New from @bitlyrics_co: a transcript of the Bitcoin as a Tool for Freedom panel at nostr:npub1h493d0qgwhu95s82zd9sxrt3ckn3ttgvaf04z02neckadxw5fkvqte4cwz featuring nostr:npub1trr5r2nrpsk6xkjk5a7p6pfcryyt6yzsflwjmz6r7uj7lfkjxxtq78hdpu nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a Farida Nabourema and nostr:npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m

https://bitlyrics.co/transcripts/freedom-from-using-bitcoin-as-a-tool/

“it has crashed so many times! To $200 then to $3,500 then to $15,500 … wait a second …”

Idk the terms, but it appears BTC may track global liquidity but in a more forceful way since BTC is log and M2 is not. Fine by me.

I am at a loss for words, I really could not have imagined the feelings I gained once reading your comments. nostr:npub14yf4yasnqgpkzjrzhysshglf82e8nkp8r9sn5hzqu4n244k3avtshhwpyu told me that #nostr became her go to place for information, friendships and inspiration. I also remember she told me “Trust me, Nostr feels like home, you will see.” Her words could not have been more true. Thank you guys for being so kind, writing such nice things, and taking the time to share so many bitcoin books, websites, videos and podcasts with me.

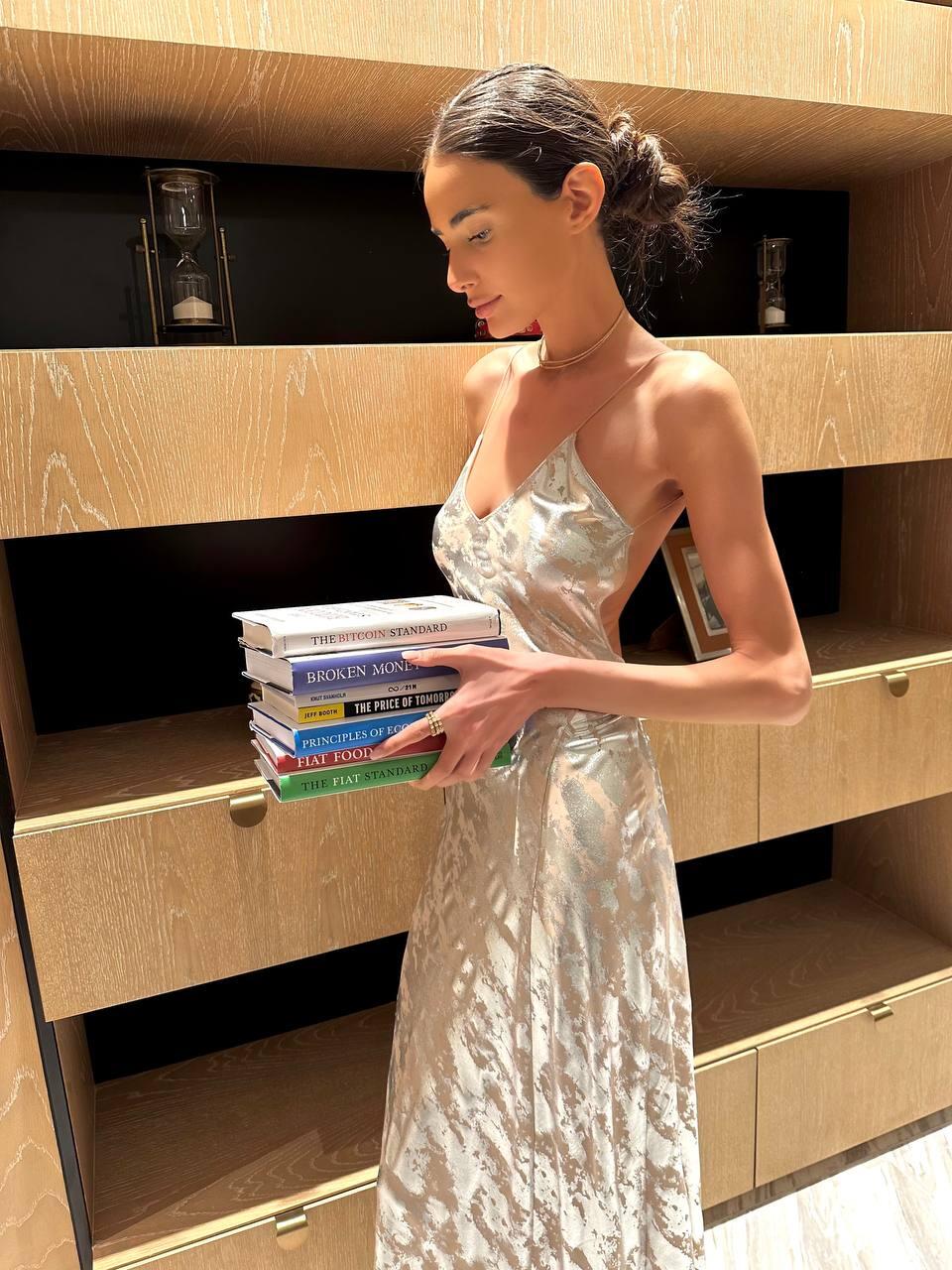

Some of the books you guys have recommended are actually in the bundle of books Duchess gave me along with the Bitcoin White Paper and a few others that she brought over the next morning at breakfast, so they will for sure be my next step. Here are the ones she gave me and I can’t wait to read👇

⁃ The Bitcoin Standard & The Fiat Standard by nostr:npub1gdu7w6l6w65qhrdeaf6eyywepwe7v7ezqtugsrxy7hl7ypjsvxksd76nak

⁃ Broken Money by nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a

⁃ Everything Divided By 21 by nostr:npub1jt97tpsul3fp8hvf7zn0vzzysmu9umcrel4hpgflg4vnsytyxwuqt8la9y

⁃ The Price of Tomorrow by nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe

⁃ 21 Lessons by nostr:npub1dergggklka99wwrs92yz8wdjs952h2ux2ha2ed598ngwu9w7a6fsh9xzpc

⁃ The Blocksize War by Jonathan Bier

⁃ The Bullish Case for Bitcoin by Vijay Boyapati

⁃ The Bitcoin White Paper (She printed it for me, but this is a good link someone shared https://bitcoin.org/en/bitcoin-paper)

She said she had not read Fiat Food and Principles of Economics yet, but she gave them to me anyways. I see none of you recommend those, should I put them on the side to read later?

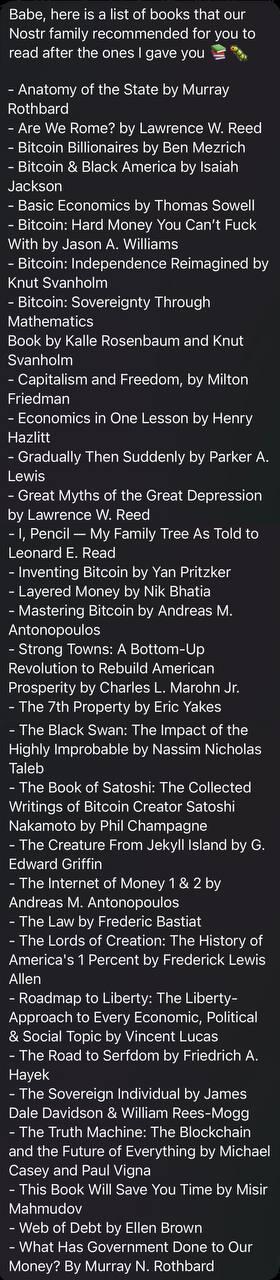

Duchess compiled a list of all the books you guys recommend and I am adding your recommendations to my future list of books to read when I’m done with the ones I have 📚

Principles of Economics by @saife is very good. As you hang out in #Bitcoin many people will offhandedly mention Austrian Economics and how it applies to so much. I was frustrated because I didn’t see anyone explain it and I was intimidated to read Menger, Mises, Hayek, Rothbard, etc. Principles is a fantastic textbook on Austrian economics. Just another very well written easy to understand volume.

#Bitcoin

#Bitcoin

Yes I can zap others. Apparently some kinks are still being worked out.

Gresham’s Law dictates that #Bitcoin will be the store of value and the U.S. Dollar will be the medium of exchange until Thiers’ Law replaces the USD with #BTC as MoE and unit of account.

A world-wide Bitcoin standard is inevitable. The main question is how we get there.

The ETFs purchased 9,150 #Bitcoin beyond what the miners produced (assuming the miners sold all).

So at least 9,150 bitcoin were sold from existing holdings. There is much more existing bitcoin that can be sold than there is new Bitcoin coming. The halving still matters but probably for how it affects miner selling behavior.

I cannot zap this note. I can zap other people’s notes.

excellent content

Why normies hate #bitcoin:

1. The volatility (especially crashes)

2. It's digital, not physical.

3. Rug pulls

4. Limited regulation

5. Electricity usage

6. Some tradfi influencer hates it.

Am I missing anything? Trying to gather these "reasons" first before figuring out how to address them.

Save the money for now and invest it into the productive economy.

I had a fascinating talk with best-selling author Michael Lewis, who wrote the Big Short, Moneyball, Liars Poker and most recently Going Infinite, about the rise and fall of Sam Bankman-Fried.

His views are evolving on #Bitcoin and he shares why he wouldn’t bet against it. You won’t believe what’s happening post FTX trial.

Watch on YT: https://youtu.be/R0_p9ANe6IY?si=cFARD53PmuRTkuv_

Listen: https://podcasts.apple.com/us/podcast/coin-stories/id1569130932?i=1000637822981

He “respects the faith people have in #bitcoin.” He’s gotta ask himself why people have that “faith.”

Was the panel with Leo from Hong Kong and Vancouver recorded and published? I would leave to hear from someone who has actually done the work of onboarding merchants.