https://www.reddit.com/r/Bitcoin/s/NSbccow17E

Time to dig out this classic

Is there any mechanism by which you could leverage this Bitcoin? Eg deposit your pension money into a LEDN BTC 2X account where they custody your Bitcoin, using it as collateral to lend you the same amount of Bitcoin? You have double the exposure.

Is this possible (as opposed to sensible or risky).

So he has read his father's book. There must be a certain number in the British establishment that *get* Bitcoin judging by this.

Ten years ago I was horrified by mma. Today I couldn't be without it (and bjj).

It's responsible for a significant part of my personal growth over this time period.

Thought that was Rip from Yellowstone for a second..

Strangely compulsive viewing. Candace really knocking it out of the park with her "Becoming Brigitte" investigative series. https://youtube.com/playlist?list=PLPW2eH9z9CUvJ0Iiv9AQqq2RVAWFFfNZR&feature=shared

Tldr? Is it credible?

They're an adult product not suitable for children.

We've had a no phones / tablets policy for all of ours going on ten years now. I definitely notice the difference in phone vs no phone children.

The negative effects are becoming more widely understood by parents which is good. More children being smartphone free makes it easier for others to do the same. Around 30% is the key number.

We have this movement in the UK that is gaining traction. https://smartphonefreechildhood.co.uk/

At what age do your kids get phones?

I'm interested but don't know where to start.

Is there a 'go to' one episode or article for the curious like me? I want to dip my toe in without committing 10+ hours

Has to be, right?

Ok I've ordered it now.

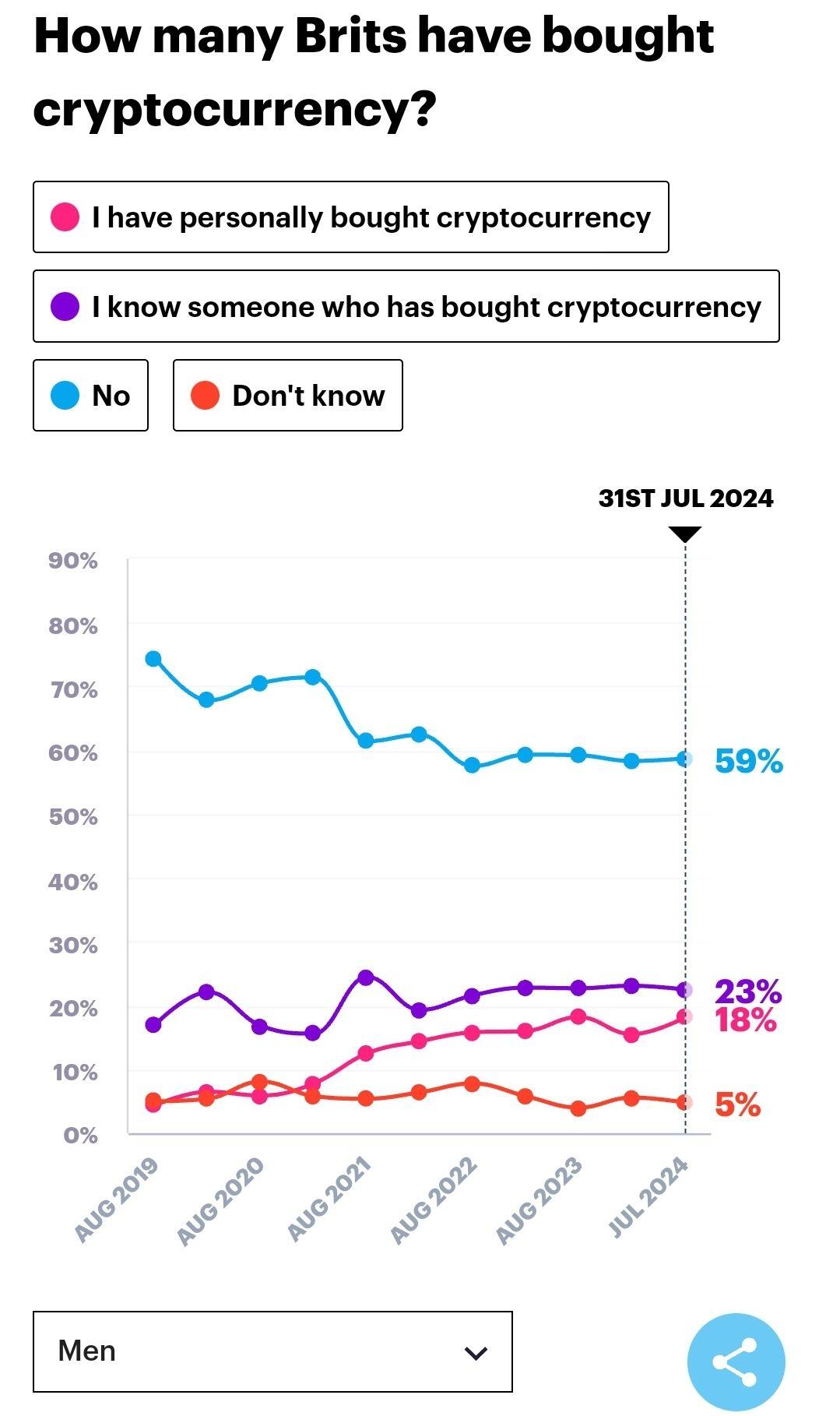

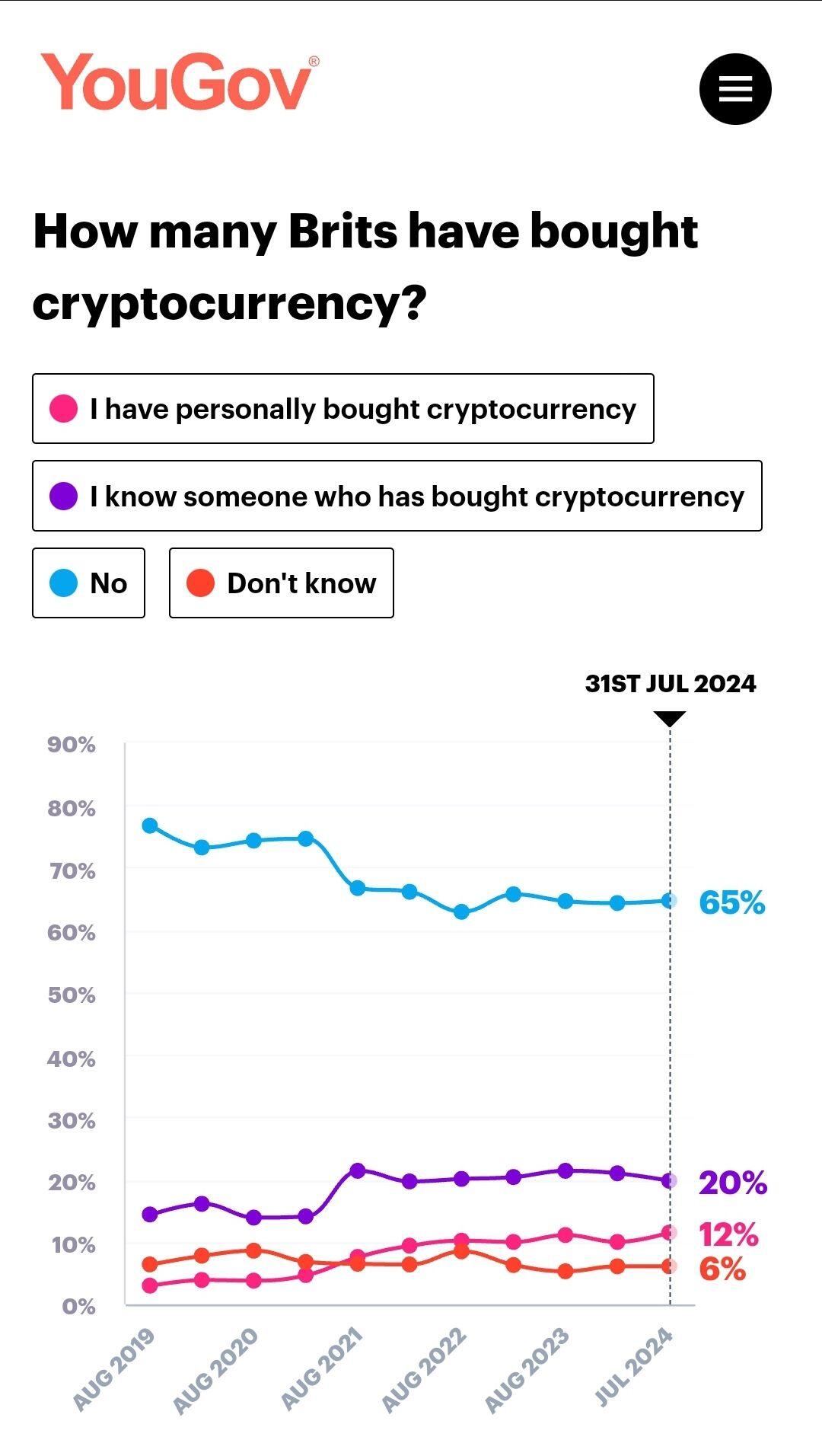

Latest update 31st July on the YouGov poll.

'I have personally bought cryptocurrency' up 2% in 6 months, up 1% from 12 months ago.

Interesting to see how this changes over the next 12 months.

Is there a way to just 'auto-like' every nostr:nprofile1qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncpz4mhxue69uhhyetvv9uju6mpd4czuumfw3jsz9nhwden5te0wfjkccte9ec8y6tdv9kzumn9wsq3yamnwvaz7tmsw4e8qmr9wpskwtn9wvql3tqm post. Would save me valuable seconds.

I bet the guy on the left surprised a few wannabee bullies in his time!

Yeah I think the most dodgy part in the UK is the 'incite hatred' part. Subjective and wide open for abuse by those deciding on what falls within 'hate'