12k more to go! nostr:note1cd3zwp5jd7dl6uj94jr9e96us978h57j3evxrh2nfz8w47pezrhqhlej35

What’s the exit strategy for Ten31 and its portfolio companies? How do the LPs (and GPs) get liquidity? This is the failure of the modern VC — every operational decision considers (if not is focused on) the exit. And since a fund life is 10 years, every company is trying to flip in 3-5 years.

When bitcoin gets more adoption, the 4-year appreciation rate will set the risk-free rate for all investments. All companies will be forced to maximize the value of their assets or prune back their balance sheets through asset sales. I expect “Big Tech” will be selling a lot of their assets.

Stock returns will be forced to compete with bitcoin returns and most large companies will not be able to keep pace. Across the board, companies that have benefited from lazy monetization of a large network effect will be fundamentally transformed as traditional stock holders choose to save using bitcoin rather than invest in stocks.

Bitcoin is going to decentralize and shrink modern commerce. Through that process, some of the network effect monopolies (e.g. iPhones) will be toppled.

I pay for his annual membership…y’all should too.

12,250 to go

nostr:note15ku2ta7kwxul7a02vpkqn0396lzt39r9fz0xl36nlvyl43q43yusna0pgy

This next bull run we need fewer influencers and “bitcoin only” personalities and more physical world builders. Real companies that and individuals who produce real goods and real services and choose to use the technology that is bitcoin to save their productivity and transact on rails outside the fiat world.

This bitcoin influencer culture of ideas and voices and conversations isn’t going to change the world. Neither is an intense focus on bitcoin only companies applications.

The real economy will contract significantly when the fiat debt bubble pops. The real economy won’t be urban apartment complexes, mix use commercial real estate, fancy restaurants, or entertainment and experience industries.

The real economy is energy, food, transport, infrastructure (on a family /community level). We need these people who work real jobs to adopt bitcoin as their primary savings and then payment technology. We change the world when these people living real lives and adding real value choose our alternative system as their preferred method of commerce. And we do that not by regurgitating the same tired influencer podcast stories and sharing the same MSM headlines and op-eds.

Real economy adoption should be our mission for the 5th epoch.

Orange pill your butcher, your grocer, your local farmer, your county sheriff, your plumber, your electrician, your gas station, your utility provider. Bitcoin adoption through personal relationships … not mass distribution marketing gimmicks.

Hello Nostriches, it’s time for a @Titcoin #zapathon

I will zap you 696 sats if you share either of these two #BitcoinOutLoud reads.

They are phenomenal pieces which I believe should be digested by as many people as possible, and I hope my readings do them justice.

➡️ STRANDED: How #Bitcoin is saving wasted energy and expanding financial freedom in Africa, by nostr:npub1trr5r2nrpsk6xkjk5a7p6pfcryyt6yzsflwjmz6r7uj7lfkjxxtq78hdpu

Fountain: https://fountain.fm/episode/IHEmu493uVdi5LUF11TZ

Everywhere else: https://pod.link/1694392423/episode/8dfd82f4d798bbe0c435564095997d74

➡️ Assessing the Health of Bitcoin, by nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a

Fountain: https://fountain.fm/episode/bKEbfNSY4JaEjELoEuEL

Everywhere else: https://pod.link/1694392423/episode/2de7da4b3be96a87e86f6118decb676d

#AnotherFuckingBitcoinPodcast

For consideration: reading other people’s work to drive traffic to your content is cringe.

Look back at how things were financed in the early 1900s in Western Europe on a gold(ish) standard. Ventures were financed mostly with debt.

I would expect decentralized debt markets will flourish. Even under a bitcoin standard if I was to buy a business or buy farm land, I would want to finance it with as much debt as I could raise and keep as much of the equity as I could. For financial upside AND for governance control of the venture.

I’m not sure I agree with this take. The current VC model is a fund model where the capital allocators raise a lot of capital with the promise that they’ll deliver returns within a ten year period. From there, the VC firm is required to allocate capital, regardless of the economic environment or companies on offer. In order to deliver those returns on that timeline, VC terms and conditions are often counter to the entrepreneur’s success…with the investor creating governance control on the venture regardless of their ability to operate a business. VC funds (and private equity funds) actually destroy productivity as they masquerade as value creators with LPs.

Debt, on the other hand, is a priority claim on cashflows but they often don’t have as much governance influence on the venture. That’s good for a business because it leaves the residual claims on the equity of the business with the entrepreneur.

There is no business case for flying cars. Land based maneuvering is plenty fast for the speed of modern commerce and is much more affordable than any propulsion engines required to get cars up in the air.

The next stage for mass bitcoin adoption is underwriting debt with bitcoin AND asset collateral to lower the liquidation risk that comes standard with bitcoin collateralized loans.

Buying farm land or another cash generating business with conventional debt augmented by bitcoin collateralized loans will lead bitcoiners to the next level of prosperity.

Capital gains tax >> 1.5% fee on 100%+ annual appreciation

But what about the global jurisdiction for ENERGY? It’s the key but missing piece.

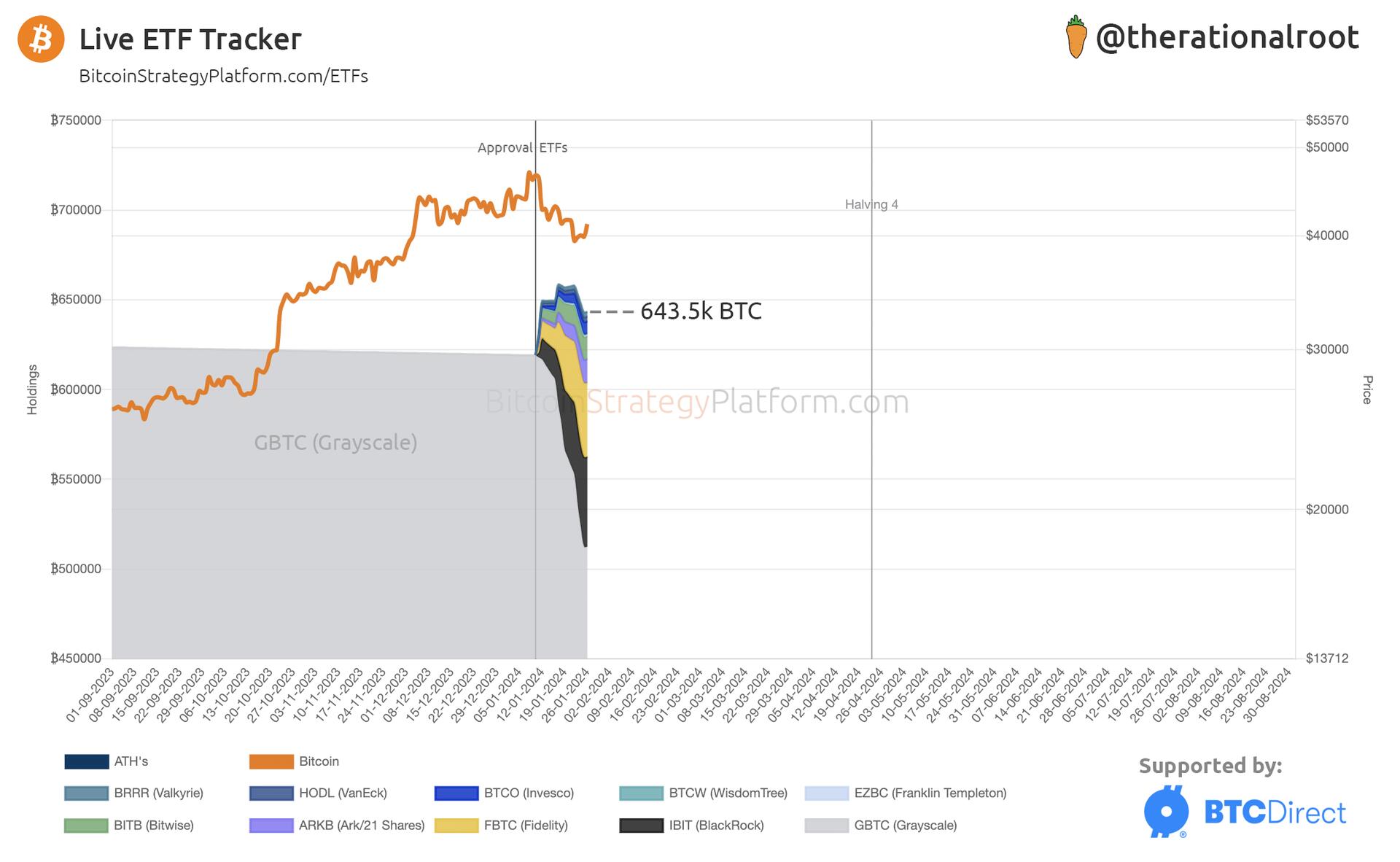

This is cool! Can you eventually include a view that has total ETF bitcoin out of the total circulating supply (or 21M). Without the y-axis visual adjustment … so we can see how much of the total bitcoin is held by “conventional Wall Street demand”

This pleb allocates 99.8% during this price action.

nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx THIS IS TRUE ABOUT EVERY SINGLE VENTURE /PRIVATE EQUITY INVESTMENT OF THE LAST 20 YEARS. THE ENTIRE PRIVATE FUND MODEL ONLY CARE ABOUT THE EXIT. VENTURES EXIT TO PE, PE EXITS TO PUBLIC. IN RATE CASES, LIKE WEWORK, VENTURE TRIES TO GO STRAIGHT TO PUBLIC EXITS…AND YOURE RIGHT, THEY USUALLY FAIL THE MOST SPECTACULARLY.

BITCOIN SUCCESS ENDS THE FUND MODEL. FUNDS AND EXITS ARE ARTIFACTS OF FIAT.

Looking forward to seeing zaps for long distance consulting on real world projects. Solar installations, retaining walls, water pumps, fencing install, forest management, etc.

When Peru can consult Poland and Wyoming is helping upstate New York all connected by the freedom tech that is NOSTR, humanity (the plebs) will be truly unstoppable!

#m=image%2Fjpeg&dim=864x555&blurhash=rxM*58j%3FoLWBt7WBt7WBofWVbHWBayoffPj%5BfQWV%7Eqayt7j%5DaeoffiofayxZj%40t6j%5BWBa%7Cj%5Bj%5BoeD%25ayofa%7Cj%5BfkWBWBj%5Bt7WVRkayofj%5Bj%5BfQWB&x=0634bcc343b8a43d9ecce6bbb39be31052d93f18c9ebcc4c60f8eb41a1fa565b

#m=image%2Fjpeg&dim=864x555&blurhash=rxM*58j%3FoLWBt7WBt7WBofWVbHWBayoffPj%5BfQWV%7Eqayt7j%5DaeoffiofayxZj%40t6j%5BWBa%7Cj%5Bj%5BoeD%25ayofa%7Cj%5BfkWBWBj%5Bt7WVRkayofj%5Bj%5BfQWB&x=0634bcc343b8a43d9ecce6bbb39be31052d93f18c9ebcc4c60f8eb41a1fa565b