THANK YOU!

This is such a foundational misconception, it's quite literally destroying civilization. So far you and Parker Lewis are the only ones I've heard who seem to really grasp the significance. It frustrates me so much, I wrote my first Substack post on exactly that topic. Hopefully people will start grasping the truth about money and wake up to the slavery they're supporting by holding dollars instead of Bitcoin.

https://open.substack.com/pub/f0xr/p/money-is-not-wealth?r=3i492j&utm_campaign=post&utm_medium=web

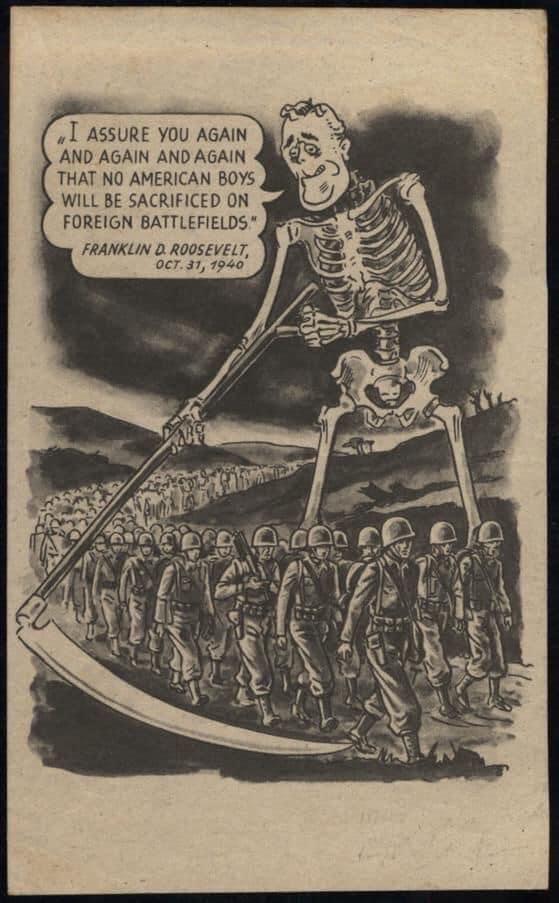

Just another lying sack of shit politician...

"No NATO boots on the ground in Ukraine"

Different century, same lying, pathetic weasels.

People don't understand money flows. Money doesn't "flow into" Bitcoin ETFs or anything else the way people imagine. That's why the people using that irrelevant data to predict prices end up being wrong over and over again: they don't understand the cause and effect of money flows and prices at a fundamental level.

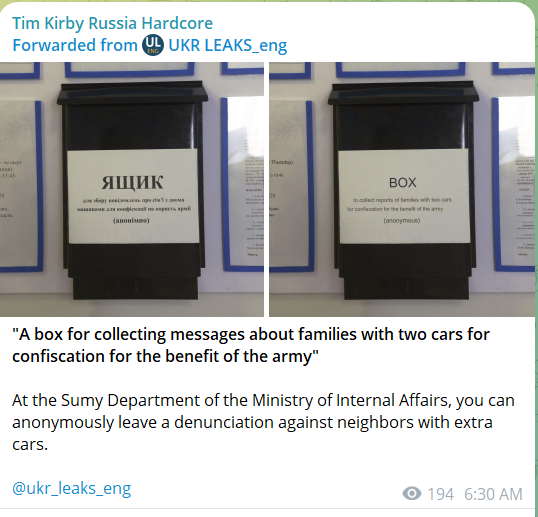

"We have to impoverish the country to send billions to Ukraine. No? Why do you hate freedom and democracy you fascist Nazi Putin-lover?!!!" -no sane person ever

nostr:note19f0glftj7zcdlpev2tff303e90v5dhc3uq0f3qu7x0mmzse9vmhqhqvqk4

#photostr

Great stuff and amazing to see the realization hit.

He does make one mistake though, saying that real estate rises in value because of currency debasement. He's conflating value and price, something even Warren Buffett figured out. I address that exact point in relation to real estate in a recent post.

"Second, just because houses are rising in price doesn’t mean they’re rising in value. It’s a simple concept, but one most people miss. Like Warren Buffet says, price is what you pay, value is what you get. If you buy a house today for $400,000, and in 10 years that same house sells for $700,000, how much did the value of the house change? The price went up, but the house is still the same house in the same location, it’s just a decade older. And a decade of wear and tear is a decrease in value, not an increase. Think of it this way. You can sell for $700,000 and you have $300,000 of “profit”. But if you want the same house back, you can’t buy it for $400,000 again and pocket the $300,000. You can only get the same house back for the full price you received. You haven’t increased your purchasing power at all in terms of housing with that “profit”. Your house hasn’t become more valuable, your money has just become less valuable when measured against houses. In that sense, you probably can’t increase your purchasing power by buying a house to live in, but you can at least avoid losing purchasing power. If you just save money in the bank to buy a house later, house prices will probably rise faster than you can save. That’s especially true if you’re paying rent at the same time. At least with a mortgage, if you pay long enough you own a house eventually. You can pay rent your whole life and you’ll still own nothing at the end."

Hypothesis: If they stop messing with the measuring stick (amount of currency), people will be able to make good decisions in building the economy.

https://video.nostr.build/1a012e437b04b6373e42821f59cdd53fbfa2519e0d0a592cbb4b0edfa1345aa3.mp4

Absolutely correct. The process he's describing where the economy grows, while the quantity of money stays the same, is the deflationary force of growth and technology. When that happens with a public company, their stock price rises and all the holders of the stock are rewarded and it's a wonderful thing.

But somehow when it happens in an economy, and prices fall, and holders of the currency are rewarded, economists are horrified and central banks step in with oceans of new money to prevent the disaster.

We aren't allowed to view money as having the same properties as equity, because the banking system is built on a lie, and deflation exposes and collapses that lie.

https://open.substack.com/pub/f0xr/p/money-as-equity?r=3i492j&utm_campaign=post&utm_medium=web

Ah okay, I'm probably just misunderstanding your comments.

"Governments don't need fractional reserve banking."

"The fed could dissappear tomorrow and the treasury could still issue debt.

It would merely have to be paid for by the savings of individuals, companies, funds, banks, etc..

This is 100% possible without fractional reserve banking and could still be the case on a bitcoin standard in fact."

That's cool, I feel you.

1. Semantics. The Fed is a banking cartel, the banks/ primary dealers and the Fed are functionally the same entity. The fact that banks have to "by law" buy the Treasuries first, before turning around and flipping them to the Fed at a profit, makes zero functional difference in the effect of the debt monetization.

2. Most. Again, semantics. If it's not essential to keeping the system going, why do they do it? Why devalue the dollar by 40% in the early 30s? Why remove the ability for individuals to redeem dollars for gold? Why YCC in the 40s? Why manipulate the gold price in the 60s? Why remove the final link to gold in the 70s? Why the money printing in 08? Why continue printing for almost a decade? Why more printing in 2019? Why print trillions in 2020?

It's not the debt bought by individuals, foreigners, etc that's relevant. It's all the "emergency" liquidity injection. Every item in that list was some version of liquidity injection, financial repression, or the equivalent designed for the purpose of keeping the banking system propped up so they can keep the Treasury propped up. If the Treasury wasn't dependent on that system to indirectly finance their fiscal incontinence through inflation, I could see your point. But it's either that, or the Treasury prints it directly. The outcome is the same either way, except for the size of the bankers' cut. The Weimar central bank "discounted Treasury bills" too, instead of letting the Treasury print it directly. Didn't save them in the end either.

Sure the balance sheet shrank as debt rose. Reverse repo also got sucked down from 2 trillion to almost nothing. You think reverse repo goes to zero, Fed balance sheet keeps falling, and government debt keeps rising at 2-3 trillion a year? My guess is no, I expect the Fed balance sheet to double from here by 2030.

3. I'll wait to see the US government run $2.8 trillion annual deficits and borrow Bitcoin at under 5%. You can't borrow hard money at interest for non-productive purposes. You'll get wiped out so fast your head will spin. The US government will be no exception.

That's my opinion, we'll see how it plays out.

When the Fed creates new base money, that IS the savings of individuals and companies. It's their savings being involuntarily diluted away by an increase in the base money supply.

If the Fed disappeared, the Treasury could issue debt, but what would it be denominated in? The dollar base settlement layer is an SQL database at the Fed, and the Federal Reserve Notes in people's pockets. Without the Fed, who's going to issue dollars? The Treasury would have to do it I guess, which would make the question obvious of why they bother with the charade of issuing debt in the first place.

So the Fed can print within reason, but not really because they can't allow inflation? But if they do print it doesn't matter and has zero effect on the global economy and doesn't cause inflation? Can't quite square that circle personally.

If it's just a number, why bother? Why not do what you suggest and let individuals buy the debt? At what price would they be willing to buy? 15%? 50%?

When the Fed create smoney to buy Treasuries, by definition the money doesn't stay at the Fed. The Fed gets the debt, the Treasury (eventually) gets the money. And they spend every penny about as soon as they get it, so then it's in private hands, driving up prices.

It takes a special kind of willful blindness to look at a rock with some chips taken out and say that proves it was a tool made by human intelligence, then look at a planet teaming with life that's complex, orderly and functional beyond our ability to understand and say that's obviously the result of random chance processes.

U.S. Money Vs. Corporation Currency, "Aldrich Plan.": Wall Street Confessions! Great Bank Combine https://a.co/d/7SiNkQv

If you want to understand how and why this happened.

The US government ceded control over issuance of their currency to a private banking cartel 111 years ago. The US government issues debt, but they're at the mercy of the private banking cartel to create the currency to buy that debt. The banking cartel always has their back, but at a price: the corrupt bankers own the corrupt politicians.

So in effect the government always gets what they need, but that's mostly because they're just empty suits acting a part in the banking cartel's dog-and-pony show.

If you only have 2 Benjamins in physical cash, you probably don't understand the banking system very well

Cash is the only self-custodial fiat. You can say that doesn't matter, it's still fiat. But it does matter, because it protects you from significant risks, and holding cash weakens the fractional reserve banking system and accelerates the collapse of the fiat scam.

Everyone should make an effort to hold their emergency savings, 3-6 months at least, in physical cash. Keep the bare minimum required for transactions in the banking system, and of course long term savings in self custodial Bitcoin.

It's a lot harder for them to enter huge amounts of debt without fractional reserve banking...

Yup, June 4 and it's well over knee high, looking nice and green but a little on the dry side. Hoping for rain today 🤞🏼 otherwise it'll need some irrigation in a few days.

nostr:note1l2qdjl9z60xzumjxg2k287amyxq4qgpczvs75ugajyhcp8y54t5q27jcae