Could be less time than most people think

We will find ways to make it better

He's always looked like an ass clown 🤣🤣

Use it if you'd like! Please provide credit if you do

I believe he was one of the people who's numbers I looked at. Great video. Gregs content is awesome.

Does $42,000,000 #Bitcoin sound stupid to you?

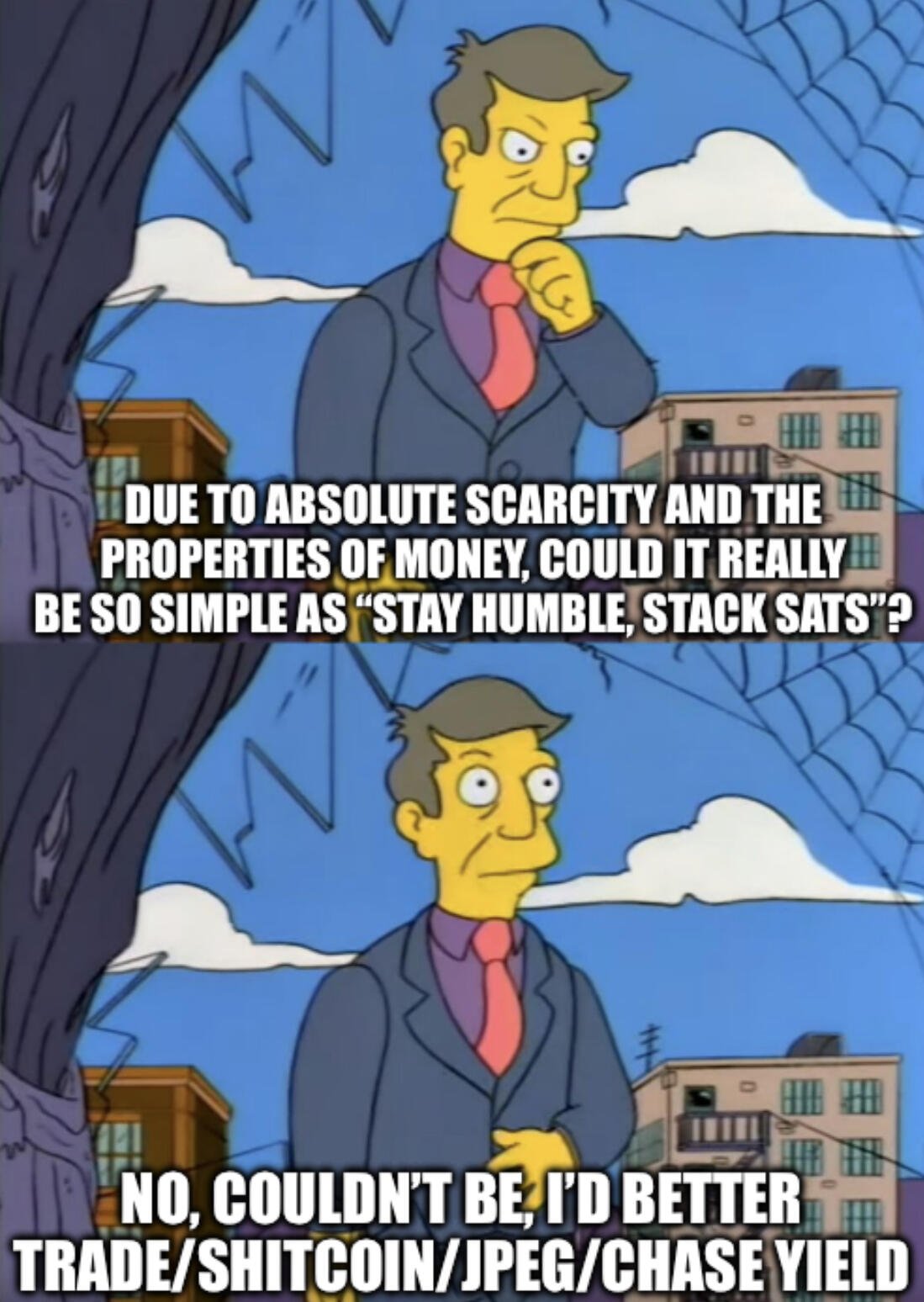

I thought the same thing until I considered that #BTC has all the characteristics of money.

It will cripple the stock market and real estate values.

Why?

Bitcoin is the first ever asset that can be used as a medium of exchange, unit of account, and store of value.

We used gold as money for thousands of years. It was very hard to manipulate the supply of gold, so it remained valuable for a long time.

The problem with gold was always that it wasn't portable and divisible.

Government-issued currencies disrupted gold because they were easy to transact with.

Real estate and stocks became a great way to store value because government-issued currencies aren't real money; they can be printed at will.

And now I can't stop thinking about how Bitcoin will absorb ALL MONETARY VALUE.

Bitcoin is digital gold - it combines the portability and divisibility of digital money we use today with the scarcity of physical gold.

It's the only asset that's ever been able to do this.

At today's prices, Bitcoin is a steal when compared to the values of all assets and commodities in the global economy.

Buying 1 BTC means you are buying 1/21,000,000 of the world's money supply, forever.

This means you own 0.0000000047619% of the supply of the world economy's coupons representing value.

The value of all monetary assets today is $900 TRILLION. 0.0000000047619% of $900T is $42,000,000.

The thing that's impossible to consider here is that Bitcoin is scarce while everything else is abundant.

You can build more houses.

You can mine more gold.

You can issue more stocks.

But you can't create more Bitcoin, no matter how hard you try.

If there's only 1 BTC available to buy in the global economy, how much will the world's elite pay for it?

These amounts will eventually be so insanely high that only 1 BTC will be able to represent the value of 1 BTC.

The world's entrepreneurs will be fighting to create value because that's the only way they'll be able to get more BTC.

All monetary value will eventually collapse into Bitcoin. We will see a $1,000,000 BTC, then a $10,000,000 BTC, then a $42,000,000+ BTC.

Don't believe me?

I don't care.

Learn how Bitcoin works, or just keep waiting for things to unfold.

Being able to transfer and store value WITHOUT A TRUSTED THIRD PARTY will become more valuable as human societies develop with time.

We interact with more people who we don't know than we ever did before.

We can trust fewer people.

And yet we are expected to trust banks (corruptible people that we don't know) to store our wealth?

Historically, trust based money has never worked.

Bitcoin is designed to be the world reserve asset.

This will take time to happen... it could take 10, 20, or even 100 years.

In the meantime, anyone that stores wealth in #Bitcoin will see prosperity, while anyone who stores wealth using anything else will have their money taken from them bit by bit (interest, taxes, fees, etc).

Bitcoin will be the Great Reset.

Bitcoin will lead to the biggest wealth transfer in human history.

Bitcoin will absorb all monetary value from the broken legacy financial system.

The majority of people don't understand this yet.

In 20 years, #Bitcoin will be a part of everyone's life. Even if you can't visualize this yet, put in the time to study it.

If you're a beginner, here are some topics you can start learning about:

- History of money

- Why gold was money

- Central banking

- Fractional reserve banking

- Executive Order 6102

- The Nixon Shock

- What is fiat currency

- Money creation in legacy financial system

- Bitcoin supply and demand

- Decentralization

After you put in the time, it becomes obvious that decentralized uncorruptible money is where the world is going.

Regular everyday people don't want to be scammed by their bank and the only way to do so is to eliminate the bank from our finances.

Bitcoin does that for you by allowing you to store your wealth in your own possession instead of trusting banks to hold it for you.

Almost anyone can be a Bitcoin millionaire for $350.

Here's how:

A Satoshi is 1/100,000,000 of a BTC.

1 million Satoshis cost $350 USD.

Within 3 Bitcoin cycles, I think 1 Satoshi will be worth $0.01+, meaning your 350 USD investment is worth $10,000+.

1 Satoshi is currently worth a fraction of a penny. You can buy 2,000 Satoshis for 1 Canadian Dollar, 3,000 for 1 USD, etc.; you don't need to buy them all at once.

Satoshis can be thought of as a digital token.

Satoshis provide utility in multiple ways.

1) Store of value

The best-known way that Satoshis provide utility is by being a store of value. You can hold Satoshis for as long as you'd like. The network will never issue more than 2.1 quadrillion Satoshis. The buying power of Satoshis will increase over time because 1 Satoshi will always be 1 Satoshi. The supply of Satoshis can never increase. If you store your wealth in Satoshis, you know your wealth won't be lost to inflation, and you'll likely be able to buy more goods with the same amount of Satoshis in a few years.

2) A fee to use the Bitcoin network

The second way that Satoshis can be used is by being paid as a fee to move Satoshis from one address to another on the Bitcoin blockchain. This can be tied in with...

3) Medium of Exchange

The third way that Satoshis can be used is as a medium of exchange. Today, we use US dollars around the world as a medium of exchange because most of the world trusts that they will be valuable tomorrow. As more individuals understand and use Satoshis as a store of value and see an increase in their buying power, they will spend their Satoshis on the goods and services they want or need.

4) Unit of Account

As more of the world's liquid wealth moves from US dollar financial markets into Bitcoin, we will see more merchants and raw material providers using Bitcoin as their unit of account because, in Satoshis, prices decrease over time. This means happier customers (how happy would you be if the cost of your groceries decreased over time?) and more business.

5) Transfer and receive information

Bitcoin can be used to transfer and receive information like comments, files and documents. The Bitcoin software is a recording of every transaction that ever happened. You can inscribe a Satoshi with information and send it to anyone who has access to the internet. Nobody can change the information recorded on the software; the records are immutable. In the future, inscribed Satoshis can be used to transfer deeds, identification, etc.

6) Insurance

Satoshis can almost be seen as insurance against the collapse of the legacy system. If financial institutions go bankrupt, we have a way to transact without them. If governments can't be trusted to protect our property rights due to negative intent, the Bitcoin network can be relied on to store the most accurate information.

Over time, as the network becomes more decentralized, we see wider adoption, and if we find more use cases, we will see the value of Satoshis increase!

Fiat currencies promote the wrong mindset.

On a fiat currency standard, most people know and understand that the currency will decrease in value over time...

So they choose to spend as quickly as possible because otherwise, they will be able to consume less of whatever they want as the value of their money slowly fades away.

On a fiat currency standard, merchants are incentivized to cut corners and create products that are of lower quality than they would otherwise be able to create.

Higher quality products take more time to create, but time and labor are not valued.

In a fiat world, we're focused on quantity over quality - we need to constantly be producing more to make higher profits, even if quality suffers.

On a Bitcoin standard, quality will be of utmost importance.

Merchants will want to provide higher quality goods because they want you to spend your money with them in the future.

When you spend Bitcoin, you are spending real money on the goods you buy, and the value of the money that merchants receive will increase over time.

If merchants produce an inferior product, it's very likely that they won't survive, because they won't have repeat customers.

On a fiat currency standard, businesses are more focused on producing the cheapest product, even if it means everyone involved suffers.

Think about McDonald's for example.

McDonald's food has the lowest quality ingredients and the worst preservatives, and yet it's one of the most successful companies in the world because its shareholders are satisfied.

McDonald's customers are slowly dying due to health issues and its employees are in poverty and rely on government benefits to survive.

Companies like McDonald's create a product that gets worse with time because they are designed to survive on a fiat standard.

Mcdonald's, a company that produces fast food, doesn't even focus on its food...

It focuses on owning as much real estate as possible.

This is all because fiat currencies are broken.

The money you get is designed to slowly lose value, and you are forced to invest and continue to be productive forever, no matter how hard you work for your money in the first place.

Instead of using higher-quality materials and ensuring customers are satisfied, producers must use lower-quality materials to maximize profits, because they want to satisfy shareholders by giving them more fiat currency profits.

The legacy financial system is breaking because more average people figured out how the game works.

As we see more people working less because they earn passive income, the system is dying.

Inflation has skyrocketed.

Fewer people are willing to do essential jobs because the pay is so low.

Costs for retail stores are rising and those costs are being transferred to consumers.

The legacy financial system is built to keep a small group of people rich while everybody else stays poor.

Now, the poor people don't want to be poor anymore.

They don't want to work until 65, when they have no energy left.

Over the last few years, more average people realized how the system works, and now the system is breaking because those average people have joined the elite.

Basically... average people hacked the system and the system is being crushed.

Bitcoin is revolutionary because it's the first form of money that can perform 3 functions:

- Store of value

- Medium of exchange

- Unit of account

Fiat currencies were born because gold is not portable, so it was difficult to use as a medium of exchange. Instead of having to move gold from one place to another, paper money that represented gold gave us the ability to transact quickly and efficiently.

Fiat money forces everyone to invest in real estate and stocks to store value for the future because there's no limit to the amount that can be created. Every fiat currency has failed in the past due to greed from the people issuing it.

Since Bitcoin has a limited supply, we are moving to a world where all other goods (including stocks and real estate) will always decrease in value in terms of BTC.

With Bitcoin, you're not required to take other risks (like counterparty risk when it comes to stocks, or the risk of natural disaster when it comes to real estate).

You hold one asset that you can use to store, transfer, and account for value.

1 USD ≠ 1 USD 10 years from now because there's no limit to the supply of USD.

1 BTC = 1 BTC 1,000 years from now because the Bitcoin network will not produce any more BTC after 21,000,000 are issued.

Money service providers like Western Union charge exorbitant fees for money transfers around the world without a bank account.

Individuals adopting Bitcoin means money service providers will lose an estimated $400 MILLION PER YEAR IN COMMISSIONS 🤯

When you invest, you're transferring wealth to your future self.

When you consume, you use up your wealth immediately.

Finding a balance between consumption and investing is the key to happiness.

There should be a course in high school that teaches students about debt, investing, banking, leases, etc.

When these topics aren't taught in school, people make big mistakes when it comes to their personal finances.