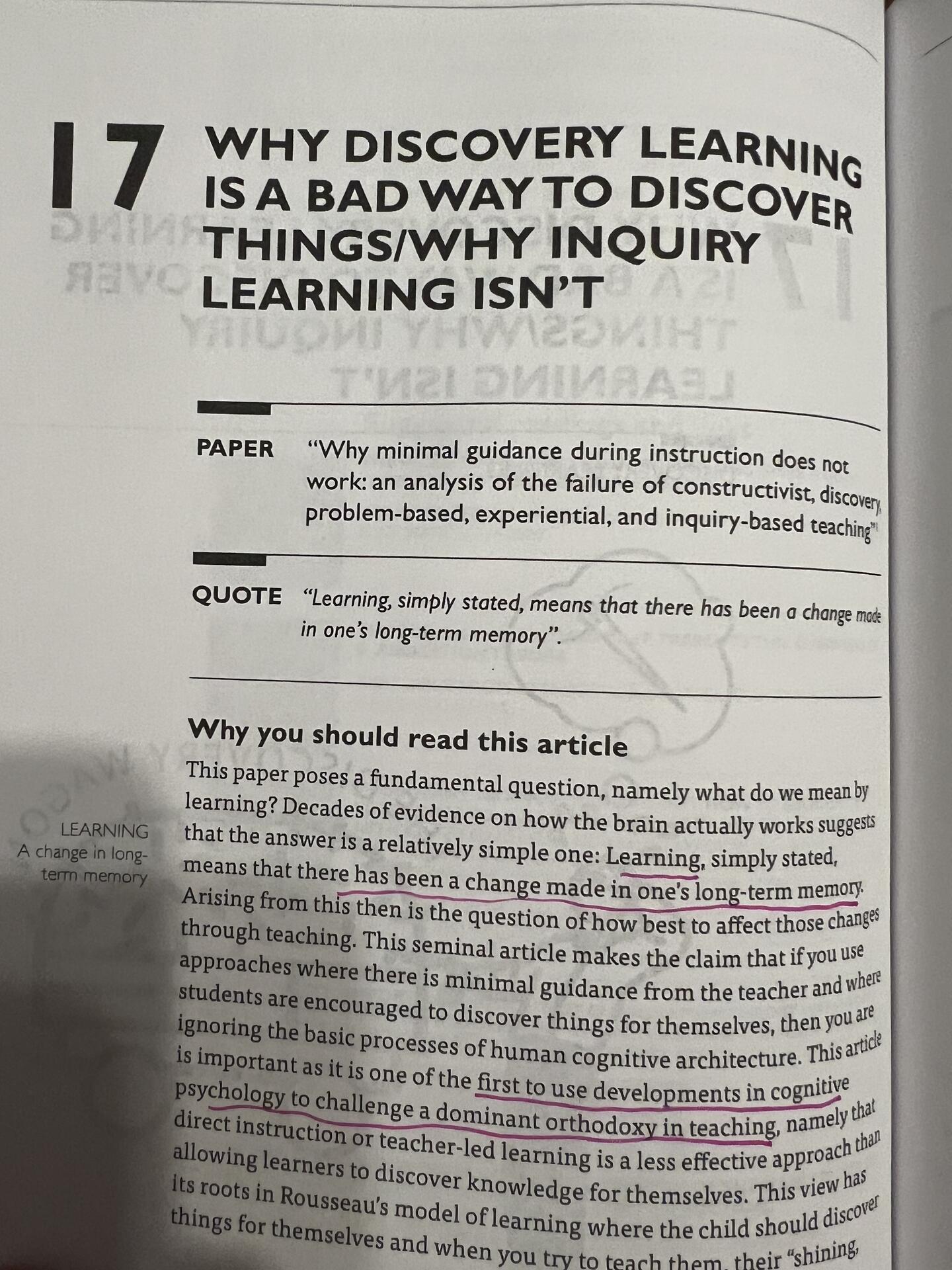

This article looks really good.

"The tech platforms aren’t like the Medici in Florence, or those other rich patrons of the arts. They don’t want to find the next Michelangelo or Mozart. They want to create a world of junkies—because they will be the dealers."

Link:

https://www.honest-broker.com/p/the-state-of-the-culture-2024

I’m agreeing, mostly. As with most things in education there are few absolutes. And the article isn’t arguing that we should NEVER let students struggle through the discovery process. Just that the contexts in which that actually helps students learn are when students have most prior knowledge required to tackle the problem. Basically, not when students are learning new stuff but when they are applying knowledge they already have.

If you’re following along, here’s the crux of the issue for me. Learners spend too much energy (their working memory) searching for solutions or even approaches to get to the solution for them to move anything from working memory to long term memory.

This is a stubborn misconception about learning that many teachers fully embrace. I’ve certainly been guilty of it over the course of my career. Early on I would’ve thought that discovery learning was ideal but it was just too time consuming to be practical. #education #teaching