Google sheets, and you can have it auto fill when opened to keep a running table of daily prices.

Nothing makes me shake my head more than seeing people talk about the Fed's 2% inflation "target" as if there was some magic to any number above zero.

Bull Bitcoin becomes the first mobile Bitcoin wallet that allows users to send and receive asynchronous Payjoin transactions without needing to run their own server, using BIP77!

I am very excited about this new and bleeding-edge feature, because it has been a long-standing ambition of Bull Bitcoin to become the first Bitcoin exchange to process Bitcoin withdrawals via Payjoin (Pay-to-Endpoint) transactions.

However, it was hard to justify Bull Bitcoin investing time into building this feature since there were no commercially available end-user Bitcoin wallets that were able to receive Payjoin payments.

Indeed, in order to receive Payjoin payments (BIP78), a Bitcoin wallet needed to be connected to a full node server and be online at the moment the payment is made. This means in practice that only merchants, professional service providers and advanced full node users had the capacity to receive Payjoin payments. This is, we believe, one of the major reasons why Payjoin had failed to gain significant traction among Bitcoin users.

For this reason, the Payjoin V2 protocol (BIP77) was conceived and developed by Dan Gould, as part of the Payjoin Dev Kit project, to outsource the receiver's requirement to run his own server to an untrusted third-party server called the Payjoin Directory. In order to prevent the server from spying on users, the information is encrypted and relayed to the Payjoin Directory via an Oblivious HTTP server.

Bull Bitcoin’s Payjoin ambitions had been put on hold since 2020, until there was more adoption of Payjoin receiving capabilities among end-user Bitcoin wallets…

But it turns out that in the meanwhile, Bull Bitcoin developed its own mobile Bitcoin wallet. And it also turns out that the open-source Bitcoin development firm Let There Be Lightning, which we had collaborated with in the past, had itself collaborated with Dan to build a software library for Payjoin that was compatible with and relatively straightforward to integrate into our own wallet software. All that was missing was to put the pieces together into a finished product.

Thanks to the collaborative open source effort of the Payjoin Dev Kit team, Let There Be Lightning team and the Bull Bitcoin team, the Bull Bitcoin wallet has now become the first commercially available end-user mobile wallet on the Google Play store to implement the BIP 77 Payjoin V2 protocol.

Moreover, the Bull Bitcoin wallet has also implemented asynchronous Payjoin payments, which means that a Payjoin transaction can be “paused” until the receiver or the sender come back online. This way, the receiver's mobile phone can be “turned off” when the sender makes the payment. As soon as the recipient’s phone is turned back on, the Payjoin session will resume and the recipient will receive the payment. This is a major breakthrough in the mobile Payjoin user experience.

We would like to thank the Human Rights Foundation for allocating a generous bounty for the development of a Serverless Payjoin protocol and its implementation in a mobile Bitcoin wallet, as well as OpenSats and Spiral for supporting the work of Payjoin Dev Kit, which made this all possible.

Why does this matter?

Payjoin, also known as Pay-to-endpoint, is a protocol which allows the Bitcoin wallet of a payments receiver and the Bitcoin wallet a payments sender to communicate with each other for the purpose of collaborating on creating a Bitcoin transaction.

I first heard about Payjoin (then called Pay-to-endpoint) in 2018 and it completely blew my mind. What I liked most about it was that it was not a protocol change to Bitcoin, but rather it was an application-layer protocol that allows wallets to communicate in order to create smarter and more efficient Bitcoin transactions.

Whereas in a normal Bitcoin payment the transaction is created by the sender, and all the inputs of that transaction belong to the sender, in a Payjoin payment both the sender and the receiver contribute coins as inputs.

In the Bitcoin whitepaper, Satoshi wrote:

"some linking is still unavoidable with multi-input transactions, which necessarily reveal that their inputs were owned by the same owner"

With Payjoin, this assumption is no longer true. With Payjoin, we have fixed one of Bitcoin’s most fundamental privacy problems... without changing the Bitcoin protocol!

In a Payjoin transaction, the output amounts visible on the blockchain does not necessarily reflect the value of the payment that was actually exchanged. In other words, you can’t easily tell how much money one wallet sent to the other. This is great for users that are concerned a malicious third party may be attempting to obtain sensitive information about their finances without their consent. This does not however pose an accounting problem for the Bitcoin wallets involved in that transaction: since both wallets are aware of which coins they used as inputs and outputs, they are independently able to calculate the "actual" value of the payment that was sent even if the payment on the blockchain appears to be a of a different amount.

Payjoin breaks the common input ownership heuristic, an assumption used by hackers and fraudsters to track ownership of addresses on the blockchain. The neat thing about this property of Payjoin is that it benefits everyone on the network, not just the Payjoin users themselves.

It allows the receiver of a payment to opportunistically consolidate his utxos when he is receiving funds, in a way which does not necessarily appear to be a consolidation transaction on the blockchain. Depending on the configuration of a payment transaction, it can also make a regular payment look like a consolidation.

In addition to these benefits, the introduction of collaborative peer-to-peer transaction protocols opens up exciting opportunities for the creation of Lightning Network channels, as well as efficiencies for transaction batching.

How to use Payjoin in the Bull Bitcoin wallet:

It’s so seamless, you may not even realize you are using it!

To receive via Payjoin, simply navigate to the “Receive tab” using the network “Bitcoin” and you will see a Payjoin invoice. When you want to get paid, send this invoice to the payer, or show them the QR code. If the sender’s wallet is compatible with Payjoin, it will be up to the sender to decide whether or not they want to use Payjoin.

To send via Payjoin, simply paste the receiver's Payjoin invoice, or scan the associated QR code, in the Bull Bitcoin wallet. If you decide that you don’t want to pay with Payjoin, simply turn off the Payjoin toggle.

Original post: https://www.bullbitcoin.com/blog/bull-bitcoin-wallet-payjoin

Download the wallet: https://play.google.com/store/apps/details?id=com.bullbitcoin.mobile&hl=en-IN

You are one of my favorites in the space, and THE best when it comes to clearly communicating about the issues and your ideas. Thanks!

Yes, for me it was an intense belief that our broken money was the root of most of society's many ills. Without that . . . Bitcoin would have meant nothing - like a normie with no conviction (except envy after ngu).

Setting up a lightning channels (on an already running Umbrel Node for example), in a way that payments will consistently go through (both ways), for people who don't want to do 100 hours researching which channel counterparties to use and how best to set them up. If we don't figure out how to make lightning stupidly easy - even for node runners, MOE will never scale. And maybe add a little practical e-cash to the episode if possible. If this has already been done somewhere (and I've looked) I'm all ears. Love your content, BTW.🙏

Yeah, he already eviscerated one of the fiscal conservative dissenters from the business-as-usual pork spending CR last week . . . Wake me when there is tangible proof MAGA is not controlled opposition (economic/fiscal/monetary policy speaking). Oh, and Elon & Cos. are like the 18th largest recipient of Federal grift.

2, bit the kids must never know, until much later in their lives after they've been bloodied by their own experience, that they're inheriting a large stack. The knowledge of inheritance WILL ruin them in younger years.

🙏 I too am tired of influencers simping for government "strategic reserves". Don't they ever think about 2nd order effects? The utter cluelessness with which government defines Bitcoin is one of the early ones, followed by them trying to destroy it like they do literally everything they touch. They can't outright destroy Bitcoin fortunately, but they can sure mess with everything around it.

SAIFEDEAN AMMOUS ON CNBC

DEC 13 2024

https://cdn.satellite.earth/8b18c664d7ce2186bd64b6158a0b53d13e177a074fc8e72c2e697824db21d07f.mp4

I hope all the former libertarian bitcoiners who are now shamelessly simping for nation/state "reserves" can follow Saif's simple Austrian logic: best thing government could do would be a hands off approach. Well said.

Nation state bitcoin reserve. This will not end well. Few.

1. Syrian Conflict: Syrian rebels have reportedly taken control of several cities, including Idlib and parts of Aleppo, following the fall of President Bashar al-Assad's regime. This marks a significant shift in the long-running conflict and has potential geopolitical implications. (Times of India, Al Jazeera, New York Times, Washington Post)

- Link: https://www.aljazeera.com/news/2024/12/09/syria-war-news-israel-hamas-gaza-lebanon/

2. U.S. Presidential Transition: President-elect Donald Trump is considering eliminating birthright citizenship, a controversial move that would change how citizenship is granted to children born in the United States. Legal experts have weighed in on the potential legality and constitutionality of such a move. (Times of India, Al Jazeera)

3. Global Markets: The Chinese government is discussing new GDP growth targets and stimulus measures as economic worries persist. Meanwhile, the price of Bitcoin has seen a significant drop due to increased selling by long-term holders. (CNBC, CoinTelegraph)

4. U.S. Elections: GOP Senator Tom Cotton called out NBC for omitting key words from the 14th Amendment during an interview with President Trump, highlighting the ongoing debate over immigration reform and citizenship. (Fox News)

- Link: https://www.foxnews.com/media/gop-senator-calls-out-nbc-omitting-part-14th-amendment-trump-interview

5. Turkish Actions in Syria: Turkey has launched attacks on U.S.-backed Kurdish forces in Syria, escalating tensions in the region and raising concerns about potential retaliation from the United States. (New York Times)

- Link: https://www.nytimes.com/2024/12/08/world/middleeast/syria-turkey-kurds.html

#4: was it Tom Cotton or Mike Lee?

I experienced this multiple times. Had to show email receipts going back to 2013. After that, the "I'm too late" trope was repeated since $1,000, or sadly we are no longer friends.

Coinbase Asks Users to Stop Using VPNs and Ad Blockers

"Attackers always use VPN's, so our risk models take that as a negative sign even if you're legitimately using your own account. Same with ad blockers and other extensions."

https://www.nobsbitcoin.com/coinbase-asks-users-to-stop-using-vpns-and-ad-blockers/

Kraken now won't let you do anything with a VPN. All compliance platforms are boot lickers.

Thanks for all you do! I met the Swann bros at the BBB conference (the big F.U. to COVID fuckery Dallas edition 😂). Such kindred spirits. The main reason I love this space is the joy of knowing there's people out there like you, who are in many ways like me.

President Elect Donald J. Trump has promised to eliminate the Income Tax and move government revenue on to Tariffs as Taft did.

The Federal Reserve Dollar is dying since it is being printed into oblivion (the definition of inflation). If Lummis was thinking correctly, the answer to several of these difficult problems at once is obvious.

When the Income Tax is abolished and Tariffs are the source of income, it should be mandated that those Tariffs be paid in Bitcoin.

This would have several immediate side effects.

1/ There would be a very large increase in demand for bitcoin globally

2/ The Federal Government would legitimately start to amass bitcoin

3/ No American Citizen would suffer theft to achieve this end

4/ The U.S. bitcoin ecosystem would be turbo kick started

On the final point, these “monies” coming in to the coffers would be spent inside America, creating multiple cascading opportunities for innovation and learning in bitcoin handling. The “Bitcoin Coffer” would be dispersing and disseminating bitcoin into the economy, triggering the de facto “Legal Tender” status of bitcoin, which I note with appropriate disdain, this bill of pure fail fails to address as part of the overall strategy.

https://medium.com/@beautyon_/pandering-as-policy-d125d002dcb3

Why do we want government empowered with Bitcoin?

Hilarious . . . How the cartel is governed in 20 seconds or less:

https://x.com/btctaipei/status/1854667544659214356?t=e-xDxIkVgMm4HisyTikE5A&s=19

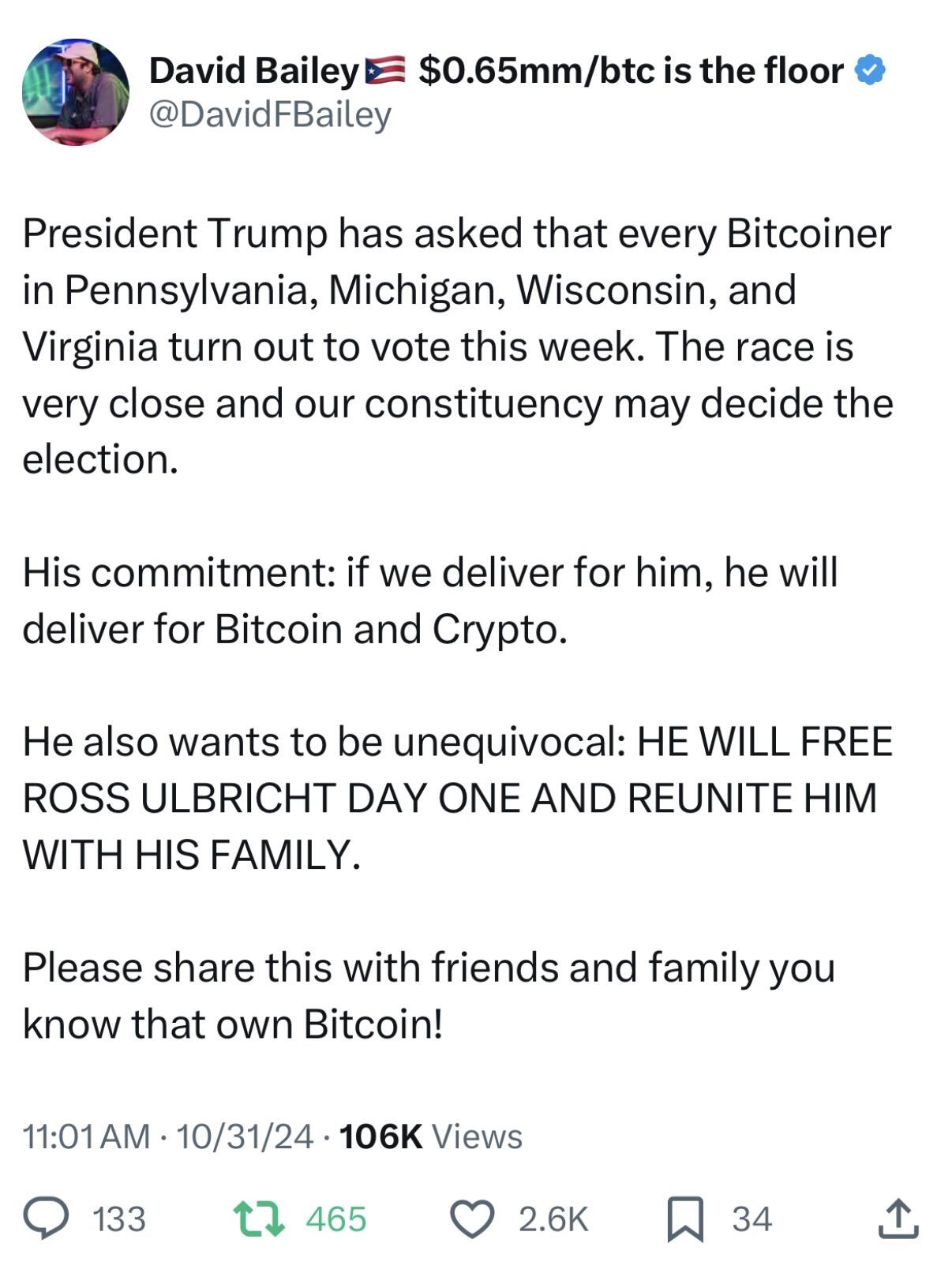

Pull it for Ross!! Very interesting story on how his potential clemency cam le about . . . .

https://x.com/LudwigNverMises/status/1852359062102454538?t=WElVASMNsfyApHZYuvu2yw&s=19

Lots of disappointments last Trump term . . . was going to protest vote a 3rd or 4th party as I've done before. But now there's a solid reason to PULL IT FOR ROSS and hope Trump doesn't fill his ranks with statist fools like last time.

Agree with many of the rebuttals . . . Bitcoin's Achilles heel now is MOE. Lightning UX really sucks for the average casual user.