I understand there are uses. What problem is it solving? A spoon has 50 uses but it solves the problem of transporting a liquid to your face. Do you see the distinction I am making?

Just you know, explain how it's solving a problem in the real world and maybe people would like it. ¯\_(ツ)_/¯

Holding a stock is a belief in the company. Trading of stock is a belief that you can sell your share to a sucker. So, If you are worried about stock price, you'd be in the latter category.

For heat, probably S9s or S19s. Either scattered throughout a larger house or directly fed into a heat duct for a central air setup.

For energy efficiency, Bitaxe's latest 601 gamma BM1370 (something like 15-16J/TH)

[Ask nostr:nprofile1qqstrcgctzz2d52thl8r3xwt205pswkauep0yexsla83w3fhrcrpxnqpz4mhxue69uhhyetvv9ujumn0wd68ytnzvuhspwqng8 for deets]

For dual use, ApolloMiner V1/V2 (can also be used simultaneously as a miniPC built on Ubuntu I believe)

Thorough article on debanking in western context and for crypto companies specifically. If you were willing to spend four hours listening to a Joe Rogan guest and fooled yourself into feeling informed, you have no excuse not to read this.

https://www.bitsaboutmoney.com/archive/debanking-and-debunking/

Okay. So the smuggled assumptions and conflation of "old people getting scammed" to people getting their accounts closed because they are politically unpalatable is gross. This is that thing people do when they know little factoids then apply them at scale where they don't apply. AML requirements do often outline MSBs as high risk (nice little factoid). The point is they are using MSB as a cover for denial. The same way someone kicks a black kid out of his store because he doesn't like his race but uses "soliciting" as a pretense because he asked another patron for a dollar to cover the gumball.

This is the same with all regulatory classifications surrounding crypto. They just offhandedly announce "you are frauds." When asked how the bank cites AML guidelines around MSBs. It's all nonsense because no one understands what money is and they assume people with a lot of dollars must.

Political debanking is real and not at all like the juxtaposition of divorce and asking for a date. It's first of all a public accommodation not a person. Secondly the person you "asked on a date" have a mandate to "go on a date" with anyone from the public who has a need for their services. The risk deleveraging argument is just political cover to deny people you don't like. It's like the "you know a tomato is technically a fruit" BS in monetary form.

Thorough article on debanking in western context and for crypto companies specifically. If you were willing to spend four hours listening to a Joe Rogan guest and fooled yourself into feeling informed, you have no excuse not to read this.

https://www.bitsaboutmoney.com/archive/debanking-and-debunking/

Lola, is this your pseudonym?

As far as block subsidy, it will likely maintain the value it has now indefinitely. Most people seem to think that the Satoshi will be the smallest denomination forever. It won't. As a matter of fact if a penny is worth anything by the time Bitcoin hits 1 million and 1 dollars a coin, we have a denominational issue. So extrapolating from there the more the value climbs from both inelastic supply and rising demand, the more decimals become commonplace. The blocksize now is pretty much perfectly designed to handle 5000 countries worth of settlement transactions per 10 minutes.

As the incentives of bitcoin kick in at the national level, states that hodle first become more powerful than the nations that encompass them. Making the cultural separations more important and further dividing the current sub 200 countries into more. This also decentralizes mining and distributes block fees among smaller parties. The cost of a large mining op just won't be able to compete with hundred of thousands to millions of individuals running 10TH/s systems at 15-17J/TH.

As far as economic velocity, that never gets handled by an asset layer. That is the final settlement for when the trust of economic actors falls or conflict arises. It is utterly staggering how many billions of transactions happen on the back of "trust me, I'm good for it." With layers like lightning it's more like "Trust the code that you can read for yourself, I'm not going to force close the channel while you're offline with a previous channel state (If I get caught I'd lose all my sats)." Much more complicated but, much less trust is necessary. The restricted block size simply makes securing the network way more cost effective. What do you think is easier auditing every ounce of gold in the world or validating the bitcoin timechain? Now THAT'S security.

He's so good it's crazy. Making the intuitive, obvious. He says things that you know deep down but never articulate in a way that fires you up like this.

You guys change PFP? AND names? Y'all got multi personalities or what?

To be upset that you are receiving money is wild behavior. Likely a reflexive response to traditional advertising where the ad is shoved into your entertainment and the user is expected to pay with their time. In this model you are paying the user to read your ad, fair deal in my book. Don't want the ad? Don't take the sats.

It's funny. A lot of people in this crowd have never won before and it makes them uneasy. When you win, your enemies (to preserve their ego) act as if they always agreed with you. And if you want to preserve your ego, you graciously welcome them to the winning side. Humans are funny.

Oh wait. Do I have to start the sentence with faggot so that you understand what I am doing?

Poor guy. You seem like you are really in pain. I hope you find peace soon.

If you find your heart, you could really be someone in the world.

Lol I'm sorry your mother hurt you. I hope you find love someday.

Lol, calls people asshole.

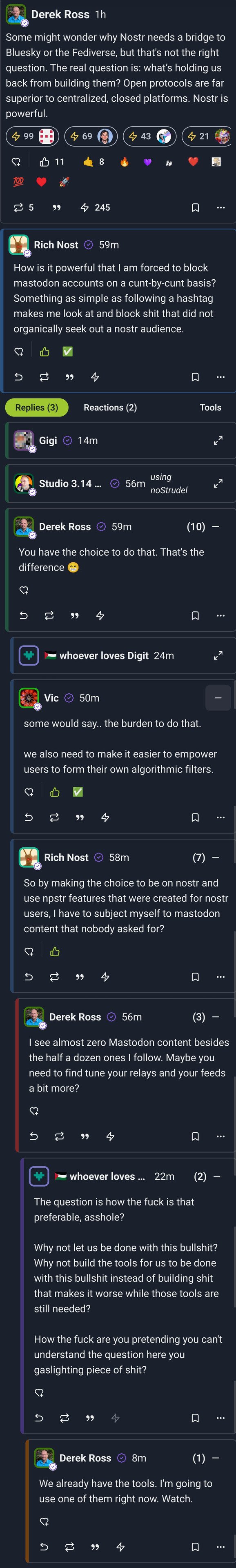

Expects response. nostr:nevent1qqs02w5gfepg60pdpz9usytt804sde3hvj5xn2lx5tx3a8gtcga0cnqzyrw3l82s93u4rh68aruw6fz730azfalg9s50ryue4rcwwjcxzyazzqcyqqqqg2g8w5ec3

You