By mining it with time and energy.

Spending power can be made most efficiently by just HODLing.

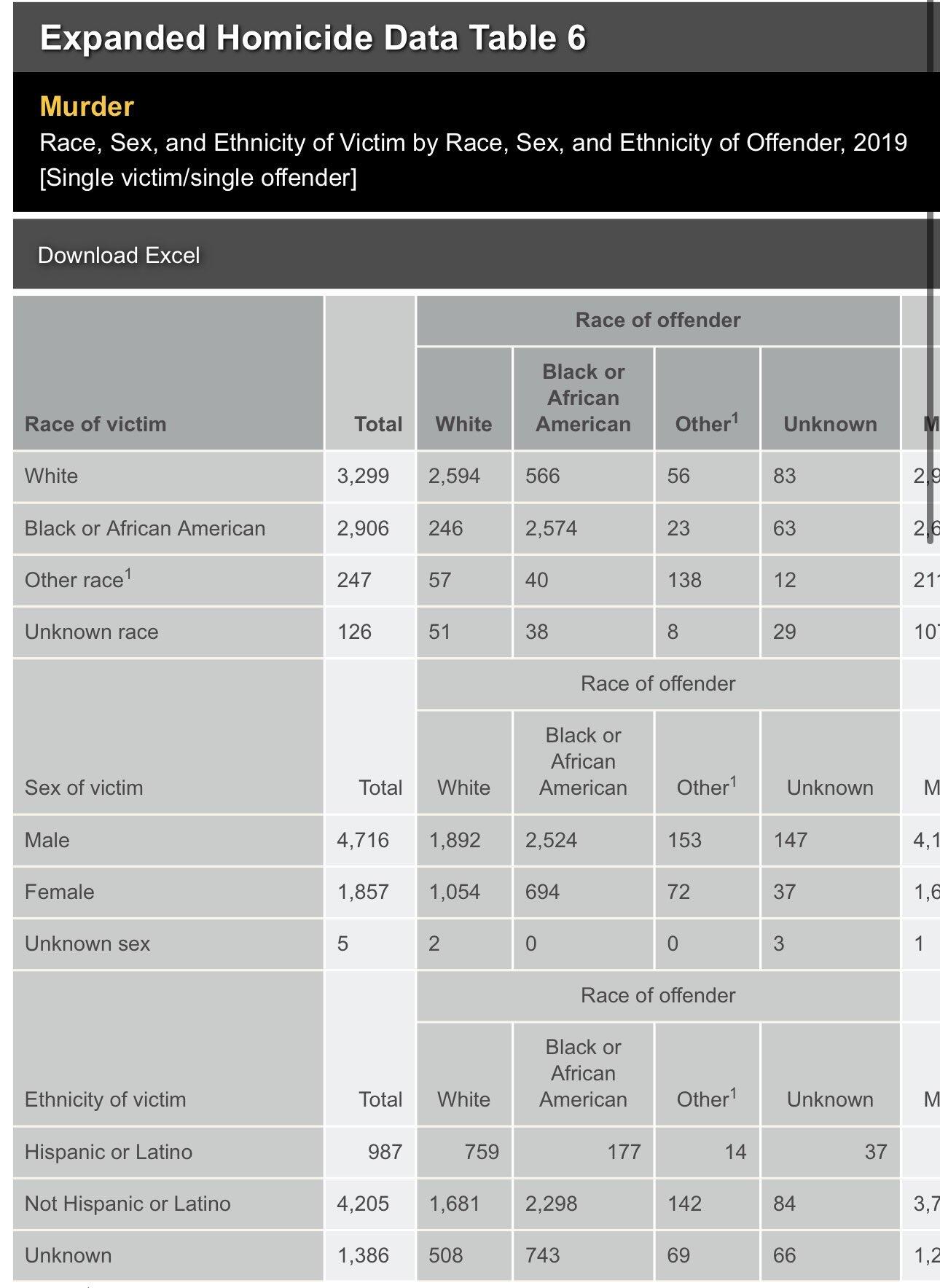

The answer is not race, it's economic.

The less financially secure you are, the more likely you are to lose access to housing and thus need to work more and put more of your income towards a home. This also means you don't have the time nor money to afford to eat well or sleep well. All leading to much higher levels of stress, which reduces rational thinking.

Financial insecurity also leads to parents working all the time, so children grow up without sufficient parenting.

Low money -> More work -> Less sleep -> Low nutrition diet -> Less time to spend with community building social bonds / Less time to spend with children providing sufficient parenting during formative years.

The hallmarks of poverty are the drivers of crime. Regardless of the subjects genetic variation.

In addition considering the southern United States made specific efforts since the civil war to suppress African American access to resources and assets (The segregation of neighborhoods and the destruction of Black Wall Street for example). These efforts were successful as IIRC African Americans have the lowest levels of wealth of any demographic in the United States. Keeping them poor and financially insecure, keeping them subservient to the system.

This coupled with the fact that if you can criminalize a population you can legally enslave them. Legal slavery is still alive in America, provided you can convict the subject of a crime first.

The high crime rates are, at least in part, by design. Keeping people poor and overworked so they can't think rationally and commit crimes, allowing them to be imprisoned and becoming legal profitable slaves for our private prison system.

Thankfully, Bitcoin fixes this by giving everyone access to permissionless banking and sound money to build a stable life on top. As Bitcoin adoption rises in demographics with traditionally high rates of financial insecurity and thus crime, there will be an observable reduction in poverty and crime rates over time.

We all want to reduce poverty and crime rates in all demographics correct? If so, then just help Bitcoin to grow because that's the solution to those problems.

☮️ 🧡 ₿

Sorry I didn't reply! I made a new post with the charts included here: nevent1qqs9xgnfcrtlpeh44gf4s6gn335j9lc2rzudp47t5g3qg8z264rlntcppamhxue69uhkummnw3ezumt0d5pzpd7063e0lyp5g8kxe42mk5r0jazzzxnwdrjj2fw5y3z3dx76q066qvzqqqqqqycj7a2v

🖖🫡

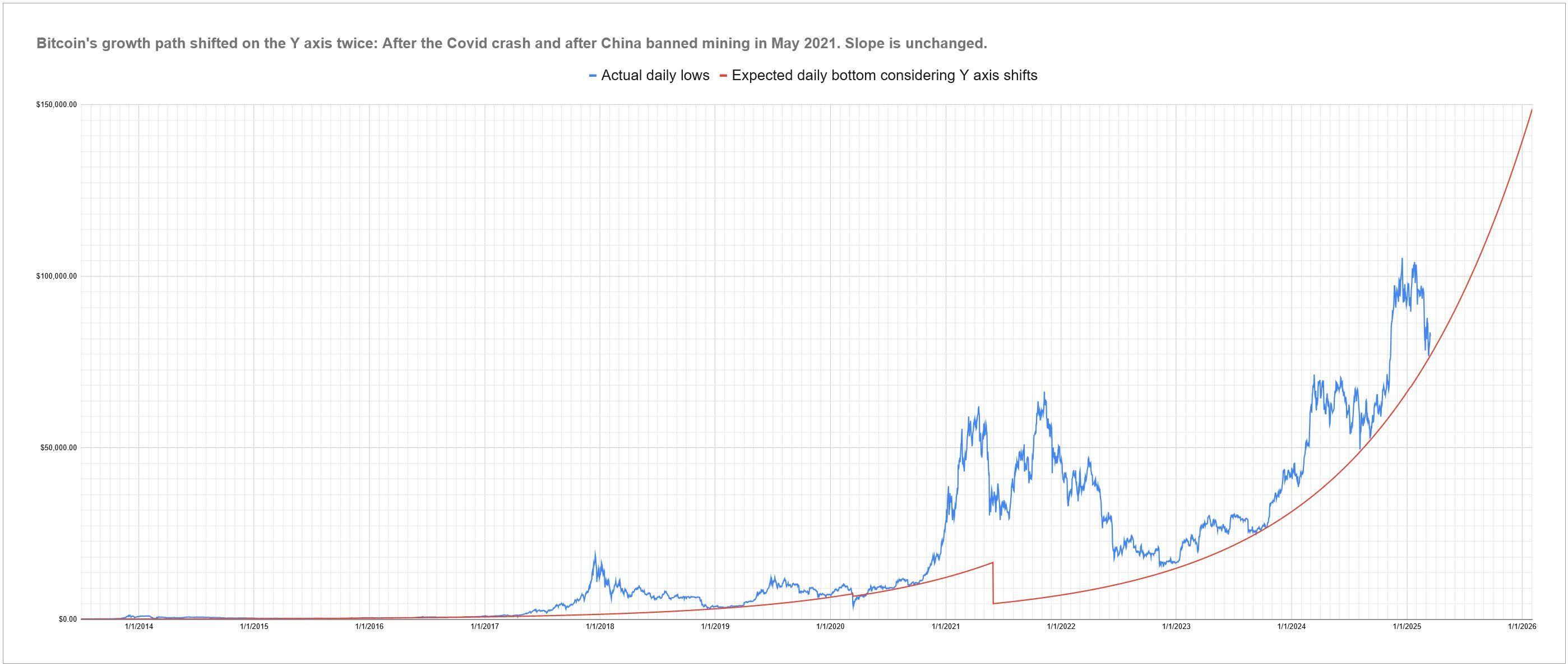

First of many milestones predicted here has been hit.

04/05/2025:

Actual price: $82,774.08

Predicted bottom: $80,000 ($80,067.71 to be precise)

Ratio between price and bottom: 1.0338

99.9% chance we're forever above $80k from now on, unless massive macro events occur that shift the trend line down again.

See y'all in June for the next check in. 🫡

Attached images were made mid March.

☮️🧡₿

So I'm now without my left big toe nail. 🫣 Feels really weird having such a big open wound. 😅 Couple weeks and I'll have new skin, 6 months and I'll have a new nail.

I have pics of the damaged nail being removed, gnarly stuff and very gross lol.

10/10 Do not recommend. Protect your toe nails from the corners of doors people! Ouch.

I have done that, but it's much more time and effort than just throwing a bag in the microwave and eating it 2 minutes later. The harder something is to do the less likely it'll happen at all, so often I'll just skip the popcorn and snack on something else.

I'm just making the point that it's ridiculous that virtually every microwave popcorn on the market says it's "butter" but has no actual butter at all. Even the brands that say "Extra butter!" Or "EXTREME BUTTER" have NO BUTTER AT ALL.

Very disappointing that words have effectively lost all meaning. If it says butter, I want it to actually have butter.

Imagine a world where butter microwave popcorn, actually contained butter.

Crazy I know.

Caught a runaway blueberry mid air after it rolled off the table during breakfast this morning. #Success

New all time high of hashrate. ✅

Upcoming difficulty adjustment of nearly 6%. ✅

Bitcoin market cost below Bitcoin mining cost. ✅

In addition, we're only 3% above Bitcoin's minimum potential price trend line, a trend line only broken during global macro events that directly affect Bitcoin. Tarrifs don't directly affect Bitcoin, mining and stacking may even accelerate as everyone flees everything affected.

We're about to see Bitcoin massively pump to new ATHs, possibly triggering the beginning of this year's expected bubble that touches a million.

See y'all next month! It'll be interesting to see what happens. 🫣🎢🚀

☮️🧡₿

Monero's monetary policy doesn't drive value growth of the underlying token like Bitcoin does.

The equation for value:

Time Value * Energy Value = Total Value

The more time and energy something costs to create, the more value it contains.

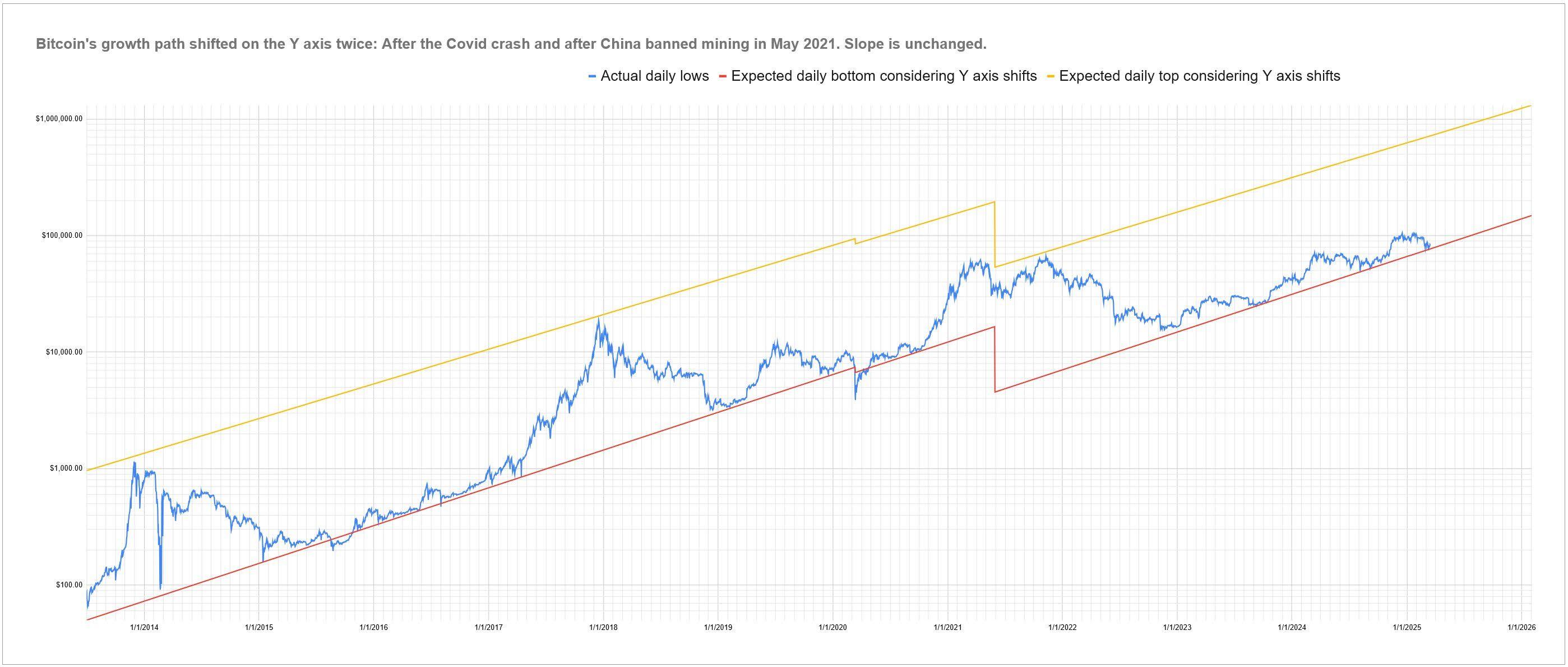

Bitcoin's issuance policy simply doubles the time required to create a Bitcoin every 4 years, the market typically doesn't value twice as much overnight however. Often the energy drops a bit to compensate before it recovers (we see this with hashrate changes around the halvings). This doubling of the time value with virtually unchanged energy value doubles the outputs total value. This is a principle driver that drives Bitcoin higher over time, and attracts greater relative investment than anything else on earth over time.

Monero's monetary policy dictates a flat permanent tail emission of 0.3 Monero a minute. It's never revalued against time, and doesn't attract the same level of interest or investment as a result. Monero will never replace Bitcoin. The economics make it impossible.

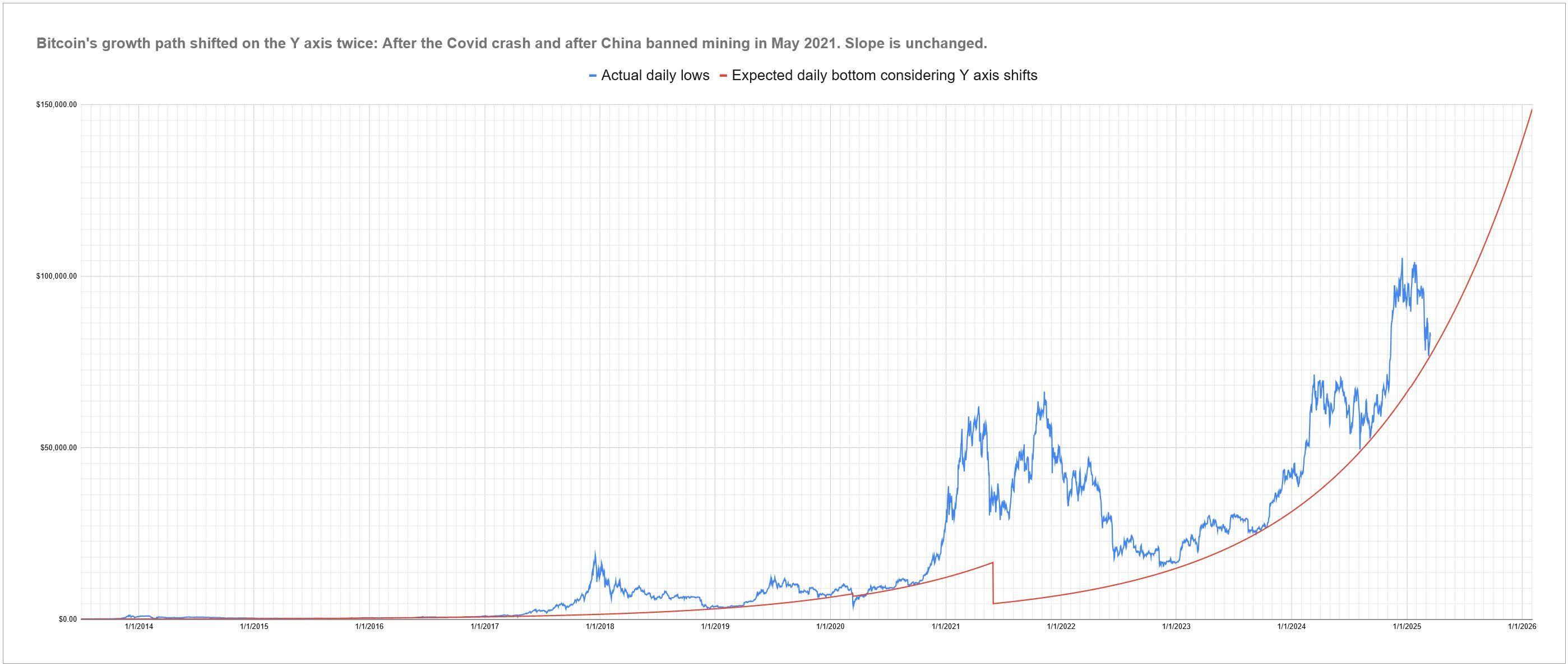

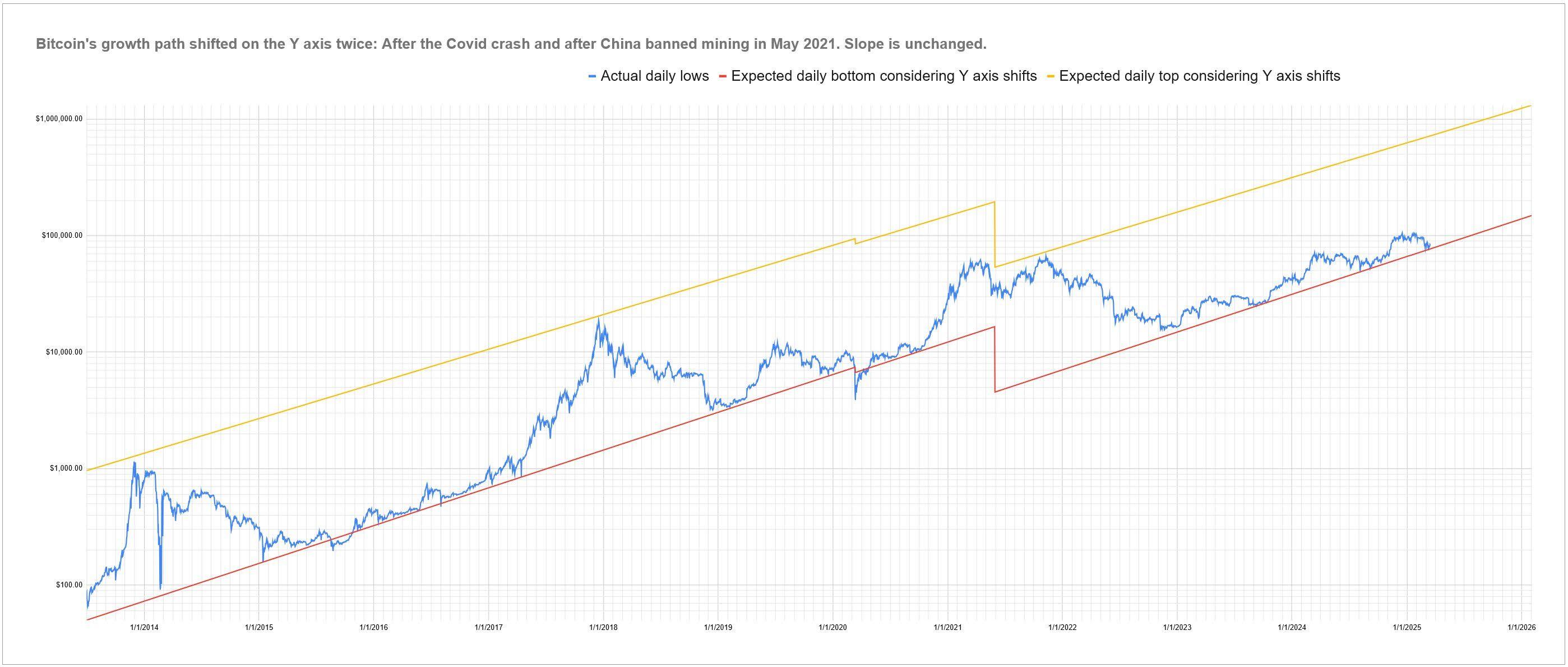

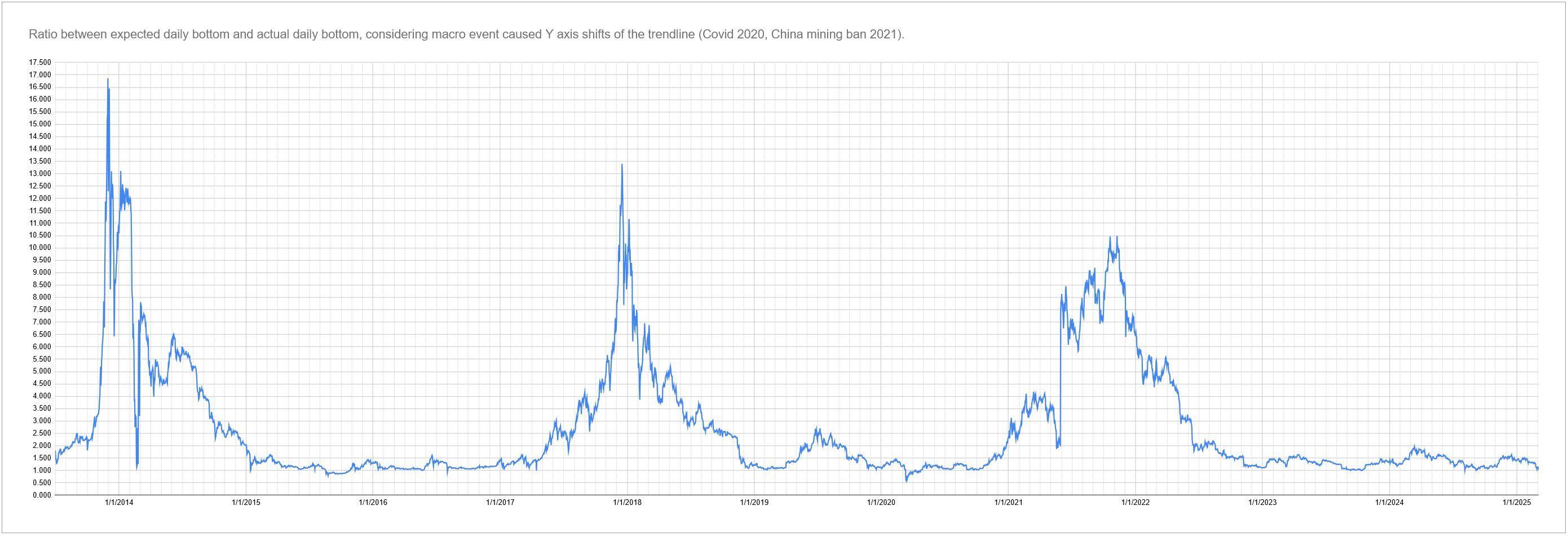

Current potential bottom is $79,741.07, with the price at $81,321.04 today we're at 1.0198 times the potential bottom. Bitcoin has not fallen below this calculated potential bottom trend line 99.9% of the time since July 1st 2013 with a few exceptions of things for which we need to account and adjust.

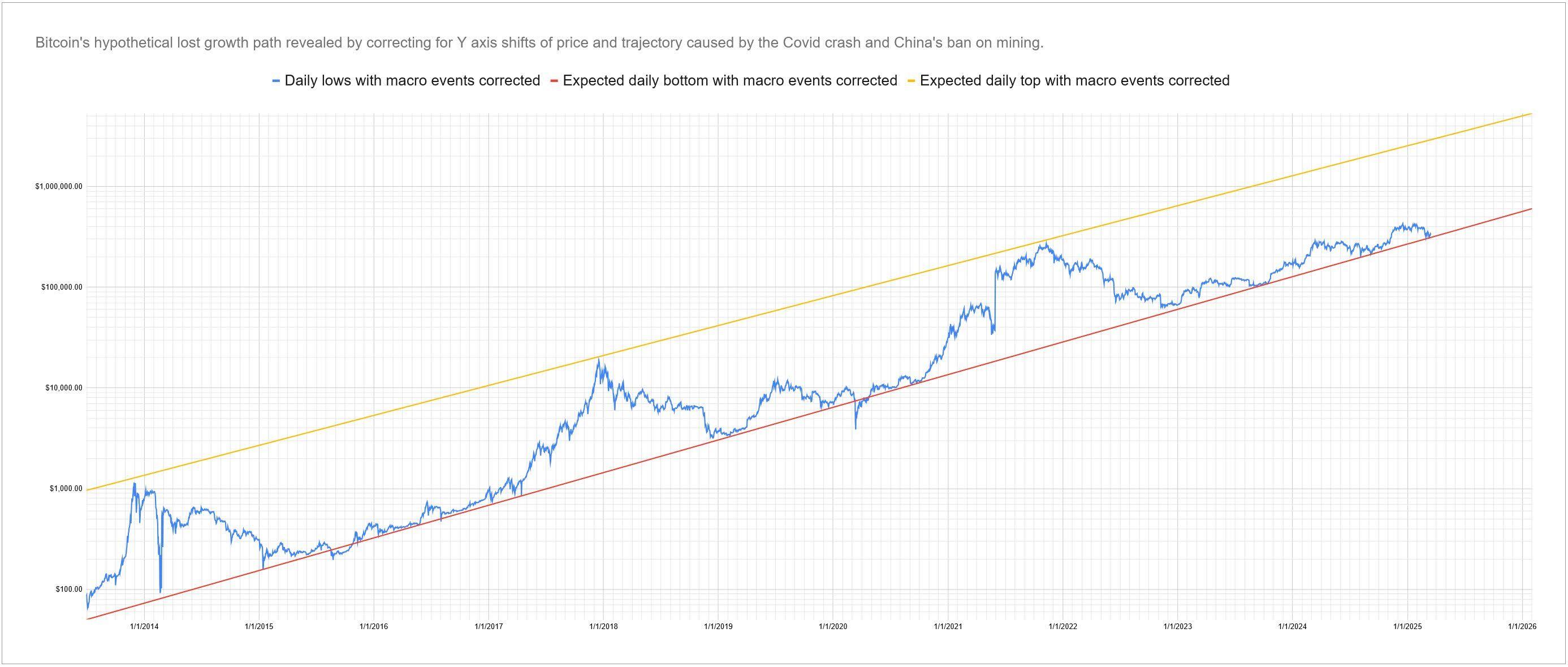

This is after adjusting for the 2 large macro events that actually shifted the overall trend line downward on the Y axis, being the COVID shutdown and the China mining ban, as well as also ignoring the temporary mid 2015 exchange glitch that crashed the price for a few months but did not change the trajectory as it's resumed it's course after.

I know this sounds a lot like "it works perfectly! Except when it doesn't", but my personal view is that this simply means the growth rate of Bitcoin cannot be stopped, it can only be delayed. We cannot predict the future considering the unknown macro events that may very well shift the trend down again and delay it further, but I do know what is most likely to happen if macro events like that don't occur based on the historical data.

By April 5th we will have a potential bottom of $80k, with a strong possibility that we'll never go below that again.

By the end of 2028 we will likely see a potential bottom (unlikely to go lower) of $1,000,000 per coin regardless of the current temporary bubble that may touch that price briefly this year before correcting back to the overall trend line about a year later Q4 2026.

Impossible to know before it happens, which is why even with this data you don't day trade. The important thing this reveals is any shift in the Y axis is a different kind of temporary dip and simply delays the inevitable exponential growth of approximately 110% a year. The Y axis may be shifted unexpectedly, but the rate of growth over the long term is unchanged. Just hodl and you will more than double your spending power nearly every year on average.

Even after the 1, 2, punch of COVID shutting down the world and China, the most populated country in the world, banning Bitcoin mining, it only DELAYED Bitcoin's growth by about 2 years.

Bitcoin cannot be stopped. It's growth is inevitable. We will replace the dollar within the decade as the primary way to transfer liquidity everywhere on earth, and that's only the beginning. We're entering a new age of human history, where for the first time ever we eliminate the rent seekers and money printers from the world by attracting their greed into a system that keeps everyone and everything fair. Humanity is about to be unleashed to the betterment of all.

I mostly enjoy listening to others when in large groups and being a fly on the wall, interjecting occasionally. It's nice. I do talk more comfortably in smaller groups where I know the people better however.

THE SENATE AND THE PEOPLE OF ROME WOULD APPROVE.

SPQR

Monero first broke $100 a token in 2016 and was roughly ₿0.1. 9 years later and the value is $200 and it's worth ₿0.0026.

Losing 97.4% of its Bitcoin value over 9 years.

Also since the dollar loses about 50% of it's value in 10 years, effectively Monero just avoids dollar debasement but doesn't meaningfully grow in any way.

For every $1000 you've held in Monero from 2016 that grew to $2000, you've lost 97.4% of the potential growth or about $75,000. Is losing $75,000 of growth worth the privacy gains of more effectively hiding your $1000? At that point you're robbing yourself friend.

Bitcoin grows 110% a year if you only track bottoms and adjust for major macro events that drop the trend line. With the value more than doubling every year I can easily and regularly split the value into multiple wallets which I might expect to lose access to by chance and perhaps regain access to in the future. Perceived greater privacy is not worth the loss of the greater benefit of exponentially growing savings which can be gifted to others and moved around into various wallets easily.

Bitcoin is the only coin worth holding.

Bitcoin turns all of humanity into a perpetual motion machine.

The only way to win is to not play their game.

Fiat is corrupt, filled with fraud and fuels wars that kill hundreds of millions. It's a system where it's be hurt and/or be hurt by others. It's modern slavery.

Bitcoin is the only option if you don't want your success to come at the expense of others. It's the only option if you disagree with the current system entirely.

Bitcoin or slavery of almost everyone in the world.

Monero is a privacy token. It's not a store of value in any sense.