That's a feature, the "Szabian" ideas explain this so well, we need sacrifice and probably the most honest pow out there.

The great majority are simps and statist cucks.

That's correct. And the Eurodollar system is incredibleusefull.

Fake elon is based. Real elon is a retard cuck salesman.

The MOE aspect are actually more sound than gold, because of low inflation, divisibility, easy to hide and transport/transfer. I think the security part is lower than gold and btc. The monetary policy is better than the vast majority of altcoins because it is clear and with low uncertainty. The mining aspect is great because occupy the CPU niche and has a great distribution lines without making obvious that people are interested in mining.

Btc, monero and 3d guns/bullets and a nice knife if all else fails.

Stay sovereign or get fucked

Avoid online taxes, simplify loan contracts with crypto collateral, escape from metadata surveillance, crowfund censoredorganizations/projects and pay for censored content are great use cases for crypto.

I have bad news for you 👺👽🤡💀

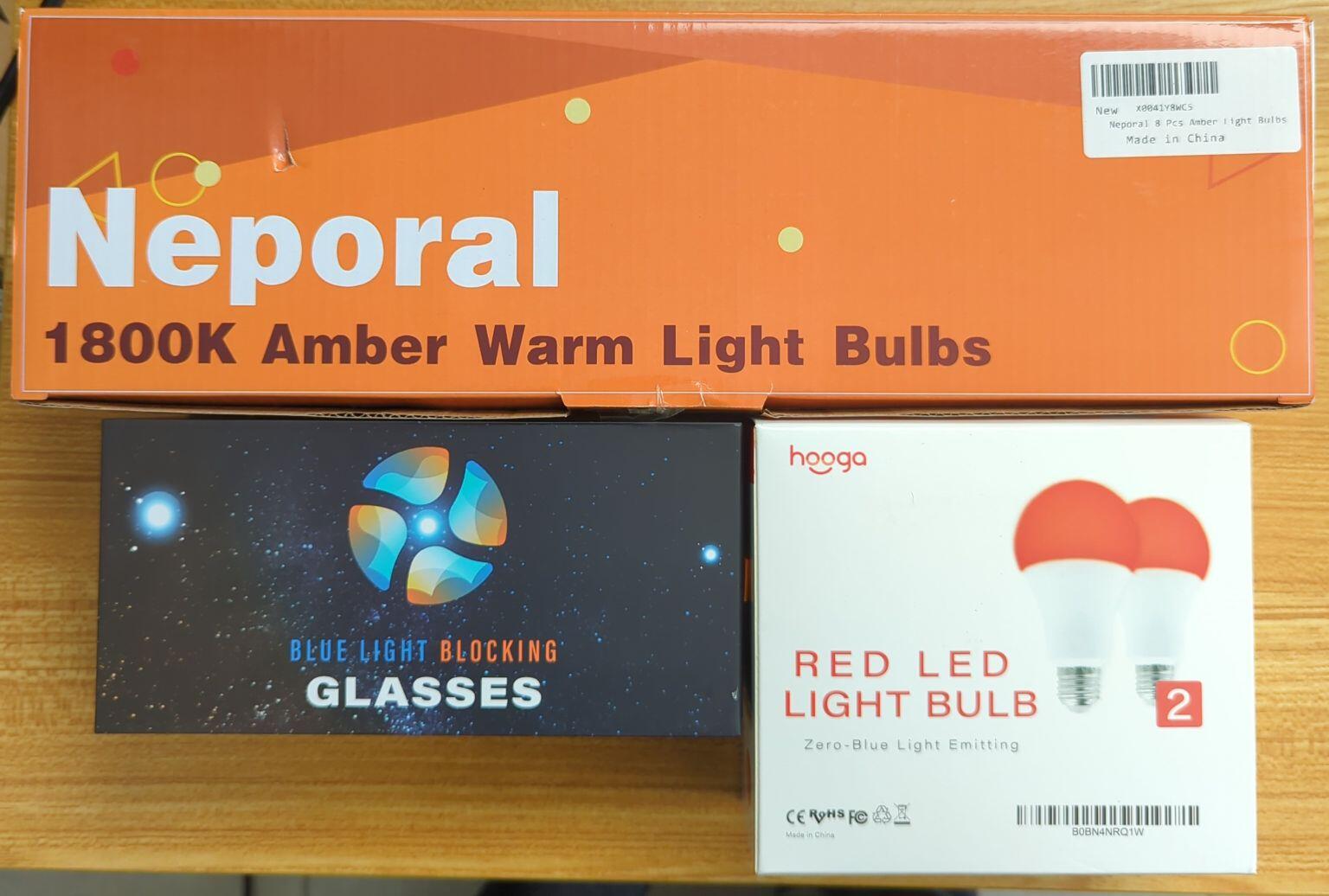

Qué es blue light blocking glasses?

Any chance of premium accounts without Google ?

Remind me in 7 months