Shitcoin has no meaningful distinction if you are saying they are the same. You're telling us nothing.

In maxi speak:

Can a shitcoin do one particular thing better than Bitcoin?

Can one shitcoin be better than another?

Respectfully, everything you said has many assumptions. And trade-offs always exist. CPU mining is more decentralized in a different way (access to plebs). ASICs are more decentralized in another way (limited access to attackers)

https://sethforprivacy.com/posts/dispelling-monero-fud/#monero-cant-scale

Monero can support roughly 10x - 100x (300,000 - 3,000,000 daily txs) more transactions on current protocol with no more upgrades without straining current tech limits. It already cut down transaction size by ~80% since inception. It's scalability will keep improving over time and consumer tech is always getting better.

As long as the rate of adoption is equal to or below the rate of consumer tech advancement (this caveat applies to any crypto) Monero will be fine.

Anyone is free to attack Monero. There is a ~$3,000,000,000 bounty to do it. It hasn't yet happened. The network is still running for almost 10 years.

On the otherhand, Liquid is a permissioned, weak privacy shitcoin.

You audit Monero the same way you audit Bitcoin. You run a node.

The code is completely FOSS.

No Bitcoiner is taking advantage of Bitcoins transparent/simple math to scrutinize the blockchain anyway so that doesn't help you. Are you making sure every block that all input = all outputs? No, you just run your node and pay no mind. So in practice what is the difference?

Monero audits supply using bulletproofs and pedersen commitments. It is well established and sound cryptography from the 80s, but admittedly more complex than bitcoins simple math.

An exploited inflation bug would be equally catastrophic once it happened to either Bitcoin or Monero. Attackers have the advantage. There is no good solution to fix an exploited inflation bug without hurting other users on either Bitcoin or Monero.

Trivia: Did you know there was a hidden inflation bug in Bitcoin only an anonymous user knew? They couldve easily exploited it, but very luckily they were an honest actor who secretly let the devs know (who couldve also decided to exploit it). If they did exploit it, how would detectable inflation help after the fact? It wouldnt.

https://bitcoincore.org/en/2018/09/20/notice/

Again none of this matters if you don't use Monero to save. So it's all moot.

Yes, their feelings on Monero has been no secret, which is why I find it odd all these laser eyes are clutching pearls.

They've also been hinting at Monero atomic swaps for more than a year.

Can't blame them if they do. It's a superior privacy tool.

Well put up your argument then! You have no argument.

Agree, Tether is a centralized, permissioned, rehypothecateable, panopticon shitcoin.

Monero is decentralized, permissionless, private, fungible, and way cheaper to transact with less than a cent.

You don't think all these things together make Monero a better Medium of Exchange than Bitcoin? (I'm not saying Monero is a better Store of Value either so don't strawman)

They are just different trade offs because they specialize in different things. ASICs have unique problems. CPUs have unique problems.

Bitcoin: Better scarcity, transparency, preservation, Store of Value

Monero: Better fungibility, privacy, adaptability, Medium of Exchange

I can argue all your concerns if you truly want me to.

But if you don't save with Monero, none of that matters. You can use Monero as digital cash. You don't have to use it as a savings tool.

Keep saving with bitcoin and spend with monero. What is the risk in that case? Nearly zero.

You can onramp P2P directly to Monero KYC-free using LocalMonero or Bisq.

You can also atomic swap for XMR if you have BTC using unstoppable swap. Samourai Wallet just announced a crosschain atomic swap for XMR <-> BTC yesterday. Or use Trocador.app if you have other crypto.

Yes, liquidity is important, but I hope you don't assume the whole Bitcoin network is your anon set... It is smaller than one would think. If users have their bitcoin on KYC centralized exchanges❌. If they don't coinjoin at all after withdrawing ❌ If they use remote public nodes not behind tor/i2p ❌. This consitutes the majority of normies and Bitcoin users.

Coinjoins are inferior privacy.

Encryption > Obfuscation

Monero completely hides amounts and recievers from the chain. There is no transaction graph. Where as in a coinjoin all connections and data is there and can be saved and used with future data to deobfuscate. Or you can mess up and consolidate coins connected to you.

I'm not jumping in and out of alts. I'm saving with Bitcoin and spending with Monero. I don't recommend going BTC -> XMR -> BTC. Probably the worst way to obtain privacy on Bitcoin. You're involving a third party. Trivial to trace if not done correctly. (Timing attacks, amount analysis, etc)

Most recommended:

BTC -> XMR -> Spend XMR

Alternatively:

BTC -> Coinjoin -> Spend BTC

Monero protocol is strong privacy by default.

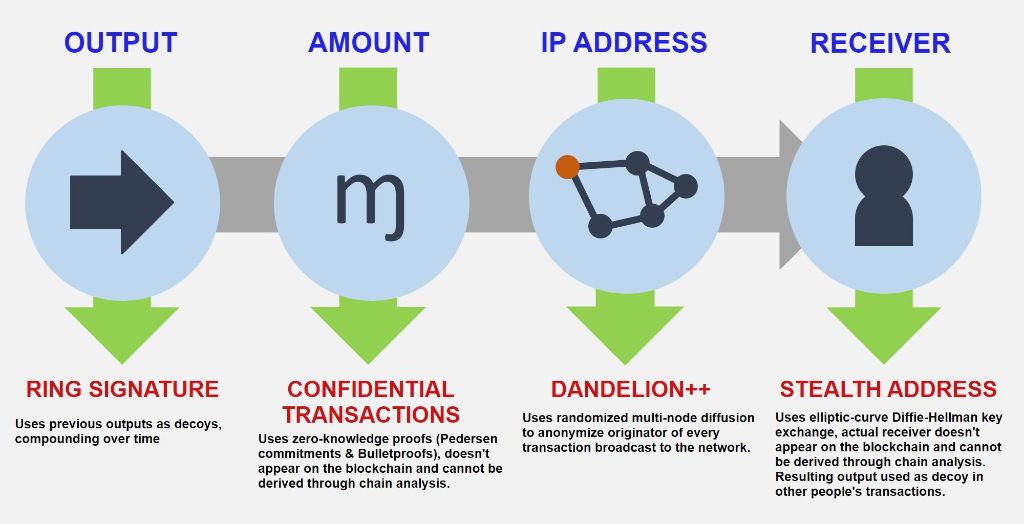

Amounts hidden using "Confidential transactions"

Receiver hidden using "Stealth addresses"

Sender obfuscated using "Ring Signatures" (16 decoys)

IP obfuscated using "Dandelion++"

Example of a Monero transaction:

~6% chance Alice sent $[?] to [?]

LN privacy is not enough against any serious attacker:

https://github.com/lnbook/lnbook/blob/develop/16_security_privacy_ln.asciidoc#attacks-on-lightning

https://abytesjourney.com/lightning-privacy/

"We identified 27,183 private channels, discovered hidden balances, and showed how a passive adversary can infer payment endpoints with very high probability."

https://arxiv.org/pdf/2003.12470.pdf

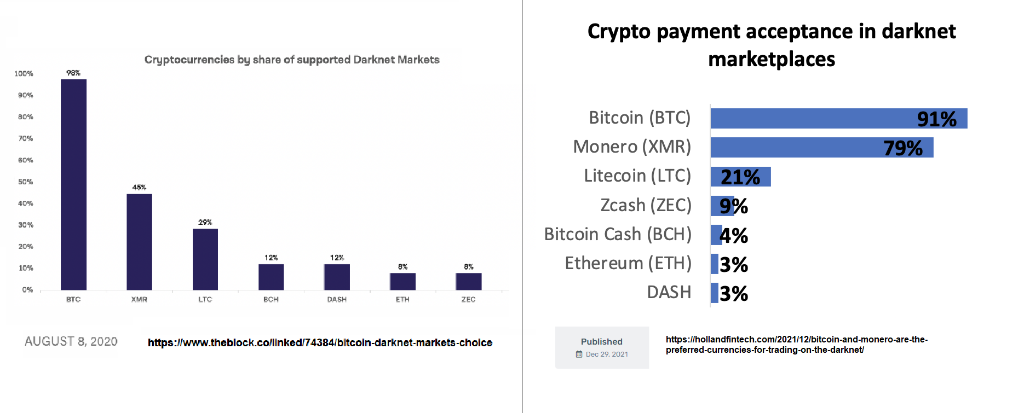

Bitcoin coinjoining is obfuscation not encryption. That data and transaction graph is available to be used against you by correalating with more future data. The only reason Bitcoin is still used in DNMs is first mover advantage and wide acceptability. It is not ideal.

You don't have to use Monero I'm just explaining the facts. Use whatever you want.

https://kycnot.me/services?xmr=on

DNMs = Darknet Markets. Where privacy truly matters and is put to the test. Monero will soon surpass on chain Bitcoin acceptance. LN is not even available on DNMs.

Physical cash is only convenient locally. You can risk sending it thru mail but it will be slow and might be lost or stolen. You wouldn't prefer to send money to anybody you want instantly, completely privately, and without permission from banks/governments?

I did start respectfully making constructive criticism, but you replied to me by calling it a "shitcoin". Is that conducive to conversation? Take your own advice.

So I gave you back the same energy

LN does not have near the same privacy. That is also why no one uses LN in DNMs 😂

Fiat physical bill is not digital. You can't instantly send to anyone on the planet. You risk confiscation across borders. And unpredictable inflation.

Because everything I said was true that is why you are throwing a red herring towards price instead of privacy.

Liquid privacy is weak vs Monero. And anon set is even worse.

Who said Monero is trying to be sound money?

We never switched from the title of the white paper "p2p electronic cash". But let's see:

Portable? ✅ Bitcoin ✅Monero

Durable? ✅ Bitcoin ✅Monero

Divisible? ✅ Bitcoin ✅Monero

Scarce? ✅ Bitcoin ❌ Monero

Fungible? ❌Bitcoin ✅ Monero

Stable value? ❌ Bitcoin ❌ Monero

The most saleable good? ❌ Bitcoin ❌ Monero

Nope. Don't see sound money anywhere. I see a couple MoEs.

Then dont save with with it! Use it!

I noticed you have no response to any of my points. Your silence is confirmation. Glad you agree Liquid is inferior trash vs Monero.

I said the exact opposite. I said save with Bitcoin. Spend with Monero.

Bitcoin fungibility is garbage and has no privacy. Bad for spending.

There is also many problems with Bitcoin.

That is your mistake viewing Monero thru a Bitcoin perspective. Monero is not trying to be "global money". It's a tool for anyone that needs it and carries the spirit of the cypherpunks and white paper "p2p electronic cash" better than Bitcoin.

Monero transaction size has already been reduced by ~80% since inception. As long as the rate of adoption is equal to or below the rate of consumer tech advancement and protocol scalability improvements (this caveat applies to any crypto including Bitcoin) Monero will be fine.

An exploited inflation bug would be equally catastrophic once it happened on either Bitcoin or Monero. Attackers have the advantage. There is no good solution to fix an exploited inflation bug without hurting other users on either Bitcoin or Monero.

Did you know that an inflation bug was only discovered because of a single anonymous user? They couldve easily exploited it, but very luckily they were an honest actor who secretly let the devs know (who couldve also decided to exploit it). If they did exploit it, how would detectable inflation help after the fact? It wouldnt.