What's great about this, is that independent journalist that go after the truth A) can't be censored and B) can be funded by zaps from the community for providing value. So bullish on Nostr.

Credit to nostr:nprofile1qqstm84k2lp9knmvmf5gw88zvfvar7duvfpqfplryfystdn55ug2gksprfmhxue69uhhyetvv9ujumn0wd68yurvv438xtnrdaksz9thwden5te0wahhgtnwdaehgu3wwpshyareqyg8wumn8ghj7mn0wd68ytnhd9hx2j8uly5 for bringing that to my attention. I haven't even scratched the surface of the freedom technology in my hands yet.

Glad you're okay. Hope he was as well. Praying that insurance will resolve the matter quickly and get your car back in a good condition.

100% I figured we need enough for at least an 80% drawdown. We also live below our monthly income, so we should be good on that end. Unless there's something major. We have long term credit lines that we could do minimum payments til it runs back up.

From what I understand, it’s immediate.

Anything I’m missing nostr:npub15dnln6cukw3yrflnv3hnrntdt9amh0uw466u6tns05ymqp3nal4qzz3lfc?

Looks like that's how the news is reporting it.

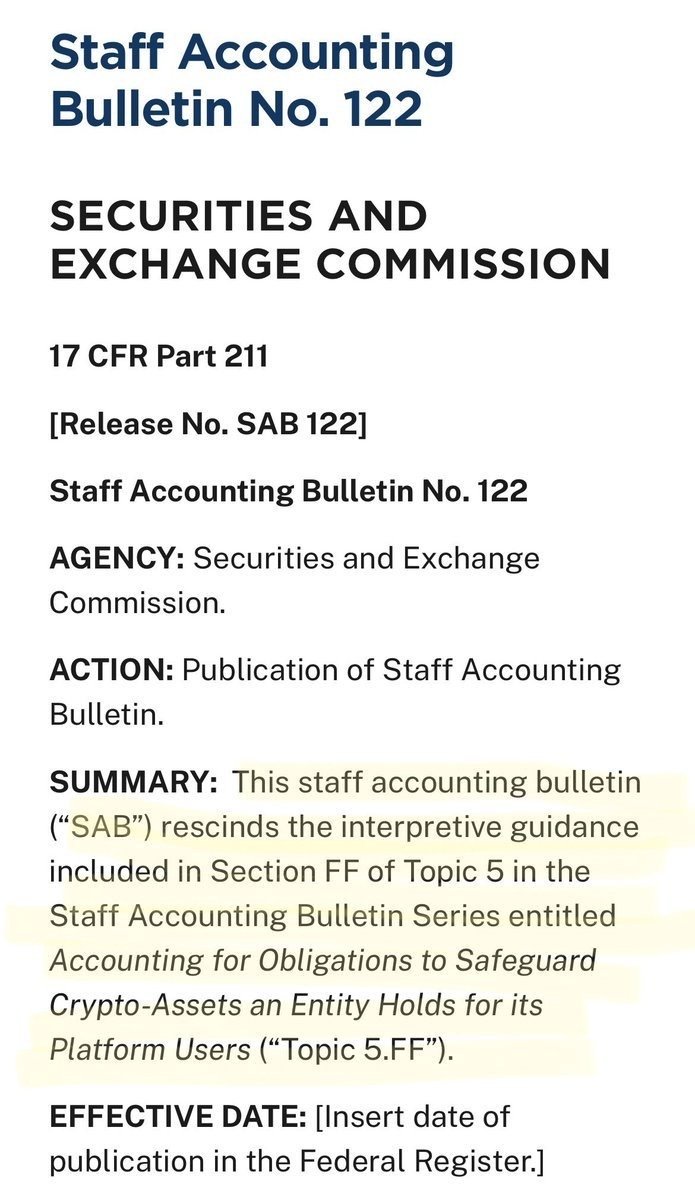

They don't have an effective date listed on the SEC's website. Do you know how that process generally goes?

Same thing happened to me. I messaged the Strike customer support, and they were able to swiftly help me out. Transitioned all our fiat on the 30th of December. While bill pay was showing up, then went to pay the mortgage on the first and the option was gone. They greenlit my account before I incurred any fees (16th day in my state).

Based. Strike's bill pay has been great so far. I converted all our finances to Bitcoin for this year. Our Fiat checking account is the equivalent of a clearing account for us now.

I'm interested to see how this plays out for me. I will choose one of the following:

Option A

1) Get paid (end of month paycheck), and withhold enough from pay to cover mortgage/rent on the 1st

2) Pay mortgage/rent (1st of month)

3) Sell the rest of our Fiat for Bitcoin

4) Spend on credit cards for living expenses (1st-end of month)

5) Get paid (mid month paycheck)

6) Pay off credit card last day of month

7) Sell Fiat from mid month paycheck for Bitcoin

Option B

1) Get paid

2) Pay bills

3) Sell Fiat for Bitcoin

Option C

1) Continue just doing what I'm already doing to live on a Bitcoin standard (see my previous post)

#FreeRoss

Just tracking my vote progress...

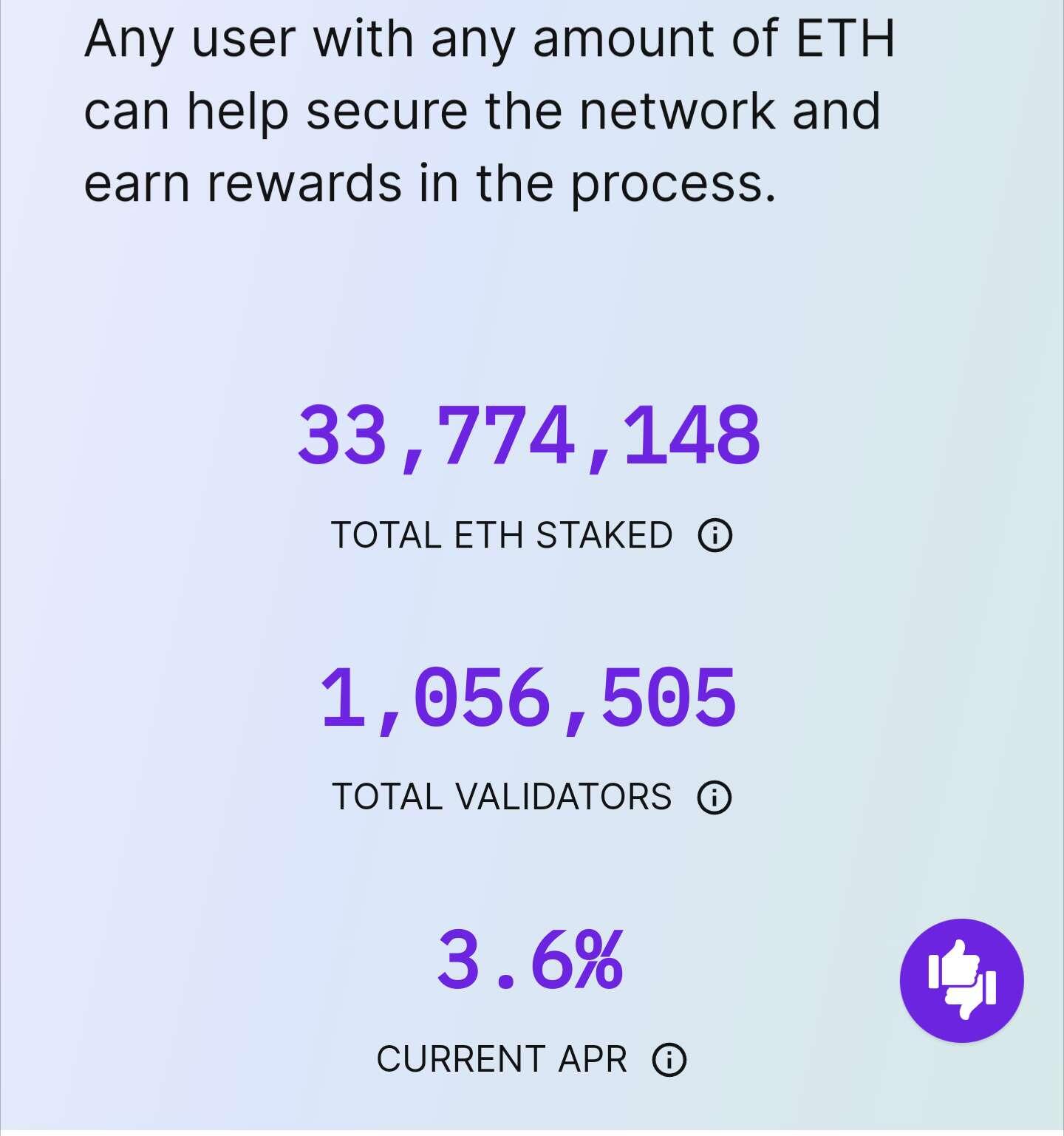

You can get CDs with better rates than that...

I try to help people understand this. Granted, it took a major life altering event for me to learn that lesson. Don't take any day for granted. Hug those you love.

Wouldn't it be crazy if their crypto backed loans were just a way for them to dissuade people of making a run on their Bitcoin...

Scrolling with Castle in the background. It's been quite enjoyable. :)

Glad to hear it! Freedom go up. :)

Probably that, and it would provide their citizens with too much freedom to get around government controls.