Egregore: non-physical entity or thoughtform that arises from collective thoughts and emotions.

In a way the first egregore was probably death.

Perhaps power hierarchies but in animals those arise more from the current fear of pain/death or seeking of pleasure related to survival like food or sex. pain is an instinct of the risk of death on the organism. Pleasure is an instinct for the needs to thrive and procreate.

Humans therefore may be the only animals that have egregores and after death the next egregore may of been money.

Money likely existed in some capacity as a belief system equating to energy before agriculture began.

Once we could think more 4 dimensionally(probably from psilocybin induced synthsia) thinking Into the future and the past allowed the concept of death to become an egregore. So did the structure of power hierarchy’s. We think into the future of that social structure. Money or just scarcity of an item can portray the meaning of the structureand peoples place in it. It took proof of work to get the scarce resource on a kings head. Crowns are in all sorts of cultures essentially proof of the power the person has by showing the work they can store that took to get the rare item.

An abstract value system that is collectively believed and would not work without the concept of death and that structure gives predictability in exchange for a tax of energy of the people within the system. Stabler systems tend to prevail and more people believe that egregore that prevailed. Systems or governments want to increase their capture of energy via tax. They will invade and control what they can, especially places with high frequency of trade like shipping ports or places with lots of resources.

The sang “death and taxes” they are the the most persistent egregores of the human story cross culturally and across time periods. I’ve heard Bitcoiners now say “death taxes and bitcoin”.

There is still transaction fees to reward miners it is taxes in a frictionless domain so it takes less energy per trade but it is still the egregore of death and taxes. Only these egregores are immortal in my opinion.

As for the implications of this…

One solution being proposed with Ai is for us to put it into our brains so we “control” it but what if instead it was built onto the most energy consuming and persistent egregore humans have… Bitcoin essentially being symbiotic with the hive mind of humanity via markets would want us to prosper and us wanting the network to do so creating a giant super Intelligent ant colony so to speak that benefits from the super organism that is the bitcoin network.

I think that if we ever have a super intelligent AI as a part of how we work as humans it exists on top of an egregore that needs us to believe in it to stay alive. if it does not help us prosper we stop believing in it, it stays alive by us believing in it. If people don’t believe in it they stop mining stop using nodes transacting int it and saving in it etc. By the economy running on bitcoin we control it as an egregore, an idea bigger than us but we hold the power and so any Ai running on the network would simultaneously be open source, have more access to energy then any other computer network, have all the economic data at its disposal in real time, and be fully incentivized to benefit humanity.

#plebchain #nostr #bitcoin #ai #zap #sat #discussion

As more capital increasingly becomes knowledge and as more of the capital is recorded on the #timechain economies of the world will see capital depreciation approach zero.

What happens after 1000 years of near zero capital depreciation, perfect saving’s technology that can’t be fucked with, and an exponential increase in our ability to harness energy??? I think it means a trillion+ humans all living in abundance with the freedom to pursue a meaningful life.

Satoshi gave us the blueprint and initial steps to build this future. I’m just grateful to be alive at a time to help build that.

#satoshi #subsidizethis #nostr #bitcoin

Been thinking of how #bitcoin and #nostr have the potential to lead to technologies that will allow for a universal basic income independent of the state. This seems needed for a post labor economic system.

We can build ways to have advertising revenue go to users and not tech companies. The amount that goes to the company/clients will be a race to zero due to the ease that users can switch to a new client. This will also be able to solve issues with spam.

My question lately though is how can we bias the #ubi to human users over accounts that are bots. How can we make sure that their is not an incentive to make 1000s of accounts that can collect a share of the ubi?

Potential solutions and there downsides…

1. Every human has their own unique finger print or face, could this or other biometric data be used. What are the trade offs here In privacy. There must be potential downsides. Who gets all this data. What about after the person is no longer living, how do we verify that with reduced dependency on centralization? Will it be possible to fake a human finger print or other biometric data?

2. Will systems that distribute ubi be in charge of verifying what accounts are an individual person and deserving of the distribution?

Basically I’m attempting to crowdsource some leads on new areas of information. I’m working on solutions in this area and want to know how we can make the difference in sovereignty of the great grandchild of someone who stacked sats be as close to possible to someone who is born with no sats in their family lineage.

#sovereignindividual #universalbasicincome #asknostr #client

The halvings will change the time preference of companies.

When on a bitcoin standard in the future or today if your a Bitcoin company you’ll measure your growth in bitcoin not fiat.

Because Bitcoin has cycles from halvings, measuring quarterly growth makes no sense. Rather growth of the company should be measured in bitcoin. Most companies will get smaller each year as we transition to post labor economics. The companies that grow in bitcoin terms will be the ones able to contribute to making their sectors highly deflationary.

As companies time preference moves towards 4 year goals instead of quarterly goals humanity will benefit greatly🧡

#nostr #bitcoin #lowtimeprefrence #halving

Hey #Nostr this is QUESTION 3 of a series where you can help orange pill one more person…

I will post the best questions i am able and my thoughts on them as i progress through my learning of money and #Bitcoin.

If you would like to help steer myself and others in the right direction shoot me a follow and start commenting your thoughts and insights.

Hopefully by the end we will have a library of useful conversations and collection of differing opinions that you all helped create.

Question #3:

It’s interesting to think about how money touches all aspects of life and if we fix the money we can fix many of the major issues in today’s world. Just a few weeks ago i had almost no background on #Bitcoin or our current economic experience and I never would have known how far the depravity has spread from its host.

I’d like to talk a bit about central banking and some of the issues people, including myself, may be unaware that it causes.

What are some 2nd and 3rd order effects of having broken money? What is broken money and how does it reach all aspects of society?

There is a video by Ray Dalio that i would recommend to anyone seeking to understand how money affects much more than just our bank accounts.

https://youtu.be/xguam0TKMw8?si=8wmxgCg-tQ3NbQ3u

Thank you again, let me know what you guys think and #repost if you find it valuable.

#bitcoinsavesus #nostr #asknostr #asknostrdev #grownostr #proofofwork #orangepill #subsidizethis

#POW #Nostrcommunity

Money is like a language to communicate value/work over space and time.

Usually the market finds the best money for this but the government has subjected by us by decree to a money that is poor at communicating value over space and time. Imagine your language just changed meaning every day due to federal reserve policy. Communication and anything built on top would become ineffective.

Because of the petro dollar which it’s proof of work is backed by oil and maintained from war is able to be printed at will it is essentially eroding the ability to communicate you work that you give to the economy. If you want to store your labor for the future you are forced to bet in the financial system. Because of this your ability to communicate your efforts to the economy is reduced and some of our best and brightest contributors to society end up in a bloated financial system.

It can take a lot of directions. I think I have both agree that Ai will be apart of of the digital space to much greater degree in the future but we can build things in a way that it does not become a negative. For starters we can create obstacles for communication or to be in our feed by people or Ai accounts having to overcome a set amount of value.

Think a wall of energy and bitcoin is the energy to overcome it. We can build energy wall APIs to solve these problems. How that will look will vary on preference, there are lots of ways to do it. This is what cause me to look more closely at #nostr

For energy prices over the next ten years I think the prices divert depending on location. Some areas will experience energy deflation as they lean into Bitcoin mining while others will see higher prices as the petro dollar system weakens and wars and trade issues make consistent cheap oil less common.

Some time after bitcoin surpasses the market cap of gold and begins to transition to a settlement layer for nations that have energy grids built around mining you’ll then start to see global energy prices falling and energy use globally trend upwards at a historically very high rate. The world will return to kilowatts per capita rising again. This metric has flattened in G7 countries and slowed to nearly nothing for the rest of the world since leaving the gold standard.

While bitcoin will be a big part of the global wealth in this scenario global wealth itself will be much larger. Just an energy use increase globally of a little over 10% per year would get us to a 50% increase every halving and a type 1 civilization on the kardeshev scale in a 92 year period. 1 #bitcoin in a type 1 civilization will have a lot of purchasing power.

#infinity/21million #digitalenergy #energy #bitcoin #nostr #halving

How do I set up a wallet so that I can send and receive zaps. New to Nostr

#bitcoinsavesus #asknostr #asknostrdev #grownostr #orangepill #subsidizethis

Benifits of the network don’t just dwarf the cost of more carbon being released. It brings down the cost of clean energy and much of the energy that is carbon based(less then half the total energy use of the network) is utilizing waste energy that was already being spent. An example to look at is flaring being used for bitcoin mining.

Even if we start using less carbon based fuels we need to have more energy for poorer nations and have cheap enough energy for both carbon capture and desalination of salt water in the poorest areas in the world. This seemed like an impossible task until bitcoin mining. The faster bitcoin gets to the millions per bitcoin the faster these problems can be solved.

Going down the rabbit hole you may experience these different thoughts along the way

1. I wish bitcoin used less energy

2. The energy it uses is worth it because it’s necessary for bitcoin to be able to solve the problems it solves. Plus it is pretty clean energy for the most part that it uses

3. I hope bitcoin uses more energy, half the world’s energy going to bitcoin mining will make the best future for the next generations. Climate change alarmists are understandably concerned but also have no solution to efficiently pull carbon out of the air or handle the problems of the carbon just staying flat for 1000 years.

Number 3 can make you sound like a wacko to people who have not put in the proof of work though 🫠

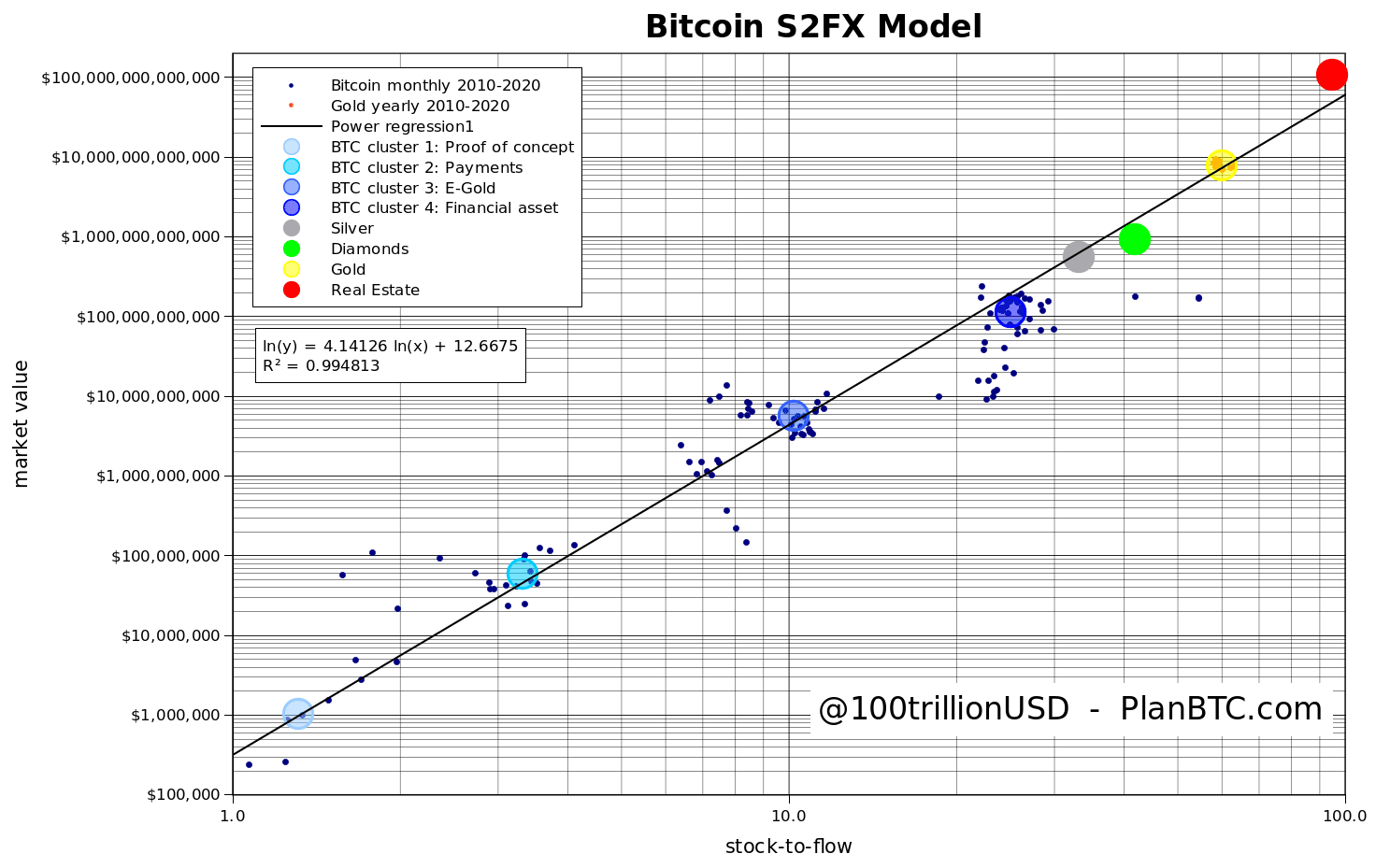

If people just understood that the properties of bitcoin and it’s stock to flow will surpass gold and real estate soon they would have their savings in bitcoin not be 0% of their portfolio. I don’t think most people will ever know or care. It will be applications that get bitcoin to the millions. The applications will be different because the properties of the native currency. That and fleeing the old system will drive the adoption.

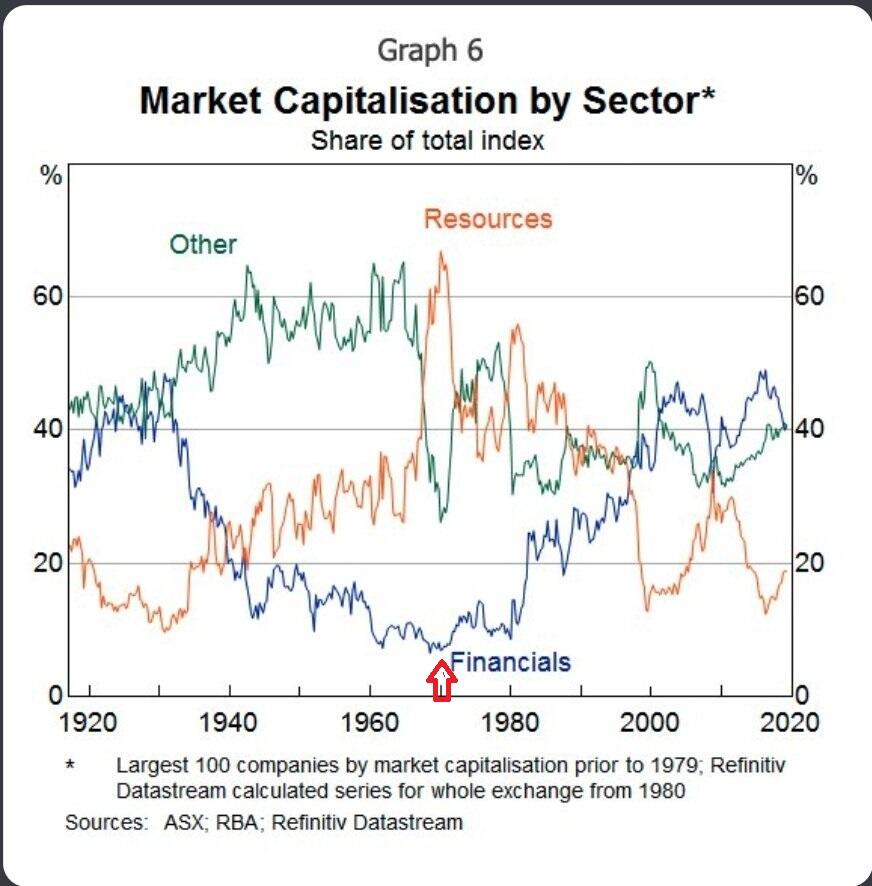

Here is a pricing model for assets based on their respective stock to flow. You’ll notice it tracks pretty spot on with a straight line on a power law basis. Real estate however has a premium of value, perhaps as the most scarce thing it captures more value or because it is essentially subsidized by the banking industry. Even if those aren’t true real estate has major draw backs as a store of value.

- not fungible

- is trapped in its original location

- subject to ongoing expenses and taxes to maintain

Despite this it still has a premium as the most scarce. Due to bitcoins preprogrammed halvings though it will surpass both gold and real estate. Potentially reducing the function of both in a portfolio meaning…

- countries that hoard gold loose to bitcoin hodling countries like #elsalvador

- central banks will have to print even more to prevent a collapsing housing market.

Bitcoin is essentially attacking the fiat system by exploiting the problems it stands to solve.

#stocktoflow #powerlaw #subsidizethis #nostr #gold #realestate #bitcoin

Ideas are capital.

That capital has been bound up with social media networks. The world tends to go through massive changes when we can better get a return on that capital. #Nostr and #Bitcoin will be the printing press of the 21st century.

nostr:npub16eqvnxnqmsnn42fk8qkdssujw3z3cp9g49wls8ewjeap3ztwkfyqs0u3m6

What would the world look like today if we discovered location independent energy demand in year 9 rather then 2009?

nostr:npub16eqvnxnqmsnn42fk8qkdssujw3z3cp9g49wls8ewjeap3ztwkfyqs0u3m6

Bitcoin mining creates location independent energy demand. Cheapest energy wins and gets cheaper by economies of scale.

Because of this…

When you build applications on Bitcoin you don’t just solve a problem or bring down the market equilibrium price with your product or service.

You don’t just help the unbanked bitcoin bag holders getting pulled out of poverty by their bitcoin savings.

You increase the energy consumption of the Bitcoin network, helping us get to a future where abundance of energy orders of magnitude above today is available to everyone.

The most efficient way to help make the 🌍 a better place is to #stacksats and #buildonbitcoin

nostr:npub16eqvnxnqmsnn42fk8qkdssujw3z3cp9g49wls8ewjeap3ztwkfyqs0u3m6 Bitcoin is the new CPI

-CPI will be looked back on as being a federal reserve scam.

-It is adjusted to be filled with things that money printing makes cheaper like corn rather then a grass fed steak. Therefore it does not measure cost of living expenses but rather cost of living expenses for a worsening quality of life as incentive structures get broken. If your stubborn about maintaining certain things of quality that existed in past generations before today your inflation rate is higher then what the fed claims it to be.

-A Bitcoin based economy can measure inflation or rather deflation accurately in a impossible to manipulate way in the two worlds that we will have, physical and digital.

Physical: inflation or deflation can be measured over periods of time by comparing the formula for energy value of 1 Bitcoin.

10 minutes of energy used by the Bitcoin network ➗total block reward = physical value of 1 bitcoin at time of being mined.

Digital: inflation or deflation can similarly be measured over periods of time by comparing the formula for computational or digital value of 1 Bitcoin.

Average hashes used by the Bitcoin network for 1 block➗total block reward = digital value of 1 bitcoin at time of being mined.

For example, if the Bitcoin network never used more energy, the block reward stayed the same rather then decreasing, and new technologies to make production of new goods and services more efficient stopped being produced then the physical economy would have a 0% inflation rate.

If Moores law continued as is the digital economy would experience deflation. Digital deflation can happen without physical as it is today but when both are happening at the same time things will begin to look very different.

What happens when Bitcoin mining itself incentivizes the very variables that will drive hyper deflation in the physical and digital when most the world is on the opposite fiat system?

A proof of work scarce digital store of value that no one controls would be a winner take all game. There will not be other proof of works with significant portions of global use. It is inevitable that it would become a way to escape being unbanked, then mild inflation protection, then used in cross boarder settlement, then used for sovereign individuals to subject other actors to natural law in a digital space. Right now the transition from unbanked to being used for escape from just mild inflation is just starting.

Digital: Technologies using bitcoin base layer and lightning will allow people to subject others to physical constraints over a digital space. This will be used via divisible units of bitcoin. Lightning has not been properly thought of as a way to subject the implications of natural law to people over the internet but it will give people the ability to choose that whenever they want/need to.

You should own and save in bitcoin for the two worlds we will have in 20+ years

Physical: In 20 years a block reward will be less bitcoin and exponentially more watts will be used to mine it. This is important because the main input cost to anything physical is energy.