After the #Bitcoin pump in the last weeks....

My dad asked me if I could get him a 10 Bitcoin Bill!!

I'm pretty sure he didn't read the material I gave him. The bastard.

Don't worry, tho. I'll set up a lightning wallet for him and I'll try not to be petty about it... I'll give him 20k sats. But between you guys and me; if stubbornness needed a name, we'd call it dad. Good lord!

It's more that the transaction fees will be high, because rich people will price you out.

An on chain transaction will cost at least 50 dollars in the coming year. Just imagine what it would cost when Bitcoin is worth a millie.

I'm just thinking out loud. Maybe it's logical that the market starts piling on the next best thing. Wich would be an old clone of the best version. #BCH in this case.

I'm not bought in yet, I just had the brain fart. Seeing BCH had a huge price hike. The market is obviously doing something with it.

You think it's bollocks?

Thought experiment.

If #BTC gets to 1 millie a coin. It will become more of an elite, high net worth protocol. It is too expensive for normal people.

The first best alternative is the same protocol, but with bigger blocks.

#BCH

Bare with me. A lot of smart people left BTC for BCH during the war. Maybe in future, the two can coexist. Maybe #BCH is the silver to #BTC's gold. Maybe... those smart people, who were/are true bitcoiners, did have a point to run the same protocol, but with a bigger block. Not as competition, but as addition.

What do you think? Is BCH bullish or is BCH bullshit.

Yes... that's exactly the risk they take, right?

Because if they're never accumulating, how do they get their BTC?

And if they don't take a risk, how do they make money?

There's no such thing as a free lunch. They expose themselves in order to make a profit.

They are like a water reservoir. In rainy season they accumulate water and in dry season they dispense water. But all year round they provide a steady stream of water.

Now, the water reservoir is empty. And people have to bid for the available water. What happens to the price of water, in this situation?

Well, there you hit the nail on the head. I also much rather have a silver coin than a government backed piece of paper.

I'm also buying some silver and gold, but much less than I would want. Just because the afore mentioned. I lose too much value in the trading process.

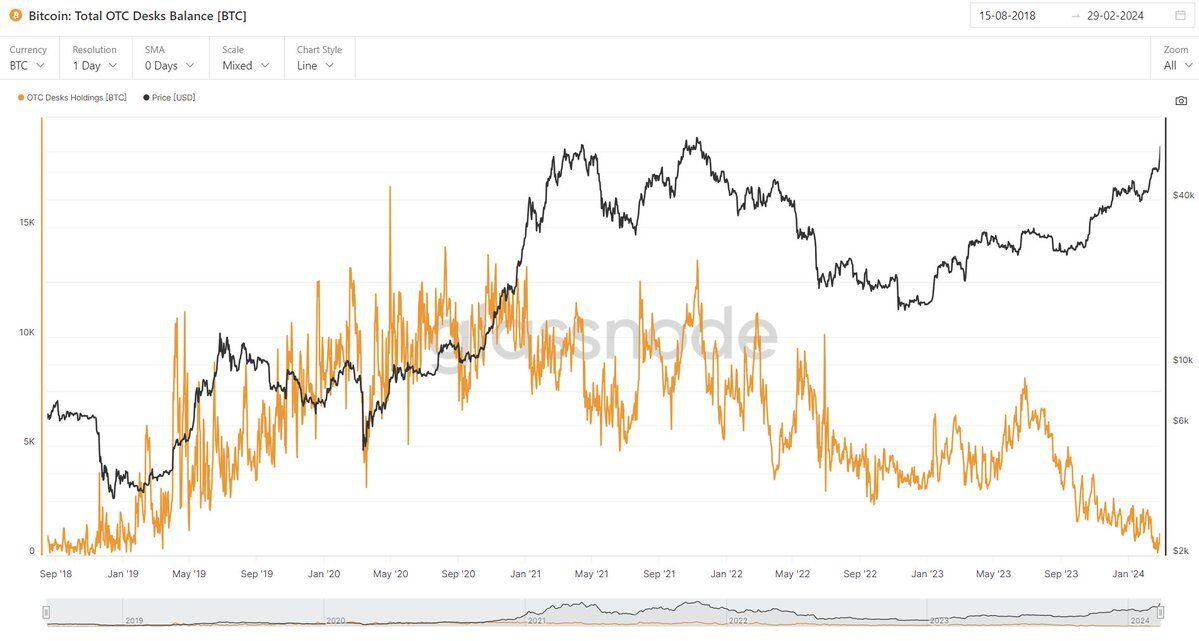

Their business plan is to function as a buffer in a volatile market.

So they accumulate a stack and they sell when stock is low and buy when stock is high.

They put a premium on the price a piece, and that's how they make money.

The benefit for their clients is that they don't have to worry about the stock and flow of the day.

They get a steady price, nonetheless. That's what the OTC desks provide. They remove volatility from a volatile market.

We're now in the situation that the buffer is bought dry. They don't have BTC to dampen the sudden daily demand anymore.

So... volatility is coming back to Bitcoin. And it will be to the upside. And it will blow up another bitcoin bubble in the coming 18 months.

The buffer is broken. We're going to pump.

Yeah, I'm less blessed in that aspect, I guess 😄. I'm in the Netherlands.

I like to have coins and I'm looking to buy. Cause I made a good Bitcoin profit so I wanted to switch out some BTC for coin...

But I lose too much money on the dealers. It's more a vanity buy, than a smart way to allocate my purchasing power. As I said... 15%, at the very least, on shipping and premiums.

As a Bitcoiner, the allure of gold and silver is not lost on me. I want it.

If you're privy to better ways, I'm honestly interested. But I'm not paying 1000 bucks for 800 dollar silver. It'd be an instant loss, right?

Yes, there are companies that provide this service, and they are known. They report the BTC they have on their balance.

The number you see in the charts is the amount they claim to have in stock.

The chart tells us their stock is being bought up faster than they can buy in.

If they buy in faster, they are pumping the price themselves and they defeat the purpose of their own service.

These are the early stages of a supply shortage and it's very bullish for us.

The arrogance is what gets me.

Here you have financial "experts" who never even so much looked at #Bitcoin... and they speak horribly of it. Without a decent substantiated argument.

It's infuriating. It's an outrage.

I know 😜

I thought it meant something. Like... spiritual.. if you look at the clock at exactly 22:22.

OTC #Bitcoin means over the counter Bitcoin.

There are companies that hold large amounts of Bitcoin and they sell it in bulk to you.

That means; if you want to buy 10 million dollars worth of Bitcoin in one go, they have the Bitcoin on the shelve. And they can provide you with that huge amount for a set price.

This means you don't have to go on an exchange. You don't want to buy that amount on an exchange, because you will influence the price to your own disadvantage. You will be pumping your own buy price. Hence, you want to buy OTC bitcoin in bulk.

This is what Blackrock does and where all the big players buy their Bitcoin. It's to not pump the price.

This chart shows; the OTC sellers have ran out of Bitcoin... if you want bulk BTC now, you will have to pump the price on an exchange.

I'm quiting my job tomorrow... it's scary, but I'm also excited 😅. I've been working there for 7 years and I don't have another job lined up.

But I'm not happy and I have to make a change. And it's time to stop being scared. I should not stay at a place I hate, just because I'm afraid.

Tomorrow is my pivot 🧡💪

I don't like to indulge myself on hopium...

But I'm a recreational user.

Well, 1 gram of gold, Umicore. Costs €84,64.

The spot gold price per gram is €61,79.

So, the premium is way more than 15% actually.

The cheapest Canadian Maple leaf silver coin costs €25,26.

That's 1 Troy ounce.

But 1 Troy ounce silver at spot is now worth €21,40.

And then add the shipping costs with extra insurance.

Where do you get better prices?

I don't get why people buy silver and gold.

If you buy it, you'll have to pay a 15% premium on the gold price to the gold trader.

And when you sell it, you'll have to pay a 15% discount to the gold trader.

There's literally only 1 person making money... the gold trader. He earns when he sells and he earns when he buys.

This what Peter Schiff doesn't want you to realize. He's not in it for the hard money. He's not in it for the hedge against inflation.

He just wants you to buy his coins and then sell them back to him.

I've tried to orange pill my father for years.

I bought him #TheBitcoinStandard by Saifedean. He finally read it, after months.

He hated it! He said Saifedean was biased and he didn't factor in all the wealth central banking has brought to our lives. He got really riled up, very much unlike him.

So this brings to a close, years of trying, years of debate. It appears that what they say about old dogs is true. I feel, in honesty, a bit crushed. I've asked for my books back, and got them. Now I have 2 copies of those books.

But it also feels like a weight fell from my shoulders. I don't have to try anymore.

I have provided the information and he rejected it. It was his own decision. I don't like saying it ,but I will this one time:

HFSP, dad!