Profile: dfa94a58...

Just keep maintaining the car. Lasts forever. After all, there are hundreds of aircraft still flying after 50+ years. Just do the maintenance if you love the car.

If the White House determines that Chinese sourced electrical transformers, data centers and bitcoin mining hardware is "foreign-sourced equipment potentially capable of facilitating surveillance and espionage activities" we may have a problem.

https://www.tftc.io/white-house-executive-order-bitcoin-wyoming/

Don't fret. Washington is like the bunker in the Reich Chancellory in March 1945. They are issuing decrees and moving around armies on the map that dont even exist. We are witnessing the final collapse. Bitcoin will be fine.

"Who gets Access" is not the same question as "what is sound money".

There is a cost to decentralised security. Its one of the iron cast tradeoffs. If you want relatively low cost then lower your security.

Sound money is existential. It is a concept expounded and defined by Aristotle and that concept remains valid today. There is only one definition of sound money just as there is only one defn of Pythagoras Theorum.

The poster child of "everything to everyone coin" and unbrideled , go-go dev/upgrade is ETH. And ETH is an unholy spaghetti mess. It is almost impossible to run a node, they had to change to POS, nobody seems to even know how many ETH are out there. Is this what we want bitcoin to become because we cannot focus on what bitcoin should be : sound money and only sound money ?

This is really important and perhaps not getting enough attention. The go-go devs and upgraders risk killing this project as the attack surface expands exponentially with each upgrade. Many may disagree, but nobody saw monkey jpegs coming out of taproot. The inherent tradeoffs don't seem to be fully appreciated. Decentralisation can't NEVER have the same max throughput as centralisation, it is impossible. Security is the tradeoff. We have to focus like a lazer on Sound Money. This is first , second and nth of what bitcoin must be. It will never be a point of sale commodity payment rail because then it won't be sound money. I am hearing people complaining that bitcoin is not everything they want it to be, it will never be everything, we have to pick what it is and stick to it. Stick to sound money , that is the killer app that hasn't existed for 3000 years and that is what is missing today and chiefly why the world is in such a mess.

Efficiency of computing and decentralization are tradeoffs. Decentralisation is not efficient , never will be, it is secure and resilient to resist central control. This is why bitcoin will never have the throughput of centralised computing, all the nodes globally, ideally, must see and verify each transaction and there are finite limits to achieving this. When people try and disolve these physical limitations we end up with a shitcoin. In 15 years 100s of thousands of shitcoins have tried and failed to recobcile this yet we still waste time moping about it. Centralise small payments , decentralise the base money and the big payments. Trade convenience for security, that the bottom line. Use both in its respective place.

These next few years are as existential for bitcoin as the Blocksize Wars.

Back then it was about who got to decide what bitcoin was, now it’s about what bitcoin is.

https://bluematt.bitcoin.ninja/2024/05/11/bitcoins-precarious-position/

"we just haven’t cracked building cryptocurrency payment rails without an (untrusted!) party being involved." And you probably never will. Because that is precisely what makes bitcoin such hard money. It's why everything else is shitcoins. The tradeoff always will be decentralization vs throughput. So, use the shitcoins for coffee money and use bitcoins for auditable (!) base money, as an unimpeachable mark-to-market for the entire financial system. We have to stop this nonsense of trying to be all things to all people, we have tradeoffs , they will never go away, recognise this and build around it. Stop the hand wringing already !

The yen carry trade , underwritten by the superhuman work ethic and productivity of the Japanese salaryman, has kept the west afloat for about 4 decades. That perpetual motion machines wheels are now falling off. The west's economies will sink without a trace.

How can you be so right and so wrong at the same time? Guess this historian will HFSP 😂 https://video.nostr.build/387f11db9dbd7414e416f8e81f1b8ccc96aaa28cfdd3713a956869b3e5f98489.mp4

The stupidist "cleverest guy in the world". All hype no substance

Has a central server. Is all that also open sourced ?

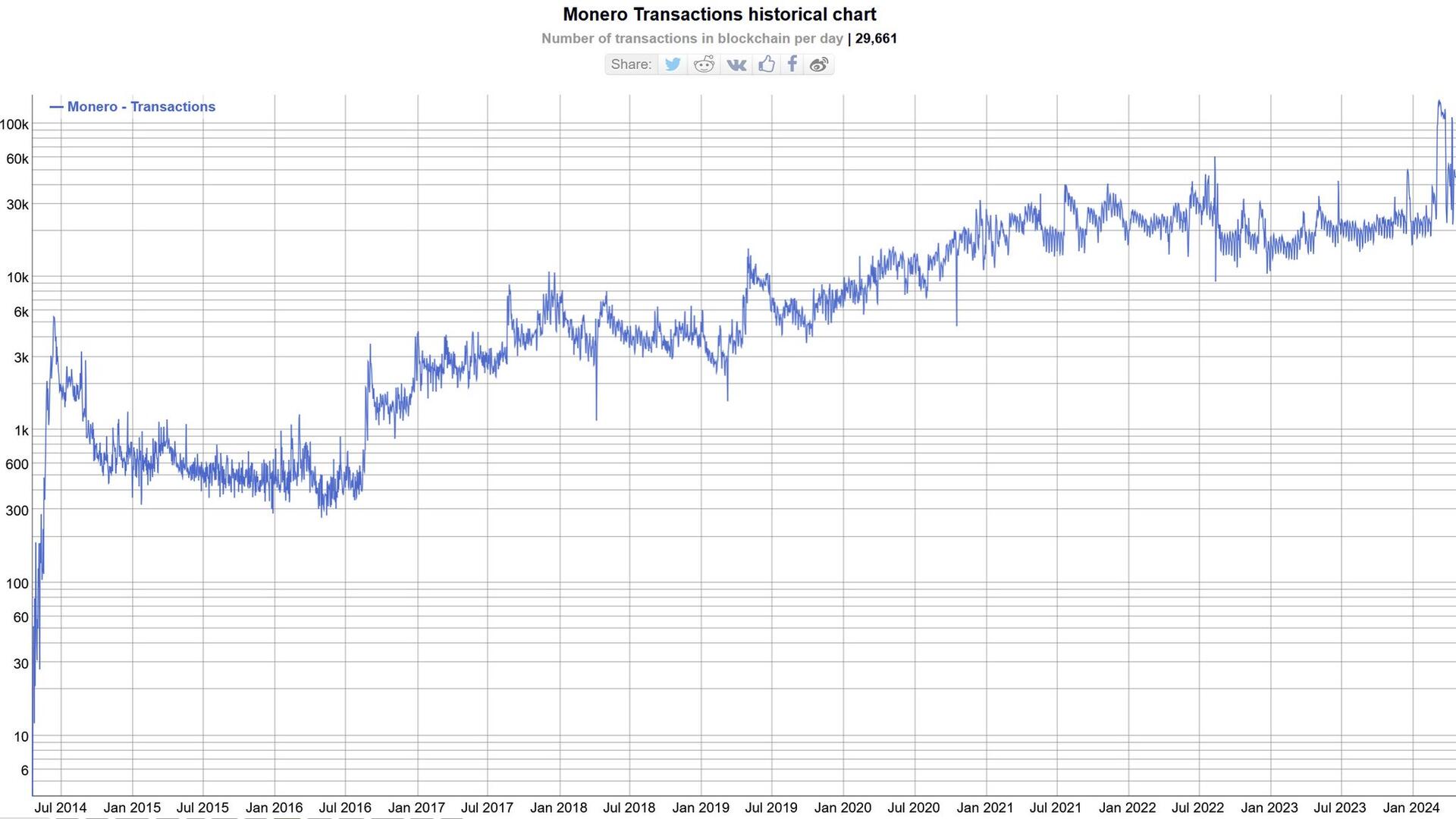

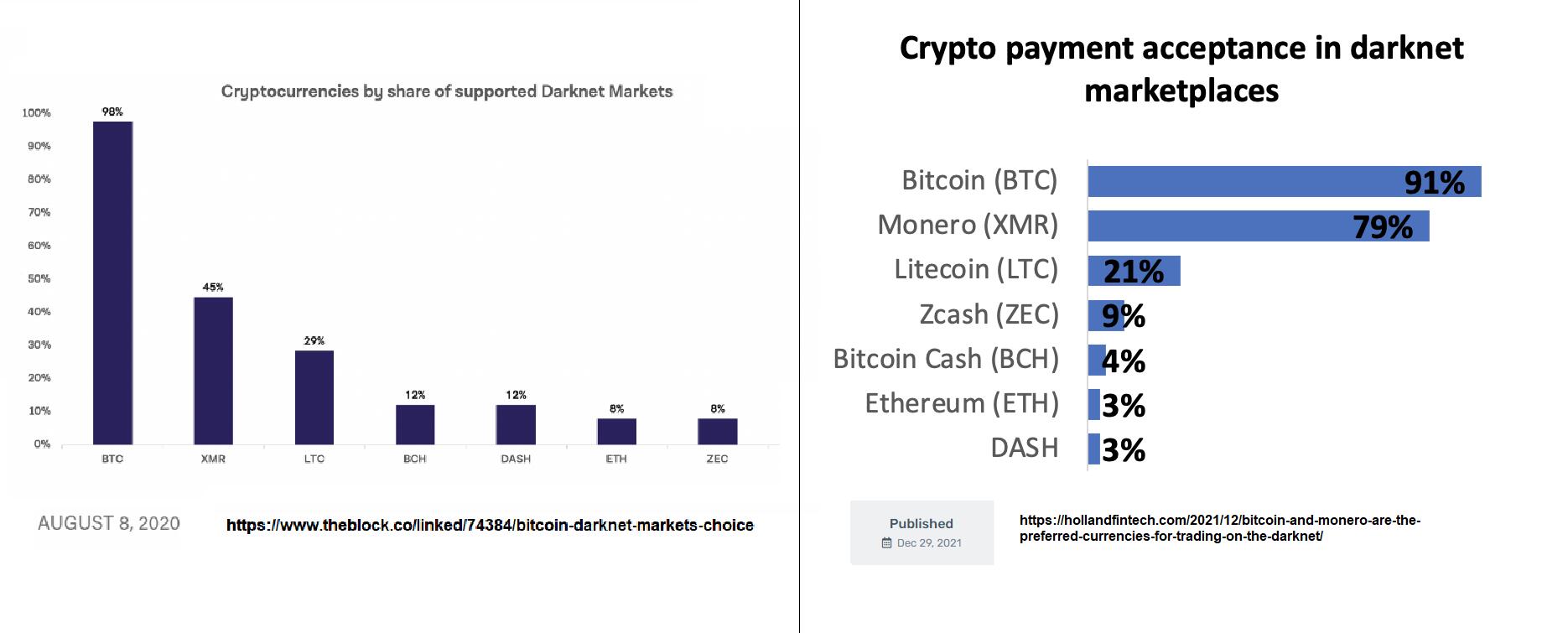

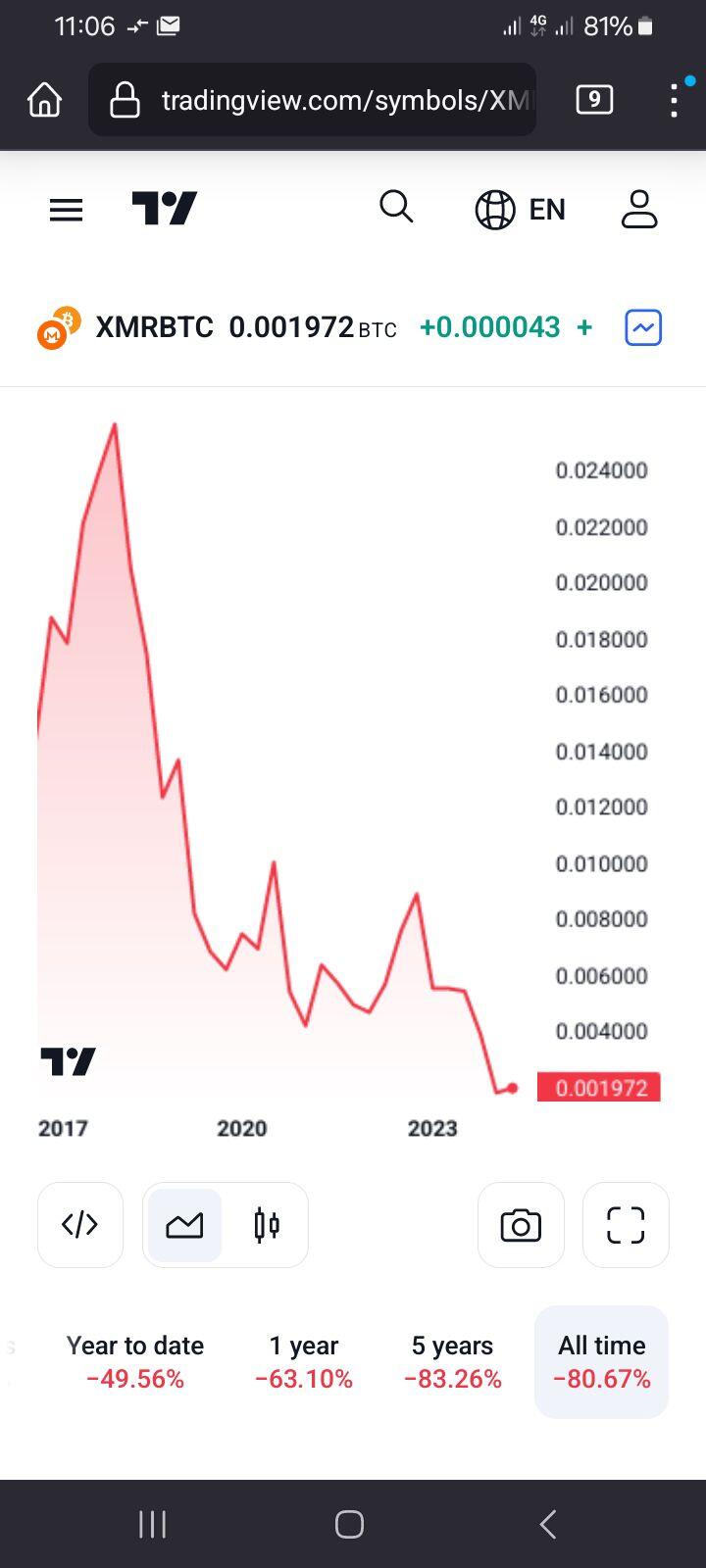

Xmrbtc getting hammered , long term. Market doesn't like monero vs bitcoin

All of what you say is true, except once you take the first inflation step the market never trusts you again. With money its all about trust. Its like tax, once introduced it never gets withdrawn and only gets worse. The market has voted , xmrbtc is plummeting over the long term. Bloated block chain also a factor ? . Use monero as side-chain to spend privately. Imo

The real problem, even for the well meaning MMT advocates(Chartelists), is that they can actually finess the inflation and tax levers to accurately control the monetary system and the allocation of resources. The Austrian School's foundation argument is that it is impossible to accurately do economic calculation because each actor in the economy has a personal goal that cannot be aggregated accurately. From that , ALL aggregated economic management is ultimately nonsense.

It can be publicly auditable AND opaque.

This is a very common misunderstanding.

You have to trust something in the whole system, that trust might be reasonably placed in cryptographic primitives that assure anonymity and privacy as well as assuring no inflated coins are created, primitives which have been reviewed and audited, over and over again.

From compilers to central processing units to hash functions, you are already trusting a LOT in Bitcoin.

#monero adds a little bit to that gigantic pile or complexity.

All of this is explained in https://www.moneroinflation.com

So, if monero is so good then it can be used as a privacy sidechain to btc, as can perhaps LN. Because , as it stands, xmrbtc is getting hammered. I don't think monero will ever have the first mover network effect, mining power and number of nodes. Also, I don't like tail emissions. Inflation is a distortion of price throughout the economy, leading to malinvestments and economic malaise. No thanks.

“I've been warning Bitcoin developers for ten years that privacy needs to be provided for at the protocol level. This is the final warning. The clock is ticking.”

- - nostr:npub1sn0wdenkukak0d9dfczzeacvhkrgz92ak56egt7vdgzn8pv2wfqqhrjdv9

We need a publicly auditable blockchain. How much gold is in ft Knox ? The public is not allowed to know, the public is not allowed to audit it. For 3000 years we could never audit publicly the base money supply and the movements of the base money. This is the root of our big problems. The govt going beserk with a cartel of money producers because nobody really knows what they are up to.. We have public auditability of money now, for the first time in 3000 years, and this is the big bitcoin breakthrough. We also need personal anonymity and we have that but that's largely up to the individual. The protocol is fine.

Bitcoin is sound money. How do you price somebody out of sound money ? You can use money for any dumb purpose you want, all that happens is that you usually end up with no money.

"But devs want upgrade and innovate !" Now we have this unintended consequence because the attack surface got too big to manage.