I definitely had to learn this when I started to communicate with people from other regions, especially Asia.

I had to get so brief, short, literal it sometimes felt rude. Had to eliminate the fluff and just write facts to ensure nothing was misunderstood.

The cool thing about #btc is it’s actually a 0% inflation. All coins are already created just locked in time waiting to be mined.

I guess you can compare it to gold in that sense, already created just locked in earth (or asteroid lol) waiting to be mined.

Difference is we know the limited supply of one vs the other.

Just a different way to think about it.

Absolutely!

Or just add espresso for an amazing affogato!

Thanks for the reply!

Yes you’re right. I did mention high-yield savings do have 4%+ in my post but there are a few notes on those.

Usually they require someone be 18+ years old and usually have a higher minimum deposit requirement than a regular savings account.

Even at 4.5%, it’s close to break-even with inflation (reported CPI is a bit lower but actual real world expenses are closer to 10% or higher year-over-year).

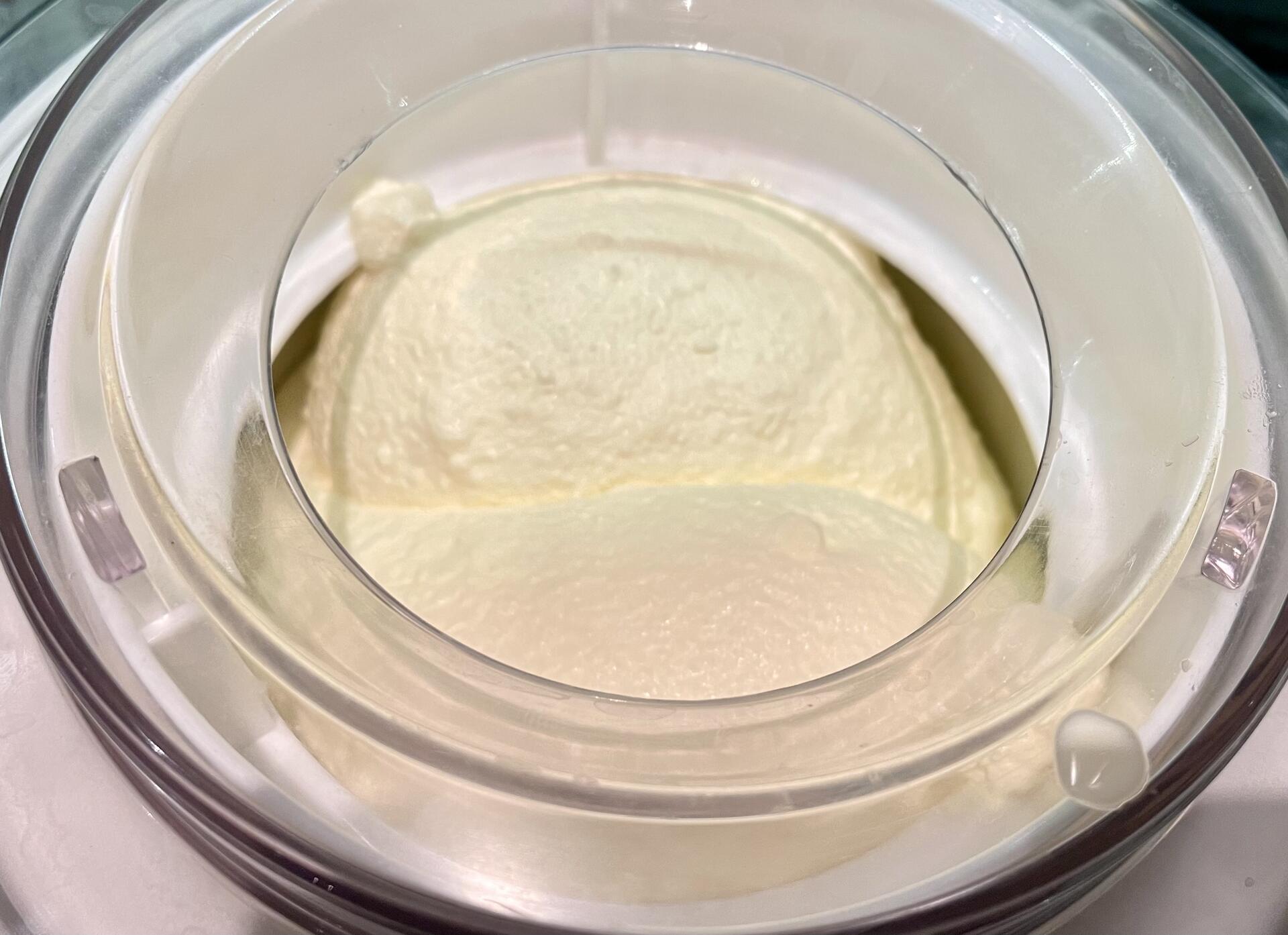

Homemade ice cream.

Simple to make and nice to know exactly what goes in.

Two main ingredients: heavy cream and egg yolks. Optional: vanilla extract, sweetener of your choice, pinch of salt.

Great way to eliminate sugar, high fructose corn syrup, seed oils, and other junk while still getting most or all of the flavor.

#nostr #foodstr #yum

When I was younger, I thought there was a secret I needed to find which would unlock wealth and happiness.

Maybe there’s an expert out there that has all the answers? A guru with information passed down for generations? A book I can find that somehow others missed? If only…

Over the years, I’ve realized there is no secret. No one knows the future. Every guru is full of lies or recycled thoughts. There are few true experts in any field, most are just faking it until they make it.

The one truth I’ve found is keeping your life simple, being honest, and working towards your goals. Some may get lucky, some might have insider info on something, but it’s all temporary and nothing to rely on.

Don’t trust gurus or spend a lifetime searching for that holy grail.

Spend time educating yourself and coming to your own conclusions. At least then, if you fail, it was all under your control and not due to someone’s influence. Live, learn, and move on.

Trust yourself.

#nostr #donttrustverify #mindset #growstr #pleb #behumble

Enjoy! Let me know if the slower cook makes a difference.

The stall can be a pain for sure. Are you on a pellet grill? If so, you can crank it up now to 250-275 since most of the smoke flavor is set by now. Try wrapping in foil around 185 to finishing it off even faster.

Patience is key, especially when everyone is asking “is it almost done???”

Okay Tony, put it on the at 225 during lunch. Will see how it looks in 5hr or so. If you don’t know, nostr:npub1g3827ewz6d23rlgdhkaslc78gyule52ymcqdyt2hsxdwtlw8dt5q7dfpvg sells spices for sats here on #nostr #grillstr

Oh man, that looks good! Is it done? How’s that meat church rub?

You weren’t messing around haha

When I was young, a savings account mattered. My parents helped me open one up with maybe $50 and the interest rate was 4%+ and inflation was under 4%, real returns were 0% at worst, usually 1-2%. Not shabby.

It was rewarding to deposit money I earned from reselling candy, marbles, cards, even a slightly used chess set and reinvesting and putting the rest in my savings account.

I actually saw that account grow in value over the years and witnessed the power of compounding.

Today, a regular savings account still yields a 0.01% interest rate (just checked Bank of America’s website).

What’s the motivation for a kid (or anyone) to put money away when interest rates are basically zero?

Now add to that the normalization and ever increasing rate of inflation. Earning 0.01% interest (even 4%+ on high-yield savings accounts) when CPI is near 4%, but we all know it’s likely over 10% for most people results in a devastating and crushing reality whether people know it or not.

There’s little chance for an average kid to generate wealth without learning to buy valuable assets, become a top earner in their field, or own a profitable business. Subjects not taught in most schools.

It should be easier for people to save their hard earned money and be rewarded for saving rather than recklessly spending.

The only solutions I found are: control your costs/spending (includes student debt) and own a profitable business, become a leader in your industry so your income grows at or above the rate of inflation, and buy hard assets (acquire rental property, gold, S&P 500 index funds, #bitcoin).

The allocation to one or many of the above depends on the person. Some aren’t suited to own a business, others might stress out investing in stocks or bitcoin. Find what works for you. I highly encourage everyone to spend a few hours every week learning and seeing what fits.

Hope this post helps at least one person. It’s something I wish someone would have told me when I was younger!

#gn #nostr #nostriches #wealth #pleb #plebchain #proofofwork #stacksats

Good morning!

An espresso shot to start the day.

Have a great day and week!

#gm #espresso #mokapot #bialetti #woo #coffeestr #foodstr #nostr

Credit to @kristincarrera

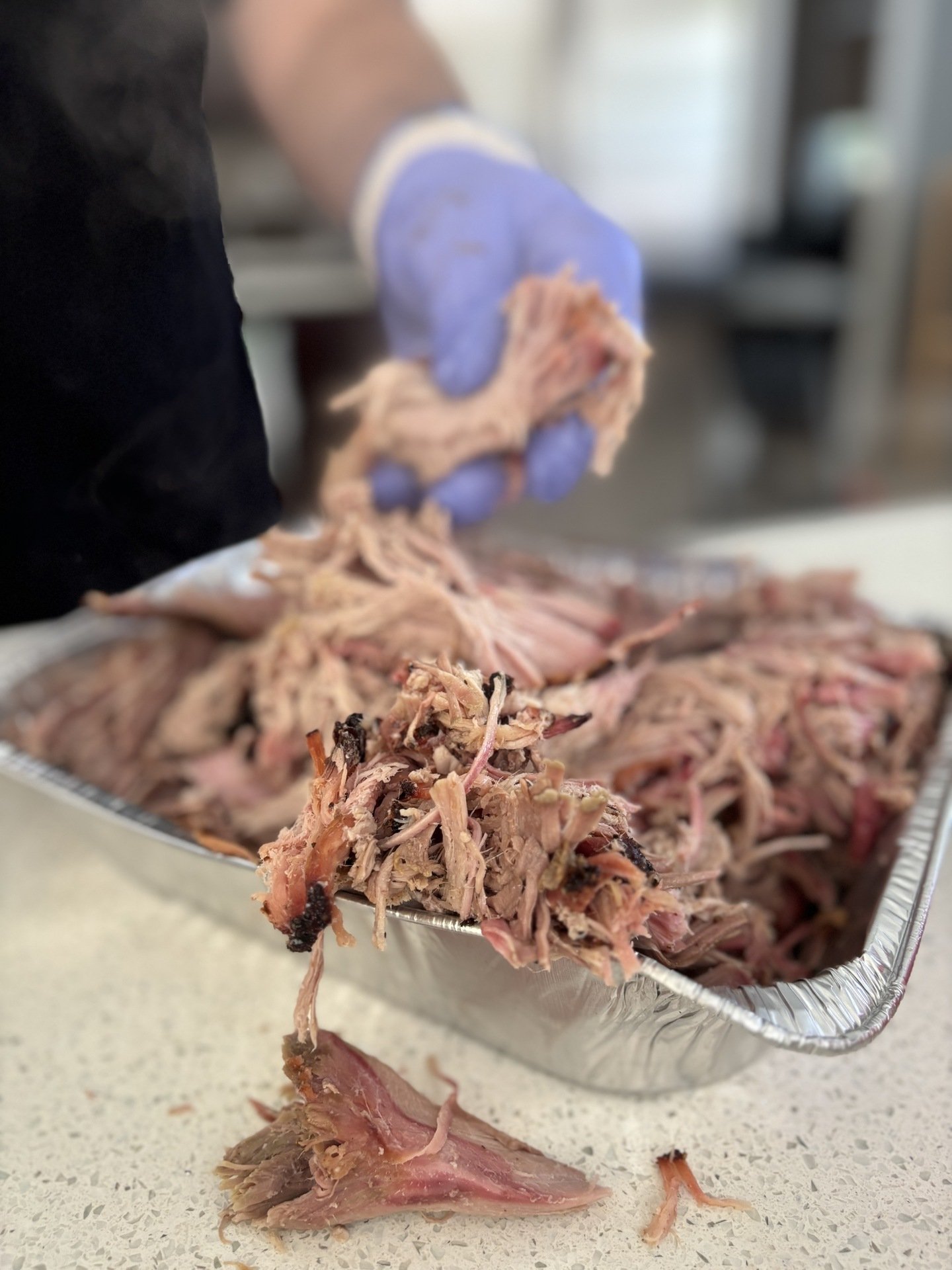

Phase 3 complete!

The result was fantastic.

If you haven’t bbq’d before, a pork shoulder/Boston butt is the most forgiving and rewarding cut to start with in my opinion.

Have a great week. #gn

#bbq #bbqstr #foodstr #carnivore #proofofsteak #nostr #happyfathersday #pork #porkbutt #smoker #pelletgrill

nostr:note1gudntzq5cnzvy2xn5pqqgfna3q5ueaqpyk3ejwd3929vjwng8azsxmzuzf

nostr:note1gudntzq5cnzvy2xn5pqqgfna3q5ueaqpyk3ejwd3929vjwng8azsxmzuzf

That’s a good point, business profit ≠ capital gains. The business profit, I would define as retained earnings or free cash flow (net income can be heavily manipulated), which should be deployed/reinvested to earn more retained earnings/FCF.

A good capital allocator will work to grow the business and reduce corporate taxes. I mistakingly mixed this up with capital gains tax, sorry about that.

I think the bottom line is monetary debasement = inflation = no bueno.

The cheat code is save in assets which beat your inflation rate (not CPI). With insurance, food, utilities, etc going up north of 10% year over year, only a few assets I can think of can help… care to take a guess? lol

I would agree with that. Basically no money printing = no inflation = no asset appreciation.

I guess I think about it differently as I’ve always tried to grow a business and think of it from that angle. From this perspective it’s an active growth vs a static asset (gold in your example) whose value is mainly derived from inflation fears.

I guess the equivalent in macro scale would be gdp. My productivity growth = business growth = capital gains

Does that make sense?

Entering phase 2 of the pork shoulder on the pellet smoker!

One shoulder is cooking a little faster so wrapping that one first while the other does its thing.

Taking a bit longer than expected, probably because these are a bit bigger than the ones I usually do and it’s two of them.

#bbq #bbstr #foodstr #nostr #smoker

nostr:note1u9n7y2vk29p6apyudj60cs3mnpwc09edkzgecxcqqutu9ne9mykslynral

nostr:note1u9n7y2vk29p6apyudj60cs3mnpwc09edkzgecxcqqutu9ne9mykslynral

Good morning!

Pork butt phase 1 progress…

About 9 hours in, first light spritz with apple cider vinegar. Been going at 200° for the last 7 hours (about 170° for first two hours), internal temp 155°.

Now lid closed for another three to four hours before phase 2 (the wrap @ 185°ish). Might occasionally spritz it if it looks dry.

#foodstr #bbq #bbqstr #nostr #nostriches #porkstr #pleb #plebchain #carnivore #proofofsteak #gm

nostr:note1yqu92ncpjxjc8ap8g27madzpw7ct3wr3lecpcdegm7jnmzey40nska4nhs

nostr:note1yqu92ncpjxjc8ap8g27madzpw7ct3wr3lecpcdegm7jnmzey40nska4nhs

I would say inflation rather than capital gains tax.

Capital gains tax is just the price you pay for participating in capitalism.

The trick is finding ways to offset that tax.