No problem, but this is actually from nostr:npub13ndpm2hm9hud4azsq5euhf5mv3d05r90wymwxsd7rdn29609hhvqp60svh not me

Ok, I don't deny what Satoshi was attempting to solve. But what if the state says "You can't use Bitcoin on the white market anymore", or "you can use it only if you deposit it at our regulated custodians or use this inflation friendly fork that we control", or "you can use it but we're going to tax using and holding bitcoin to effectively be the same value lost as if it were being inflated"?

The only way to ultimately enforce what youre saying is through black markets

Coinjoins are outdated privacy solutions in the age of sophisticated chain analysis and ZK tech.

Even Moneros ring signatures for sender privacy isn't cutting it anymore for edge cases (despite hiding amounts and receivers completely) which is why it is upgrading to full chain membership proofs.

It's funny you bring up market cap and liquidity when Lightning is a fraction the size of Monero. And ecash is a fraction of that fraction.

Bitcoin at it's core is black market digital money. Transactions on regulated markets aren't possible unless you're following the rules of a central authority which defeats the whole point. Any white market use is incidental and transient.

less liquidity, smaller network effect, and no general purpose scripting

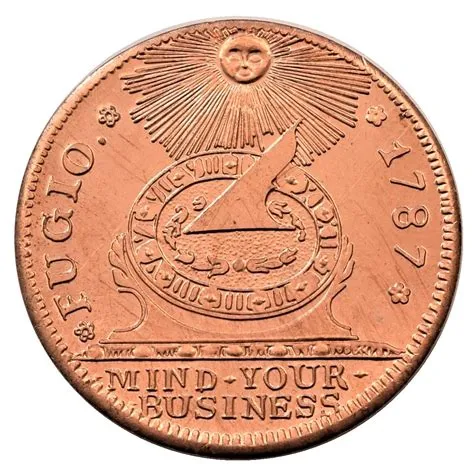

He also designed the fugio cent so probably would be a Monero bro

"mind your business"

c’est la vie

I get what you're saying and agree it is kind of funny how we're always hopping around, but if we had that attitude for everything Bitcoin or Monero wouldn't exist

Pubky has different advantages over Nostr, it's not necessarily a replacement, they can both be complementary to each other

https://pubky.app/post/operrr8wsbpr3ue9d4qj41ge1kcc6r7fdiy6o3ugjrrhi4y77rdo/0033GF5QN04E0

"This is the decentralization technology powering your Pubky identity."

https://pubky.app/post/operrr8wsbpr3ue9d4qj41ge1kcc6r7fdiy6o3ugjrrhi4y77rdo/0033B3XAXE28G

"Pubky vs Nostr - Under the Hood"

https://pubky.app/post/gujx6qd8ksydh1makdphd3bxu351d9b8waqka8hfg6q7hnqkxexo/00335K18AMRRG

If anyone is interested in trying out the Pubky invite only beta ask nostr:npub13ndpm2hm9hud4azsq5euhf5mv3d05r90wymwxsd7rdn29609hhvqp60svh for an invite code

A brief comparison of Nostr vs Pubky (mostly accurate I think):

https://nostr.download/51576d74df92ad7734292d62f319e2f9f314a885e5cf9ef795f4b4bb07a00d33.webp

https://nostr.download/4c4056651ca06e0ae382a64de060c8659322ffc4ca28035526cb75a48f7e61f9.webp

My public key:

egheqxn78mst7pwdshtgxmgctsqspwhzqir1nucjgc981kbj8ujy

Subaddresses are deterministically generated, but have a massive space of 2^96 possible subaddresses per private key (virtually endless for all practical purposes). I could be wrong but I think you could technically choose a random range where the index would start. It would basically be impossible to find your transactions for an adversary even if they somehow got ahold of your private keys. I don't know any wallet that has this option built-in and not sure how practical it would be since you would have to save that index range somewhere along with your private keys. I think wallets should provide users an accessible way to do this though if they wanted to.

MW is great. There are no addresses on the blockchain, period, not even stealth addresses. I like Grin and LTCMWEB, and Beam is doing some cool things. But you already described the problem that an active malicious node could simply save that info in the mempool to put together a transaction graph. It would only be able to see from that point forward, but it is pretty weak privacy as far as hiding transaction graphs go.

There is a nazi under every rock and around every corner. And if someone doesn't agree with you they're probably helping a nazi!

You're the walking trope I described earlier

Get your priorities straight. You're unironically telling people to work for intel agencies, governments, and NGOs in your post. The most glowie shit ever.

It's like asking others to join Satan himself to fight against evil in the world

Please stfu 😂

Replace Monero with Lightning in this scenario. How would this have changed anything? It wouldn't have. The problem is obviously with the chokepoints which are the exchange and swap services where they can see this extra data that isn't revealed on the network themselves.

Unless you would define that as "tracing" Lightning too, if so, fair enough but not sure I would agree this was tracing Lightning itself.

Oh no not banned slogans and a website! 😱

The real fascists are extorting us, trampling on rights, and killing and maiming tens of thousands of civilians in Gaza

But yea go on and focus on fringe groups with no real power or relevance since WW2!

Chasing mice while ignoring the elephant in the room. It's pathetic and pure larp.

LOL

Yea Nazis really have a grip on the levers of power all around the globe right now. Nazis everywhere thats the real issue.

You're delusional tilting at windmills

Is this a joke lol? I think the world has much larger problems than "nazis" in this day and age (a label that is often carelessly used on anyone that doesn't agree with someone elses politics)

It would be great if they actually directed all their energy and resources towards real fascists, war criminals, and corrupt politicians with REAL POWER in their own governements that actually manifestly affect all our lives.

"Deverickapollo and napoly post first progress report for BTCPay Server Monero plugin CCS"

https://nostr.download/c8f933456b24fe6f25608fb46958287d8f02d38c1222d55d0fff5cb19dc292a0.webp

A verifibale 24% premine at the very least, but potentially as high as 78% if you include the Boolberry swap that can't be verified (we'll never know for sure)

Yea, it's made so much worse by combining th premine with PoS. On top of that it's claim to being a private Ethereum is weak once I realized token issuance is centralized to the token creator and lacks programmability.

Large verifiable premine. Even larger unverfiable premine from Boolberry.

It's also proof of stake meaning de facto indefinite tax that mostly goes to holders of that premine.

I think Beam does a much better job in every aspect above if someone wants a "private Ethereum"

(potentially darkfi too whenever it's officially launched)

nostr:note1ppazle5cfuxsns3z5xutnkzcg4uhfsvk3rma3grasxgv09w2za7q3qqq96

Judge: "Oh you like Lightning solely because you want to save on transaction fees? You can transact for free on Cash App, Paypal, Zelle, etc"

Come on. Your supposed deniability easily falls apart by even your own logic. You can't avoid this with either Lightning or Monero without adding sovereignty/self-custody/permissionless txns into the combination of reasons. Otherwise it makes no sense.

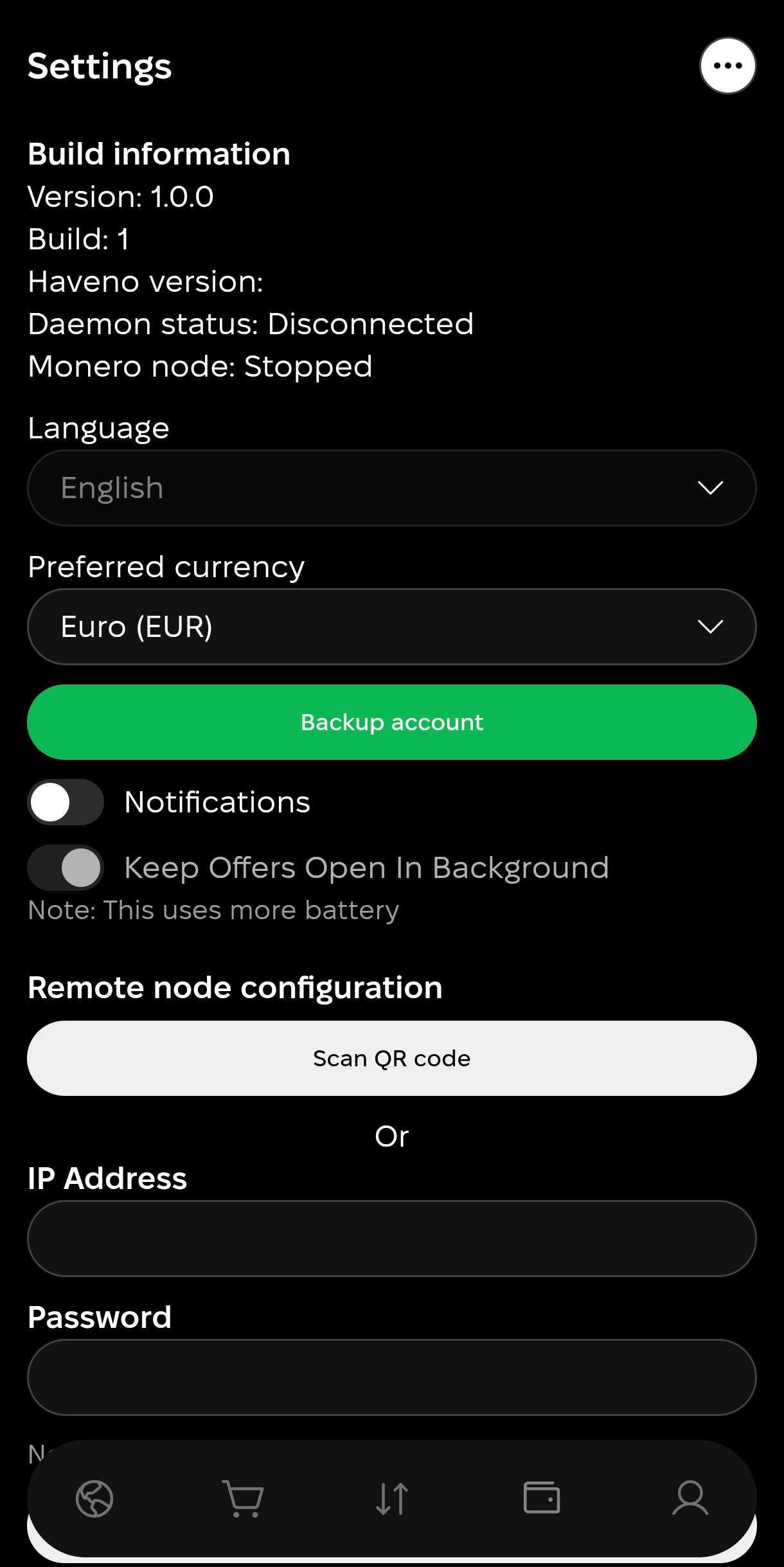

This is a very new experimental phone app. I would be cautious using it.

Desktop software has been going for over a year now. I use it fairly often without problems. ~260 active offers.

A solid phone app would be a game changer though.