Oh thank you, will send them the questions too then

Good morning, its been over 3 weeks since the Samourai Wallet indictment and there still seems to be no sign of TDev

in the justice system. I don't like it, so I sent the Feds some questions.

(also can someone help me fix my zaps, they still seem to be borked)

CISA for privacy is a very non trivial issue. As Chris Belcher always used to point out, the simple argument "coinjoins become cheaper with CISA, therefore CISA promotes cheaper privacy" is mostly just not true, because coinjoin promotes "A is paying B, C is paying D" to happen in one transaction instead of two, but that batched transaction doesn't *by default* offer any additional privacy, because they will not modify the structure (in particular the output amounts) in a way that obfuscates the transactions. Now there are definitely counterarguments but I think that's more true than false.

And whether you get into those counterarguments or not, either way, CISA is clearly a net positive in many senses, and *at the very least* shouldn't make privacy worse (in this, I am disagreeing with https://delvingbitcoin.org/t/cisa-and-privacy/824 for example; it seems most people there argree with me)

Still, let's not jump the gun. CISA doesn't yet exist unfortunately.

Im not sure I understand your argument re cjs, is it that CISA makes batching in general cheaper with cjs being a byproduct, meaning that private txs would have no economic benefit over batched txs and, assuming cjs will continue to be centrally coordinated in a fee model, cj txs continue to be less economically favorable to non-cj txs even with CISA?

If I understand this correctly I agree that CISA doesn't technically address your OP. Practically I think I disagree if we assume that the tx gets cheaper the bigger it gets with full aggregation – reaching sizes of 400+ inputs will likely mostly be unachievable for single signers, so i think cjs practically would have an economic benefit over non-private txs excluding fees (at least until there is non-private CISA collaboration).

Do you have any proposals in mind that would explicitly make privacy cheaper than non-privacy?

I fundamentally disagree with this for several reasons.

First, re counterparty risk, this is what reputation scores are for, and in my experience they work fairly well. Second, I think we are speaking from extremely different perspectives here. When I dont have a means of payment (say bc my bank blocked my account), I really dont care weather I'll pay a premium on my tx because my plan is not do engange in degen trading but to have money to live. Comparing a P2P marketplace necessary for people to transact in private (or even at all) to broker interfaces is not the right approach here imoo.

The point is also not that people are 'lazy users' – of course its nice for stuff to work at the click of a button, but the point is that people can easily be overwhelmed when facing complex systems, keeping them from using them at all – not because they are lazy, but because they dont understand them, which then also speaks to the liquidity issue.

Lastly, and again speaking to perspective, Im not talking about people doing six figure trades here. Im talking about people who earn their income in bitcoin or have no other means of payment and need to pay their bills, who will be facing complete financial exclusion unless they are willing to submit themselves to full surveillance tyranny.

Unpopular opinion, but here it goes: UX is the most important problem we need to solve for Bitcoin Privacy.

We can hate on KYC exchanges all we want, but they've got UX nailed down. We cannot expect privacy to become the norm when I have to take an hour out of my day to make a P2P trade.

Now that CASPs will start delisting privacy assets like Monero and blocking coinjoined btc with the EU's new AMLR, we're being stripped of using regulated exchanges even semi-privately. This makes P2P exchanges like BISQ Network even more important, but its of no use to regular users when you need an introductory course in computer science before understanding what's going on in the app.

Privacy will only become the norm when we make it usable for everybody. **If you're a UX designer, copywriter, or in any other way have expertise in UX design, please consider contributing BISQ:** https://github.com/bisq-network/bisq

ℹ️ If you're not a developer, contributing to GitHub projects can be scary. It really doesn't have to be. I can't tell my asshole from a python script either, and if I can do it, you can too.

Here's how to get started:

If you find a UX issue in the BISQ app that could be improved, start by opening an issue in the BISQ github repository. Give it a clear title describing the problem you want to solve.

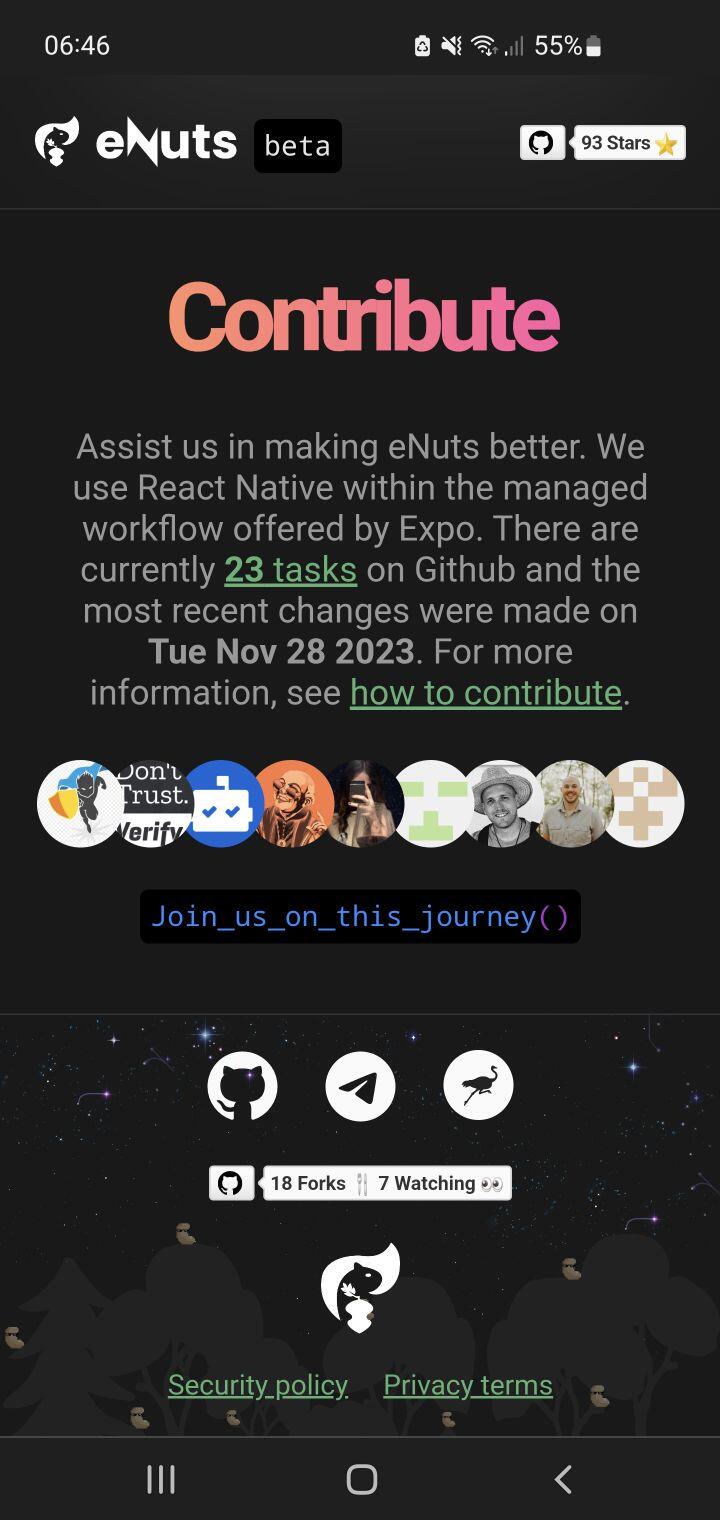

Add screenshots or videos to your issue showing what the problem is. If you can, add a proposal for a potential solution. Bonus points if you can add wireframes, layouts or clickdummy documentation. For reference, see npub1zqsu3ys4fragn2a5e3lgv69r4rwwhts2fserll402uzr3qeddxfsffcqrs 's work on eNuts: https://github.com/cashubtc/eNuts/issues/341 (I don't know how to tag people here but you get the idea).

In open source projects, questions are your friends. I've spent countless hours asking every dev i know absolutely insufferable questions, and I still dont know how the fuck to get out of VIM. Everybody starts somewhere, and most people are happy to help.

If you already know how to use git or github and can code a little, ask where you could find the corresponding code for your problem in your issue and offer to do a PR. If you can't, ask what assets would be needed to implement your proposal. Remember that people are nice and generally happy about new contributors, even if you're a beginner.

If you have any questions on contributing to open source projects as a non-coder, feel free to reach out anytime. My DMs are open (I think).

100% ->

The entire Tornado Cash verdict is completely insane and will turn the legality of building any privacy service on its head.🧵

1. Open-source devs building non-custodial tools can be held responsible for criminal activity when crim. actors cannot be stopped or deanonymized👇

2. TC cannot be classified as a communications service despite the fact that that's exactly what TC is: a tool to communicate transactions between users. It does not matter whether TC took custody of funds. 👇

3. Building an unstoppable privacy system is laid out to suggest criminal intent.👇

4. TC dev was aware of money laundering activity in TC, laid out as intentional participation in the act. 👇

5. Devs are fully responsible when their open source code is used for criminal activity through the development of source code and UIs. 👇

As predicted, the verdict references FATF, which has no regulatory powers and operates with zero democratic oversight. https://www.therage.co/meet-fatf-the-financial-bullies-memberclub/

The assumption that "criminal intent lies with the individuals and not the tools they use" seems void with the TC verdict. This verdict is a full on declaration of war against privacy service in existence.

FYI I am not a legal scholar and this is just my opinion

Alright assholes I'm back in this bitch because I've had it with the Twitter shithole censoring my links and telling me i cant say fuck, no idea if anyone is reading this but if you do read nostr:npub15dnln6cukw3yrflnv3hnrntdt9amh0uw466u6tns05ymqp3nal4qzz3lfc 's fantastic new piece speaking to US regulators on open-source arrests:

https://www.therage.co/us-officials-sour-on-biden-war-on-privacy/

Yeah hi. This is completely wrong and literally not how TC worked. At all.

Statistics like these make chain analysis firms look like your friends. They're not. Here's why:

Statistics showing that the overall use of cryptocurrencies is *not* illicit help us fight FUD. They're also necessary for chain analysis companies to keep existing: no cryptocurrencies, no business model.

The problem arises with how chain analysis firms *calculate* the use of illicit transactions, as this includes the use of privacy technologies.

For example, every transaction involved in a coinjoin is flagged as illicit by chain analysis firms. This completely distorts the overall volume of illicit transactions. The actual volume of illicit transactions (hacked funds, sanctioned entities, etc) is *much lower*.

Privacy is not just a human right, it is also outlined in the US constitution via the 4th amendment, as well as via federal financial privacy regulations.

If you want to have an intellectually honest debate about illicit transaction volume, stop criminalizing privacy.

For context: Every coinjoin/"mixing" transaction is deemed as incompliant by blockchain analysis software by default and therefore "illicit".

The list of contributors continues to expand, each contribution enhancing the project's value. Grateful for your work. 🧡🦸♂️🦹

nostr:npub14a93ehrzfgd73uclhans95xcwdqsselevat42cqa30q73nacfnussnlgen

nostr:npub1mznweuxrjm423au6gjtlaxmhmjthvv69ru72t335ugyxtygkv3as8q6mak

nostr:npub1q6ps7m94jfdastx2tx76sj8sq4nxdhlsgmzns2tr4xt6ydx6grzspm0kxr

nostr:npub16up8472yajrceaxq72yz4an7lggw0s6esgg7rm74k8fh3khsesjs6vnevp

nostr:npub1twfye8nxnnftqfya4zsyj46atrpakmwscqxyt7j9pm58fxu2ckss83uh4s

nostr:npub1pp355axf69z8ndrz8zdnqa54s90e5xy737mwqk9e9cvt606nwszsdx8nu7

Special thanks to nostr:npub14a93ehrzfgd73uclhans95xcwdqsselevat42cqa30q73nacfnussnlgen who initiated this and has been around since the project's inception. 🙌👏

💖

Ugh… I gotta go through and/or setup cashu now…

I will do this… but

I would also like to zap nostr:npub1mznweuxrjm423au6gjtlaxmhmjthvv69ru72t335ugyxtygkv3as8q6mak directly on #nostr.

#PLEBchain hear me!

You can zapper me directly with ecash, try https://www.enuts.cash/

much private, very easy, super wow

sure boomer, that'll do the trick xD

For anyone looking for a simple project to get into Cashu dev, I just had an idea: the redeem page [1] right now swallows all overpaid Lightning fees (code: [2]).

However, we have NUT-08 (which is also implemented into cashu-ts [4]) which allows users to receive back the overpaid fees. It would be nice to have that feature on the redeem page!

I imagine the steps would be:

- Figure out how NUT-08 works (rather simple) and how it is used in cashu-ts

- Add that to the redeem page to receive overpaid fees back from the mint

- Store overpaid fees in local storage so the user can use it when they try to make the next redeem attempt.

- Hint: overpaid fees from different mints (identified by keyset ID) need to be stored separately in local storage because you can't use the tokens from mint A to pay in mint B

[2] https://github.com/cashubtc/cashu-redeem

[3] https://github.com/cashubtc/nuts/blob/main/08.md

[4] https://github.com/cashubtc/cashu-ts

If you're a dev, join: https://t.me/CashuBTC

wen tx history

lol, are you stupid or something? you do realize that state trojans have existed for years?