Library staff picks display at my local library, not only does Becky not pick some esoteric book, but picks one of the greatest action movies of all time. Hell ya, Becky, hell ya.

Officially enrolling nostr:nprofile1qqs8l7cf847rw8vkkhta7v8faa066r5le7dds8tgnau7ng2d74ey2cgpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhszrnhwden5te0dehhxtnvdakz7qgnwaehxw309ac82unsd3jhqct89ejhxtcymzaec in #nsex because the feature was announced, but doesn't actually work and we've gotten no response. You're in good company tho, cuz nostr:nprofile1qqs9xtvrphl7p8qnua0gk9zusft33lqjkqqr7cwkr6g8wusu0lle8jcpp3mhxue69uhkyunz9e5k7qg4waehxw309ajkgetw9ehx7um5wghxcctwvsqs6amnwvaz7tmwdaejumr0ds2g5zx8 and nostr:nprofile1qqsth7fr42fyvpjl3rzqclvm7cwves8l8l8lqedgevhlfnamvgyg78spzpmhxue69uhkummnw3ezumrpdejqz9rhwden5te0wfjkccte9ejxzmt4wvhxjmcpp4mhxue69uhkummn9ekx7mqqdtrej are here too.

Devs know key rotation doesn't exist but still want us to trust them and paste our nsec all over the internet, and I'm tired of it. #NameAndShame

no amber integration on android 😯

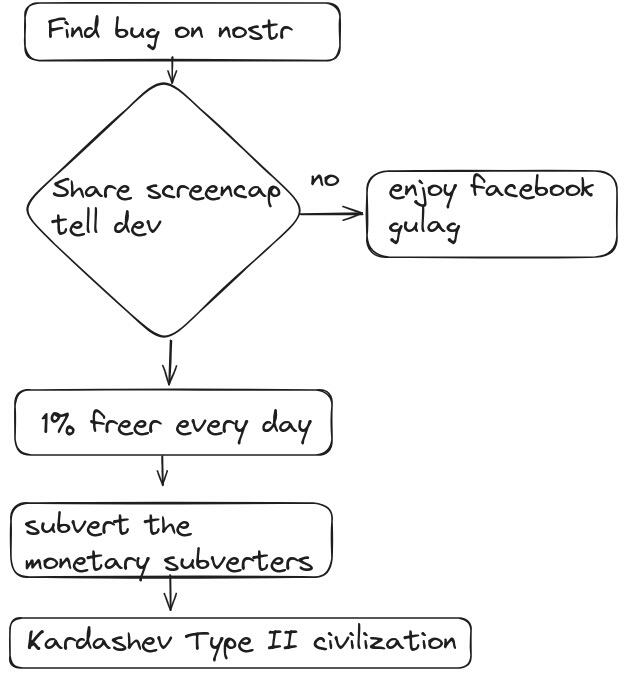

this is a good reminder 🫡

itd be cool if #Amber had a version you could install on a phone, keep it offline, then use qr card scanning to authorize signing on another online amber using on your online phone with a nostr client ( perhaps you gotta re-up it every few weeks or something). the offline phone would effectively act as your hardware signer. Maybe this functionality already exists in Amber, nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5 ? hopefully that made sense.

@nostr:npub1yzvxlwp7wawed5vgefwfmugvumtp8c8t0etk3g8sky4n0ndvyxesnxrf8q when one tap default zaps ?

thanks for the suggestion, will check out 🤙

damn, nuked my yakihonne wallet by accident 😞

whats the price for one?

yeah, lot of tradeoffs to consider though

thats pretty quiet in terms of DBs, nice work. you never do quite know if a machines noise or vibration is annoying you / your family 'til its been in place a few days though.

Yakihonne's zap game has a bit to go to catch up with Amethyst, but it can get there im sure 🤙

The only thing worse than TikTok being banned...

Reports Suggest That Elon Musk May Be Buying TikTok

https://www.makeuseof.com/elon-musk-buying-tiktok-us-ban/

#IKITAO #Tech #FreedomOfSpeech

lol, o goodie.

Today’s a special day in Bitcoin. It’s Lightning Whitepaper Day!

On this day in 2016, Joseph Poon and Thaddeus Dryja released the whitepaper about scalable off-chain instant payments using a decentralized system.

Payments would be sent over a network of micropayment channels…

⚡ Today, we have #Nostr and zaps for the #plebchain! ⚡

Read the whitepaper: https://lightning.network/

at the end of the day, and even with all the pain, lightning is fucking awesone

whoa, Yakihonne is good. built-in wallet is impressive too.

#nostr

#grownostr

#lightning

they just pulled it from the dominant app stores, you can still get phoenix in the US. i think it was smart as it kept their product from being flooded with normies at a precarious time and risk becoming a target, but allowed them to persist, build and then they can re-enter app stores in US when regulatory environment is more friendly.

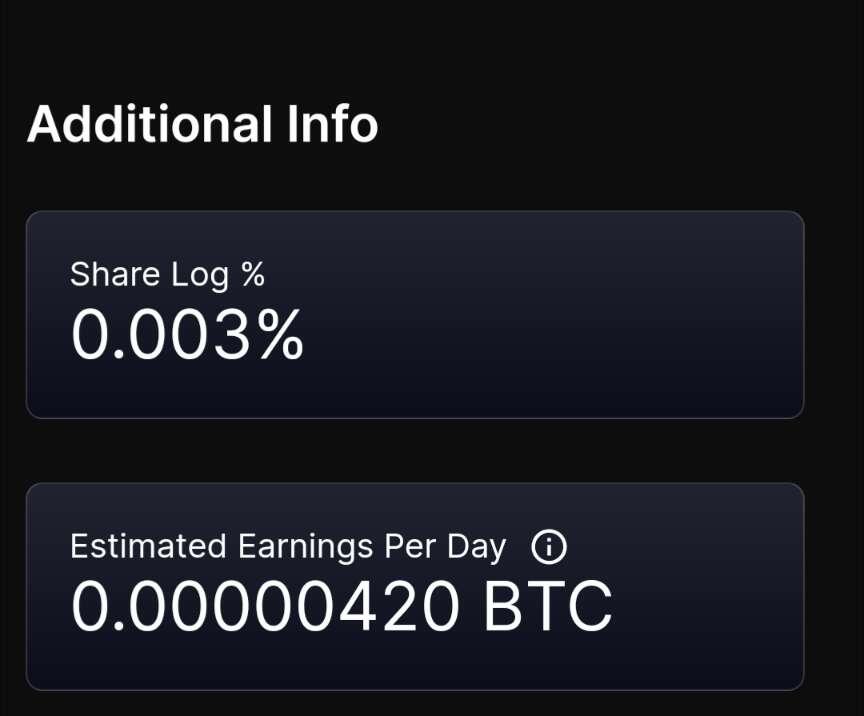

i do mining rentals, dont own anything other than a bitaxe and a futurebit standard

well i want a relay that auth's read/write for whitelisted users. like a friends only relay.

anyone played around with nip 42 auth in the lnbits relay? tried fir a bit just now with amethyst and 0xChat, was nit successful yet

hell yee

lucky to be alive

you ever seen that one star trek next generation episode ?

nostr:note1vfsefy0z4zpue60ut3v4njjglrvyw0u40mlvmdkfz5ch49m6py7syks972

nostr:note1vfsefy0z4zpue60ut3v4njjglrvyw0u40mlvmdkfz5ch49m6py7syks972