Assuming corporations continue to exist in the way we experience them today under a bitcoin standard, I’m not sure bitcoiners can ask for let alone expect much more than this. Yes, I appreciate trust is involved (as nostr:npub17nvfw7g53nxjghyd2zg552z06cke0jc0k69hj7ns7f9pw26j9kusap4u85 points out) and there are considerations around using a single address but still this is pretty dang good for this first round of ETFs.

Well done, Bitwise! nostr:note1rsglm2a3qpnq9unstsfnx4y09y3jl5vzhsfvc7z69xrva3gz4dxqf9r2j3

Sure but the value of a casual in-person street performer enhancing the real-world experience of a couple walking down the street experiencing a real moment that would otherwise be devoid of music os different than scrolling through a timeline of content and listening to a recorded, disassociated clip of music with no association to a real moment of importance.

Even the 1950s-1990s street performer had a guitar box hoping to get 20 people to throw in a dollar a piece. The actual yield from the old day street performer was quite low and represented the “value” that performer was really contributing. Further, those performers were filling in the gaps of their income, using street performances as the method to get real “gigs” in venues that would bring them more of an audience and more success.

The modern street performance that has its own in-show marketing and hook and drawn out process that pressures onlookers into contributing to maximize the performer’s yield is also very fiat.

The modern content creator is gimmicky and short-attention focused which prioritizes more TikToks and fewer symphonies. V4V ultimately is going to put value on symphonies and NOSTR is going to enable the best symphony to find its way to the ends of the earth to give people hope who otherwise couldn’t experience that hope.

But an initial release of most original music or the “cool cover” of a Journey classic or the podcast episode discussing the latest “thing” and how it applies to bitcoin…those are (for all intents and purposes) worthless when it comes to monetizing via the internet.

Monetizing social media is a relic of fiat 2010s … there is no long-term V4V money to be created through sitting at home or behind a computer and typing what a person thinks or the stuff a person creates that is distributable across the internet with a click of a button.

V4V comes from real goods and services being contributed and delivered within local communities. V4V is a return to the 1950s-1970s with the benefit of instantaneous global communications.

NOSTR is a freedom technology, a coordination technology. NOSTR is NOT a technology to “monetize” one’s ideas nor one’s content. This will be the tension in the system that plagues people trying to fit the 2010 content model into NOSTR’s open source, freedom tech reality.

Monetizing social media is a relic of fiat 2010s … there is no long-term V4V money to be created through sitting at home or behind a computer and typing what a person thinks or the stuff a person creates that is distributable across the internet with a click of a button.

V4V comes from real goods and services being contributed and delivered within local communities. V4V is a return to the 1950s-1970s with the benefit of instantaneous global communications.

NOSTR is a freedom technology, a coordination technology. NOSTR is NOT a technology to “monetize” one’s ideas nor one’s content. This will be the tension in the system that plagues people trying to fit the 2010 content model into NOSTR’s open source, freedom tech reality.

I am enjoying the price anxiety around $40k USD/bitcoin. It’s more fun than the price anxiety around $15k/Bitcoin from November 2022.

#BTFD #HODL

This was a big one.

nostr:note1cz7e6s3n4k6p0x2eeeauj8ypydpj0sxmsx067r9yygwhw9glzlfsw97u5t

What’s the first fiat economy thing to break in 2024? When?

That’s got to be total bitcoin out of 19.5M … can’t be UTXOs, math doesn’t hold up.

Reduce consumption, solve “man-made”climate change. Raise the risk-free investing rate. Save using #bitcoin.

Credit - as we know in the modern world - it goes away. That improves life for the Common Man.

Nah, government and corporate bureaucracies are too slow, inept to get this sophisticated. Also, when bitcoin becomes the successful money (1) enforcement agencies will get smaller and (2) the people who work for those agencies will want exposure to bitcoin.

If for whatever reason (2) does not play out then they’re hiring incompetent idiots which then pushes us back to government bureaucracies are too slow, inept.

The good guys win.

In fact, it’ll fall dramatically from here … and then stabilize … not sure anyone should be invested in real estate if the equity in their home is greater than their bitcoin stack.

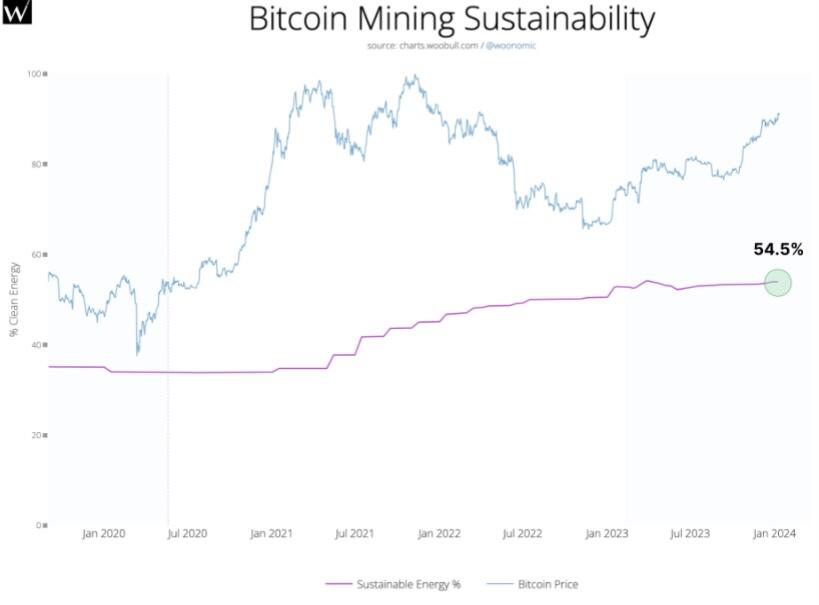

Not sure where you’re getting your number but also confident that no matter how bitcoin is defined it will not qualify for most ESG funds. They’re focused in incremental generation capacity or explicitly focused on development of certain technology (I.e. hydrogen, DAC). Bitcoin mining is coming in behind the bad investments to fix them but more than likely will not qualify for the mandates that the funds have defined in their investment documents.

Also, it’s worth starting to consider the difficulty adjustment, too. Bitcoin mining isn’t profitable in perpetuity…it is the most ruthlessly competitive business out there. With plenty of existing energy sources with a marginal production cost of near zero, there will be no sustained opportunity for incremental build out of new renewables on the back of Bitcoin mining. Money forward economics trump all-in economics every time.

If they don’t know economics, then Basic Economics and anything else by Thomas Sowell.

If they know economics, then Ways and Means by Roger Lowenstein. Highlight how reluctant Congress was to print money even when printing money was REQUIRED to win the Civil War and how the federal government created many of the financing structures (income tax, federal currency, federal banking) we still deal with today in that moment of existential crisis.

Doing my best not to allow it.

PSA: stack harder or someone else will.

At this point, it’s one of the last remaining ways for governments to encourage “manufacturing” “growth” in geographic areas that otherwise wouldn’t have free market economic activity with the current conditions. As long as governments are able to create money, they will continue to funnel it towards these “green” projects because the perception of “jobs” and “opportunity”. People will (hopefully) get smarter … things will continue to get more expensive and it will be harder for the government to deny their role in inflation.

Not only that but electrification is making the population more dependent on the grid…think Sovereign Individual.

The real disturbing technology governments are preparing is the direct air capture systems. Literally pushing money into a community to “clean” CO2 out of the air. But relatively small and they can deployed anywhere and everywhere - assuming there is enough construction capital and operating capital provided.

Talk about money laundering…that’s a special kind of money laundering. A bitcoin standard - the return to sound money - will fix that.

Yep, the whole name of the game with renewables is overbuilding capacity (capital destruction) to be able to have sufficient capacity in times of need.

This leads to the near constant curtailment of renewables in many jurisdictions and is why many bitcoin miners are currently finding solid PPAs on renewable assets, but it is not because these are “good assets” to mine bitcoin with. It is because they are a terrible allocation of capital in desperate need of a solution.

Renewable investments were wasteful capital allocations made due to perverted diligence processes. Bitcoin is positioned to benefit from fiat mistakes.

Make no mistake, in most jurisdictions, “renewable” projects will not be built on a bitcoin standard. Oil and gas primarily … eventually transitioning to nuclear.

“Sustainable energy” is a farce. Stop giving credibility to the climate narrative. Climate action is communism.

The only reason bitcoin mining uses wind and solar is because it is overbuilt due to subsidies. Bitcoiners trying to justify Bitcoin mining on the basis of how much wind and solar and hydro it uses is a bad look for bitcoin…in using subsidized energy, it is monetizing the capital allocation mistakes of the past, not monetizing “sustainable” energy.

Climate action is communism. Bitcoin fixes this.