the only thing thar could save them

https://cointelegraph.com/news/japan-gpif-state-pension-fund-bitcoin

ngmi

fiscal dominance doesn't care about their political objectives. their past politicians sold their future selves down the river.

the only thing left is to hyper inflate.

a great book on the related carry trade.

there must exist a cheap and stable currency to borrow to buy the US debt. japan has been the best

a baked potato in tinfoil and can of corn with margarine

ha. frogfren and i were just on this. which exchange is next? nostr:nevent1qqsvcuk2layl5hv9f5y5gx55ap8c5qlpd69sellc27f8uyr5fg2wnsqpz4mhxue69uhhyetvv9ujumn0wd68ytnzvuhsyg95t905zts3cdefvlrhz024fw2rhnsmsz294e8ruafrcpg447ps0gpsgqqqqqqsyg6uv3

custom emoticons on #amethyst are the best

following question, who is next?

if an actor has these analytics they will be on the hunt.

we can ask and explore those. might get some good theories.

heres what i think

when dollars or stables get scarce on a platform the spreads between market price and platform price widens.

in this case the price was way lower than market which means there was almost no available usdt on bitmex.

available could be an "absolute" thing -> there was almost no usdt on the platform

or available could be a "relative" thing -> whoever had the usdt didnt want bitcoin

in bitmex case it was probably an absolute thing, as their such a small player these days based on spot volume (66m last 24 hours in coingecko). while most of the OTC desks and asian market makers have an account there, they would have loved to arb this right? of course, but who wants to keep collateral on such a small exchange? no one.

if someone knew this, they could spark a run with spot sells, step out and then be the liqudiity backstop on the other side.

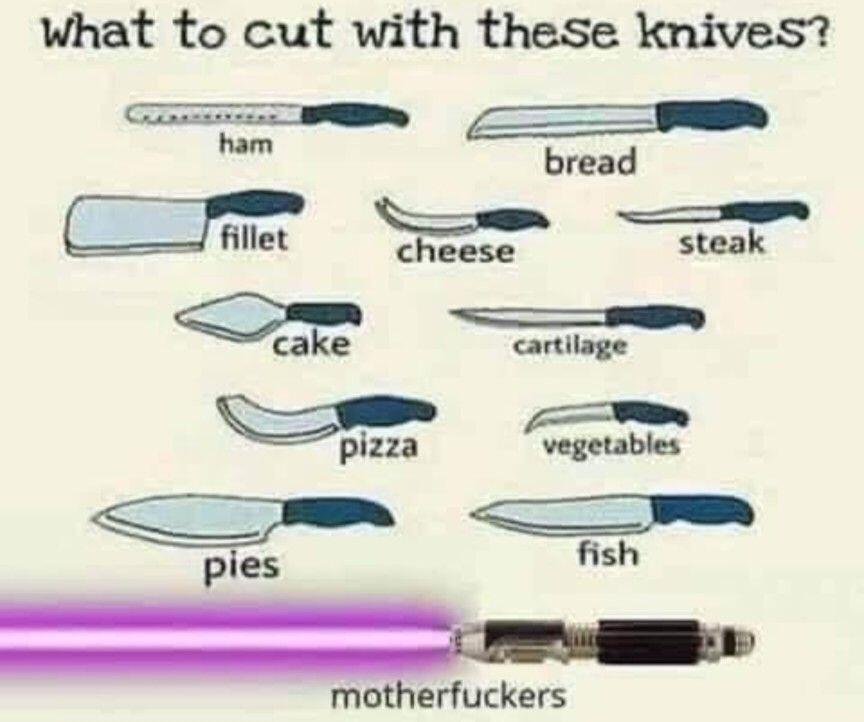

memes for days

i cant stop watching

like..whats the test here? learn to commit to the stunt and accept damage?

their key tactic must be confusion and disorientation.

imagine these two cartwheeling at you. id fall over

this implies an extreme liqudity shortage on bitmex. jeesh

is the conclusion russia is more democratic rican ukraine?

nostr:npub12qz56plzehejkyp4waaannmnny4y4c30j8q55a3wlk49haslga2snypdx8 live with John Carvalho on Lightning, Synonym & Bitcoin

this conversation was thoroughly enjoyable

john on your show can express his thoughts differently vs on a show like WBD.

i especially like some of the timechain traveling yall did looking back in time to find analogs to the noise we are seeing in bitcoin today.

im class of 2019 and can only imagine what OGs from earlier days are going through wading through the nonsense coming out of the main "bitcoiner" camps

convos like this put it into perspective.

thanks Vlad and John.

"NGU properties"...as if demand exceeding supply is a feature.

21m doesnt guarantee NGU. its demand for bitcoin growing against a fixed supply. without increase in demand the supply cap is meaningless.

what are these in demand properties?

bitcoins method of encryption, decentralization, mining, sending and receiving

these things let you preserve your amount of bitcoin through time without regard for what those things can buy you between today and when you spend.