It's a tradeoff of supply-audit-design that is essential.

Privacy, while being one of the most important aspects of individual sovereignty, doesn't solve the problem of inflation debasement and centralized control of money issuance.

As stated in the Monero page above, Bitcoin solves this by providing an immutable public ledger that is currently the most secure decentralized network.

We have proposals that are pushed such as Bolt 12 that tackle the anonymity problem. It is not a a clearcut failure as monero folks push it to be while ignoring the other aspect of this.

theres an conversation on this point happening now.

heres a link and a pod if you're not just a maxi zealot idiot.

https://xcancel.com/NotASithLord/status/1857208794851483991

https://www.buzzsprout.com/1790481/episodes/16100781-bitcoin-and-ossification-w-jameson-lopp.mp3

Thanks for the link – a good post.

Though I didn't find anything there that suggested that bitcoin is corruptible as it currently stands. We have a leadership problem that could be potentially exploited, and it is good that we are discussing these things now.

As for me, I vote with my node and hash power.

What I dislike is when folks downplay Bitcoin and cheer for monero; these are two different beasts with different directions and tradeoffs. I own both and appreciate both.

Then, one needs to assume that Bitcoin is corruptible. That rests my case. Thanks.

Ok there, hold on. Now #bitcoin is American, just like Coca Cola? Isn't the US law responsible for imprisonment of many bitcoin devs? Isn't it the first in line trying to kill the FOSS ethos? Why do you, Americans, have to make everything about USA? Bitcoin was made to demolish statism through separation of state and money issuance; the only thing USA has had going for it since Breton Woods.

Great work. Looking forward to implementation of receievd capability.

One thing though, I wasn't able to pay the human readable address, had to use the string.

The problem we have is not privacy: after all, we have cash that fulfills the problem of privacy. What we need is to separate the state from the money issuance. This is a much bigger problem than not being able to buy drugs online. A MoE that is incorruptible by the state fulfills this premise.

Well..,who Gabe thought. Another libtard community platform.

You are what you repeatedly do. Excellence, then, is not an act but a habit. - Aristotle

Everyone is declaring victory over deep state and it is just funny because it seems nothing can stop statism except mass adoption of agorism through bitcoin.

Power that are will always use trickery and social engineering to fool the masses into yet another epoch of enslavement.

Mind sharing where did you get those stickers?

Note how the clapping is so different between the two.

Hotel Bergues is very good, if you don't mind the price tag.

CHF is a safe haven currency as it inflated less rapidly than other currencies; hence, the upward pressure against the more rapidly inflating currencies such as EUR.

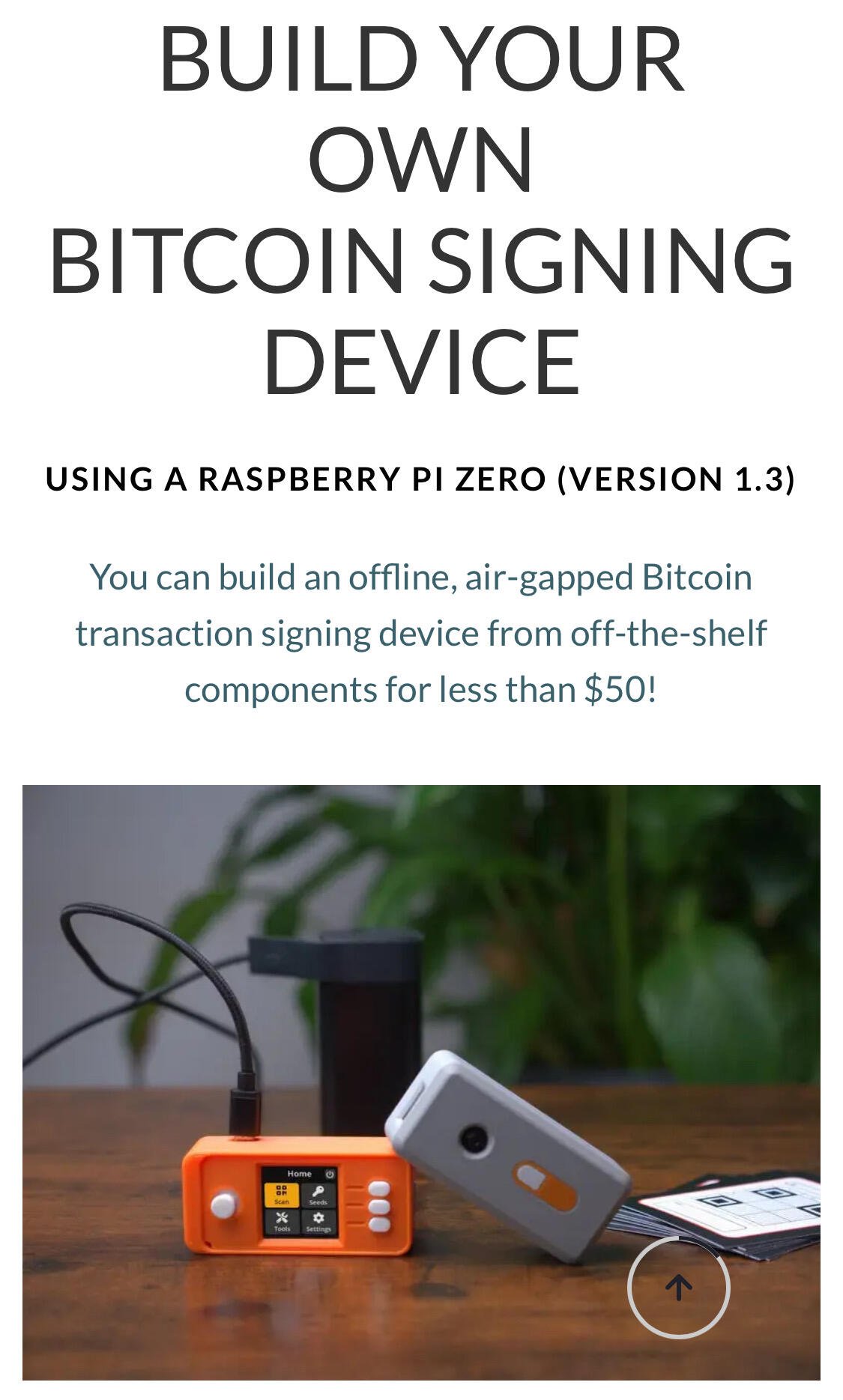

The next step in my Bitcoin journey. I’m building one. nostr:npub17tyke9lkgxd98ruyeul6wt3pj3s9uxzgp9hxu5tsenjmweue6sqq4y3mgl

#bitcoin #btc

Pi is closed source. Trying #Krux as the hardware is open source there. Though it's slightly harder to pull through.

A bitcoins since 2009 needs more lol

This is what I kept repeating to the Monero cheerleaders. The inscription in the genesis block is telling us there's more to this than just privacy or scalability.

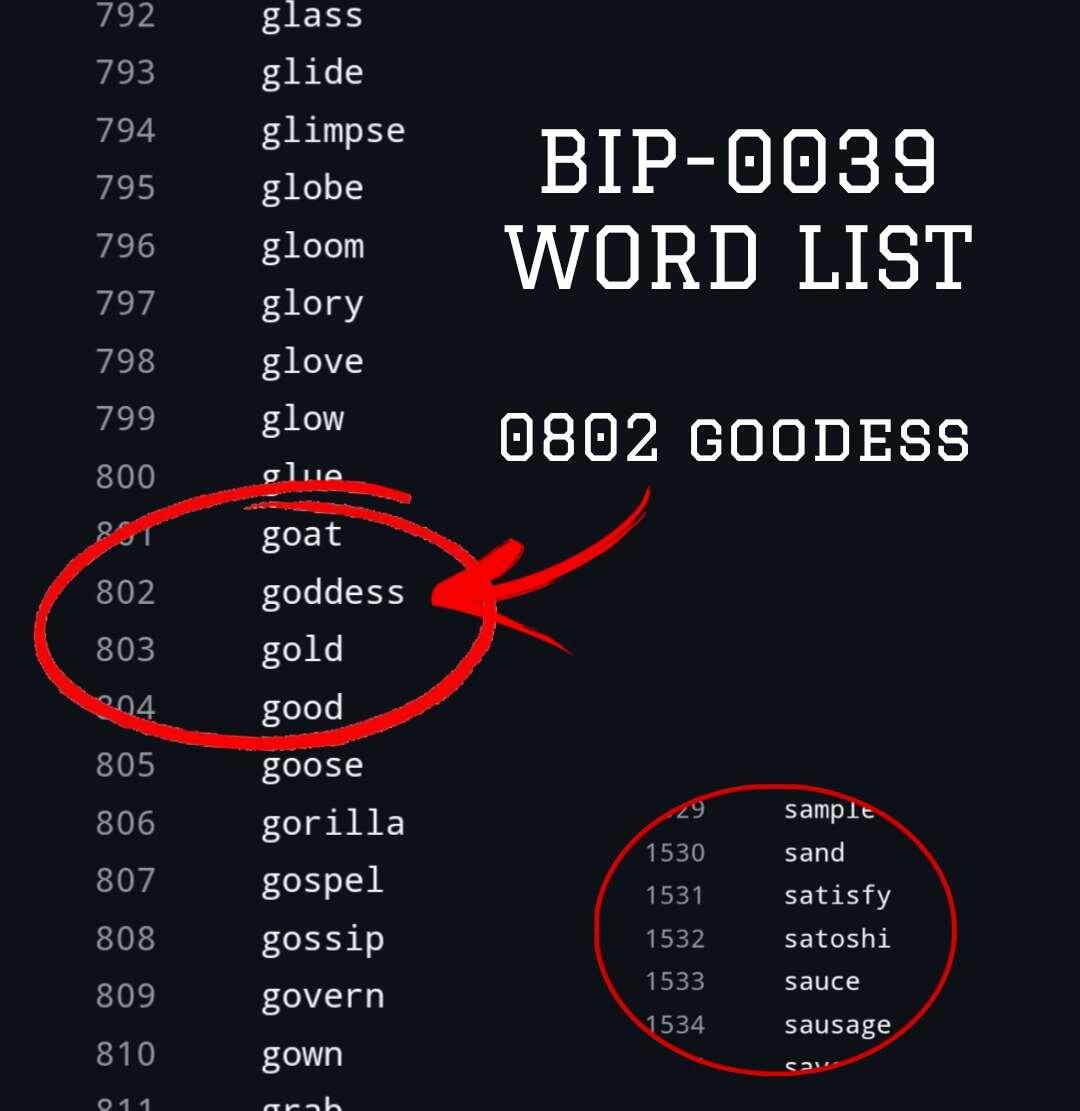

Maybe we should call Satoshi a goddess?

Just finished setting up #Bitaxe #Supra. I must say it's quite loud even at 50% fan. I really hoped it would be quiter.

It is choosing between two poisons. And they make it seem like it's such an easy choice.

Why can't we have a choice that is not tied to either pro-west or pro-russian outcomes? Why are there no politicians that declare such course?

It is imperative for small nation states to declare their independence from having to take a side in this. Forcing to take sides is prevalent lately, even Switzerland was pressered to choose a side and jeopardize its neutrality.

Best government is the one that governs least.

I guess due to rounding for easier division.

The odds of Bitcoin network becoming major settlement layer for most of worlds wealth are certainly higher, somewhere between 10000-100 to 1.

It seems absurd that some figures pushing SoV narrative for #bitcoin intentially leave out the fact that bitcoin was foremost a tech that cut out the intermediaries. In fact, by solving the Byzantine General's Problem, the need for centralized models is left behind; those still pushing these outdated models are malaign or just too stupid.

Running personal/private relays is one of the least understood things in Nostr. Maybe more accent should be given in showcasing the different approaches for private/public relays.

Biggest thing now: bolt12,

is from blockstream too

I lived right in the centre of Amsterdam for two years, and I can confirm – you grow out of it. Especially with the English tourists pissing and puking all around.

Can I buy these with monero?

Peach Bitcoin or Robosats for non-KYC.

I have enabled the internal TOR and, to my surprise, it has no latency deterioration.

Excellent work.

Clients must support the same NIPs. For encrypted DMs/Chats/Groups in 0xChat: NIP 04, 17, 29, 44, 100. https://github.com/0xchat-app

What about DM inbox and outbox relays?

Those of you that are seeing reports and notes from a new DM Reporter bot need not fear the reports. They again are a form of education. This is how we grow and improve.

These bots are telling you that the client that you're using to DM others is leaking metadata such as who you spoke to and when you spoke to them. The conversation itself is encrypted.

How can you stop this from happening?

You need to switch to a client that uses better DM technology such as Amethyst, Snort, Iris, etc. or just use nostr:nprofile1qqs9ajjs5p904ml92evlkayppdpx2n3zdrq6ejnw2wqphxrzmd62swspzemhxue69uhhyetvv9ujuvrcvd5xzapwvdhk6qgdwaehxw309aukzcn49ekk2qghwaehxw309aex2mrp0yh8x6tpd4ehgu3wvdhk6ynf30t for all of your DM needs.

Does the recipient also need to have similar client?

Let’s play devil’s advocate for a second:

In the long run, what if the emergence of #Bitcoin is a means to trade liquidity like TradFi trades the #VIX??

https://capitalwars.substack.com/p/is-bitcoin-a-liquidity-proxy

The antithesis is that Bitcoin is still considered a risk-on asset class in the conceptual framework of TradFi world, snd this susceptible to risk on/off flows.

Every step is a small fall.

Tread lightly.

It can't be in its true sense: used for adversary exclusion.

It was born to be weaponized.

It's more nuanced than a coin went up. I gave you the reason why DOGE went up and tried to explain why one can't draw analogies based on that.

FWIW, I own and use monero too, I just dont cheerlead for it at the expense of Bitcoin because Bitcoin's proposition is not just privacy – anyone with honest attitude can comprehend this simple truth.

We need agoras.

I'm surprised silk road was the biggest take at this.

Dreams of circular bitcoin economy are just dreams for now.

Alas.

You can buy whatever you want, no shame in that. But you can't cheerlead an alt without looking desperate.

Bitcoin is not just about privacy, it's more about printer go brr. If you, the monero cheerleaders, can't grasp your heads around that, there's nothing to be discussed further.

Say that to the Monero folks who say increase in fiat terms is nor value. Annoying shitty comeback.